A mini-perm loan is a crucial financial tool for developers and real estate investors, providing short-term financing for newly constructed for-lease projects. This type of loan is typically used to refinance a construction loan and allows borrowers to pay off the original interest-only loan, stabilize their operations, and then refinance with a longer-term loan or sell the property. Local community banks are often the main providers of mini-perm loans and the structure of these loans vary, but they typically have a term of 3–7 years and an amortization period of 20–25 years. In this article, we will explore the concept of mini-perm loans, their structure, and benefits, and how they fit into the lifecycle of a for-lease development project.

What is a Mini-Perm Loan?

A mini-perm loan is short-term financing, typically used to refinance a construction loan. The purpose of a mini-perm loan is to provide the borrower with time to lease up and stabilize the operations of a newly constructed for-lease development project.

The mini-perm loan is usually offered by the same lender that provided the construction financing. It enables a developer to pay off the original interest only construction loan, and achieve stabilization before refinancing with a longer-term loan or selling the property.

Local community banks are typically the main providers of construction and mini-perm loans. This is because local banks have a more in-depth understanding of local markets than larger out-of-town national or regional banks.

Borrowers benefit from a mini-perm loan because they do not need to secure a pre-commitment from a permanent lender before construction. Lenders benefit from a mini-perm loan because it gives them a way to refinance a riskier interest only construction loan.

Mini-Perm Loan Structure

The structure of a mini-perm loan varies, but typically, mini-perm loans are amortized over 20–25 years and have a 3-7 year loan term. The required loan to value, debt service coverage, and debt yield will depend on the property type as well as the lender’s credit policy. Occasionally, a mini-perm loan will also include an interest only period, typically between 6–18 months.

Unlike permanent loans, mini-perm loans are typically recourse and require a personal guarantee. Lenders will also have other loan convents the borrower must comply with. These allow the lender to monitor the creditworthiness of the project over the term of the loan. These covenants could include submitting a personal financial statement and tax return each year, as well as a rent roll, operating statements, and signed leases.

Mini-Perm Loan Example

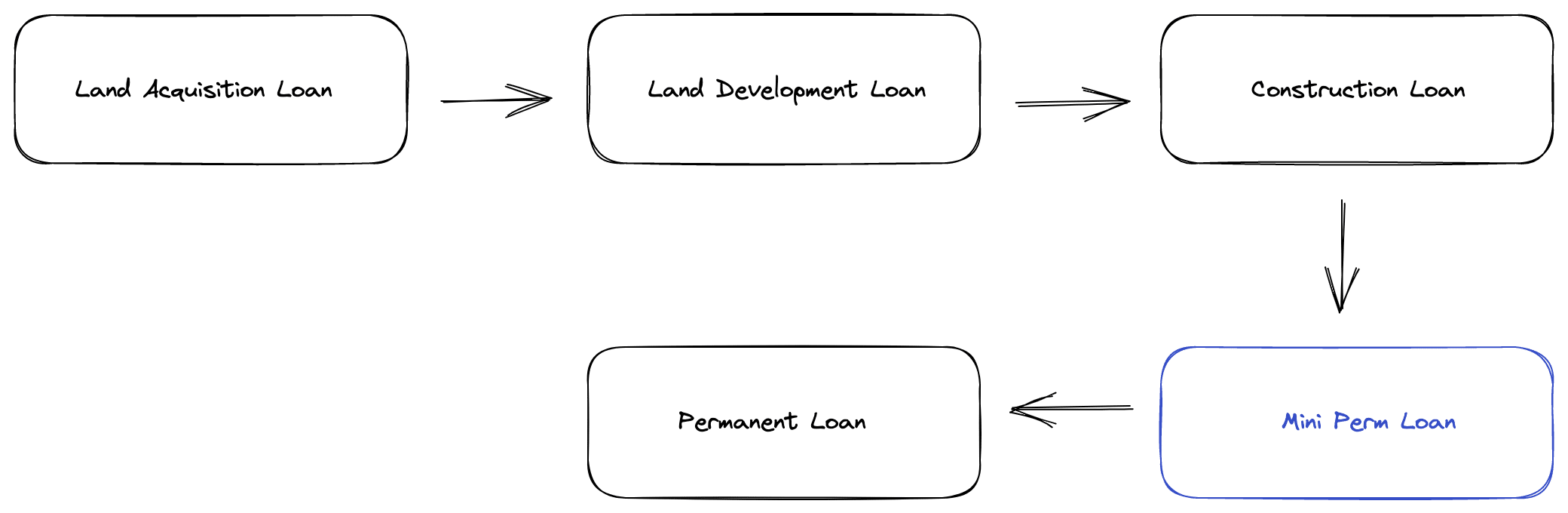

A mini-perm loan is typically used to refinance a construction loan, while a permanent loan is used to refinance a mini-perm loan. Here’s an easy way to visualize the different loans in the lifecycle of a for-lease development project.

- A land acquisition loan is used to finance the purchase of raw land.

- A land development loan is used to finance the installation of horizontal improvements to the land such as streets, sewers, utilities, etc.

- A construction loan is used to finance the vertical construction of buildings.

- A mini-perm loan is used to finance, or “take out”, the construction loan.

- Finally, a permanent loan refinances a mini-perm loan.

Lenders will sometimes commit to finance all the acquisition, development, and construction (ADC) at the same time. This type of loan is known as an ADC loan and simplifies the financing process for the borrower while eliminating potential conflicts of interest that might occur between more than one lender. The same lender will also sometimes commit to a mini-perm loan to give the borrower time to reach stabilization before refinancing with a permanent lender.

Conclusion

Mini-perm loans play a critical role in the real estate industry by providing short-term financing for newly constructed for-lease projects. They offer a way for developers to pay off their original interest-only construction loan, stabilize their operations, and then refinance with a longer-term loan or sell the property. While mini-perm loans are typically recourse and require a personal guarantee, they provide borrowers with an opportunity to secure financing without the need for a pre-commitment from a permanent lender. Local community banks are often the main providers of mini-perm loans, due to their in-depth understanding of local markets. In the larger scheme of things, mini-perm loans are an important step in the lifecycle of a for-lease development project, allowing developers to secure financing and reach stabilization before securing a permanent loan.