Being completely comfortable with the time value of money is critical when working in the field of finance and commercial real estate. The time value of money is impossible to ignore when dealing with loans, investment analysis, capital budgeting, and many other financial decisions. It’s a fundamental building block that the entire field of finance is built upon. And yet, many finance and commercial real estate professionals still lack a solid working knowledge of time value of money concepts, and they consistently make the same common mistakes. In this article, we take a deep dive into the time value of money, discuss the intuition behind the calculations, and we’ll also clear up several misconceptions along the way.

What is the Time Value of Money

The time value of money is defined as the economic principle that a dollar received today has greater value than a dollar received in the future. What does the time value of money mean? The intuition behind the time value of money is easy to see with a simple example. Suppose you were given the choice between receiving $100,000 today or $100,000 in 100 years. Which option would you rather take? Clearly, the first option is more valuable for the following reasons:

No Risk – There is no risk with getting money back that you already have today.

Higher Purchasing Power – Because of inflation, $100,000 can be exchanged for more goods and services today than $100,000 in 100 years. Put another way, just think back to what $100,000 could buy you 100 years ago. $100,000 in 1922 would be the equivalent of roughly $1,700,000 today.

Opportunity cost – a dollar received today can be invested now to earn interest, resulting in a higher value in the future. In contrast, a dollar received in the future cannot begin earning interest until it is received. This lost opportunity to earn interest is the opportunity cost.

For these reasons, we can boil down the time value of money into two fundamental principles:

- More is better than less.

- Sooner is better than later.

With this fundamental intuition out of the way, let’s jump right into the two basic techniques used in all time value of money calculations: compounding and discounting.

Compounding and Discounting: The Foundation For All Time Value of Money Problems

All time value of money problems involve two fundamental techniques: compounding and discounting. Compounding and discounting is a process used to compare dollars in our pocket today versus dollars we have to wait to receive at some time in the future. Before we dive into specific time value of money examples, let’s first review these basic building blocks.

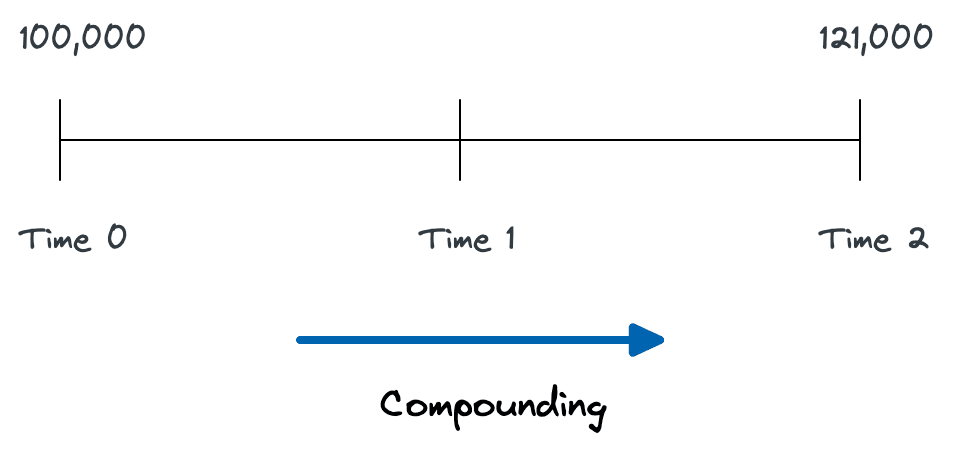

Compounding is about moving money forwards in time. It’s the process of determining the future value of an investment made today and/or the future value of a series of equal payments made over time (periodic payments).

What’s the intuition behind compounding? Most people immediately understand the concept of compound growth. If you invest $100,000 today and earn 10% annually, then your initial investment will grow to some figure larger than the original amount invested. For example, in the illustration above $100,000 is invested at time 0 and grows at a 10% rate to $121,000 at time 2. We’ll go over the details of this calculation later, but for now just focus on the intuition. The initial investment compounds because it earns interest on the principal amount invested, plus it also earns interest on the interest.

