When trying to finance a real estate project, it’s common for a borrower to approach multiple lenders for a loan. Unfortunately, it’s equally as common for those same lenders to provide inconsistent responses. One lender may look at a deal and want nothing to do with it while another may look at the same deal and be quick to approve it. Why?

The answer to this question rests within a lengthy and complex technical document called the “Credit Policy.”

What is a Credit Policy?

A lender’s credit policy is a document that outlines the requirements and procedures for approving a loan. It’s the guiding force behind the credit officer’s approval or denial decision and the criteria may vary significantly from one lender to another, which explains the inconsistency. It’s rare for anyone outside of a bank or lender’s office to see the credit policy and it can be complicated and sometimes frustrating for those within a bank that use it. In an effort to demystify the credit policy, let’s discuss how it gets written, what’s in it, and who has the responsibility for maintaining it.

How a Credit Policy is Written

Taking a step back, it’s important to note that a credit department’s purpose inside of a bank is to analyze new loan and renewal requests and to approve the requests that represent an acceptable level of risk for the bank. Naturally, it makes sense that there are a series of rules and requirements to govern the entire analysis and credit approval process, which is why the credit policy gets created in the first place.

A bank’s credit policy is created as part of their founding process and with input from senior executives responsible for managing the bank’s risk profile. It’s often adapted from another bank or lender’s policy and must be written within regulatory guidelines and formally approved by senior management prior to the first loan being made. The actual writing of the policy is a collaborative effort among senior members of the credit department.

What Information Does a Credit Policy Contain?

Specifically, a bank’s credit policy contains details on three key components of the lending process:

- Underwriting Standards: The primary function of the document is to define the credit department’s underwriting and risk mitigation standards, which includes things like:

- Identifying characteristics of desirable and undesirable loans

- Portfolio concentration limits and sub-limits for each loan type

- Credit approval authority and the approval process

- The role of the board of directors in reviewing and approval loan requests

- Software applications used and systemic dependencies

- Frequency of portfolio stress testing and individual credit reviews

- Financial statement requirements

- Credit and Collateral file maintenance standards

- Guidelines for insider transactions and appraisal practices

- Elements of an Acceptable Credit Memo: The details of an individual loan request are written up in a document called a “Credit Memo” and the Credit Policy outlines the elements of an acceptable memo, including:

- Loan purpose

- Sources of repayment

- Collateral description and valuation

- Analysis of Borrower and Guarantor financial condition

- Risk grade

- Identification of any credit policy exceptions

- Credit Risk Management and Monitoring Procedures: Once the loan is made, the Credit Policy also outlines the procedures for ensuring that the deal remains an acceptable level of risk to the bank. This includes things like:

- Elements of an effective loan review system including frequency, scope, and depth

- Requirements for an effective credit grading system

- Portfolio mix and risk diversification guidelines

- Collection and problem loan resolution procedures

- Methodology for establishing sufficient allowance for loan losses

- Procedures to identify, approve, and monitor all Credit Policy exceptions

Who’s Responsible for Maintaining the Credit Policy?

The credit policy is not a static document. It’s written at the time the bank is founded and is reviewed and updated periodically to keep up with changing market conditions and bank risk appetite. Formal changes to the credit policy aren’t a trivial thing and they often have to go through several layers of approval.

For the most part, changes and updates to the formal credit policy are the responsibility of the senior members of the credit department.

Credit Policy Example

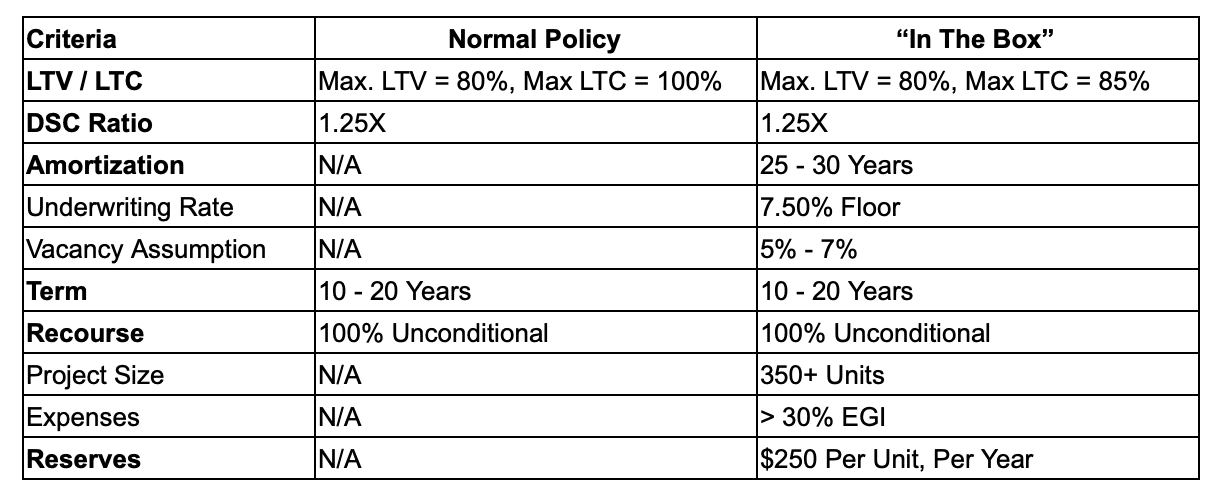

For borrowers, the most mysterious and confusing part of a lender’s credit policy is the approval criteria and it’s often the portion of the policy that may vary the most from one lender to another. As such, let’s look at an example of the approval criteria for a multifamily loan from a regional bank’s actual credit policy:

From the table it can be seen, that there are relatively few defined policy criteria, 80% Loan to Value, 1.25X Debt Service Coverage, and 10-20 years term. Let’s call these the “formal” criteria and they don’t change very often.

However, a bank may also have informal criteria which may be referred to as their “risk appetite” or “in the box” criteria. This is what is likely to change in response to market fluctuations and portfolio concentrations. They’re also at the root of why one bank may want to do a deal and another may want nothing to do with it.

As a best practice, it’s usually a good idea to ask a bank or lender up front if they have “appetite” for your deal type. If they don’t, there’s no sense in forcing the issue. It’s best to move on to another lender.

What to Do When a Loan is Declined

A loan may be declined for several reasons, many of which have nothing to do with the formal criteria defined in the credit policy. Approving the loan may cause a bank to exceed their portfolio concentration threshold for that loan type or they may have a regulatory restriction on loans of that type.

When a loan is declined, the first logical question for the applicant is, why? There’s no harm in asking for additional detail on why the loan was declined and if there’s anything that can be done to reverse the decision. If the decline reason is related to the formally defined policy requirements or regulatory mandates, there probably isn’t much that can be done. It’s best to move on to another lender.

However, if a loan is declined because the bank doesn’t have the “appetite” for the loan as presented, there may be things that can be done to help them change their mind. Additional collateral could be pledged, the guarantee structure could be strengthened, or the interest rate could be adjusted. If the denial is risk related, the applicant has several options to restructure the deal to the point that it’s approved.

Conclusion

Every bank and lender has a credit policy and it’s the driving force behind loan approval/denial decisions. Differences in the documents that a bank asks for, loan structure, and approval/denial are likely due to differences in the credit policy of the respective institutions to which the deal was presented.

On occasion, a loan will be declined for reasons that don’t have a lot to do with the defined policy requirements. It may be that the bank or lender just doesn’t have any “appetite” for the loan type at the time of application. If this is the case, there may be some avenue for appeal or a method of restructuring the deal to help the lender change their mind.