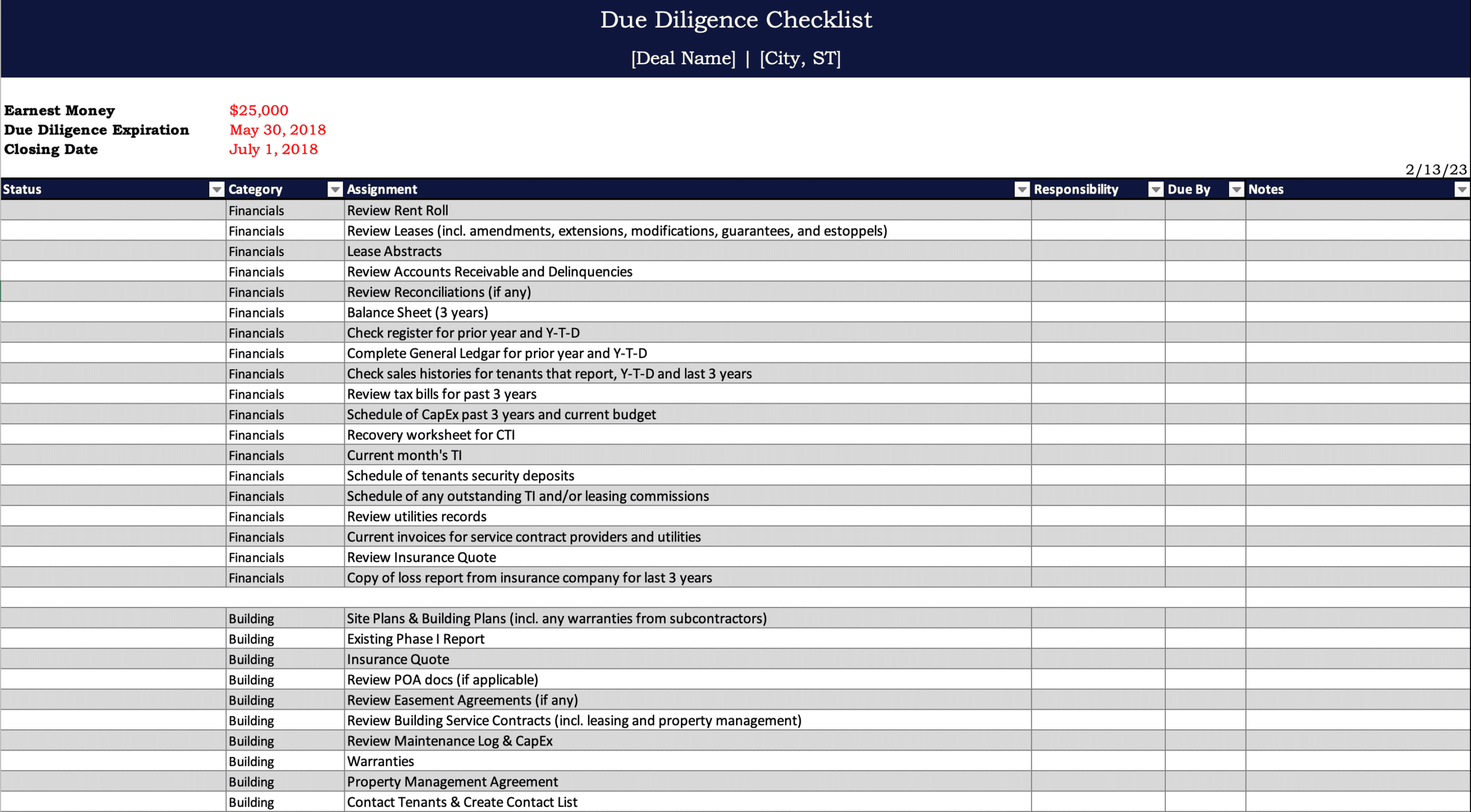

Do you need a real estate due diligence checklist for a commercial real estate property? The PropertyMetrics team has created several helpful resources for commercial real estate professionals. Please feel free to download and use the following real estate due diligence checklist template:

What Is Real Estate Due Diligence and Why It Matters

Buying a commercial property isn’t just a numbers game; it’s a risk audit. Due diligence is the structured process of verifying everything the seller and the marketing brochure claim—from legal ownership and building integrity to tenant performance and zoning compliance. A thorough review:

- Mitigates downside risk. Hidden roof leaks, unpaid property taxes, or a tenant lawsuit can quickly erode your projected returns.

