Looking for a self storage proforma template in Excel? You’ve come to the right place. Our self storage proforma Excel template is perfect for quick and simple back of the envelope calculations for an apartment building.

Self Storage Proforma Excel Template

Fill out the quick form below and we’ll email you your free real estate proforma template.

"*" indicates required fields

Self Storage Overview and Case Study

Often, in the world of commercial real estate, it is stated that there are four (4) property types available for investment – Retail, Industrial, Multifamily, and Office. While this is true, it may be overly simplistic. There are a number of additional, specialized property types for which investment can be equally as profitable, but they are often overlooked. These include hotel/motel, restaurant, and self storage, among others.

In this article, we are going to provide an overview of the self storage property type, highlight pros and cons of investing in it, and discuss some of the unique operational requirements of owning it. And, perhaps most importantly, we are going to discuss how to analyze it by reviewing a simple case study. The goal of the article is to provide readers with the information and tools necessary to become more comfortable with analyzing self storage properties.

Let’s start with the basics.

What is Self Storage

Self storage is both an industry and a property type that provides short or long-term storage space for businesses and individuals to store their belongings. Typically, the motivation to rent storage space comes from one of the “4Ds” – death, divorce, dislocation (moving), or downsizing. For example, a family may be required to move to a new city for a job, and they may need to rent a storage unit for a few months while they determine where they want to live.

Self Storage Classes

Like other property types, self storage is divided into four “classes” to indicate price, condition, size, finish, and general risk level. The classes are as follows:

- Class A: Class A self storage properties are the newest, nicest, and biggest. They are typically located in the largest MSAs (Houston, New York, Dallas, Los Angeles, etc) and have 60,000+ SF of leasable space, easy access from major roadways or public transportation, and they are in the best condition – often new construction less than five years old. They also have the best amenities like gates, elevators, and temperature control systems.

From an investment standpoint, Class A self storage properties are the most expensive to purchase and they typically deliver the lowest, but most stable returns.

- Class B: Class B self storage properties are slightly older (10–20 years), but well maintained. They are typically located in secondary MSAs like Orlando, Denver, Charlotte, or Tampa. They are slightly smaller than Class A properties, usually 40,000 – 60,000 leasable SF and their amenities may be slightly lower quality. For example, they may not have temperature controlled options.

Class B properties hold a particular appeal for investors. They are typically well-maintained, minimizing the risk of major capital expenditures. However, they also offer room for enhancement. Investors can unlock value-add opportunities through third-party management or by making improvements to the physical structure. These strategies can yield moderate returns without substantially increasing risk.

- Class C: Class C self storage properties are older in age and have less attractive locations. Often, they are located in tertiary or even rural markets and were built in the 1980s or 1990s. As a result, they may have some deferred maintenance issues like roofs that need to be replaced or updates to gates or security systems. Often they receive limited traffic and have little or no exposure to major roadways.

From an investment perspective, Class C properties are much more affordable on a per square foot basis, but they also come with more risk in the form of high vacancy or major capital expenditures. In many cases, Class C properties are purchased by experienced operators who have a proven track record of turning around or improving properties.

- Class D: Technically, Class D properties may exist, but they are not likely to be investible. They are the oldest properties, with the least desirable locations and likely need major capital improvements, if not a complete overhaul. For the purposes of this article, they are not considered to be a realistic investment opportunity given the risk associated with them.

Types of Self Storage Properties

Not all self storage properties are created equal. There are several types of self storage assets that have their benefits and drawbacks of owning. They include:

- Drive Up: This is what most of us probably think about when we picture a self storage property – rows of single story buildings with driveways in between, divided into individual units with roll-up doors. They may or may not have temperature control, and usually have some sort of gate or security feature that is designed to keep non-tenants out. Finally, they may have some sort of small office onsite with a manager and the ability to buy supplies like boxes and tape.

More often than not, these types of drive up facilities are located in suburban or rural areas.

