The gross rent multiplier is a simple measure of investment performance used in the commercial real estate industry. Understanding the gross rent multiplier is important when evaluating commercial real estate transactions, but it also comes with several built-in limitations. In this article, you’ll learn:

- What is Gross Rent Multiplier (GRM)

- Gross Rent Multiplier Formula

- How to Calculate Gross Rent Multiplier

- Gross Rent Multiplier Example

- What is a Good Gross Rent Multiplier?

- Limitations of the Gross Rent Multiplier

- Gross Rent Multiplier vs Cap Rate

- Gross Rent Multiplier vs Gross Income Multiplier

What is Gross Rent Multiplier (GRM)

The gross rent multiplier, often abbreviated as GRM in real estate, is a simple measure of investment performance used to compare alternative real estate investments.

The GRM in real estate is the ratio of a property’s sales price to its gross rental income.

Gross Rent Multiplier Formula

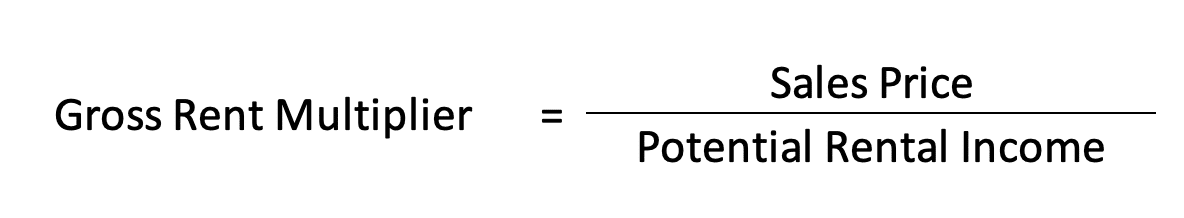

The gross rent multiplier formula is calculated as follows:

The gross rent multiplier is defined as the sales price of a property divided by its potential rental income. If we rearrange the above formula, we can solve for the price or value of the property:

The gross rent multiplier can be used to quickly survey the market for opportunities by filtering out properties with a low price relative to the market-based potential rental income. The gross rent multiplier can also be used to value a property by using the gross rent multipliers (GRMs) of very similar properties within the same market area.