- Strengthens negotiation leverage. Every issue you uncover can justify price reductions, repair credits, or revised deal terms.

- Protects lender and investor capital. Most debt covenants and partnership agreements require documented diligence to prevent fraud or material misrepresentation.

In short, a well-run due-diligence program is the difference between a proforma that becomes reality and one that becomes a cautionary tale.

When Does Due Diligence Occur?

Most purchase contracts grant a 30- to 60-day “inspection period.” The clock starts the moment both parties sign the purchase and sale agreement (PSA).

| Asset class | Typical window | Common wrinkles |

|---|---|---|

| Multifamily | 30 days | Access to tenant units must be coordinated; estoppel certificates needed. |

| Office/Retail | 45 days | Lease audits take longer; CAM reconciliations add complexity. |

| Industrial | 30 days | Environmental Phase I/II can extend timeline if contamination suspected. |

| Land Development | 60 days+ | Entitlement studies, wetlands, and geotech often require extra weeks. |

Who’s on the Due-Diligence Team?

A “one-man show” won’t cut it. Assemble a multidisciplinary squad:

- Acquisition lead / Broker – Drives the process, interfaces with seller, tracks deadlines.

- Real-estate attorney – Reviews title, PSA clauses, zoning, and closing docs.

- Environmental engineer – Conducts Phase I ESA; commissions Phase II or remediation plan if needed.

- Building engineer / Inspector – Evaluates HVAC, roof, structure, ADA compliance, and capital-repair budget.

- Lease auditor / Property manager – Verifies rent roll, estoppels, CAM reconciliations, and tenant credit.

- Appraiser – Confirms market value supports price and loan amount.

- Lender representatives – Order third-party reports (appraisal, PCA, ESA) and ensure loan conditions are met.

- Surveyor & zoning consultant – Produce ALTA/NSPS survey; flag encroachments, setbacks, or use restrictions.

High-Level Roadmap Before You Dive Into the Detailed Checklist

Below is the “30,000-foot view” that mirrors the granular items you’ll see in the full real-estate due-diligence checklist:

- Acquisition Documents & Seller Deliverables Gather the PSA, prior appraisals, operating statements, and service contracts.

- Title, Survey & Zoning Review Order a title commitment, ALTA survey, and zoning verification letter to confirm legal conformity.

- Tenant & Lease Audit Scrutinize each lease abstract, estoppel, arrears report, and security-deposit ledger.

- Financial Verification Tie out the trailing-12 P&L to bank statements, tax returns, and utility bills; validate budget assumptions.

- Physical & Environmental Inspections Complete a Property Condition Assessment (PCA), roof report, elevator inspection, and Phase I ESA.

- Governmental & Legal Compliance Check building permits, code violations, fire-life-safety certifications, and ADA accessibility.

- Lender Requirements & Insurance Satisfy debt covenants, flood-zone determinations, and secure binders for property, liability, and rent-loss coverage.

- Closing & Post-Closing Tasks Reconcile prorations, prepare closing statements, file transfer documents, and schedule post-close lease notifications.

By following this top-down sequence—then drilling into the detailed tasks that follow—you’ll ensure no critical item slips through the cracks before finalizing the deal.

Maintaining a shared checklist and weekly status call keeps everyone aligned as findings emerge.

What’s in our Real Estate Due Diligence Checklist?

Real estate due diligence is a critical step in the acquisition process of a property. It is the process of verifying the information provided by the seller and ensuring that the property meets the buyer’s investment criteria. The due diligence checklist helps to ensure that all the important aspects of the property are thoroughly reviewed before the closing.

The real estate due diligence checklist includes several items that need to be reviewed and addressed before the closing. The items can be divided into several categories: Acquisition Actions/Documents, Title/Survey/Zoning Matters, Tenant/Lease Matters, Financial Matters, Service Contracts, Litigation, Insurance, Physical Property Inspection and Review, Personal Property Inventory, Governmental Review, Closing and Miscellaneous Actions, Property Operations and Management, and Financing Matters.