- Climate Controlled Storage: Certain types of things like art or furniture must be kept at a certain temperature to prevent unwanted damage. For example, a gallery quality painting would likely suffer from being exposed to extreme heat or cold over time. Thus, climate controlled storage is precisely what it sounds like, an enclosed storage facility that provides heat or air conditioning to ensure that the interior of storage units remains at a relatively constant temperature.

Climate controlled facilities are likely to be in an enclosed, multi-story building that could be located in an urban or suburban area. In some cases, there may even be an elevator and a loading dock to make moving in and out easier.

- Specialty: We are going to lump several types into a “specialty” category, which includes self-storage facilities that are designed for a very specific purpose – think vehicle storage, military storage, or business storage. For each of these types, the property must meet certain requirements. For example, a vehicle storage facility may need ramps to get cars in and out of the units or special facilities for the disposal of fluids like oil, gas or freon. Or, a military storage facility may need strict security protocols.

These types of facilities are more the exception than the norm, but they serve an essential purpose for a niche market.

Each one of these types comes with its own set of pros and cons, which should be considered as part of the investment due diligence process.

Why Investors Like Self Storage

Self storage is becoming an increasingly popular asset class for investment because there are numerous benefits and demographic trends that point to potentially higher values ahead. They include:

- Population Growth: As of the 2020 census, the US population was approximately 331 million people and growing. As it continues to grow, people will continue to acquire things, and they will need places to store them.

- Diversity of Client Base: As a property type, self storage serves a diverse client base from businesses to families, military, students, and individuals. It is not tied to any one type of client.

- Automation: As a general rule, self storage is not a capital intensive business. Some properties may have onsite staff, but there is a significant opportunity to automate much of what happens on site by adding things like vending machines, key fobs, smartphone apps and automatic gates. Some properties can be fully automated, meaning that there is no onsite staff required and little oversight to keep it running. These cost savings can go right to the bottom line.

- Economies of Scale: Much of the effort to own and manage self storage properties can be consolidated in a single back office, driving economies of scale for this property type. This means that it is possible to own and manage a very sizable (and profitable) portfolio with a relatively small team.

- Cost: Self storage properties are fairly inexpensive to construct and to manage. Thus, they can be very profitable to own.

- Recession Resistant: Individuals and companies require a place to store their things through all phases of the economic cycle. In addition, the monthly cost for a unit is relatively inexpensive. Thus, self storage tends to be somewhat resistant to recessionary forces, meaning that they may not suffer as much as other property types (like office or retail) during an economic downturn.

- Private Equity: This point may be somewhat controversial, but private equity is increasingly interested in self storage and is a very active player when it comes to acquiring new properties. For individual investors, private equity firms can represent a strong potential exit opportunity. Further, they also represent an opportunity to rinse and repeat, buying a self storage property, fixing it up and selling it to a private equity firm over and over again,

For these reasons, and others, self storage can be a very exciting place to invest. But, it is not without its risks. Investors must vigilantly enforce storage rules to avert any potential safety concerns with the rented units. Equally crucial is the commitment to maintain a high occupancy rate, especially given that most leases operate on a month-to-month basis.

Ways to Invest in Self Storage

For investors who agree that self storage is an exciting and potentially profitable asset class, there are several ways to invest in it. We’ll highlight the most common below:

- Develop It: For investors with the resources and expertise, one potential option would be to develop a self storage facility from scratch, either leasing it up or selling it upon completion.

The major benefit of this approach is total control over the site selection, due diligence, financing, and leasing processes. In addition, the developer stands to be the only party to benefit if the project is successful.

However, this is perhaps the riskiest way to get involved in the self storage space. There is a significant amount of unknown from the beginning to the end of the development process, and delays or disruptions can be very costly.

Development is most likely to be the best fit for well-experienced operators and those with the financial resources necessary to shepherd a project through the inevitable challenges and delays.

