The Net Present Value (NPV) is a frequently used and critical measure of investment performance. This online NPV calculator makes it easy to quickly calculate and share the net present value for any set of cash flows.

NPV Calculator

Cash Flow

Calculated Result

Discount Rate

0.0%

Number of Periods

1

Year

Cash Flow

Internal Rate of Return (IRR)

0.0%

Present Value (PV)

$0

Net Present Value (NPV)

$0

About Our NPV Calculator

A Net Present Value (NPV) calculator is an important tool that helps investors determine the value of an investment by comparing the present value of expected future cash flows to the initial investment. Our NPV calculator is an easy-to-use tool that can help investors evaluate potential investment opportunities and make informed decisions. Our web-based real estate analysis software can help you create a more advanced real estate proforma and discounted cash flow analysis, but sometimes all you need is a simple calculator.

To use our NPV calculator, simply enter the initial investment and the expected cash flows for each period. The calculator will then use a discount rate to calculate the present value of each cash flow and add them together to determine the net present value. If the net present value is positive, the investment is expected to generate a profit, while a negative net present value indicates that the investment is likely to result in a loss.

One of the standout features of our NPV calculator is its flexibility. The calculator allows users to enter up to 20 cash flows, which can be adjusted to reflect changes in expected cash flows or investment costs. Additionally, the calculator includes a convenient “Copy” button that makes it easy to duplicate cash flows across multiple periods. This is particularly useful for investments with steady, predictable cash flows, such as rental properties or bonds. And once you are done, you can click the “Share” button and copy the URL to share your analysis with anyone.

The NPV calculation is based on the time value of money, which takes into account the fact that money today is worth more than the same amount of money in the future. By using a discount rate, the NPV calculator adjusts expected cash flows to reflect their present-day value. This allows investors to compare the expected value of an investment to its actual cost and determine whether the investment is worth pursuing.

The discount rate used in the NPV calculation is often based on the investor’s required rate of return, which reflects the level of risk associated with the investment. Investments with higher levels of risk typically require a higher rate of return to compensate investors for the additional risk. The NPV calculator can help investors determine the required rate of return needed to achieve a specific level of profit, or it can be used to determine the potential profit of an investment given a specific required rate of return.

In addition to the NPV calculation, other metrics are also usually considered, such as the internal rate of return (IRR) and the payback period. The IRR represents the discount rate at which the net present value of the cash flows is equal to zero. The payback period represents the amount of time it takes for the initial investment to be paid back through the investment’s cash flows. These metrics can provide additional insights into the expected value and risk associated with an investment opportunity.

Overall, our NPV calculator is a powerful tool that can help investors evaluate potential investment opportunities and make informed decisions. By using the calculator to compare the present value of expected cash flows to the initial investment, investors can determine whether an investment is likely to generate a profit or result in a loss. Additionally, the calculator’s flexible input options and ability to calculate other key metrics such as IRR and payback period make it a valuable tool for anyone interested in making smarter investment decisions.

NPV Calculator in Excel

We’ve also created a handy NPV calculator in Excel. This Excel based NPV calculator will allow you to calculate the net present value for cash flows in a simple to use Excel model.

NPV Calculator

Fill out the quick form below and we’ll email you our free NPV calculator. You can use our NPV calculator to quickly calculate NPV for any holding period you need. You can also visualize what your cash flows are doing in each period of the analysis.

How to Use The NPV Calculator in Excel

Here is how you can use this NPV calculator, step by step.

- Download the NPV calculator using the form above.

- Adjust the number of periods you want in your holding period. Our calculator can handle any number of periods you require.

- Input your cash flows.

- Enter your required discount rate.

- View the calculated NPV

As you can see, we’ve made it simple to use our NPV calculator.

