The Internal Rate of Return (IRR) is a widely used measure of investment performance in finance, private equity, and commercial real estate. Our simple IRR calculator will help you quickly calculate the internal rate of return for any set of cash flows.

IRR Calculator

Cash Flow

Calculated Result

Number of Periods

1

Year

Cash Flow

Internal Rate of Return (IRR)

0.0%

About our IRR Calculator

An internal rate of return (IRR) calculator is a powerful tool that helps investors make more informed decisions about their investments. By providing a view of potential returns, an IRR calculator can help investors better understand the risks and rewards associated with their investment choices.

Our IRR calculator is a simple yet robust tool that allows users to enter up to 20 cash flows and then calculates the internal rate of return. One of the standout features of our calculator is the ability to copy any single cash flow down to the remaining rows. This makes it easy to enter large amounts of data quickly and accurately.

To use the IRR calculator, simply enter the cash flows for each period in the input fields. The first field is for the initial investment or cash outflow, while the remaining fields are for cash inflows in each subsequent period. Once you have entered all of your cash flows, your results will automatically be calculated in real-time.

The IRR calculation is based on the time value of money, which takes into account the fact that money today is worth more than the same amount of money in the future. The IRR represents the discount rate at which the net present value of the cash flows is equal to zero. In other words, it is the rate at which the investment’s future cash flows are discounted to equal the initial investment.

The IRR is a useful metric for evaluating investment opportunities because it provides a single rate of return that takes into account the timing of all cash flows. By comparing the IRR of different investments, investors can determine which one is likely to provide the highest return for the amount of risk they are willing to take.

For example, suppose you are considering two investments: one that requires an initial investment of $10,000 and will provide annual cash inflows of $3,500 for five years, and another that requires an initial investment of $10,000 and will provide annual cash inflows of $2,000 for ten years. Using our IRR calculator, you can quickly see that the first investment has an IRR of 22.11%, while the second investment has an IRR of 15.10%. This means that the second investment provides a higher return. However, it’s important to consider other factors as well. For example, different holding periods, different amount of risk, etc. could all impact your investment analysis.

Share Your IRR Calculator Results

In addition to its other features, our IRR calculator also includes a convenient “Share” button that allows users to easily share their results with others. Once you have entered all of your cash flows and calculated the IRR, simply click the “Share” button to generate a unique URL.

This URL contains all the data you entered in our calculator, including the cash flows and the IRR calculation. You can share this URL with anyone you like, and they will be able to see exactly what you see in the calculator. This makes it easy to share investment opportunities with colleagues, friends, or family members and get their input on whether a particular investment is worth pursuing.

The shareable URL is particularly useful for financial advisors or anyone else who needs to communicate investment opportunities with clients. Rather than sending multiple emails or attachments, advisors can simply provide a single URL that contains all the relevant information. This saves time and reduces the risk of miscommunication or confusion.

The shareable URL also makes it easy to revisit a particular investment opportunity at a later time. By bookmarking the URL or saving it in a document or spreadsheet, you can quickly access the data and calculations whenever you need them.

In conclusion, our IRR calculator is a valuable tool for investors who want to make informed decisions about their investment choices. By providing a view of potential returns, the calculator can help investors evaluate the risks and rewards of different investments and determine which one is likely to provide the highest return for the amount of risk involved. So, why not try it out today and see how it can help you make better investment decisions?

IRR Calculator in Excel

We have also created an Excel IRR calculator as well. This IRR calculator is based on Excel and makes it easy for you to quickly calculate and visualize the IRR for any set of cash flows.

IRR Calculator

Fill out the quick form below and we’ll email you our free IRR calculator. You can use our IRR calculator to quickly calculate IRR for any holding period you need. You can also visualize what IRR is doing in each period of the analysis.

