Create & Share a CRE Proforma Online in Minutes

Web-based commercial real estate investment analysis software for office, industrial, retail, multifamily, and more. No installs, no spreadsheets, no hassle.

Start your free 7-day trial (Cancel Anytime)

Model complex leases & reimbursements in minutes

Forecast levered & unlevered cash flows, IRR, and more

Export presentation-ready PDF and Excel reports

Skip messy spreadsheets and work 100% online

What Sets Us Apart

Our web-based commercial real estate investment analysis and real estate development software makes it easy to create and share a CRE proforma online. Unlike Argus Enterprise, our commercial real estate valuation software is simple-to-use, affordable, and 100% web-based. Here are a few reasons why our customers love our app:

Simple to use

Enjoy a simple and intuitive user interface that just makes sense. Get up and running in just a few minutes.

100% Web-Based

Works on any Mac, PC, or tablet. No installs, downloads, or VPN hassles, ever.

Collaboration-Friendly

Share free read-only links with clients or co-edit with your team. No more version-control chaos or email attachments.

Polished Reports

Export presentation-ready PDF and Excel reports packages for your lenders, investors, and clients.

Affordable

One low monthly rate without any contracts or upfront fees. Expense it and move on.

Real-Time Calculations

Watch cash flows, IRR, DSCR, equity multiple, and more update instantly as you tweak assumptions.

What Others Are Saying

Your product is great, very intuitive and easier to use than Argus.

John Dickerson

Valuewize

I’m a 30+ year seasoned veteran in shopping center development. PropertyMetrics is an excellent source of information with professional grade software for analysis and presentation. I highly recommend it.

Frank C. Guess

Partner, Barnhart Guess Properties

I am not only an MAI appraiser, but also an investor and syndicator. I find your information and tools invaluable.

Craig A. Schumacher, MAI

Managing Partner, IRV Consultants

Start Free 7‑Day Trial of CRE Investment Analysis Software

Solutions for Every CRE Role

Underwrite Faster

- Underwrite acquisitions with our commercial real estate underwriting software

- Build multifamily, office, retail, industrial, and self-storage proformas and run discounted cash flow (DCF) analysis in minutes

- Model complex leases and loan structures

- Instant levered & unlevered IRR, equity multiple, and other key financial metrics

- Share a read-only link with partners for free or co-edit with your team

- Export Presentation-ready PDF and Excel Reports

Model Lease by Lease Cash Flows in Minutes

- Rely on our commercial property valuation software to quickly prepare accurate DCF models, proformas, and valuation reports

- Model unlevered cash flows for complex leases and reimbursement structures

- Bulk upload multi-tenant rent rolls

- Instant present value analysis

- Export PDF and Excel reports to drop into appraisal reports

Win Listings With Polished Proformas

- Build institutional-quality, branded proformas for complex multi-tenant properties

- Instant levered and unlevered IRR, cash on cash, equity multiple, and more key financial metrics

- One-click PDF & Excel export to drop numbers straight into your pitch deck

- Send buyers a free read-only share link

- Automatically import into PMX Publisher to create branded flyers and offering memorandums

Model Development Costs and Loan Draws

- Use our real estate development software to model budgets, construction draws, lease-up, and sources & uses for new projects

- Model detailed hard and soft development costs

- Tie each development cost line item to an interest-only construction loan draw

- Get a detailed monthly draw schedule to see interest carry and construction funding

- View a monthly sources and uses to see how funds flow through your project at every step

Underwrite CRE Income Over the Loan Term

- Streamline loan underwriting with instant DSCR, debt yield, and maximum loan sizing