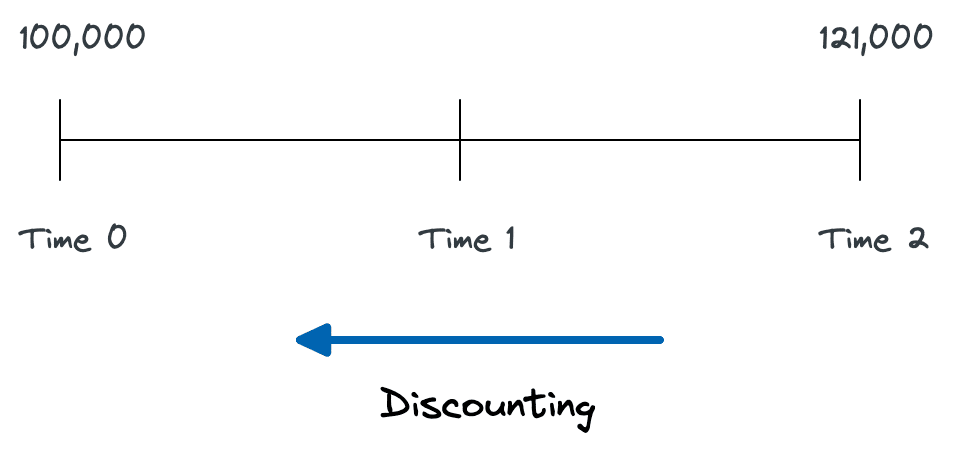

Discounting is about moving money backwards in time. It’s the process of determining the present value of money to be received in the future (as a lump sum and/or as periodic payments). Present value is determined by applying a discount rate (opportunity cost) to the sums of money to be received in the future.

What’s the intuition behind discounting? When solving for the future value of money set aside today, we compound our investment at a particular rate of interest. When solving for the present value of future cash flows, the problem is one of discounting, rather than growing, and the required expected return acts as the discount rate. In other words, discounting is merely the inverse of growing.

The 5 Components of All Time Value of Money Problems

So now that we have some basic intuition about compounding and discounting, let’s take a look at the 5 components of all time value of money problems. Why is it important to understand this? Because in every single time value of money problem, you’ll know four out of these five variables and will be able to easily solve for the fifth unknown variable. The 5 components of all time value of money problems are as follows:

Periods (n). The total number of compounding or discounting periods in the holding period.

Rate (i). The periodic interest rate or discount rate used in the analysis, usually expressed as an annual percentage.

Present Value (PV). Represents a single sum of money today.

Payment (PMT). Represents equal periodic payments received or paid each period. When payments are received they are positive, when payments are made they are negative.

Future Value (FV). A one-time single sum of money to be received or paid in the future.

The Key to Solving Any Time Value of Money Problem

Every single time value of money problem includes the above 5 components. Understanding this is critical because of one simple fact: if you can identify any 4 of the 5 components, then you can easily solve for the 5th. The key is to simply learn to identify the 4 known variables in a time value of money problem. Let’s revisit the example above to illustrate how this works.

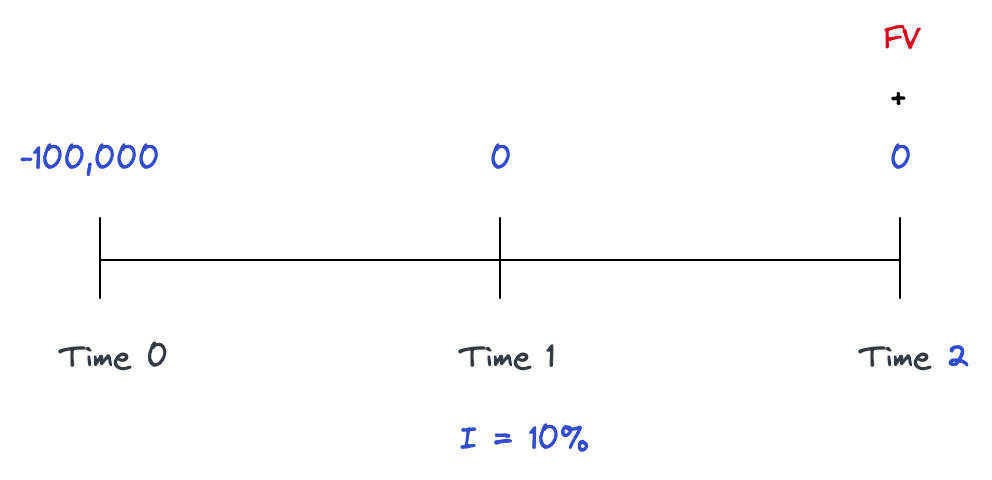

Suppose you invest $100,000 today at 10% compounded annually. What will this investment be worth in 2 years?