- Direct Purchase of an Existing Property: For investors who don’t want to take the development risk, the next best option may be to purchase an existing property, either on their own or with partners.

The major benefit of this approach is that the development risk is removed from the deal; however, investors retain full control over the property selection, financing, leasing, and management processes. In addition, they solely benefit from the success of the project.

The downside is that it still takes time to oversee the property – maintaining it, collecting rent, leasing space, and making repairs as needed. In addition, there is some portfolio concentration risk because many investors are likely to only be able to afford one or two properties.

A direct purchase is likely going to be the best fit for investors who have the time and resources needed to manage a property on their own.

- Fractional Ownership: A fractional purchase of a self storage property is precisely what it sounds like, it happens when many investors come together to pool their money to complete a property purchase. There are many structures through which this can be completed, but the most common is known as a “syndication” that is run by a private equity firm or real estate investment company.

The major benefit of a fractional approach is that investors don’t need nearly as much money to get into a deal – for example, they may be able to get into a syndication for $25k or $50k. As a result, they may be able to diversify their portfolio with multiple investments. In addition, investors are likely to benefit from professional management in a syndicated structure, as well as investment grade properties that they could not likely afford on their own.

The downside of a fractional investment is that investors have to split the profits with others. Additionally, investors typically need to compensate the deal orchestrator for their management of the investment. Furthermore, such deals are usually exclusive to investors who satisfy specific income or net worth prerequisites.

A fractional investment is typically a good fit for investors with the desire to gain exposure to self storage real estate, but not the time or expertise necessary to manage it.

- REITS: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances commercial real estate assets. REITs tend to specialize in certain asset classes, like self storage, and are often publicly traded on equity markets. For example, Public Storage (NYSE: PSA) is the largest publicly traded self storage REIT.

Benefits of a self storage REIT investment include low minimum investment, professional management, regular dividends, portfolio diversification, and there are some tax advantages to the REIT structure.

The downside of a REIT investment is that investors don’t have much say in which properties their funds are used to purchase. In addition, shares in publicly traded REITs may be subject to some volatility that may not necessarily have anything to do with the fundamentals of the underlying portfolio.

How to Analyze Self Storage Assets

Like other commercial property types, self storage assets are valued based on the amount of Net Operating income they produce. However, before we get to the financial piece of the analysis, there are several qualitative factors that must be considered. So, to analyze a potential self storage development of investment, a two-step approach is recommended: (1) Analyze qualitative and market factors; then (2) analyze financial factors.

Qualitative and Market Analysis

Like every good or service, the success of a self storage investment is largely a function of supply and demand in a local market. So, the focus of the qualitative and market analysis is to: (1) clearly define the market area; (2) analyze existing supply; and (3) compare supply to local, state, and national averages. Detail on each of these steps is provided below.

Define the Market Area

Self storage is a highly local business, meaning that the vast majority of potential customers are likely to be within a 10 to 20-minute drive of the self storage property. So, as a first step, it makes sense to define the market area by looking in a ~2-10 mile radius of the property. If the property is in a particularly dense, urban area, it may make sense to lower this to somewhere in the 1 to 3-mile range. There are several mapping tools that can be used to complete this analysis. When performing this analysis, look for the following key information:

- Population: How many people, households, or businesses exist within this circle?

- Growth: Are the number of people, households, or businesses growing or shrinking?

- Income: What is the median household income for the population within the circle?

- Access Barriers: Are there any significant barriers that would prevent, or make it more difficult for potential customers to get to their self storage unit. For example, mountains, rivers, or tunnels could cause a customer to have to take a major detour, which they may not be thrilled about.

This sort of information will provide potential investors with a profile of the local market, which can be a good first step in determining potential demand.

Existing Supply

After the demand side of the equation has been evaluated, the next step is to look at the supply. Within that same radius, investors should attempt to determine how many other self storage facilities exist as potential competitors to the target property. For each potential competitor, the following information should be obtained:

- Size: What is the size of competitor properties in terms of number of units and total leasable square feet?