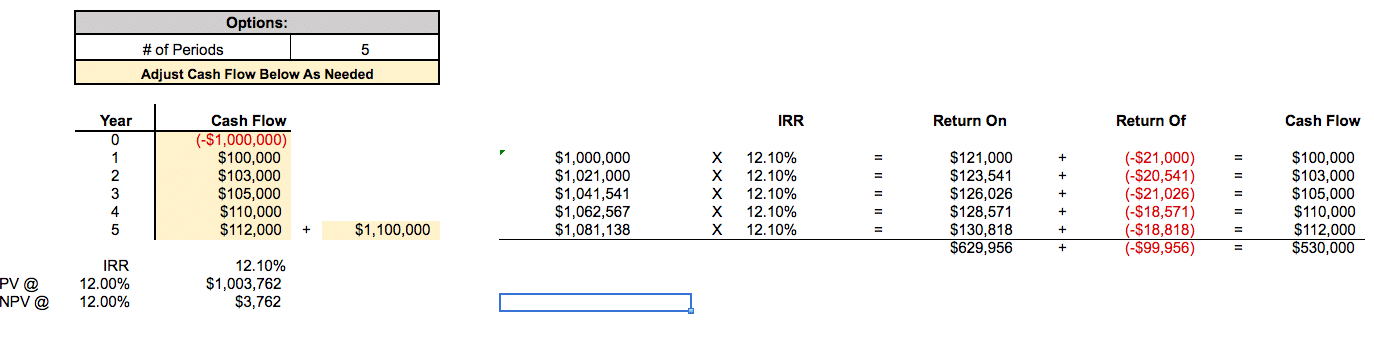

NPV Calculator Example #1

Let’s walk through a simple example using this NPV calculator. Suppose we have the following cash flows we’ve estimated for a potential commercial real estate investment property:

Initial Investment: $1,000,000

Annual Cash Flows for 5 years: $100,000, $103,000, $105,000, $110,000, $112,000

Net Sales Proceeds: $1,100,000

To determine if this is an investment we want to take a closer look at, we can quickly calculate the net present value. To accomplish this, we simply need to input the above cash flows into our NPV calculator, enter a discount rate, and then view our NPV:

As you can see, the projected cash flows result in an NPV of $3,762 assuming our discount rate is 12%. What does this mean? The net present value simply measures the present value of all future cash flows minus the present cost to acquire those cash flows. Our present value is also calculated above at a 12% discount rate and this results in a PV of $1,003,762. This is what all of these future cash flows are worth to us today at a 12% discount rate. Now we can simply subtract our initial cost of $1,000,000 to get our net present value of $3,762. The NPV formula in Excel simply completes this process in one single step. As you can see, we also provide the internal rate of return (IRR) in this calculator, as well as a visual breakout of the cash flows in each period of the holding period.

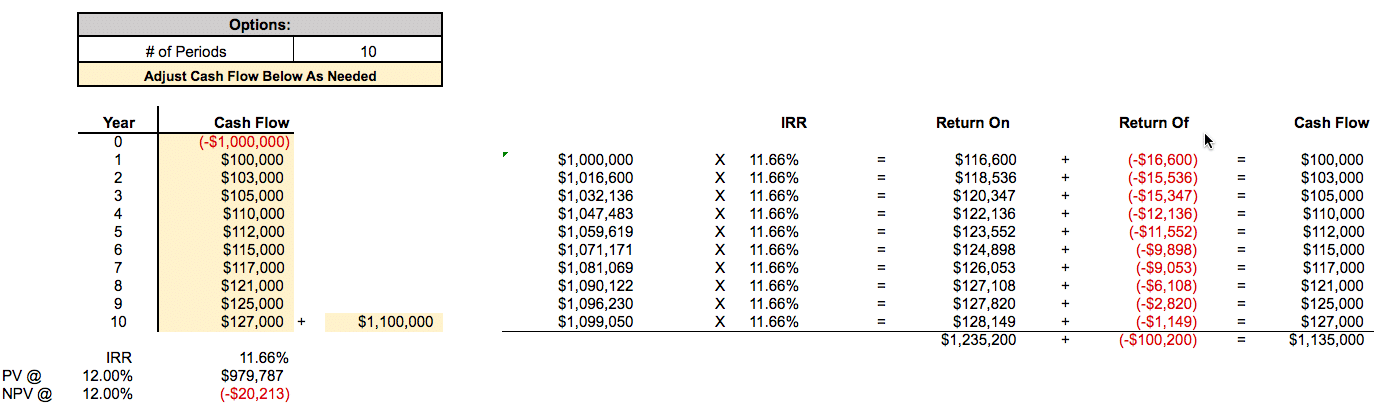

NPV Calculator Example #2

Now suppose we have more than 5 cash flows. To change the holding period all you need to do is change the optional “# of Periods” input. Then the cash flow table and visual chart will automatically update for you. As shown below, we’ve updated our cash flow projection from the example above to 10 years instead of 5. Now we instantly have a new cash flow table as well as new calculations.

Again, we can see that the NPV calculated above is $-20,213. This means that in order to achieve our required return of 12%, we need to pay $20,2013 less than the initial investment of $1,00,000. In other words, if we pay $979,787 for this set of cash flows instead of $1,000,000, then we will achieve our requires rate of return of 12%. For more on the meaning of NPV, check out our article on the intuition behind IRR and NPV.

NPV Calculator

Fill out the quick form below and we’ll email you our free NPV calculator. You can use our NPV calculator to quickly calculate NPV for any holding period you need. You can also visualize what your cash flows are doing in each period of the analysis.