Discounted cash flow analysis for real estate is widely used, yet often misunderstood. In this post, we’re going to discuss discounted cash flow analysis for real estate and clear up some common misconceptions. As you follow along, you might also find this discounted cash flow analysis calculator helpful.

Table of Contents

- What is Discounted Cash Flow Analysis?

- Why DCF Analysis Matters

- Understanding the Discounted Cash Flow Model

- Components of the DCF Model

- How to Perform a Discounted Cash Flow Analysis

- Discounted Cash Flow Analysis Example (Appraisal Focus)

- Discounted Cash Flow Analysis Example (Investor Focus)

- Using DCF to Set a Maximum Offer

- Ignore at Your Peril

- Conclusion

What is Discounted Cash Flow Analysis?

Discounted Cash Flow (DCF) analysis is a valuation method used to evaluate an investment by forecasting future cash flows over the investment’s holding period and discounting them back to their present value. The result of a DCF analysis includes three primary calculations: present value (PV), Net Present Value (NPV), and Internal Rate of Return (IRR), which collectively help decision-makers evaluate whether an investment or project is worthwhile, determine its value, and compare it against other opportunities.

Intuitively, DCF analysis answers the question: “What are future cash flows worth today?” This analysis explicitly considers the time value of money, acknowledging that cash received today is worth more than the same amount received in the future because today’s cash can be invested and grow.

DCF analysis produces three key measures:

- Present Value (PV): The current value of individual future cash flows, discounted at a specified discount rate (required rate of return).

- Net Present Value (NPV): The total present value of all expected future cash flows minus the initial investment. A positive NPV indicates that an investment is expected to generate more than your required rate of return.

- Internal Rate of Return (IRR): The discount rate that makes the present value of all future cash flows equal your initial investment. It is the percentage return earned each period on invested capital for as long as it remains invested.

Key Questions Answered by a DCF Analysis:

- PV answers the question: “What is this investment worth today given my required return?”

- NPV answers the question: “How much more or less can I pay given my required return, assuming all else remains the same?”

- IRR answers the question: “What return am I actually earning based on these cash flows?”

Why DCF Analysis Matters

Discounted cash flow analysis matters because it plays an important role in determining both market value and investment value in real estate, and in certain cases, it’s the most appropriate valuation method.

- Market value estimates the price a typical buyer would pay under normal market conditions. Appraisers calculate market value using DCF analysis in combination with other methods like comparable sales, direct capitalization, and the cost approach.

- Investment value is the property’s worth to a specific investor based on their individual goals, assumptions, and required returns. Investors use DCF analysis to determine this personalized value.

Because DCF explicitly forecasts multiple years of future cash flows and adjusts them for timing and risk, it uniquely captures cash flow variability over an investment’s holding period. In situations where cash flows significantly fluctuate, such as properties undergoing renovations, lease-ups, or repositioning, DCF is the only reliable valuation method compared to simpler, single-period metrics like cap rate, yield on cost, cash on cash return, or the gross rent multiplier.

An Example of When DCF is Indispensable

Consider a multi-phase, mixed-use redevelopment project involving office, retail, and multifamily components. Each phase has different renovation timelines, lease-up strategies, and financing structures. Early years may show negative or minimal income due to heavy renovation costs, while later years realize significantly higher stabilized rents and occupancy. In this scenario, single-period metrics fail because:

- Phased Capital Outlays & Lease-Up – Costs are staggered, and occupancy ramps up at different times for office, retail, and multifamily.

- Shifting Risk Levels – The risk profile changes from high (construction, re-leasing) to moderate (early lease-up) and then to lower risk (stable occupancy).

- Complex Financing – Different layers of debt and equity are drawn in phases, affecting net cash flows.

Here, a multi-period DCF is the most reliable way to capture the true timing of capital investments, tenant improvements, variable lease terms, and eventual stabilized revenues. By discounting each phase’s cash flows at a risk-adjusted rate, the DCF approach precisely measures the project’s present value, something a single cap rate or yield on cost cannot accurately reflect.

Understanding the Discounted Cash Flow Model

Four basic questions must be answered to use the discounted cash flow model:

- How much money goes into the investment?

- When does the money go into the investment?

- How much money comes out of the investment?

- When does the money come out of the investment?