How to Calculate Gross Rent Multiplier

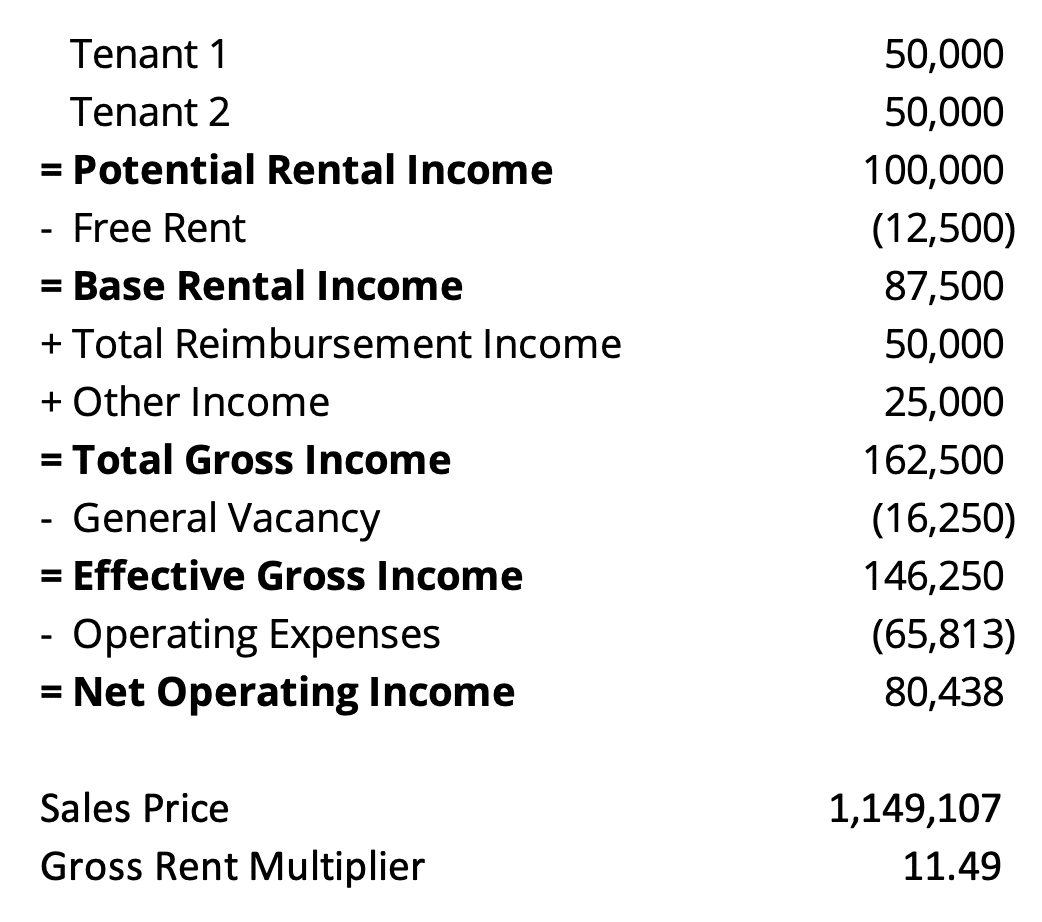

The gross rent multiplier can be calculated by taking a property’s purchase price and dividing it by the gross potential rental income.

In the example above the sales price is 1,149,107 and the potential rental income is 100,000. This results in a gross rent multiplier of 1,149,107 / 100,000, or 11.49x.

In practice, you will sometimes see variations on how the gross rent multiplier is calculated. One difference could be that the actual in place gross rents could be used instead of the potential gross income. This means the base rental income would be used instead of the potential rental income. The difference between potential rent and base rent is that base rent considers actual vacancies and any rental concessions deducted from tenant rents.

Another way the GRM calculation could vary is based on which period of time is used to measure the gross rent. For example, the gross rent from the trailing twelve months could be used to calculate the gross rents versus using a forward-looking proforma projection.

The important thing to remember with the gross rent multiplier is to clarify how it is calculated and make sure your calculations are consistent when making comparisons with other similar properties.

Gross Rent Multiplier Example

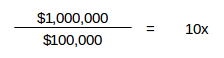

Let’s take a quick example to illustrate how the gross rent multiplier works. Consider a commercial office building with a year 1 potential rental income of $100,000 and a sales price of $1,000,000.

The gross rent multiplier in this case is simply $1,000,000/$100,000, which results in a GRM of 10x. So, what does this gross rent multiplier of 10x mean? By itself, not much. But when you compare this GRM with other similar properties, it can give you a quick indication of whether it’s in line with those other similar properties or not.

This type of GRM analysis could be helpful if you want to quickly evaluate several potential acquisitions in the same area. If one of the properties has a smaller GRM than the others, it may indicate an opportunity.

Let’s take another example of the gross rent multiplier, where you want to use the GRM to estimate the value of a property. Let’s say that you’re considering listing your investment office building for sale, and you would like to get a rough indication of value. The building has a potential rental income of $50,000 per year.

After surveying the market for recently sold comparable buildings in the same area, you determine that the average gross rent multiplier is 11x. Based on the GRM formula above, you can use this information to get a rough value estimate for your building of $550,000.

Introducing CRE Investment Analysis Fundamentals

A complete online course that teaches you the entire commercial real estate investment analysis process

A big picture overview of the commercial real estate investment analysis process

A step-by-step walkthrough of the real estate proforma

How to calculate and interpret simple measures of investment performance

A complete time value of money crash course

A walkthrough of the intuition and calculations behind IRR and NPV

How commercial real estate loans work, including a lender comparison spreadsheet

Office building case study with 5-year proforma, ratios, and discounted cash flow analysis

Fully unlocked Excel models included

60-day money-back guarantee

What is a Good Gross Rent Multiplier?

The gross rent multiplier is best used when compared to other gross rent multipliers for similar properties located in the same trade area. What this means is that GRMs will be different for different groups of properties in different locations.

It is also important that the gross rent multiplier calculation is consistent across all comparison properties. As mentioned above, there could be some variation in how the gross rent multiplier is calculated. As such, there is no one magical gross rent multiplier figure that can be used as a rule of thumb. Instead, the GRM should be compared to a peer group using a consistent methodology.