- Model complex contractual lease cash flows over the term of the loan

- Get instant DSCR, Debt Yield, and other credit ratios

- Stress test the loan interset rate, vacancy, and more to see changes in DSCR

- Export to PDF and Excel to seamlessly integrate with credit memos

100% Web-Based Commercial Real Estate Investment Analysis Software

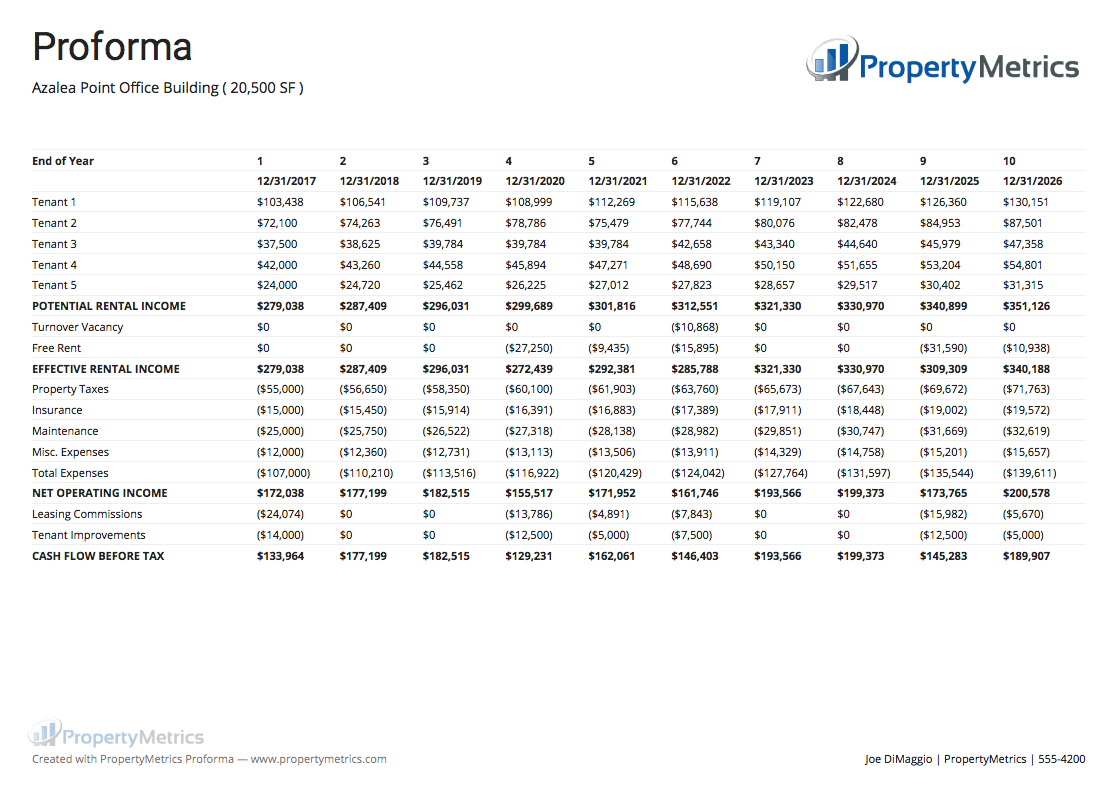

Build a CRE Proforma in Minutes

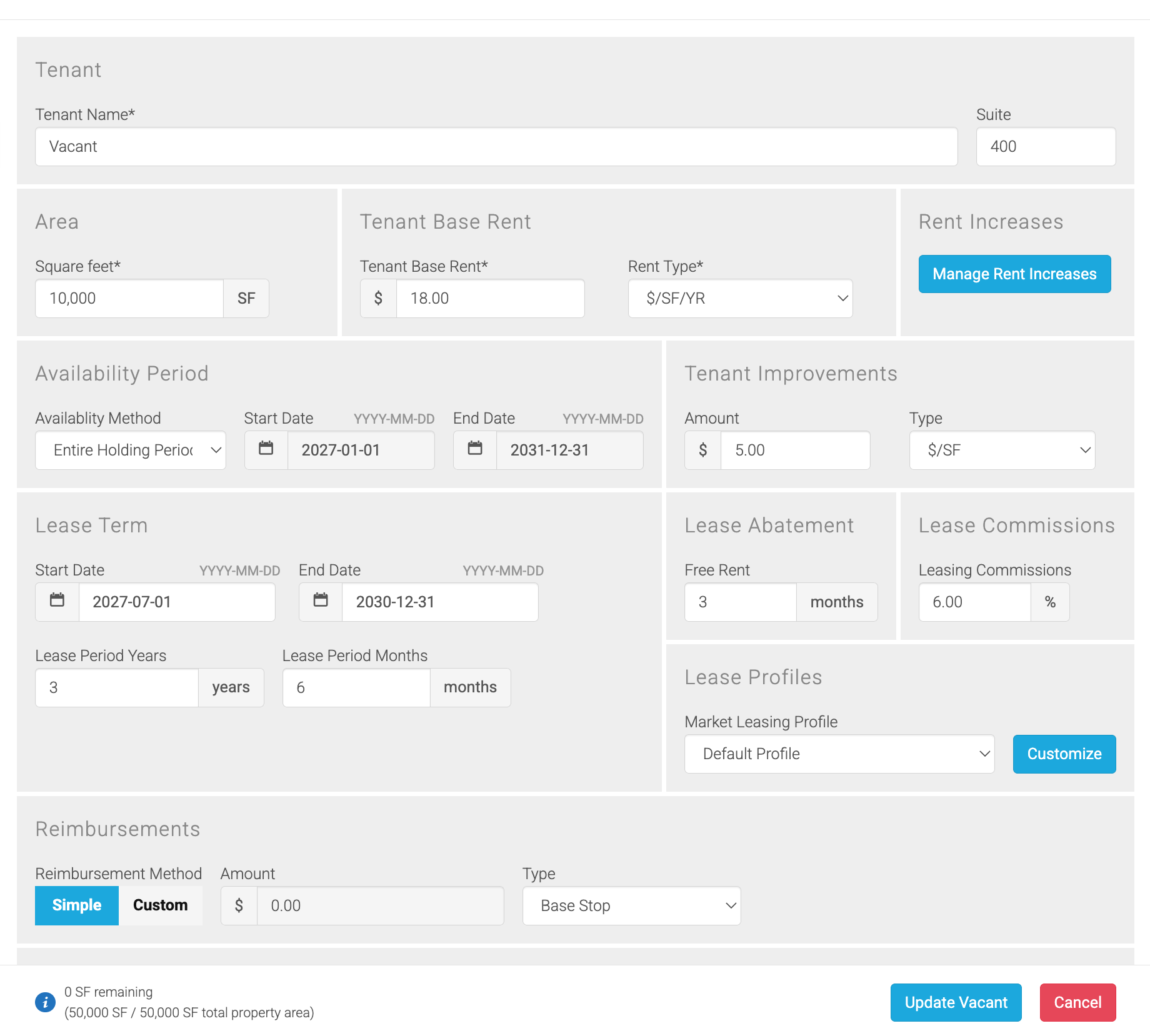

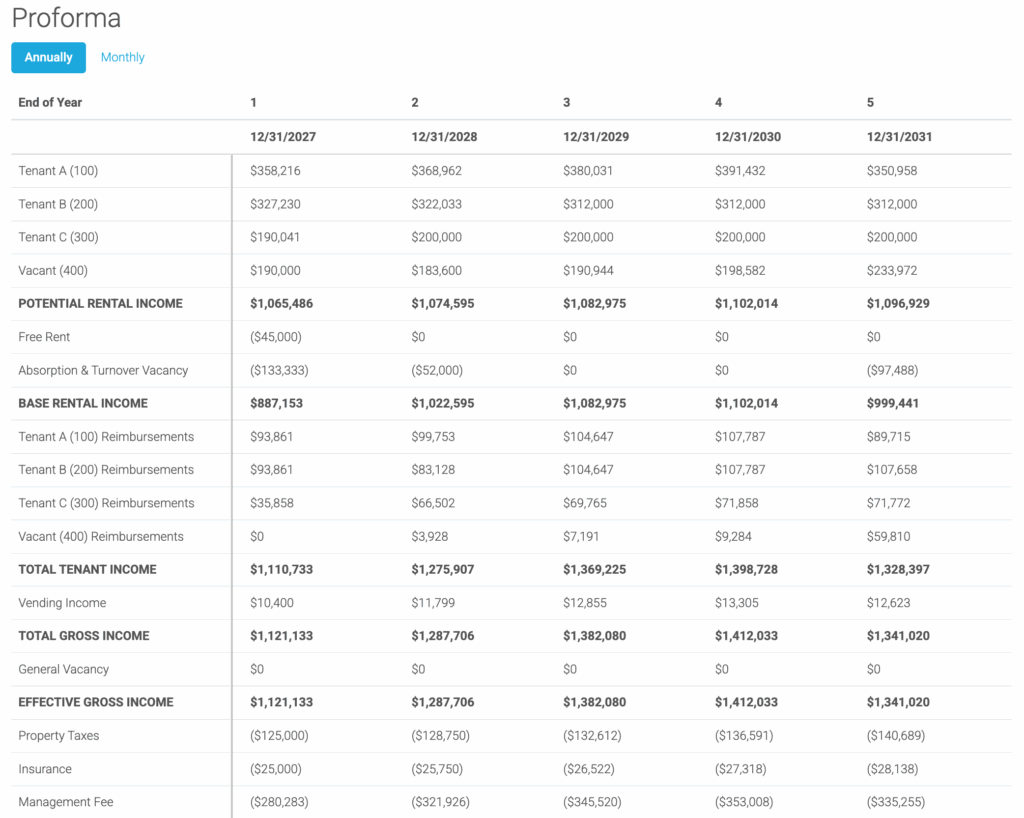