The above real estate due diligence checklist includes the following due diligence items.

Acquisition Actions / Documents

- Signed Letter of Intent

- Investment Committee Presentation and Approval

- Request/obtain Due Diligence Materials

- Select Legal Counsel

- Select UBIT/ERISA Counsel

- Obtain/review 1st draft of Purchase Contract

- Obtain/review 2nd draft of Purchase Contract

- Obtain/review 3rd draft of Purchase Contract

- Obtain/review 4th draft of Purchase Contract

- Obtain/review 5th draft of Purchase Contract

- Obtain Access Agreement

- Client Authorization Letter

- Portfolio Manager Authorization Letter

- Obtain/review fully executed purchase contract

- Deliver copy of fully executed Contract into escrow

- Arrange for Buyer’s initial LC or cash deposit with Escrow Holder

- Arrange for investment of Buyer’s initial cash deposit

- Independent Contract Consideration to Seller

- Prepare funding schedule and forward to portfolio manager/client

- Obtain name of acquiring (title holding) entity

- Arrange for required bank accounts to be set up

- Obtain fully executed 1st Amendment to Purchase Contract

- Obtain fully executed 2nd Amendment to Purchase Contract

Title/Survey/Zoning Matters

- Select Title Company

- Receive/review SellerÕs title commitment and underlying documents; forward to Title Company

- Order current title commitment and underlying documents

- UCC and judgment lien searches

- Receive and review existing survey

- Order new ALTA survey (or update)

- Subdivision and parcel maps

- Restrictive covenants, easements, and agreements

- Local improvement district information

- Verify Leases, Entitlements, and other assets are in Seller’s name or that appropriate Assignment documents exist

- Confirm releases available from current lienholders (if applicable)

- Deliver Title and Survey Objection Letter to Seller (if applicable)

Tenant/Lease Matters

- Obtain current Certified Rent Roll

- Receive/review Leases, Amendments and all related documents; prepare Lease Summaries

- Engage Legal Counsel to review Leases and prepare Lease Summaries

- Compare Internal Lease Summaries to Legal CounselÕs Lease Summaries

- Compare Lease Summaries with Rent Roll and Pro Forma

- Review Tenant Lease Files

- Resolve issues regarding Leases

- Review Tenant Correspondence Files

- Compare expense pass-throughs/CAM charges to Operating Statements

- Review cost pools for overcharges to tenants

- Receive/review tenant sales reports

- Receive/review list of security deposits

- Receive/review aged receivables report

- Review tenant credit information, payment history

- Review Leases for any contractual Landlord obligations (i.e. construction, payments to tenant)

- Compare square footage between Leases and Rent Roll

- Prepare Tenant Estoppel Certificates

- Review signed Tenant Estoppel Certificates

- Cross check signed estoppels against the rent/deposit schedule

Financial Matters

- Receive and review copies of historical and proforma financial information

- Receive and review utility bills (electric, water, gas)

- Receive and review most recent tax statements and related information

- Verify all expenses of operating the property have been reflected in the financial information provided by the Seller

- Compare expenses to comparable building data

- Receive/review past and budgeted capital improvements

Service Contracts

- Receive and review service contracts

- Verify all service contracts terminable without penalty

- Confirm assignability of service contracts

- Approve contracts to be transferred & notify Seller

Litigation

- Review litigation list (if applicable)

- Determine existence of contingent liabilities or open claims against the property

Insurance

- Obtain insurance quote from Risk Management

- Review third party Property Management Agreement for adequacy of insurance coverage

- Provide information to Risk Management for final Certificate of Insurance

Physical Property Inspection and Review

- Receive/review as-built plans/specs (electrical, mechanical, structural)

- Receive/review existing inspection reports (roofing, HVAC, seismic, soils)

- Order current engineering report (Property Condition Assessment), to include structural, mechanical, code compliance and ADA compliance.