- Security: What security features do competitor properties have? Is it just something like an access control gate? Or are there additional features like cameras, key fobs, and fences?

- Amenities: Do competitor properties have onsite staff or a kiosk to purchase supplies like boxes, bubble wrap and tape?

- Occupancy: What is the occupancy of competitor properties? If they are always full, this is a promising sign that the market can accept additional supply. If they have major vacancies, this could be a sign that there is either too much supply, or an opportunity to take market share with a better property.

- Rental Rates: What rates are charged for competitor property units? Rates should be viewed on a per unit basis and on a per-unit type basis.

The result of this analysis should be two key metrics: (1) market rent PSF, and (2) supply per person in the market.

Compare To Averages

As a very general rule, the supply of existing property should average around 9 or 10 SF per person in the defined market area. So, for example, if the target market area has 100,000 people and the existing supply of self storage space is 950,000 SF, this would equate to 9.5 SF of space per resident in the target market area.

Anything less than this amount may indicate a market that can handle new supply and one that is favorable for existing properties. Anything more than this may indicate that the market is saturated and may not be the right place for new supply. Or, it could indicate that existing properties could struggle to take share away from competitors.

Unique Circumstances

The final step is this portion of the analysis is to look for any special circumstances that may drive an investment decision. For example:

- Location: Suppose that a property appears to be saturated with self storage space, but the target property has an excellent location at the corner of two main streets and has access into it from either one of them.

- Occupancy: Again, suppose a target market area appears to be saturated with self storage space, but the average occupancy for all the properties is high, above 90%. This is a sign that, despite the high amount of space, the properties remain fully occupied so demand is likely strong.

- Quality: A market may be saturated, but there may be certain high-quality features of a property that put it in a good position to take market share from other properties. For example, the construction could be new, the interior could have climate control, or it could have exceptional security. If these are enough to get tenants to choose your property over another, it can be a good thing.

To be clear, these sorts of adjustments require some amount of expert judgment based on market knowledge and experience. It is always a good idea to take an approach that is as data-based as possible, and to err on the side of being conservative.

The Proforma

A proforma is a projection of a property’s income and expenses over a defined holding period and it forms the basis upon which financial analysis of a property is completed. The above qualitative analysis is important because it helps target the appropriate income and expense levels for the target market, which is why it is important to complete first. In general, a proforma can be divided into three sections.

Income

In a self storage property, there are two types of income to consider, potential income and other income.

Gross potential income is the total amount of income that would be received if all units in the property are leased

The vast majority of a self storage property’s income will come from monthly rent. However, there may be ancillary sources from things like late fees, tenant insurance policies, or supply income from the sale of boxes or tape.

As part of the income calculation, it is necessary to make a deduction to account for vacant units. This is usually done by taking a percentage of gross potential income.

Operating Expenses

Operating expenses are the costs associated with running the property on a day-to-day basis. They include things like property taxes, insurance, maintenance, management fees, and admin costs.

The information needed to estimate operating expenses is typically obtained from a combination of historical operating statements, market data, and individual estimates. Again, because this is a projection, it is usually a good idea to err on the side of being conservative so as to not potentially overstate operating income.

Net Operating Income, Debt Service, and Cash Flow

Gross income less operating expenses is equal to a metric known as “Net Operating Income”, which is the key figure upon which self storage properties are valued. So, for example, if the property produced $100,000 in net operating income and had $50,000 in operating expenses, the resulting net operating income would be $50,000.

Debt service for the property is calculated from a number of factors including the loan amount, interest rate, and amortization. Once calculated, it is subtracted from Net Operating Income to determine a property’s annual cash flow and several financial return metrics. For example, if the net operating income is $50,000 and annual debt service is $25,000, the resulting cash flow is $25,000.

