The loan to value ratio (LTV) is widely used in commercial real estate. It is calculated by dividing the loan amount by the value of the property and expressed as a percentage. In this article, we will review the loan to value formula, how to calculate LTV, its significance, and its use in real estate finance. We will also cover examples of how to use the LTV ratio in a maximum loan analysis, as well as a cap rate and cash on cash return calculation.

What is the Loan to Value Ratio?

The Loan to Value (LTV) is the ratio of the loan amount to the value of a property. It is widely used by lenders to determine the size of a loan and to measure the credit quality of existing loans. It can also be used by appraisers to determine the market capitalization rate with the band of investment method. Additionally, it can be used in the weighted average cost of capital formula to quickly estimate the cash on cash return for a property.

The loan to value ratio describes how much cushion there is between the outstanding loan amount and the value of a property. The lower the spread between the loan amount and the value of the property, the higher the risk for the lender. Conversely, the higher the spread between the loan amount and the value of the property, the lower the risk for the lender. The loan to value ratio is used by lenders along with other underwriting ratios such as the debt service coverage ratio (DSCR) and the debt yield ratio.

Loan to Value Ratio Formula

The loan to value (LTV) is the principal amount of the loan divided by the estimated property value.

The loan to value ratio is expressed as a percentage rate and describes how much cushion exists between the loan amount and the value of the property. If the LTV ratio is known, the LTV formula can be re-arranged to solve for the loan amount:

This relationship allows lenders to determine the loan amount for a property based on a specific loan to value requirement.

How To Calculate The Loan To Value Ratio

To calculate the loan to value ratio, the lender must first estimate the value of the property. In most cases, the lender will hire a third-party appraiser to provide a valuation of the property under consideration. This value will then be used to calculate the loan to value ratio.

For example, suppose the appraised value for a property is 10,000,000 and the loan amount is 8,000,000. In this case, the loan to value ratio would be 8,000,000 / 10,000,000, or 80%.

Usually, the LTV is known, and it’s the loan amount we need to solve for. For instance, suppose a lender’s credit policy requires a maximum LTV of 70% and the appraised value for a property is 10,000,000. In this case, the loan amount using the LTV method would be 10,000,000 x 70%, or 7,000,000.

Since an appraisal is only an estimate of market value, the lender will typically use the minimum of the appraised value or the actual purchase price of the property. For example, if the purchase price for a property is 7,500,000 but the appraised value is 7,600,000, the bank would use 7,500,000 in the loan to value calculation.

For construction loans, the lender will instead use the loan to cost ratio (LTC), which uses the total cost of the project in the denominator instead of the value or purchase price.

What Does Loan to Value Mean?

A loan to value ratio greater than 100% means the property is worth less than the outstanding loan amount. A loan to value less than 100% means the property is worth more than the outstanding loan amount. And a loan to value ratio equal to 100% means the value of the property is equal to the outstanding loan balance.

Typically, a lender will require a loan to value ratio much lower than 100% to provide a margin of safety in case something goes wrong. The actual loan to value ratios will vary depending on the property type, borrower credit risk, as well as the bank’s own internal credit policy guidelines. Generally, loan to value ratios range from 50% – 80%.

LTV Calculation Examples

Let’s take a look at a few ways the loan to value ratio is used by commercial real estate professionals. First, we’ll look at how banks calculate a maximum loan amount using various methods, including the loan to value method. Next, we’ll review how appraisers determine the market cap rate using the band of investment method. Finally, we’ll calculate the cash on cash return using the weighted average cost of capital. The loan to value ratio is a key component in all of these calculations.

How to Calculate the Maximum Loan Using LTV

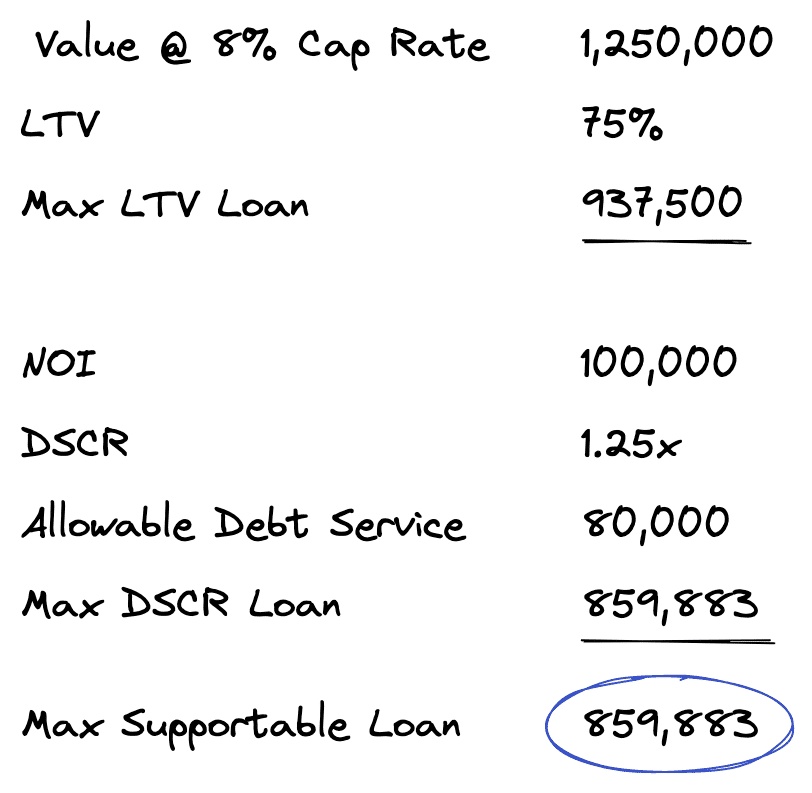

The loan to value ratio is widely used by lenders in a maximum loan analysis. A maximum loan analysis calculates the maximum supportable loan amount using several methods. Then, the lender will take the lowest result from all the calculations. Here’s what a maximum loan analysis typically looks like.