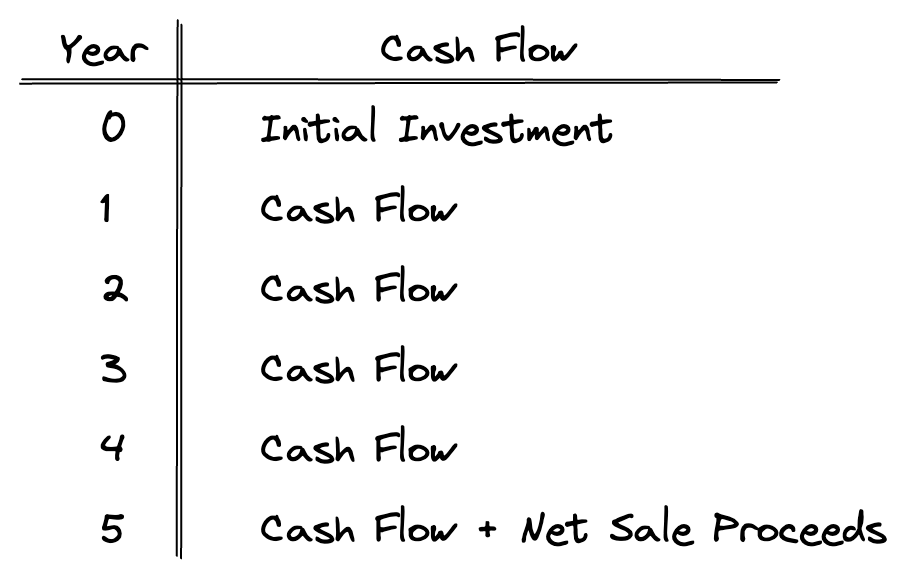

In real estate finance, the answers to these four basic questions are boiled down to a simple diagram:

In practice, a real estate proforma is used to model these cash flows over time.

Components of the DCF Model

Let’s now explore each component of the discounted cash flow model in more detail.

Holding Period

The holding period is shown in years on the left-hand side of the diagram. It is usually assumed that the timing of the cash flows occurs at the end of each year (EOY). In commercial real estate, the holding period is typically between 5-15 years for the purposes of a financial analysis.

Initial Investment

The initial investment is normally shown in time period zero (0) and includes all acquisition costs required to purchase the asset, less any loan proceeds. In other words, this is your total out-of-pocket cash outlay required to acquire a property.

Cash Flows

The cash flows for a real estate investment property are typically broken out line by line on a real estate proforma. Depending on the focus, cash flows may be modeled as:

- Unlevered cash flow (before debt service): NOI less capital expenditures, leasing costs, and reserves.

- Levered cash flow (after debt service): Cash flow available to equity investors after subtracting loan payments.

If cash flow is negative, it means dollars are going into the investment, and if cash flow is positive, it means dollars are coming out of the investment.

Sale Proceeds

Sale proceeds represent the net cash flow received from the disposition of an investment property. This cash flow item shows up in the last period of the holding period of the real estate cash flow model.

How to Perform a Discounted Cash Flow Analysis

Now that we’ve defined discounted cash flow analysis, let’s discuss exactly how to perform one. Conducting a DCF analysis for real estate valuation involves three straightforward steps.

1. Forecast the expected future cash flows

This step involves creating a detailed real estate proforma, a comprehensive projection that clearly outlines expected cash inflows and outflows. Your proforma should answer the four fundamental questions of any investment:

- How much money goes into the investment?

- When does the money go into the investment?

- How much money comes out of the investment?

- When does the money come out of the investment?

2. Determine your required rate of return (If Using PV and NPV)

If you’re performing a Present Value (PV) or Net Present Value (NPV) analysis, you’ll need to choose a discount rate, also called your required rate of return. This rate compensates for the time value of money and the specific risks associated with your investment.

- Individual Investors: Usually select a discount rate based on their personal financial objectives, risk tolerance, and alternative investment options.

- Institutional Investors (Private Equity, Pension Funds): Typically use target IRRs driven by investor expectations, property-specific risks, and market conditions.

- Real Estate Investment Trusts (REITs): Often start with their Weighted Average Cost of Capital (WACC), derived from their publicly traded equity and debt, and adjust based on individual asset-level risks and local market factors.

- Appraisers: Determine discount rates through investor surveys (e.g., PwC Investor Survey, CBRE surveys), market comparables, risk-premium methods (adding premiums to risk-free rates), and consultations with active market participants to reflect current market conditions accurately.

Discount rates are widely used by appraisers. However, in practice, many investors skip explicitly choosing a discount rate and instead focus directly on equity IRR, rather than calculating PV or NPV.

3. Discount future cash flows to their present value

This step depends on your valuation focus:

- Present Value (PV) or Net Present Value (NPV): Use your chosen discount rate to convert future cash flows into present-value terms, allowing comparison against your initial investment. This is typically done using Excel or specialized software.

- Internal Rate of Return (IRR): Many investors prioritize Equity IRR, which directly measures returns on invested equity without explicitly selecting a discount rate. Instead, the IRR calculation itself determines the discount rate that results in an NPV of zero. In this scenario, simply input your projected equity cash flows (after debt service) into Excel or use specialized commercial real estate analysis software to compute the Equity IRR.