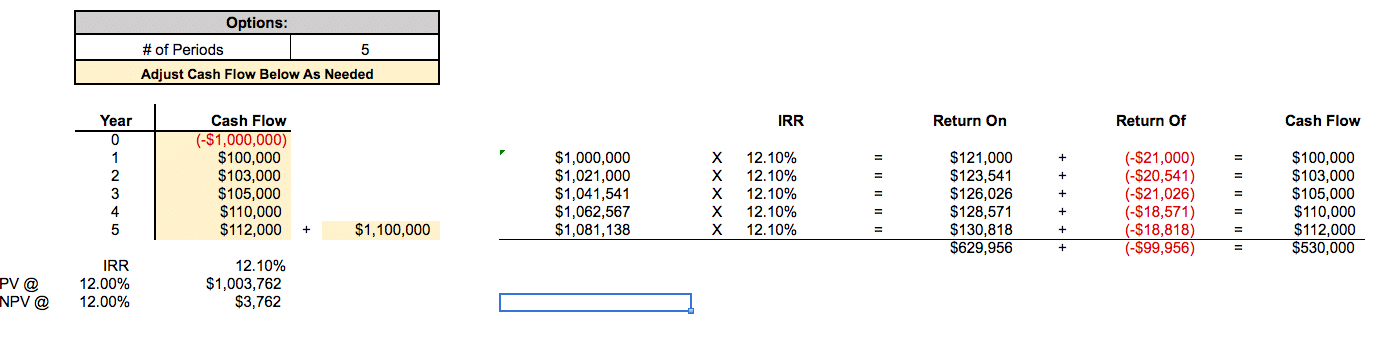

IRR Excel Calculator Example #1

Let’s walk through a simple example using this IRR calculator. Suppose we have the following cash flows we’ve estimated for a potential commercial real estate investment property:

Initial Investment: $1,000,000

Annual Cash Flows for 5 years: $100,000, $103,000, $105,000, $110,000, $112,000

Net Sales Proceeds: $1,100,000

To determine if this is an investment we want to take a closer look at, we first need to calculate the IRR. To accomplish this, we simply need to input the above cash flows into our IRR calculator, and then view our IRR.

As you can see, the projected cash flows result in an IRR of 12.10%. What does this mean? The IRR is defined as the percentage rate earned on each dollar invested for each period invested. So, in this example, our 12.10% IRR simply means that we will earn 12.10% in each of the 5 years during our holding period. This is shown in the visual chart to the right of our inputted cash flows. As you can see, our initial investment of $1,000,000 earns 12.10% in year 1 (this is our calculator IRR). This results in a “Return On” investment of $121,000. However, since our cash flow is only $100,000 in year 1, that means we have an extra $21,000 (since we earned $121,000), and therefore this extra $21,000 gets added to our investment balance in year 2. As shown above, our year 2 investment balance is our original $1,000,000 investment balance plus the extra $21,000 in cash flow earned by not returned to us. This process repeats for every year in the holding period and is summarized in the visual chart above.

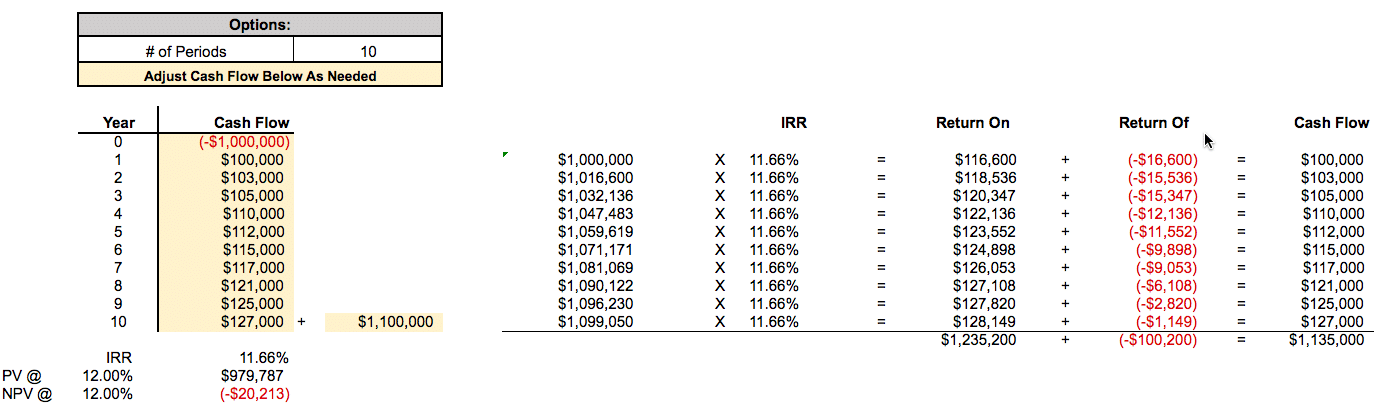

Excel IRR Calculator Example #2

Now suppose we have more than 5 cash flows. To change the holding period, all you need to do is change the optional “# of Periods” input. Then the cash flow table and visual chart will automatically update for you. As shown below, we’ve updated our cash flow projection from the example above to 10 years instead of 5. Now we instantly have a new cash flow table and visual IRR chart: