The development spread is a back of the envelope calculation widely used by real estate developers. It is a fast and easy way to size up the financial feasibility of a real estate development project, before completing a more in-depth analysis. In this article, we’ll take a closer look at the development spread and walk through an example of how it is used in practice.

What is the Development Spread?

First, what is the development spread? The development spread is defined as the difference between the going-in cap rate and the going-out cap rate.

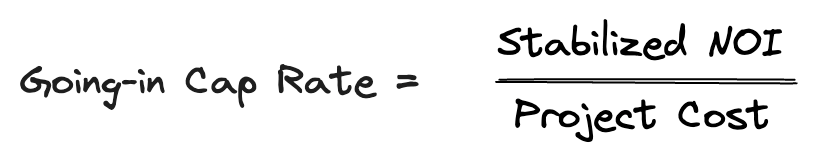

The going-in cap rate is the projected stabilized net operating income for the property, divided by the initial project cost.

For example, suppose that after the construction and lease-up of a project, the stabilized net operating income is $100,000 and the total project cost is $1,000,000. That means the going-in cap rate would be 100,000/1,000,000, or 10%. It is also common to see the going-in cap rate referred to as the yield on cost, development yield, return on cost, cost cap rate, or the “build-to” rate.

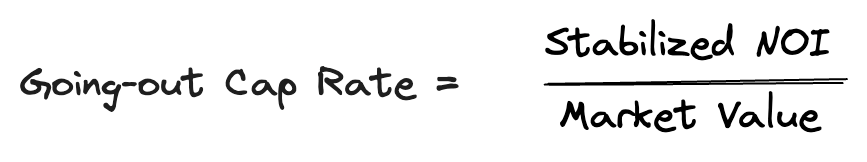

The going-out cap rate is the projected stabilized net operating income for the property, divided by the market value upon completion.

For example, suppose the stabilized net operating income for our project is again $100,000 and the expected market value of our project once stabilized is $1,200,000. In this case the going-out cap rate would be 100,000/1,200,000, or 8.33%. It is also common to see the going-out cap rate referred to as the exit cap rate, terminal cap rate, market cap rate, or the “sell-to” rate. This going out cap rate can be calculated by researching prevailing cap rates for similar properties in the same submarket.

The development spread is the difference between the going-in cap rate and the going-out cap rate. In the example above the development spread would be 10% – 8.33%, or 1.67%

The development spread is a quick way to compare the yield when developing a new project versus the yield when acquiring a similar but already existing and stabilized property. The development spread tells you how much more return you will get by choosing to build a new project and as such taking on all of the additional risk of development. Typically, real estate developers aim for a development spread of 150-250 basis points.

Practical Development Spread Example

Let’s look at an example of how the development spread might be used in practice. Suppose we are evaluating a potential office building development project. Our estimated development budget shows a total project cost of $2,500,000.

Once the project is built and leased up we are projecting a stabilized net operating income of $250,000. So, our initial cost is $2,500,000 and our expected stabilized net operating income is $250,000. That means our going-in cap rate is 250,000/2,500,000, or 10%.

To estimate our going-out cap rate we can research recently sold, similar properties in the local market. Based on our own internal market data as well as discussions with local lenders, investors, appraisers, and brokers, we believe the market cap rate for our completed and stabilized project is 8%.

So, our going-in cap rate is 10% and our going-out cap rate is 8%. If we subtract the going-out cap rate from the going-in cap rate then we will get our development spread of 2%.

In practice you may also hear this scenario referred to as “building to a 10 cap” and “selling to an 8 cap”. Often real estate developers will use this “build to” and “sell to” language to describe the development spread.

Development Spread and Profit

The going-in cap rate and the going-out cap rate can also be used to calculate a back of the envelope profit. When combined with the development spread, an estimate of profit can give some additional context about the financial feasibility of a project. Let’s take a look at how we can quickly calculate the profitability of a project, using the same numbers from the development spread.

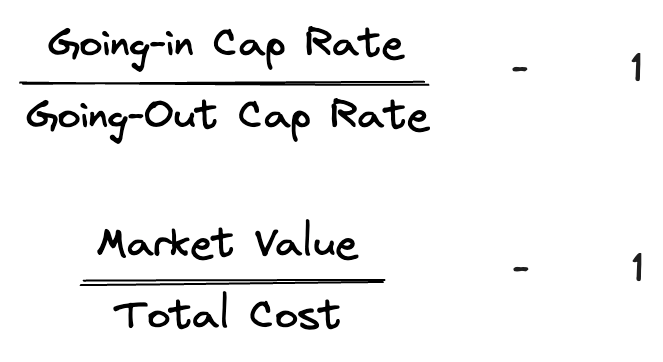

To calculate the profit, you can first calculate the cost markup by dividing the going-in cap rate by the going-out cap rate and then subtracting 1. This is the same as dividing the market value by the total cost and subtracting 1. Here is the formula:

So, in our example above, this would be (0.10 / 0.08) – 1, or 25%. This is the same as taking our stabilized market value of $3,125,000 ($250,000 NOI divided by 8% market cap rate), divided by our total development cost of $2,500,000, and subtracting 1. When we do this, we get a cost markup of (3,125,000/2,500,000) – 1, or 25%. This means our total dollar amount of profit is $2,500,000 (our project cost) x 25%, or $625,000. This results in a profit margin of 625,000 / 3,125,000, or 20%. Note that while this is technically a cost markup calculation, in real estate development it is often called the profit on cost margin.

Using these back of the envelope calculations in our example above, we were able to quickly see that the development spread on our project is 2%, which means we will earn an additional 2% above the market cap rate. This also translates to a 20% profit margin, which would be $625,000 based on our estimated project cost.

These are of course simplified calculations and do not consider timelines, selling fees, closing costs, leverage, unexpected cost variations or delays, etc. Nonetheless, these are quick and easy “back of the envelope” calculations that allow you to screen potential projects with minimal effort.

Development Spread vs Discounted Cash Flow Analysis

If a project doesn’t make sense using simple back of the envelope metrics such as the development spread and profit margin, then it is highly unlikely it will make sense using a more detailed discounted cash flow analysis. However, if a project does look financially feasible based on the development spread and profit margin, then refining the development budget and creating a more detailed proforma is usually the next step. A detailed monthly or annual proforma can then be used to calculate an internal rate of return, net present value, modified internal rate of return, equity multiple, and other financial metrics.

This will allow you to sharpen your pencil and consider all income, costs, timing, as well as best and worst case scenarios. Our Proforma software is designed to help you create a detailed proforma for commercial real estate projects, and includes functionality for complicated lease structures, unit mixes, custom reimbursements, variable and fixed expenses, development costs, capital expenditures, permanent and interest only construction loans, and more.

Conclusion

In this article we discussed the development spread in real estate. We defined the development spread as the difference between the going-in cap rate and the going-out cap rate. This difference is the additional return earned by undertaking a development project and all of its associated risks. We then showed how the same going-in and going-out cap rate can be used to calculate the profit margin for a development project. When combined with the development spread, the profit margin gives additional context about the financial feasibility of a real estate development project.

Finally, we contrasted these back of the envelope calculations with a more sophisticated proforma and discounted cash flow analysis. While a more detailed proforma and discounted cash flow analysis is an important next step after a project passes an initial screen, it is unlikely that a project will make sense using a discounted cash flow analysis if it doesn’t already make sense using the development yield and profit margin calculations.