First, we know that our present value (PV) is $100,000 since this is what we are investing today. Next, the rate (i) is given to us as 10%. Third, the number of periods (n) in this problem is 2 years. So that leaves 2 remaining variables out of the five: payment (PMT) and future value (FV). Which one out of the two do we know? While it wasn’t explicitly given to us, we do know that the payment (PMT) in this problem is zero. Whenever payment isn’t explicitly given to us, it’s implied that there is no payment. So, all that leaves us with is the future value (FV) component, which we can now easily solve. For now, don’t worry about actually doing the calculations. Instead, just focus on identifying the 4 known variables and the final 5th unknown.

The Time Value of Money Timeline

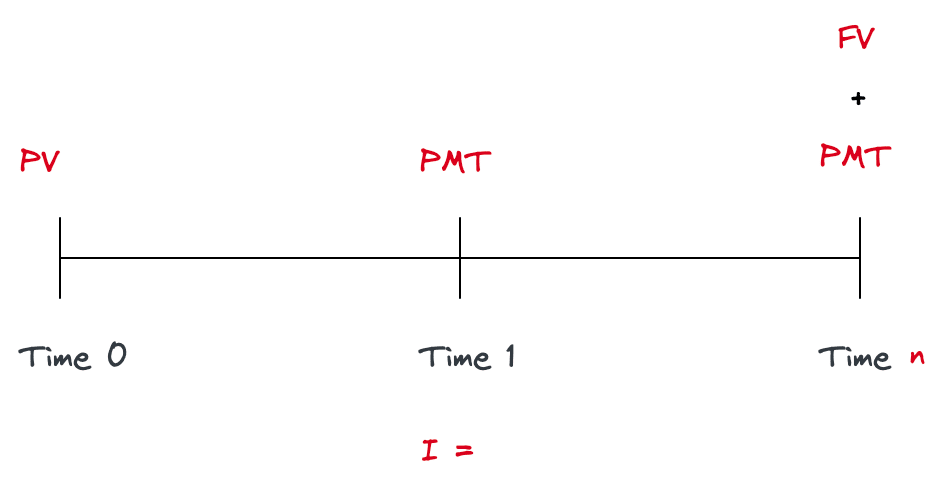

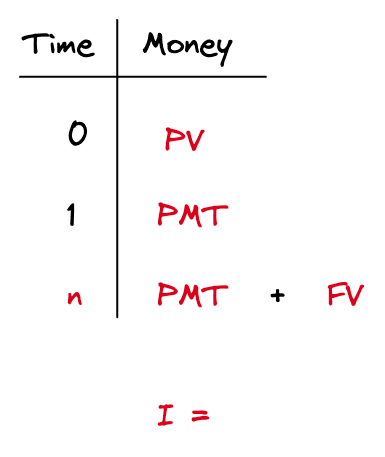

Time value of money problems can always be visualized using a simple horizontal or vertical timeline. When you’re first learning how to solve time value of money problems, it’s often helpful to draw the 5 components of each problem out on a timeline, so you can visualize all the moving pieces.

As shown above, the 5 components of all time value of money problems (PV, FV, PMT, i, n) can be illustrated on a simple horizontal timeline. It’s also common to see a vertical timeline as well:

When drawing out a timeline for a time value of money problem, simply fill in the 4 known components, so you can clearly identify and solve for the unknown component. Here’s a timeline for the example compounding problem above, showing the 4 known components:

Note that it’s important to distinguish between a point in time and a period of time. The portion of time between “Time 0” and “Time 1” is collectively Period 1. However, “Time 0” and “Time 1” are each just specific points in time during Period 1. Time 0 is the beginning of Period 1, and Time 1 is the end of Period 1. In the same way, Time 1 is the beginning of Period 2 and Time 2 is the end of Period 2.

Consistency of Time Value of Money Components

Before we dive into specific time value of money example problems, let’s quickly go over one of the most common roadblocks people run into. One of the most common mistakes when it comes to the time value of money is ignoring the frequency of the components. Whenever you are solving any time value of money problem, make sure that the n (number of periods), the i (interest rate), and the PMT (payment) components are all expressed in the same frequency. For example, if you are using an annual interest rate, then the number of periods should also be expressed annually. If you’re using a monthly interest rate, then the number of periods should be expressed as a monthly figure. In other words, n should always be the total number of periods, i should be the interest rate per period, and PMT should be the payment per period.

Note that most financial calculators have a “Payment Per Year” setting that attempts to autocorrect the consistency of the n and i components. If you’re just starting out with a financial calculator, it’s a good idea to ignore this functionality altogether. Instead, you can simply set the payments per year in the calculator to 1 (one) and then keep the n, i, and PMT components consistent. This will greatly reduce the errors and frustration you have with your financial calculator.