Finally, this cash flow figure is an important input into several return calculations like IRR and Cash in Cash return. For example, if the initial investment was $250,000 and the property returned $25,000 in one year, the Cash on Cash return was 10%, which is great.

Each one of these categories is projected over the property’s desired holding period, usually 5-10 years, to get a more accurate picture of the return potential on a deal.

Back of the Envelope Analysis Tool & Case Study

To highlight how self storage analysis works, we have created (1) a self storage case study, which we will describe below; and (2) a back of the envelope self storage analysis tool that is designed to provide an overview of the potential returns in a deal and determine if it is worth further investigation.

Case Study

In this case study, let’s assume we’ve conducted all the qualitative market analysis and found the property promising. With these positive insights in hand, we are now ready to delve into the financial aspect of the deal, employing our ‘back of the envelope’ self-storage tool for the analysis.

Unit Mix Overview

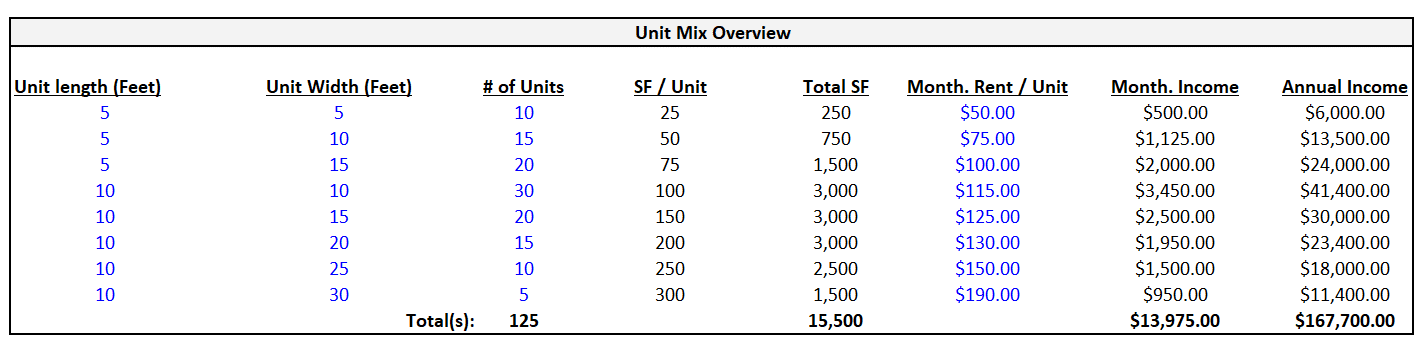

The property to be analyzed is a small asset with 125 units. The following table describes the unit mix and the estimated monthly rent for each type:

| Length (Feet) | Width (Feet) | # Units | Est. Monthly Rent |

| 5 | 5 | 10 | $50.00 |

| 5 | 10 | 15 | $75.00 |

| 5 | 15 | 20 | $100.00 |

| 10 | 10 | 30 | $115.00 |

| 10 | 15 | 20 | $125.00 |

| 10 | 20 | 15 | $130.00 |

| 10 | 25 | 10 | $150.00 |

| 10 | 30 | 5 | $190.00 |

In the back of the envelope model, these inputs are entered in the “Unit Mix Overview” table. Once complete, it should look like the screenshot below:

It should be noted that everything in blue is a manual input, while everything in black is a calculated output completed by the analysis tool.

Building Data

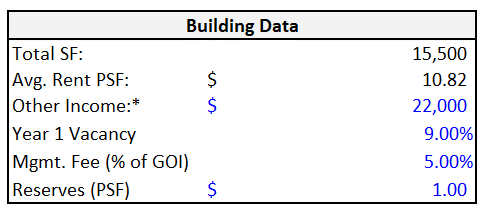

In addition to the unit mix information above, there are a handful of additional data points about the property that can be used to calculate both income and expense line items. They include:

- Total SF: 15,500

- Avg. Rent PSF: $10.82

- Other Income: 22,000

- Year 1 Vacancy: 9.00%

- Management Fee: 5.00%

- Reserves (PSF): $1.00

Several of these metrics are calculated by the tool while others are manual inputs. Once complete, the building data should look like the screenshot below:

Again, the cells in blue are required manual inputs, while those in black are calculated outputs.