Our commercial real estate investment analysis software lets you produce a complete proforma for any income-generating property, fast. You can effortlessly handle the details that make deals complex, from rent escalations and rolling expirations to reimbursements, tenant improvements, leasing commissions, market-leasing assumptions, renewal probabilities, development costs, and loan draws.

As you adjust assumptions, results update instantly with a real-time cash-flow preview, making scenario testing quick and painless. When it’s time to share, you can generate lender-ready projections for banks, investors, clients, and broker marketing packages—anytime, from any device with an internet connection.

Stop wrestling with spreadsheets and start making faster, data-driven decisions.

Real-Time Metrics & Sensitivity Analysis

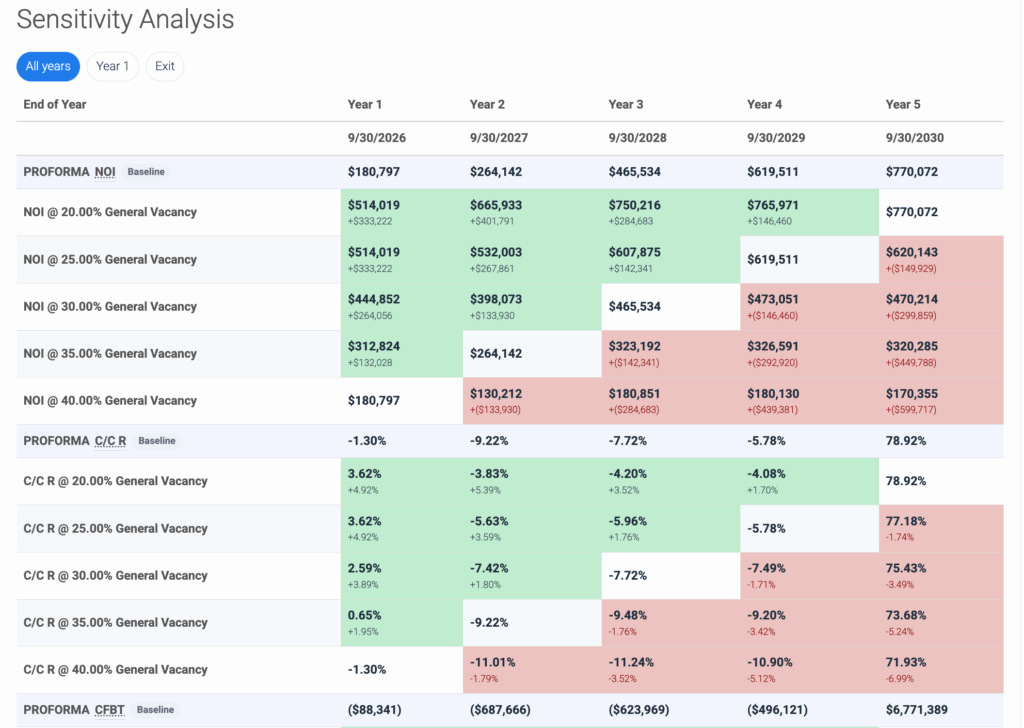

Our CRE investment analysis software doesn’t stop at building a proforma. It instantly serves up the numbers that matter. See live updates for IRR, NPV, cash‑on‑cash return, gross rent multiplier, DSCR, breakeven occupancy, and more the moment you tweak an assumption.