- Receive/review existing environmental reports and studies

- Order current Phase I Environmental Site Assessment

- Order current Additional Site Investigation (Phase II)

- Receive/review building permits, licenses, certificates of occupancy

- Verify parking is adequate (i.e. governmental regulations, practical requirements, lease requirements)

- Verify approximate sf of improvements

- Review utility site plan, verify adequate utility hook-ups, verify all utility hook-up fees paid, identify requirements for utility deposits

- Review energy usage reports; compare usage to expenses

- Verify amount of available wattage psf and compare to market

- Receive & review construction contracts/subcontracts

- Receive & review building warranties/guarantees

- List of personal property and trade/service names

- Copies of liability, casualty and other insurance

- Site plans, leasing brochures, maps and photographs

Personal Property Inventory

- Receive and review list of personal property

- Verify no material personal property omitted from personal property list

- Verify personal property in good operating condition

Governmental Review

- Review licenses and permits; verify no breach of licenses and permits, that all conditions are satisfied, that licenses and permits are in current OwnerÕs name and whether transfer is required, and that there are pending applications for licenses and permits

- Verify certificates of occupancy for property and tenant spaces on file

- Verify proper zoning; obtain zoning letter

- Verify improvements comply with governmental regulations

- Verify no development rights transferred

- Verify no existing contemplated assessments

- Verify no pending rezoning

- Verify no pending administrative proceedings or governmental plans or studies

- Verify no utility moratorium

Closing and Miscellaneous Actions

- Notify Seller of any breach or misrepresentation discovered during due diligence review

- Aggregate cost of correcting any problems discovered through due diligence

- Initiate any necessary changes to forms of Closing Documents

- Prepare and approve authority documents

- Request current financial information from Seller for prorations

- Confirm prorations for taxes and assessments

- Confirm prorations for utilities

- Confirm prorations for rents

- Confirm prorations for permit and license fees

- Confirm prorations for utility deposits

- Confirm prorations for operating accounts

- Confirm prorations for obligations under contracts

- Confirm prorations for security deposits

- Confirm prorations for closing costs

- Confirm prorations for any commissions, tenant improvements, or other leasing expenses

- Confirm prorations for any other apportionments

- Request schedule of Buyer’s title related costs from title company

- Prepare schedule of estimated closing costs

- Prepare & distribute form of Tenant Notice

- Prepare the assignment of Purchase Contract

- Arrange for Buyer’s replacement/additional cash deposit

- Arrange for investment of Buyer’s replacement/additional cash deposit

- Confirm return receipt of initial LC and return it to bank; or

- Confirm return receipt of initial/additional cash deposit; or

- Instruct bank to transfer returned cash deposit to line of creditPrepare schedule of Buyer’s funding into escrow

- Arrange for Buyer’s purchase proceeds to be funded into escrow

- Arrange for Buyer’s purchase proceeds to be invested overnight

- Review escrow instructions and exhibits to closing documents

- Coordinate delivery of original documents to property manager

- Obtain/review the closing statement

- Confirm recording/disbursement of funds

- Confirm property/liability insurance in place

- Send letter to client confirming closing (with closing statement/funding schedules)

- Instruct counsel to distribute the closing binders

Property Operations and Management

- Select Property Management company

- Finalize Property Management Agreement

- Verify financial terms of Property Management Agreement are reflected in proforma

- Select leasing company

- Verify Service Contracts are at market

- Verify no disputes with brokers, suppliers or employees

- Verify no existing or contemplated labor strikes

- Verify all obligations and trade creditors being paid in normal course

- Review Property management files

- Review list of warranties and expiration dates

- Review maintenance schedules for equipment, and repairs and maintenance expenses

Financing Matters (If applicable)

- Contact Mortgage Consultant

- Provide Property information to Mortgage Consultant

- Receive/review Loan Quotes

- Select Lender

- Signed Loan Commitment

- Arrange Payment of Loan Commitment Fees

- Receive/review/negotiate Loan Application

- Signed Loan Application

- Provide Mortgage Consultant/Lender with requested documents

- Finalize Loan Documents

- Signed Loan Documents

- Arrange for funding of Financing Proceeds

Internal Procedures and Reporting

- Confirm property visit by Asset Management and Management Committee member

- Confirm that all client specific acquisition requirements are met

- Issue transition memo to Asset Management, Property Management and Accounting (if applicable)