Cash Inflows vs Cash Outflows

In time value of money problems, it’s also important to remember that negative and positive signs have different meanings. One helpful way to think about sign changes is as inflows and outflows of money. A negative sign simply means money is flowing out of your pocket. A positive sign means money is flowing into your pocket.

Financial Calculators and The Time Value of Money

The above 5 components of every time value of money problem are the same regardless of how you decide to solve for the unknown. There are several popular financial calculators available, and all of them include the above 5 components as buttons. Teaching you how to use a financial calculator is beyond the scope of this article, but if you’re just getting started we recommend either the Hewlett Packard 10BII or the Texas Instruments BA II Plus. They both come with instruction manuals that include helpful tutorials.

Additionally, all time value of money problems can also be solved in Excel. Below, we provide you a solutions worksheet containing sample time value of money problems and answers. This will give you the exact formulas you can use in Excel to solve the most common time value of money problems.

Learn How to Use a Financial Calculator

Try our complete online course that teaches you how to use an HP 10BII financial calculator with a complete time value of money crash course

Includes a complete time value of money crash course

No prior finance knowledge required

Commercial real estate specific examples

60-day money back guarantee

Time Value of Money Problems: The 6 Functions of a Dollar

With the above foundations out of the way, let’s dive into some time value of money practice problems. There are 3 fundamental types of compounding problems, and also 3 fundamental types of discounting problems. Together, these make up what’s commonly referred to as the 6 functions of a dollar.

These fundamental time value of money problems come up over and over again in finance and commercial real estate, so mastering them will go a long way towards strengthening your skill set. As mentioned, we are providing you with a solutions worksheet below containing answers to the following 6 time value of money problems. As you read through the questions, focus on identifying the 4 known components, and if you are already comfortable with a financial calculator, try solving them first before looking at the answers.

3 Basic Types of Compounding Problems

Half of the 6 functions of a dollar are compounding problems. These time value of money problems include finding the future value of a lump sum, the future value of a series of payments, and the payment amount needed to achieve a future value. Let’s dive into each of these problems with specific time value of money examples.

Future value of a single sum

This type of problem compounds a single amount to a future value. Here’s an example of this type of time value of money problem:

What will $100,000 invested today for 7 years grow to be worth if compounded annually at 5% per year?

To solve this problem, you need to identify the 4 known components and then use a calculator to find the 5th unknown component.

- Present Value (PV): We know the present value is -$100,000 because it’s what’s invested today. It’s negative because it’s leaving our pocket when we put it into the investment.

- Number of Periods (N): The number of periods N is 7 years.

- Interest Rate (I): The interest rate is 5%.

- Payment (PMT): Since no payment is mentioned in the problem, it is implied to be $0.

- Future Value (FV): This is what we want to calculate.

The N and I components are both expressed annually, so they are consistent. Knowing this, we can simply plug the 4 known components into the calculator and solve for future value FV, which is $140,710.

Future value of a series of payments

This type of problem compounds an annuity to a future value. Here’s an example of this type of time value of money problem:

If you deposit $12,000 at the end of each year for 10 years earning 8% annually, how much money will be in the account at the end of year 10?

To solve this problem, let’s first identify the 4 known components.

- Payment (PMT): We know that the payment amount PMT is -$12,000 because that’s what we are depositing at the end of each year.

- Interest Rate (I): We also know that the interest rate I is 8%.

- Number of Periods (N): The total number of periods N is 10 years.

- Present Value (PV): Since we aren’t starting with anything, our present value is $0.

- Future Value (FV): This is the fifth unknown we want to calculate.

Again, in this problem the total number of compounding periods is expressed annually and so is the interest rate, so the N and I components are consistent. Now we can easily solve for the future value FV, which is $173,839.

Payments needed to achieve a future value

This type of problem compounds a series of equal payments into a future value and is also known as a sinking fund payment. Here’s an example of this type of time value of money problem:

At a 7% interest rate, how much needs to be deposited at the end of each month over the next 10 years to grow to be exactly $50,000?

Let’s start by identifying the 4 known variables.

- Interest Rate (I): We know that the rate I is 7%, and it is implied to be an annual rate.

- Number of Periods (N): We are given the total number of periods N which is 10 years.

- Future Value (FV): The future value FV we are trying to achieve is $50,000.

- Present Value (PV): Since no present value is mentioned, it is implied to be $0.