Investment Data

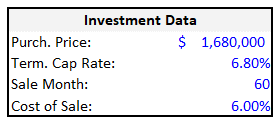

The purchase and sale price are major factors in the ultimate return on investment, so they are a vital component of the financial analysis. They are:

- Purchase Price: $1,680,000

- Terminal Cap Rate: 6.80%

- Cost of Sale: 6.00%

Instead of entering a specific sales price, the tool will calculate a sales price based on Net Operating Income in the final year and the terminal cap rate, less the cost of sale (brokers fees, closing costs, etc). Enter this information in the “Investment Data” section of the analysis tool. When complete, it will look like the screenshot below:

Financing Data

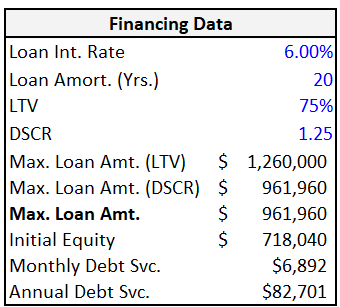

More often than not, self storage purchases are financed with some amount of debt. So, we must account for it in the case study. Here are the key points:

- Interest Rate: 6.00%

- Loan Amortization (Years): 20

- Maximum LTV: 75%

- Minimum DSCR: 1.25x

- Maximum Loan Amount (LTV): $1,260,000

- Maximum Loan Amount (DSCR): $961,960

- Maximum Loan Amount: $961,960

- Initial Equity Required: $718,040

- Monthly Debt Service: $6,892

- Annual Debt Service: $82,701

The key point in this section is that the tool will calculate the maximum loan amount based on the lesser of the supportable loan based on LTV or DSCR. In this case, it is $961,960. Then, with the loan amount known, it can calculate the initial equity required as the purchase price minus the loan amount. These are shown in the screenshot below:

Based on these calculations, the annual debt service on the loan is $82,701, which is deducted from Net Operating Income to estimate annual cash flow.

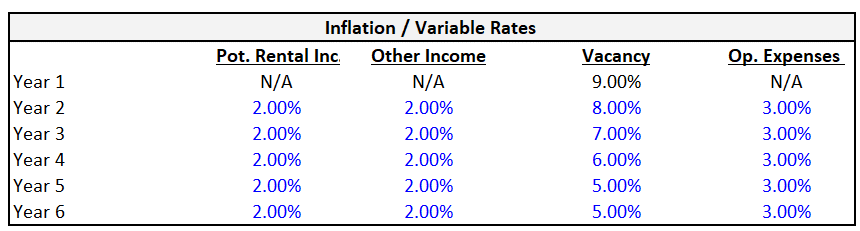

Inflation / Variable Rates

One of the challenges of creating a multi-year proforma is that conditions change over time. So, it is necessary to account for this by estimating changes in key variables:

- Potential Rental Income: It is assumed that potential rental income will rise at a rate of 2.00% per year.

- Other Income: It is also assumed that Other Income will rise at a rate of 2.00% per year

- Vacancy: It is assumed that vacancy will start at 9.00%, but will decline at a rate of 1.00% each year until it reaches 5.00%, where it will remain.

- Operating Expenses: Finally, it is assumed that operating expenses will increase at a rate of 3% per year.

