Every day, and in every market, there are office deals to be made. The question, of course is which will become valuable assets in your real estate portfolio, and which could put the rest of your portfolio in jeopardy.

The answer is a thorough and thoughtful investment analysis.

We’re going to walk through an office opportunity, run the numbers, and decide if it’s a portfolio maker or a portfolio breaker.

Office Investment Case Study Objectives

Before we run projections and stress test our answers, let’s set out our objectives. We’re going to:

- Forecast the before-tax cash flows over a five-year holding period for the small office building described below

- Calculate the maximum supportable loan amount based on the debt service coverage ratio (DSCR) and the loan to value ratio (LTV)

- Calculate the gross rent multiplier (GRM)

- Calculate the cash on cash return

- Calculate the debt service coverage ratio

- Complete a discounted cash flow analysis to determine the levered and unlevered internal rate of return (IRR) and net present value (NPV)

- Stress-test the vacancy rate to analyze how it impacts cash flow

- Stress-test the vacancy rate to analyze how it impacts the debt service coverage ratio, and

- Consider deal factors outside of strict financial analysis

Office Building Investment Case Study Scenario

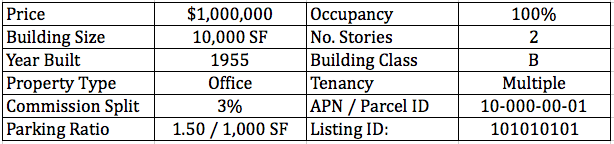

Let’s start with the building’s listing. Here is our mystery opportunity in all its glory:

Property Listing

1234 Main Street, Our Town, Big State 11111

10,000 SF · Main Street Office For Sale

Description

Investment or Owner User. Existing, long-term tenants will extend leases a minimum of five (5) years if new buyer agrees. Brick building in pristine condition. Private drive off Main leads to 15-space parking lot. Lot has direct entry to glass executive offices. 12 offices on the main floor, and public entry on Main. 8,000 sf space has boardroom, kitchen facilities, and two bathrooms. 2,000 sf space has one newly-renovated bathroom. New roof in 2010 (roof warranty through 2025). Excellent west-side location, two blocks from newly-constructed 200-unit condominium, and adjacent to Castle Centre retail approved for $5M TIF redevelopment.

Building faces Main Street, on SE corner block at Main Street and 1st Street, Our Town, Big State.

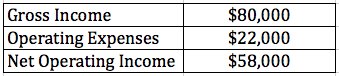

Financial Summary (2016 Actual)

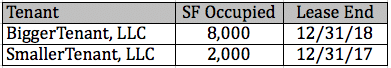

Tenant Information

Estimated Income / Expense

Now you’ve been in the office world long enough to know what rents this kind of building will bring, and what it’ll take to operate and maintain it. You also know that if the initial analysis warrants a closer look, you can get the property’s actual income and expenses through your due diligence request. Until then, let’s make some educated estimates.

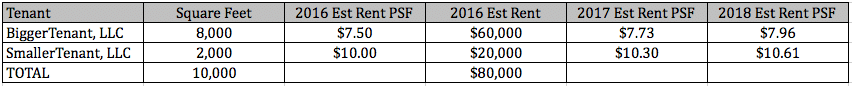

Potential Rental Income

With the help of a few calls and a review of comps, you estimate the rental rates for 2016, 2017, and when the existing leases expire:

For projected rental income we’ll assume both tenants will renew at the estimated 2018 market rate for 5-year terms with 3% annual bumps.

Other Income

Oh, and here’s some good news. Your lawyer knows the property has a small billboard on its west side. While it’s currently empty, he thinks it could be rented for $1,000 per month, increasing 3% annually. We’ll add that as Other Income. Though, as there’s no such thing as a free lunch, it’s going to take a one-time $750 capital expenditure to get the billboard in rentable shape, and $500/year to maintain it.

Operating Expenses / Additional Rent / CAM Charges

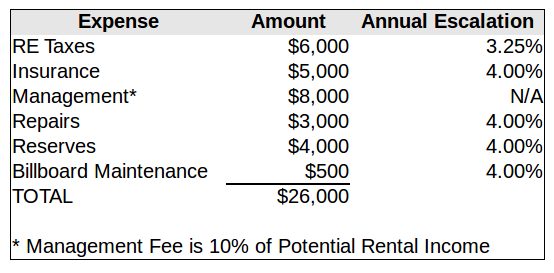

You project the operating expenses below, and recognize that they’ll be reimbursed by the tenants as Additional Rent on a pro-rata basis. Reserves and billboard maintenance, however, will be funded by you.

Now, this isn’t an operating expense, but it is an expense you need to account for: based on the advice of an HVAC professional, this building’s system only has a year or two left before it shoots craps. It will be a $50,000 one-time hit that you won’t be able to pass along to your tenants.

Okay, we have income and expenses, now let’s set a few other assumptions we’ll need for our analysis.

Vacancy and Credit Loss

The two tenants are described as “long-term,” and your local contacts report that both have a solid rental history and business reputation, so you estimate only a 5% credit loss.