- Payment (PMT): This is what we want to calculate, and it is a monthly payment.

A quick check ensures that the rate and the number of periods are both expressed in years, but what about the payment frequency? The payment frequency in this problem is expressed monthly, so we are going to have to do some conversion to set this problem up correctly. Let’s convert everything to a monthly frequency so we are consistent with our payments.

To accomplish this, we can simply divide the 7% interest rate by 12 months to get .58% per month. Next we can multiply our 10-year analysis period by 12, since there are 12 months in each year, to get 120 total months. Now our N is 120 months, I is .58% per month, our FV is $50,000, and we can solve for a monthly payment PMT amount. Now we can simply plug these 4 known components in and solve for the payment PMT needed, which is $288.88 per month.

3 Basic Types of Discounting Problems

The other half of the 6 functions of a dollar involve discounting. These time value of money problems involve finding the present value of a lump sum, the present value of a series of payments, and the payment amount needed to amortize a present value such as a loan. Let’s dive into these discounting problems with some specific time value of money examples.

Present value of a single sum

This type of problem discounts a single future amount to a present value. Here’s an example of this type of time value of money problem:

A U.S. savings bond will be worth $10,000 in 10 years. What should you pay for it today to earn 6.5% annually?

To solve this time value of money problem, let’s take a look at the 4 variables that we know.

- Future Value (FV): We are given the future value FV of $10,000.

- Number of Periods (N): The number of periods N is 10 years.

- Interest Rate (I): The interest rate is 6.5% per year.

- Payment (PMT): The payment is not mentioned, so it is implied to be $0.

- Present Value (PV): This is what we want to calculate.

Both the rate and the number of periods are consistent, so we can now solve for the unknown present value PV, which is $5,327.26.

Present value of a series of payments

This type of problem discounts an annuity (or series of equal payments) to a present value. Here’s an example of this type of time value of money problem:

An insurance company is offering an annuity that pays $2,500 per month for the next 20 years. How much should you pay for the annuity to earn 8% per year?

To solve this problem, you need to identify the 4 known components and then calculate the 5th unknown:

- Payment (PMT): We know that the payment PMT is $2,500 per month.

- Number of Periods (N): The total number of periods N is 20 years.

- Interest Rate (I): The interest rate is given as 8% per year.

- Future Value (FV): The future value is implied to be $0.

- Present Value (PV): This is what we want to calculate.

The rate and the total number of periods are consistent as annual figures at first glance. However, we also have monthly payments. So, we have to convert our annual number of periods (20 years) to 240 months, and also convert our annual rate of 8% to a monthly rate of .667. Now we can now easily solve for the present value PV, which is 298,885.73.

Amount needed to amortize a present value

This type of problem determines a series of equal payments necessary to amortize a present value. Here’s an example of this type of time value of money problem:

What are the monthly payments on a 30-year loan of $300,000 at an annual rate of 4.5% compounded monthly?

Let’s start by identifying the known variables:

- Number of Periods (N): We are given the total number of periods N of 30 years.

- Present Value (PV): We are also given a present value PV of $300,000.

- Interest Rate (I): The annual interest rate is 4.5%, and it is compounded monthly.

- Future Value (FV): This is a loan amortized over 30 years, so it is implied that the future value FV is $0, since it will be fully amortized.

- Payment (PMT): This is the unknown we want to calculate.

After a quick check, it appears that the number of periods and the rate are actually expressed in different compounding periods, which of course presents a conflict. To resolve this, let’s adjust the N and I components so they are both expressed monthly. Using the formulas above, we can convert the total number of compounding periods to 30 x 12, or 360 months and the rate to 4.5% / 12, or 0.375% per month. Now we have our 4 known components and can easily solve for the present value, which is 1,520.06.

Time Value of Money Solutions Worksheet

As mentioned above, there are many ways to solve a time value of money problem, including financial calculators, regular calculators, software, and spreadsheets. While going over calculator keystrokes is outside the scope of this article, we did put together an Excel worksheet with solutions to the above 6 problems. You are welcome to download it for free here:

Time Value of Money Solutions Worksheet

Fill out the quick form below and we’ll email you a free Excel worksheet with solutions to the above 6 functions of a dollar time value of money problems

Conclusion

Time value of money concepts are at the core of valuation and other finance and commercial real estate topics. This article provides a solid foundation for understanding time value of money at an intuitive level, and it also gives you the tools needed to solve any time value of money problem. The time value of money is required as a basic building block in finance, and mastering these concepts will pay dividends for years to come.