Need deeper insight? Run maximum‑loan sizing, drill into a roll‑up rent roll, or spin up a full sensitivity matrix in seconds. Then export every metric—branded with your logo and contact info—to PDF or Excel with a single click. Automate the math, focus on the deal.

Create Presentation-Ready Reports

Create polished PDF and Excel packages with a single click. Our web‑based CRE investment analysis and real estate development software automatically assembles every report you need—proforma, rent roll, sources & uses, market‑leasing assumptions, construction budget, draw schedule, maps, aerials, and more—then lets you brand the entire set with your logo, contact details, and page numbers.

When you’re ready to share, one tap sends the full package to our built‑in Publisher tool—no copy‑paste, no file juggling. Focus on insights, not formatting, and showcase your analysis like a pro.

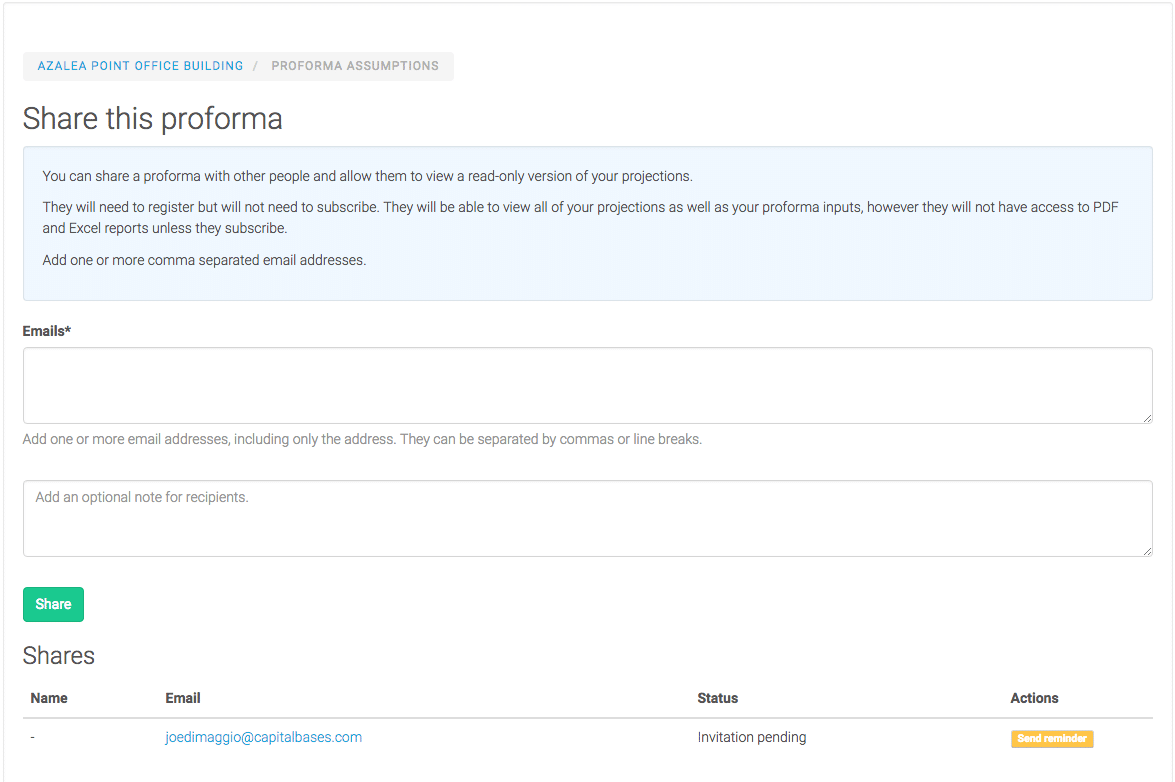

Share Your Model in Seconds

Share your analysis in seconds. Just type a few email addresses and hit Send. Each person gets a secure link to create a free, read‑only account and view the live model. Invite as many teammates, consultants, clients, or investors as you need at zero extra cost.