Limitations of the Gross Rent Multiplier

Using the gross rent multiplier is essentially like using revenue for a corporation as a measure of value. The problem with this approach is that when you purchase an investment property, your return isn’t based on top-line revenue (gross income), but rather it’s based on bottom line cash flow. Furthermore, a property can generate ancillary income from sources apart from rent such as laundry, vending, billboards, etc. That means the gross rent multiplier won’t always consider all sources of income for a property.

In other words, without considering a property’s ancillary income, operating expenses, future value, financial leverage or mortgage amortization, it’s simply not possible to estimate your true return on investment.

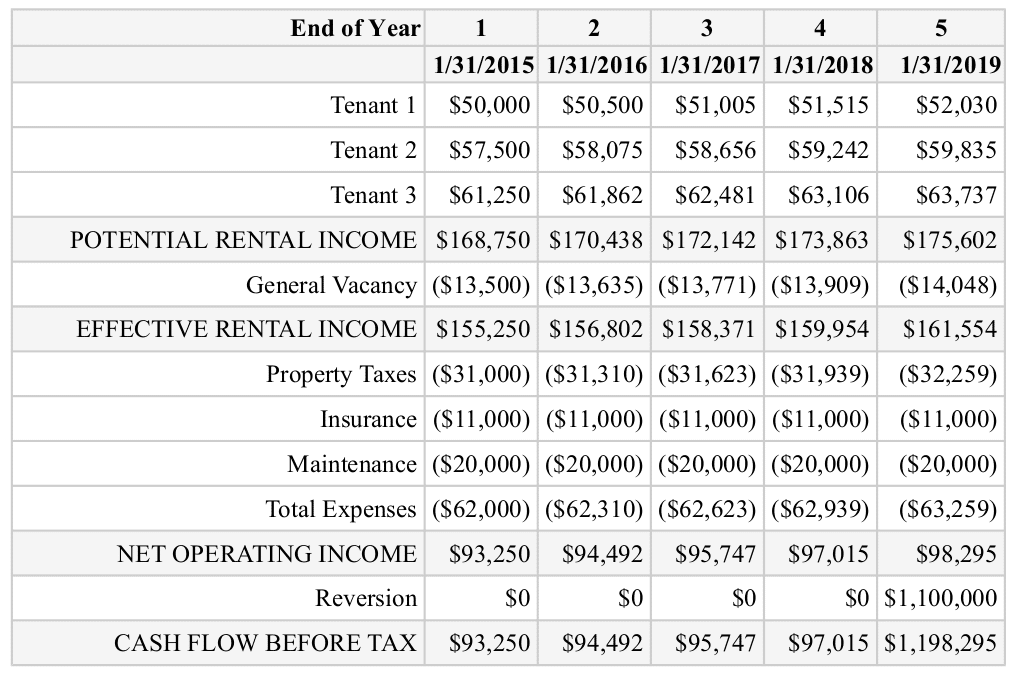

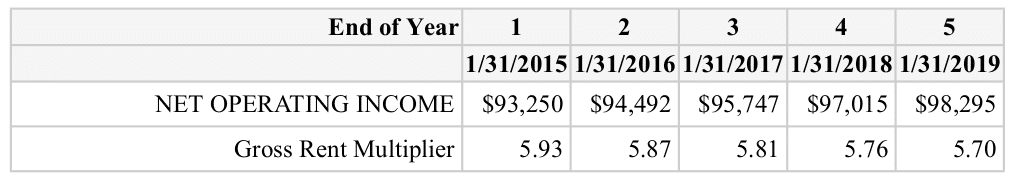

Consider the following proforma for a small office building:

In the first proforma above, the potential rental income in year 1 is $168,750. Based on an acquisition price of $1,000,000, the resulting gross rent multiplier in year 1 is 5.93x. By itself this doesn’t tell you all that much, but suppose you’ve been underwriting several other office buildings for sale in the same area, and you have determined that the average gross rent multiplier for these similar properties is 5.00x.

In this case, the gross rent multiplier for the above property seems high when compared to other similar properties. If you were using the gross rent multiplier alone as your criteria for evaluation, you’d probably discard this property and move on. But is that the right decision?

As mentioned earlier, the gross rent multiplier doesn’t consider ancillary income, vacancy, expenses, disposition prices, or any of the other factors that affect the bottom-line cash flow of a property. Without digging into all of these details, it’s not possible to know what your true return will be on this property as an investment.

