What’s the difference between a recourse vs. non-recourse loan? In commercial real estate both types of loans are common depending on the stage and type of financing. In this article, we’ll take a closer look at recourse and non-recourse commercial real estate loans, as well as the “bad boy guaranty.”

What is a Recourse Loan?

First, what does the term recourse mean? The definition of a recourse loan is a loan where the borrower or guarantors are personally liable for repaying any outstanding balance on the loan, in addition to the collateral itself. In other words, if the collateral securing a loan needs to be liquidated but is insufficient to cover the total amount owed on the loan, then “recourse” enables the lender to go after the guarantors personally to cover this deficiency. Full recourse loans are common with construction and other shorter term commercial real estate financing, such as a mini-perm loan that finances lease up and stabilization of an asset.

What is a Non-Recourse Loan?

A non-recourse loan is defined as a loan where the borrower or guarantors are not personally liable for repaying any outstanding balance on the loan. Non-recourse financing is typically found on longer-term permanent commercial real estate loans placed on a stabilized and performing asset. However, a common misconception with non-recourse loans is that if a loan is non-recourse, then a borrower or guarantor can never be held personally liable in the case of a loan default. This is not always true, and there are several exemptions commonly covered under what’s known as carve out provisions or the bad boy guaranty.

Non-Recourse Loan: Bad Boy Guaranty

Carve out provisions, also known as bad boy guaranties, protect the lender and enables personal recourse in the case of certain events, such as fraud. Essentially, bad boy guaranties are exceptions to the non-recourse status of a loan that originally were created to prevent the borrower from siphoning cash out of a property in the months leading up to a loan default. This varies by state, but here are some common carve out provisions of bad boy clauses included in non-recourse loans:

- Filing for bankruptcy

- Fraud or misrepresentation

- Failure to maintain required insurance

- Failure to pay property taxes

- Any environmental indemnification

- Committing a criminal act

Another common misconception with non-recourse loans is that the bad boy guaranty is limited to just these major events or bad acts. In the past, this was typically true, but over time, the bad boy guaranty has slowly expanded to include more and more minor provisions, such as failure to deliver financials to the lender or permit lender inspections of the property. These and other minor carve out provisions may or may not be appropriate or acceptable.

As always, it’s critical to read and understand the loan documents, and it’s always best to have them reviewed and negotiated by a competent commercial real estate attorney.

Recourse vs. Non-Recourse Loan Example

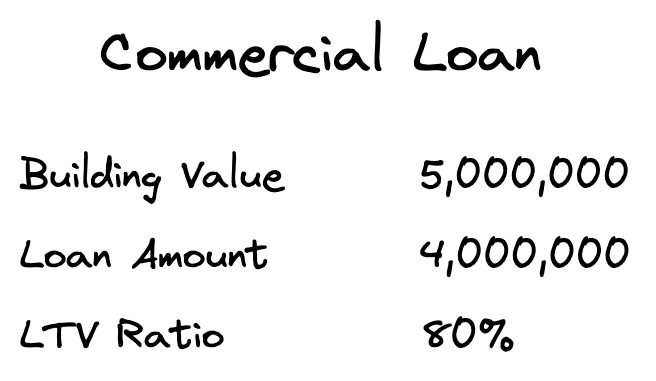

Let’s take an example to illustrate the difference between recourse and non-recourse loans. Suppose a borrower has the following loan outstanding for an office building:

Now, suppose the vacancy goes up in the building much higher than expected and market based rental rates decline substantially. Unfortunately, the borrower can’t keep up with his loan payments and ends up defaulting on his loan.

With a non-recourse loan, the lender can take back the real estate which is collateral for the loan. Sometimes this will be adequate, but what if the liquidation value of the collateral is no longer sufficient to repay the outstanding loan balance?

Let’s further suppose that the higher than expected vacancy and reduced NOI cause the building value to decline to only $3,000,000, which is less than the outstanding loan balance of $4,000,000. In this scenario, the lender does not have any personal recourse to cover the shortfall, so if the building is foreclosed and liquidated then the lender will take a loss.

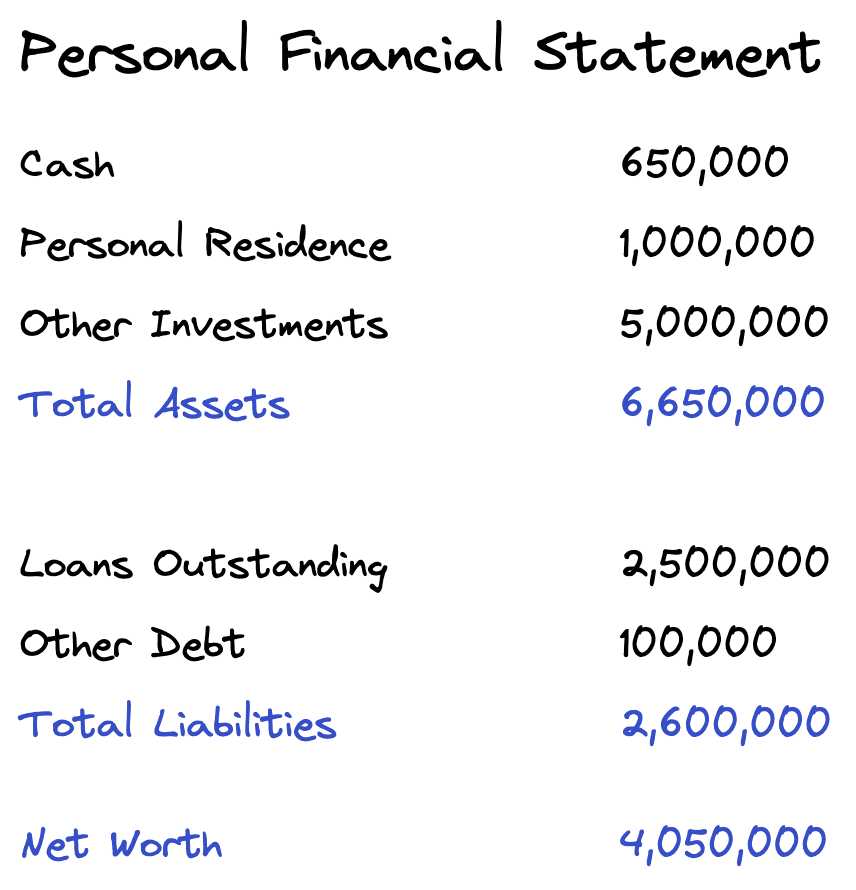

Now let’s look at what would happen if this was a recourse loan. Assume the guarantor has the following personal financial statement:

If the above loan was a recourse loan, then the lender would not only be able to liquidate the collateral for $3,000,000, but the lender would also be able to go after the guarantor personally for the deficiency of $1,000,000. This means the bank could levy or legally seize the guarantors bank accounts, wages, and other assets to satisfy any outstanding debt.

Conclusion

In this article, we discussed recourse vs. non-recourse loans, as well as some common misconceptions and pitfalls to avoid. Recourse just puts the borrower or guarantor on the hook for the loan, in addition to the collateral itself. In construction and mini-perm loans a full personal guarantee from the sponsors is almost always required. This aligns incentives to get a property fully constructed, leased, and stabilized. Longer-term loans on stabilized properties are typically non-recourse, unless otherwise triggered by various “bad boy” clauses. This limits the personal exposure for borrowers, but also protects the lender and allows them to go after the borrower/guarantors personally in the case of certain events such as fraud.