In the analysis above we calculate the maximum loan using the LTV approach assuming a 75% loan to value ratio and a property value of 1,250,000. This results in a maximum loan amount of 937,500.

Next, we calculate the maximum loan amount using the debt service coverage ratio, which results in a maximum loan amount of 859,883.

Finally, we take the smaller of these two values to determine the maximum supportable loan. In practice, this would typically be rounded down to 859,000.

How to Calculate the Cap Rate Using LTV

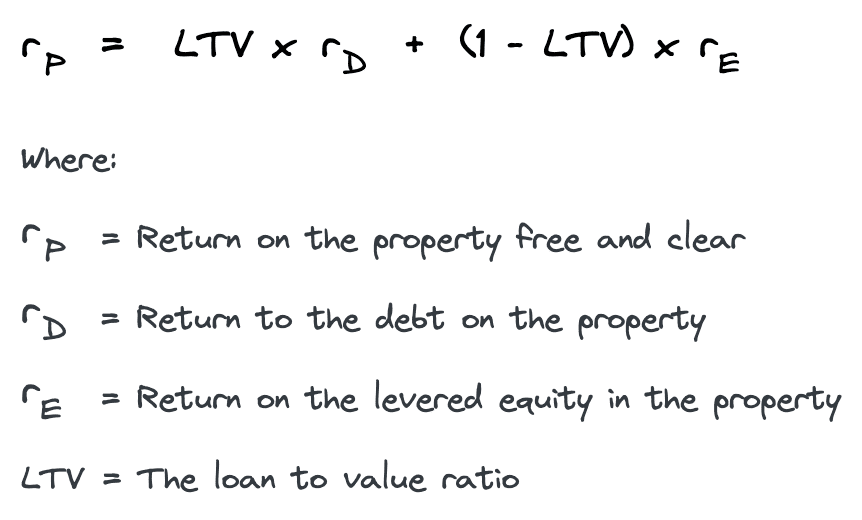

Appraisers frequently use the loan to value ratio in a band of investment calculation. The band of investment calculation is a weighted average cost of capital calculation used to determine the market capitalization rate with limited information.

An appraiser could extract the overall capitalization rate for a market by surveying local lenders and investors. The lender survey would tell the appraiser what the typical loan terms are for the subject property, while the investor survey would indicate the typical required cash on cash return. With this data, the appraiser can calculate the overall capitalization rate.

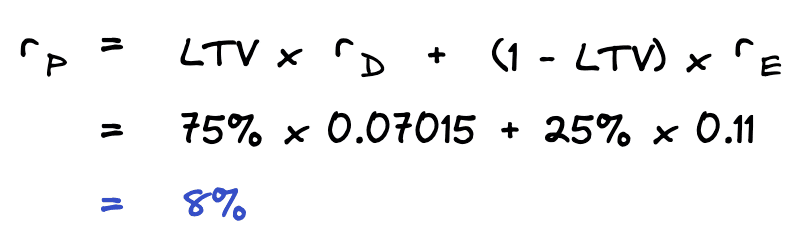

For example, suppose that lenders are willing to underwrite a loan for the subject property at a 75% loan to value ratio, amortized over 25 years, at an interest rate of 5%. This results in a mortgage constant of 0.07015.

Suppose the cash on cash return required by investors is 11%. Now we have enough information to estimate the overall capitalization rate:

This type of analysis is commonly used by appraisers when market data is difficult to find. This can occur during slow periods in the market cycle, or in tertiary markets that do not have a lot of transaction volume.

How to Calculate the Cash on Cash Using LTV

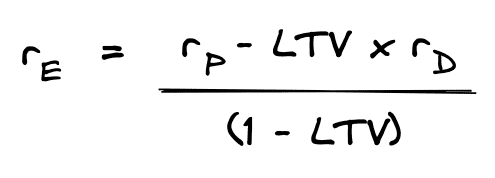

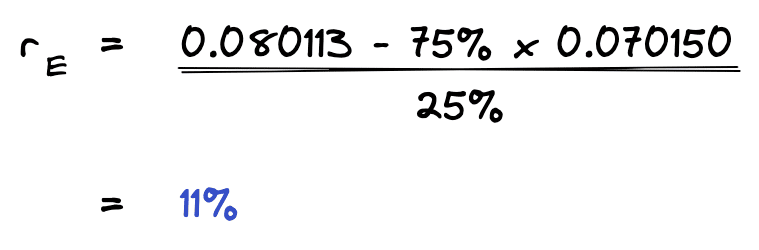

The weighted average cost of capital formula can also be used to calculate the cash on cash return with limited information. To achieve this, we can re-arrange the formula to solve for the return on equity. Then, using the loan to value ratio, the return on debt, and the return on the property, we can solve for cash on cash.

For example, let’s use the same data from our prior band of investment problem, except this time we will solve for the return on equity when leverage is used. Recall that the mortgage constant in our example was 0.07015, which is the return on debt. The overall capitalization rate that we found was 8%, which is the return on the property. Now, we can use the equation above to solve for the return on equity, which is the cash on cash return.

As illustrated above, we can quickly calculate the cash on cash return with the LTV ratio, the mortgage constant, and the cap rate.

Conclusion

The loan to value ratio is widely used in the commercial real estate industry. In this article, we defined the loan to value ratio, reviewed how to calculate the LTV ratio, and discussed what it means. Finally, we walked through several applications of the loan to value, including a maximum supportable loan analysis, the band of investment calculation, and the weighted average cost of capital.