Discounted Cash Flow Analysis Example (Appraisal Focus)

Consider an appraiser estimating the market value of a property. The appraiser forecasts the property’s net operating income (NOI) and eventual sale proceeds over a 5-year holding period:

| Year | Description | Cash Flow | Present Value (8%) |

|---|---|---|---|

| 1 | Net Operating Income | $70,000 | $64,815 |

| 2 | Net Operating Income | $72,000 | $61,728 |

| 3 | Net Operating Income | $75,000 | $59,537 |

| 4 | Net Operating Income | $78,000 | $57,332 |

| 5 | Net Operating Income + Sale Proceeds | $80,000 + $1,100,000 = $1,180,000 | $803,089 |

| Total PV | $1,046,501 |

Using a market-derived discount rate of 8%, the appraiser calculates the Present Value (PV) of these cash flows, estimating the property’s market value at approximately $1,046,501 (typically rounded down to $1,046,000).

This approach uses assumptions reflective of typical market conditions to provide an unbiased estimate of market value.

Discounted Cash Flow Analysis Example (Investor Focus)

Now, consider an investor evaluating the same property. The investor offers $1,000,000 and plans to finance 70% of the purchase price ($700,000 loan) at 5% interest, amortized over 25 years, and invest $300,000 in equity. They forecast the following equity cash flows after debt service:

| Year | Description | Cash Flow |

|---|---|---|

| 0 | Initial Equity Investment | ($300,000) |

| 1 | Cash Flow After Debt Service | $20,894 |

| 2 | Cash Flow After Debt Service | $22,894 |

| 3 | Cash Flow After Debt Service | $25,894 |

| 4 | Cash Flow After Debt Service | $28,894 |

| 5 | Cash Flow After Debt Service + Net Sale Proceeds | $510,833 |

Using these projected equity cash flows, you can use a discounted cash flow calculator to find your Equity IRR is 16.93%.

Using DCF to Set a Maximum Offer

Suppose the investor’s initial offer of $1,000,000 was rejected, and the seller requests everyone’s best and final offer. The investor has a firm requirement of achieving at least a 15% equity IRR. To determine the maximum price they can pay, the investor iteratively adjusts the purchase price, recalculating the loan amount, equity investment, debt service, cash flows, and resulting equity IRR each time, until they precisely hit their 15% target. The final results are shown below:

- Maximum Purchase Price: $1,029,760

- Loan Amount (70% LTV): $720,832

- Equity Investment: $308,928

- Annual Debt Service: $50,567

- Remaining Loan Balance after 5 Years: $638,515

- Net Sale Proceeds: $461,485

| Year | Description | Equity Cash Flow |

| 0 | Initial Equity Investment | ($308,928) |

| 1 | Cash Flow after Debt Service | $19,433 |

| 2 | Cash Flow after Debt Service | $21,433 |

| 3 | Cash Flow after Debt Service | $24,433 |

| 4 | Cash Flow after Debt Service | $27,433 |

| 5 | Cash Flow after Debt Service + Net Sale Proceeds | $490,919 |

Increasing the purchase price to $1,029,760 and updating the loan and equity assumptions, the resulting equity IRR calculation hits the 15% target.

Note: In practice, lenders typically round down the loan amount to the nearest increment (often to the nearest thousand), slightly reducing the loan and requiring the investor to increase their equity investment. This additional equity reduces leverage and slightly decreases the actual IRR compared to the idealized scenario above.

This iterative approach demonstrates how investors use discounted cash flow analysis to determine their highest possible bid while adhering strictly to their target return.

Investors also frequently use DCF analysis to run multiple scenarios (base, optimistic, pessimistic) and perform sensitivity analysis, stress-testing critical variables such as exit cap rates, vacancy rates, rental growth, and inflation, to better understand risks and potential returns.

Ignore at Your Peril

Many analysts favor simpler metrics such as cap rates, yield on cost, equity multiple, or cash-on-cash returns, overlooking the deeper insights provided by discounted cash flow (DCF) analysis. While simpler metrics offer quick insights, they typically reflect only a single stabilized period of cash flow. By failing to capture the timing and variability of cash flows over multiple years, these simpler metrics may overlook factors that significantly influence an investment’s true value.

DCF analysis uniquely addresses these nuances by explicitly forecasting each cash flow and its timing across the entire holding period. For scenarios involving fluctuating cash flows, such as renovations, lease-ups, or repositioning, DCF analysis isn’t just helpful, it’s essential.

Although no single metric tells the entire story, neglecting DCF analysis can lead to incomplete or misleading investment decisions. A robust investment analysis should incorporate both simpler metrics and the comprehensive insights provided by DCF.

Conclusion

Discounted cash flow analysis is a fundamental valuation method that provides investors with a thorough, accurate, and nuanced evaluation of real estate investments. By carefully considering cash flow timing, risks, and the time value of money, DCF analysis enables investors to make informed and strategic investment decisions. Utilizing DCF metrics, PV, NPV, and IRR, ensures investors can accurately compare opportunities and choose investments that align best with their financial goals.

Ready to get started? Try our commercial real estate analysis software to quickly build detailed DCF models, run scenario analyses, and stress-test your assumptions with sensitivity analysis, all in one place.