The Modified Internal Rate of Return (MIRR) is an important return metric that fixes the problems associated with the Internal Rate of Return (IRR). As such, the MIRR is a metric that finance professionals must understand. This simple MIRR calculator makes it easy to quickly calculate the MIRR for any set of cash flows.

Dynamic MIRR Calculator

Cash Flow

Calculated Result

Finance (Safe) Rate

0.0%

Reinvestment Rate

0.0%

Number of Periods

1

Year

Cash Flow

Internal Rate of Return (IRR)

0.0%

Modified Internal Rate of Return (MIRR)

0.0%

About Our MIRR Calculator

The Modified Internal Rate of Return (MIRR) is a powerful financial metric that helps investors evaluate investment opportunities. Unlike the traditional Internal Rate of Return (IRR) calculation, which does not consider how cash flows are reinvested, MIRR calculates the rate at which cash inflows are reinvested at a separate rate of return. This is a more realistic assumption, as investors typically reinvest cash inflows at a different rate than the project’s internal rate of return.

Our MIRR calculator is a user-friendly tool that allows investors to quickly calculate the MIRR for any investment opportunity. The calculator provides a range of input options, allowing investors to specify the initial investment, cash inflows, and cash outflows for each period. Additionally, the calculator allows investors to specify the discount rate for both the reinvestment of cash inflows and the financing of cash outflows.

To use the MIRR calculator, simply enter the initial investment, cash inflows, and cash outflows for each period. The calculator will then use the discount rate for reinvesting cash inflows and the financing rate for cash outflows to calculate the MIRR. If the MIRR is greater than the investor’s required rate of return, the investment is expected to generate a profit.

One of the standout features of our MIRR calculator is its ability to provide a more accurate assessment of investment opportunities. By assuming that cash inflows are reinvested at a separate rate of return, the MIRR calculation provides a more realistic view of the potential value of an investment. This can help investors make more informed decisions and identify investment opportunities that may have been overlooked using traditional investment metrics.

The MIRR calculation is particularly useful for evaluating investments that have complex cash flows or that require significant financing. By taking into account the separate rates of return for reinvesting cash inflows and financing cash outflows, the MIRR calculator can provide a more accurate assessment of the investment’s value and potential return. This can help investors make more informed decisions about which investments are worth pursuing and which should be avoided.

In addition to the MIRR calculation, it is helpful to consider other useful metrics as well, such as the net present value (NPV) and the payback period. The NPV represents the present value of all cash inflows and outflows, discounted at the required rate of return. A positive NPV indicates that the investment is expected to generate a profit, while a negative NPV indicates that the investment is likely to result in a loss. The payback period represents the amount of time it takes for the initial investment to be paid back through the investment’s cash flows.

Overall, our MIRR calculator is a valuable tool that can help investors evaluate investment opportunities more accurately and make more informed decisions. By using a more realistic assumption for reinvesting cash inflows, the MIRR calculation provides a more accurate assessment of an investment’s potential value and return. Additionally, the calculator’s flexible input options and ability to share your results with your team, make it a valuable tool for anyone interested in making smarter investment decisions.

MIRR Calculator in Excel

We also created an Excel based MIRR calculator for you to download and use.

MIRR Calculator

Fill out the quick form below and we’ll email you our free MIRR Calculator that can handle any set of cash flows you need to analyze.

How to Use The MIRR Calculator

Here is how you can use this MIRR calculator, step by step.

- Download the MIRR calculator using the form above.

- Adjust the number of periods you want in your holding period.

- Input your cash flows.

- View the calculated MIRR

As you can see, we’ve made it simple to use our MIRR calculator.

MIRR Calculator Example

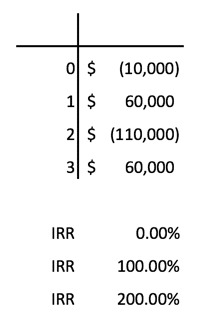

Let’s walk through a simple example using this MIRR calculator. Suppose we have the following cash flows:

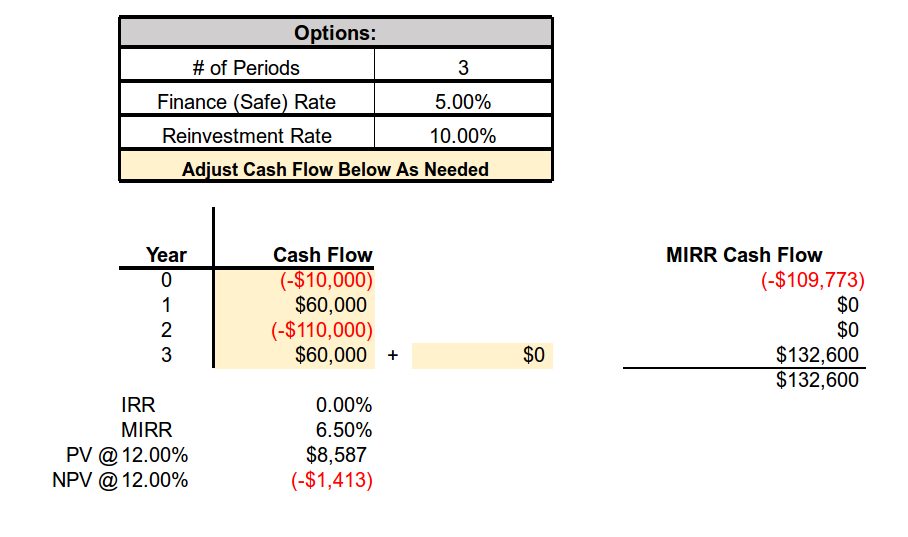

As you can see, there are 3 different internal rates of return calculated for this set of cash flows. To solve this problem, we can instead use the modified internal rate of return to analyze these cash flows. Here’s how this is done with our modified internal rate of return calculator:

As you can see, the projected cash flows result in an MIRR of 6.50%. This assumes a safe rate of 5% and a reinvestment rate of 10%. This 6.50% MIRR allows us to set our reinvestment and finance rates, which will produce a more reliable rate of return. Also, the MIRR can easily solve the multiple IRR problem.