Financing

You read, and so you know… The lending market will likely approve a loan for the purchase of a small office building with established tenants who’ve promised five-year lease extensions (i) on the lesser of a 1.25x debt service coverage ratio or 75% loan to value, (ii) at a 6.5% interest rate, and (iii) amortized over a 20-year term.

Sales Price and Cost of Sale

You’ve projected that the sale price following the 5-year holding period will be $1,175,000 based on annual increases of 3.25%. You’ve bumped this escalation from the market’s traditional 3% annual increase because of the new and projected developments surrounding the office. Additionally, you anticipate 3% in broker commissions and transaction costs on both your purchase and the sale.

Discount Rate

What are your returns for the rest of your office portfolio (at least those buildings that resemble the size, location, and condition of this one)? 13 percent? Great. Let’s then assume a 13% discount rate, your required rate of return.

Main Street Office Investment Proforma

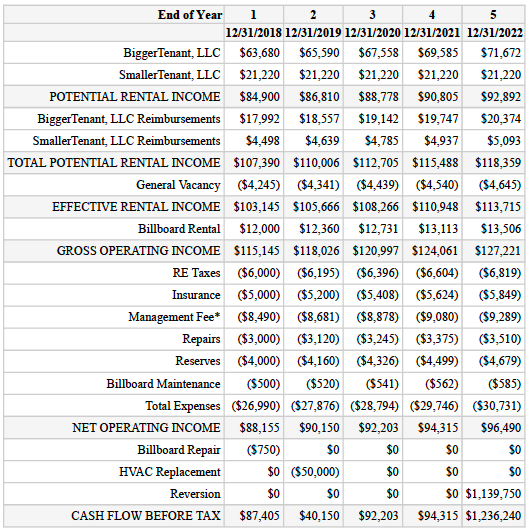

With the information you’ve gathered and estimated above you can now build a proforma. You’re old school, and pop open your Excel sheets, but I’m going to try and crank out an analysis for you in just a few minutes with the PropertyMetrics Proforma App (and then you’ll have more time to look at those three other deals sitting on your desk). Let’s first look at income/expenses without debt-service:

Next, using the above income stream and your knowledge of the current lending environment (i.e., it’s likely you’ll be able to borrow up to the lesser of 1.25x DSCR or 75% LTV), you calculate the maximum potential loan:

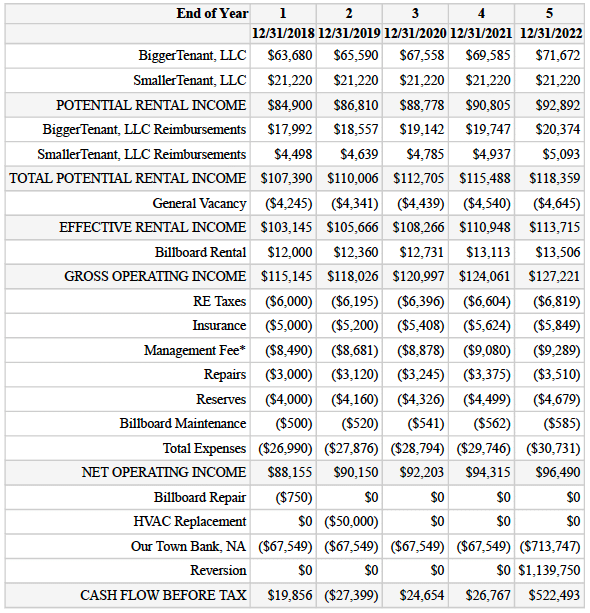

So based on the Year 1 NOI in your proforma, the maximum loan analysis shows you can initially borrow up to about $755,000. Plugging in this loan amount, amortized over 20 years, your proforma including debt service looks like this:

Wouldn’t it be nice to just enjoy the cash-flow without having to pay down a loan? Nonetheless, using other people’s money is going to improve your yield.

Okay, now let’s check a few relevant financial ratios.

Financial Ratios

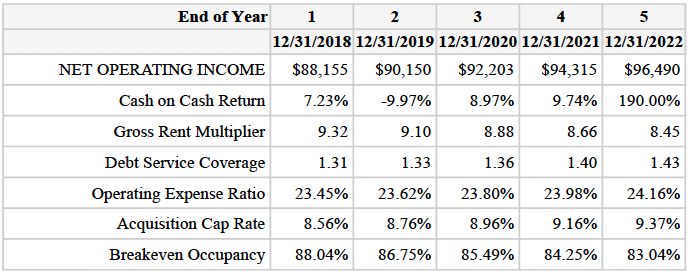

Okay, the cash on cash stands out. Especially that Year 2 -9.97% (remember the $50,000 HVAC expense you’ve planned for?). But not to worry. If you’re looking for the 13% discount rate you need, just hang on until we get to the IRR and NPV calculations. As explained in other PropertyMetrics articles, IRR and NPV are better measures of a project’s return because they consider the entire holding period, rather than cash-on-cash considering one year at a time (and hence the heart attack inducing Year 2 number).