One source of truth, no version chaos. Keep everyone aligned and move deals forward faster.

Make Deals Not Spreadsheets

Stop untangling homebrewed Excel models. Our CRE underwriting and valuation software eliminates the limitations of Excel and makes it simple for you to create, analyze, and share real estate proformas online. No more struggling to decipher someone else’s financial model or spending countless hours fixing formula errors.

Our online commercial real estate investment analysis and real estate development software is utilized by individuals worldwide and is constantly being updated and improved, so you don’t have to start from scratch. Start using it today for free and experience the benefits of a streamlined and efficient real estate analysis process.

Test‑Drive Our CRE Investment Analysis Software Free for 7 Days

Frequently Asked Questions

It’s cloud-based commercial real estate investment analysis software that helps you create a complete pro forma in minutes, not hours. Whether you’re evaluating an acquisition, underwriting a new development, analyzing an existing asset, or preparing an appraisal, it’s designed to support the full spectrum of CRE projects across office, industrial, retail, multifamily, self-storage, and more.

The software can model multi-tenant cash flows, reimbursements, rent escalations, tenant improvements, leasing commissions, renewal probabilities, market-leasing assumptions, loan draws, and construction budgets. It brings structure to the details that make commercial real estate complex, so you can underwrite confidently and value properties more accurately.

With built-in discounted cash flow (DCF) modeling, it calculates IRR, PV, NPV, DSCR, debt yield, cash-on-cash return, cap rate, equity multiple, operating expense ratio, breakeven occupancy, and other essential valuation metrics. A real-time interface makes scenario testing and sensitivity analysis fast and intuitive, letting you see how assumptions affect returns instantly.

It’s faster and more reliable than Excel and handles complexity far beyond spreadsheets. Investors, brokers, lenders, developers, and appraisers all rely on our commercial real estate underwriting and valuation software to estimate property value, test investment scenarios, and decide whether a project meets their target returns.

You import or enter a rent roll, operating expenses, other income, and loans. You can layer in assumptions for vacancy, capital expenditures, development costs, market leasing assumptions, and inflation. Our commercial real estate underwriting software then calculates monthly and annual cash flows along with all supporting schedules and projections. These include a proforma, lease audit report, loan amortization schedule, loan draws, rent roll, sensitivity analysis, and more. When you are done you can export your report package to PDF or Excel. Everything works in your browser—no downloads or desktop installations required.

Yes. You get 80% of typical ARGUS workflows (lease‑level modeling, detailed recovery structures, DCF, sensitivity tables) at a fraction of the price and with zero desktop installations. Plus, PropertyMetrics adds real‑time collaboration, share‑links, and polished PDF/Excel branding that ARGUS lacks. Our commercial real estate investment and development software is a good alternative to both Argus Enterprise and Argus Developer.

Yes. PropertyMetrics is 100 % browser‑based and works on Mac, Windows, iPad, Android tablets, and even phones. No downloads, VPNs, or remote desktops are required.

Yes. Our real estate development software includes functionality for adding development costs and self-funded interest only construction loans that can fund individual cost line items. We include a monthly loan draw schedule and a detailed monthly sources and uses report.

Yes. Just paste your rent roll into our pre‑formatted Excel template and drag‑drop it. PropertyMetrics auto‑maps tenant names, suite numbers, lease dates, rent steps, recovery structures, and even market‑leasing profiles, importing dozens or hundreds of rows in seconds with zero manual re‑keying.

Our software is designed for the full spectrum of CRE professionals:

- Appraisers conducting valuations

- Investors evaluating acquisitions

- Developers modeling new projects

- Lenders reviewing loan underwriting

- Brokers preparing offering packages

No. PropertyMetrics is 100% web-based commercial real estate software. There’s nothing to install or maintain, and it works on any device with an internet connection. Updates are automatic, so you always have the latest features without relying on IT.

Yes. We offer a free trial so you can explore the software before subscribing. During your trial, you’ll have full access to all core features, including building proformas, running discounted cash flow (DCF) models, and generating reports. You can test it with your own projects and see how it compares to Excel or other CRE tools. If you decide to continue to a paid plan, you can proceed without losing your work.