Building Data

Unit Mix

Unit Type

Number of units

Average Rent per Month

Total Annual Rent

Total

0

$0

$0

Investment Data

Financing Data

Metrics

Purchase Price

$0

Per Unit

$0

Loan Interest Rate

0.0%

Loan Amortization

0

LTV

0.0%

DSCR

0x

Loan Amount (LTV)

$0

Loan Amount (DSCR)

$0

Maximum Loan Amount

$0

Initial Equity

$0

Monthly Debt Service

$0

Annual Debt Service

$0

Cash on Cash Return

0.0

About Our Cash on Cash Return Calculator

Our cash on cash return calculator is a powerful tool that enables investors to quickly and easily calculate their cash on cash return for a potential investment property. With just a few inputs, investors can see the projected return on their investment and make informed decisions about whether to move forward with a particular property. Our commercial real estate valuation software can be used for more advanced analysis, but sometimes all you need is a simple back of the envelope calculator.

One of the key features of our calculator is the ability to share your results with anyone. This means that you can easily communicate your back of the envelope analysis to partners, lenders, or anyone else involved in the decision-making process. Sharing results can help streamline communication and ensure that everyone is on the same page when evaluating a potential investment opportunity.

To use our calculator, all you need to do is input a few key pieces of information about the property, including the expected cash flow for the first year, the purchase price, and the loan amount. From there, the calculator will automatically calculate your cash on cash return and display it as a percentage.

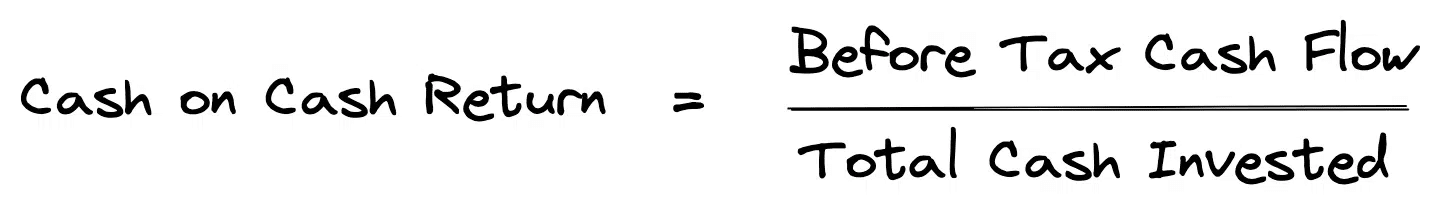

The cash on cash return is a widely used return metric in commercial real estate analysis, as it measures the income earned in a single period on the cash invested into a property. The cash on cash return is often expressed as a percentage and can also be referred to as the equity dividend rate. It is a key component of the band of investment method used by appraisers to calculate the cap rate.

Let’s take a look at an example. Imagine that you are assessing an office building that is projected to generate a Year 1 Cash Flow Before Tax of $60,000. In addition, let’s assume that you have negotiated a purchase price of $1,200,000, and you have secured a loan for $900,000 (75% Loan to Value). What would be your cash on cash return for the first year?

Calculating your cash on cash return for year 1 is a straightforward process: simply divide the Year 1 cash flow by your total cash out of pocket. In the provided example, the cash on cash return for year 1 is 20%. This means that the investment is expected to generate a return of 20% in the first year based on the amount of cash invested.

In the example provided earlier, the cash on cash return for year 1 was 20%. This means that the investor’s return on investment for the first year was 20% based on the cash they had out of pocket. It’s important to note that a good cash on cash return is one that is equal to or greater than the investor’s minimum cash on cash return requirements. If an investment generates a return that is lower than the minimum requirements, it may not be a good investment based on the investor’s objectives.

While the cash on cash return is a helpful tool for evaluating an investment, it does have some limitations and should not be used in isolation. It’s important to consider all relevant factors when making investment decisions, including the investor’s overall investment objectives, strategy, risks, and time horizon. Additional metrics should also be considered, such as the internal rate of return (IRR), net present value (NPV), and modified internal rate of return (MIRR).

Overall, our cash on cash return calculator is a powerful tool that can help investors make informed decisions about potential investment opportunities. With the ability to easily share results with others, investors can streamline communication and ensure that everyone involved in the decision-making process is on the same page.