Second in line is the gross rent multiplier, showing here at 9.32x in Year 1. Typically a GRM doesn’t reveal much about the opportunity (without context), but can be an indicator that the deal is off if the GRM is significantly different than GRMs of similar properties.

Now we anticipated that lenders would require a DSCR of 1.25x, and we’re seeing ratios consistently above 1.30x. This should give some comfort that income can drop without violating the lender’s criteria.

The breakeven occupancy shows as about 88% in Year 1. This means your project will still cash flow if there is a 12% or less vacancy or credit loss. If you lock up the existing tenants for new five-year terms, you shouldn’t approach a 12% loss.

Office Building Discounted Cash Flow Analysis

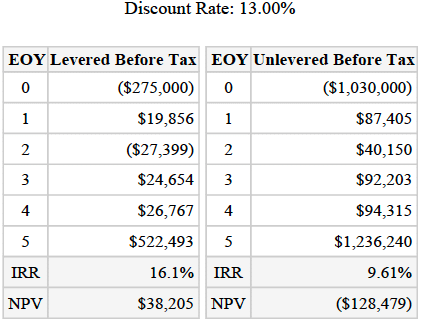

On to the granddaddy of real estate deal measurements: your discounted cash flow analysis to determine IRR and NPV:

This looks good. Might even bring a smile to your face. You wanted a 13% return, and this analysis shows that with the help of the lender’s funds this deal has the potential to return 16%. Notably, the NPV of $38,205 reveals that you’ll have to pay almost the full asking price of $1M to get the 13% IRR you desire. Anything more than $1,038,205 and the 13% return starts to drop.

Office Building Investment Vacancy/Credit Loss Sensitivity

So far, so good, but let’s do a little stress-testing. What would give you the greatest heartburn with this deal? How about SmallerTenant, LLC’s managing member goes to federal prison for wire fraud and the LLC and its rental income disappears. Suddenly you have a 20% vacancy rate. Let’s see how big your heartburn would be if (against all odds) you had to carry that empty 2,000 sf space through the full 5-year holding period. What will it do to your IRR…

Well 10.38% isn’t great, but given that you’re still in double digits for an almost unimaginable occurrence, you should be in good shape. Now if the SmallerTenant and BiggerTenant managing members are golfing buddies…

Credit Loss Stress Test

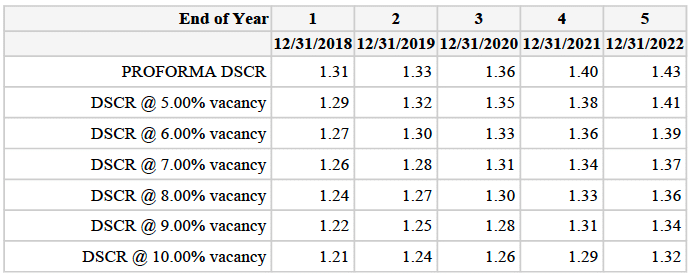

Okay, second to last thought. While our 5% credit loss assumption keeps us comfortably under the lender’s 1.30x DSCR, what if credit loss goes up. How bad can it get before the bank is calling? Let’s try stepping up the credit loss rate from 5% to 10% in one percent increments and see what happens to the DSCR.

Looking good. You’ll have to run about a 7.5% credit loss rate before dipping below the bank’s 1.30x DSCR. Nonetheless, as we’d noted in other case studies, when a deal approaches the DSCR, if the vacancy/credit loss is set too high (as it may be here given the tenants’ history), then dropping it to a lower, but more realistic, rate may save you an unexpected surprise during loan underwriting. If you can show an actual 1% vacancy or credit loss from these two tenants, then maybe you need to project 2%…

Other Considerations – Future Value

While this thought should enter into any real estate purchase, we’ll just note it, and leave an analysis for another discussion: what is the potential future value of the property? There are many, many factors that may affect future values, but hopefully you picked up on this one when reading the property losting: The age of our office, and its neighboring properties.

At 62 years old, this is a relatively old building. As neighbors it has (i) a newly-constructed 200-unit condominium, and a to-be-redeveloped retail center approved for a $5M TIF project. Clearly at least two developers of sizable power (and thus analytic resources) believe this area is prime for new and rehabilitated real estate development. Maybe this asset will appreciate much faster than those in no/little-growth properties.

Of course, this begs a few questions: (i) why is the owner selling; (ii) will the surrounding growth complement the existing office use (there’s no point in owning a restaurant in the middle of an area booming with unmanned underground storage facilities), and (iii) if the growth doesn’t complement the small office use, is the property’s lot size large enough to accommodate a new building and use?

A good broker’s opinion, a thorough due diligence review, and an engineer’s, architect’s and land use attorney’s opinions might get you pretty close to answering these questions.

Food for thought.

Conclusion

This case study illustrates one way to attack the financial analysis of a potential small office property acquisition: (1) use your income and expense assumptions to determine how much you can borrow; (2) build your proforma take a look at the relevant financial ratios; (3) determine the projected return (IRR and NPV please; don’t need those cash-on-cash heart attacks); and (4) stress-test your model for variables like credit loss.

Comments? Questions? Limericks? Please leave them in the section below!