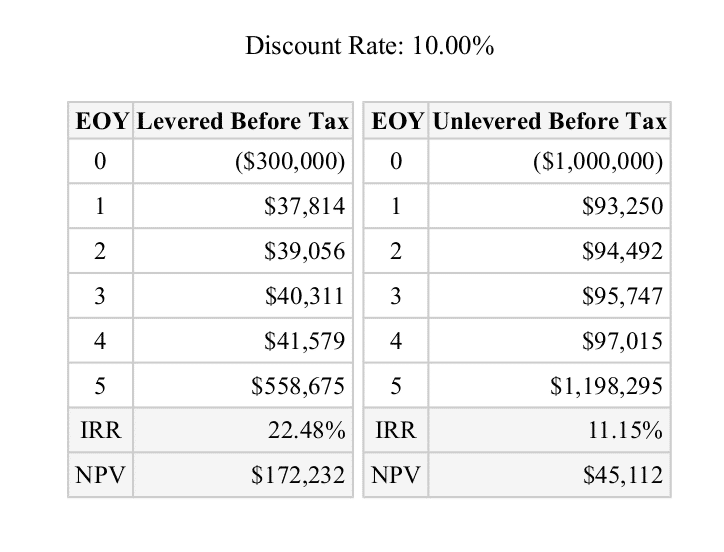

To illustrate this, let’s take a closer look at the above property using a discounted cash flow analysis.

The above discounted cash flow analysis considers the cash flow before tax for each year in the holding period, which includes vacancy, expenses, and all the other items the gross rent multiplier ignores.

Based on an acquisition price of $1,000,000 and a discount rate of 10%, the resulting unlevered net present value is $45,112, and the internal rate of return is 11.15%. If we’re able to secure a loan at a 70% loan to value ($700,000) at 5% amortized over 20 years, then our internal rate of return will improve to 22.48%.

Now, is this a good investment? Of course that depends, and there are many other factors that have to be considered. Assuming your discount rate is 10% this would certainly be something to take a closer look at. However, as shown above, this opportunity would completely fly under the radar of the gross rent multiplier.

Gross Rent Multiplier vs Cap Rate

The gross rent multiplier tells you how much a property is worth as a multiple of the potential rental income it can generate. The cap rate is also a simple ratio, but there are several important differences.

The cap rate is the ratio of a property’s net operating income to its market value. First, since the cap rate uses the net operating income for a property it gives more context since it includes operating expenses, unlike the gross rent multiplier.

Second, the cap rate places the market value of a property in the denominator and the net operating income in the numerator. Because the market value is in the denominator, that means the cap rate is expressed as a percentage. The gross rent multiplier, on the other hand, is expressed as a multiple because the value or sales price is placed in the numerator.

The cap rate and the gross rent multiplier are both simple ratios that can be useful when screening a property. However, the cap rate is more important because it factors in operating expenses for a property. The cap rate is also widely used in commercial real estate appraisal and valuation, unlike the simplistic gross rent multiplier.

Gross Rent Multiplier vs Gross Income Multiplier

The gross rent multiplier is calculated using the gross rent for a property. On the other hand, the gross income multiplier is calculated using gross potential income, which considers all sources of income for a property, not just the rental income.

The difference between the gross rent multiplier and the gross income multiplier is important because these metrics are easily confused. In fact, it is common for these terms to be used interchangeably while the calculations themselves are different.

If a property has ancillary sources of income from parking, vending, laundry, events, billboards, etc., then there could be a meaningful difference between the gross rent multiplier and the gross income multiplier.

Conclusion

The gross rent multiplier is a simple measure of investment performance that has several advantages. It requires very little information to calculate, the required information can be easily obtained, comparable properties within the same market area should have roughly the same gross rent multipliers, and overall the GRM concept is fairly easy to understand.

Of course, as we detailed in this article, the gross rent multiplier has several built-in limitations that you should be aware of. It does not consider all sources of income for a property, it doesn’t consider any expenses for a property, and it does not account for the time value of money.

Ultimately, the solution to these gross rent multiplier problems is to build a complete proforma for your property and then calculate a variety of real estate investment metrics. To quickly build a real estate proforma, and run a discounted cash flow analysis plus other financial metrics including the GRM, you might consider our real estate investment software.