These variables can be accounted for in the “Inflation / Variable Rates” section of the analysis tool. Once complete, it should look like the screenshot below:

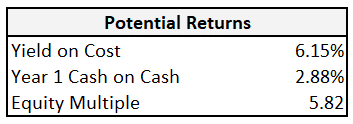

Potential Returns

Based on the projected cash flow, there are three metrics that are commonly used to measure returns:

- Yield on Cost: This metric measures the yield on the deal based on the cost to acquire the property, calculated at net operating income divided by the purchase price.

- Cash on Cash Return: This metric measures the return based on the amount of cash invested into the deal. It is calculated as cash flow before tax divided by the cash invested into the deal (purchase price minus loan amount).

- Equity Multiple: This metric measures the return as a function of the total cash received over the life of the transaction. It is measured as cash received divided by cash invested.

In the analysis tool, there are no inputs required to see these metrics. Instead, they are calculated based on previous inputs, as shown in the screenshot below:

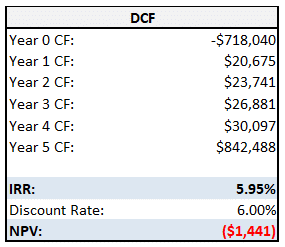

Discounted Cash Flow (DCF)

The other method for calculating returns involves a discounted cash flow analysis (DCF). This approach takes the Cash Flow Before Tax for each year in the proforma, applies a discount rate to it, and subsequently determines the Internal Rate of Return and the Net Present Value. Again, there are no manual inputs needed for these metrics as they are calculated by the tool, which can be seen in the following screenshot:

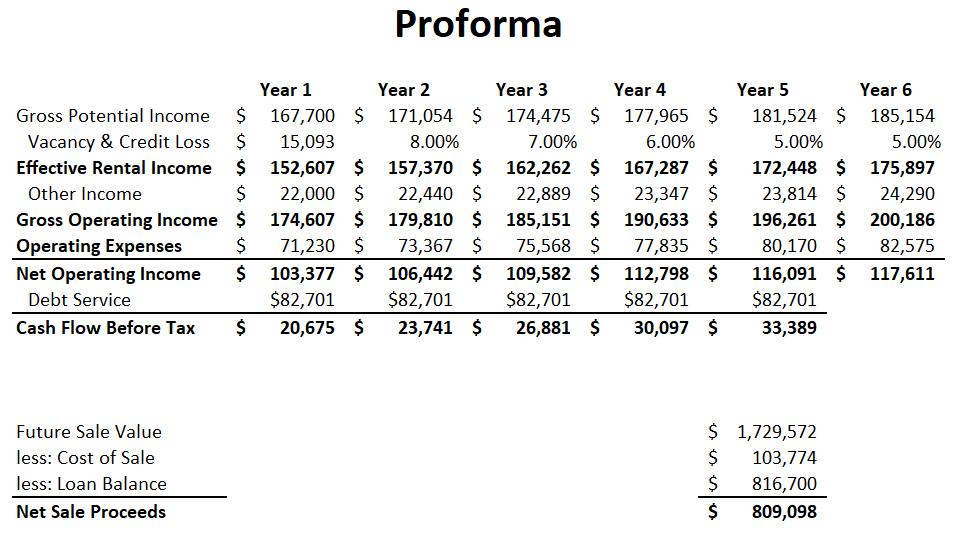

Proforma Cash Flows

Finally, in the last piece of the case study, the analysis tool utilizes all inputs to create a 5 year projection of property income and expenses, with a substantial cash flow at the end when the property is sold. These cash flows are displayed on the “Proforma Cash Flows” tab of the tool and looks like this:

The Outcome

The outcome of all of this work is a back of the envelope estimate about the potential returns that would be produced by this self storage property.

In this case, the Yield on Cost is 6.15%, Year 1 Cash on Cash is 2.88%, and the potential Equity Multiple is 5.82x. With no context, it is difficult to determine if this is a “good” return or a “bad” return, so investors must consider these results relative to what their target is for each of these metrics. If they are good, then it may be an indication to dig into the property further and perform a complete analysis before making a go or no-go decision.