Do you need a back of the envelope real estate development proforma? The PropertyMetrics team has created several helpful resources for commercial real estate professionals. Please feel free to download and use the following real estate proforma template:

About Our Real Estate Development Proforma Excel Template

Evaluating the financial feasibility of a real estate development project can be a challenging and time-consuming process. Developing a financial model from scratch can be a repetitive and error-prone task. That’s why we’ve created a real estate development proforma template in Excel that simplifies the process and makes it more efficient. If you’re looking for a reliable and free back of the envelope real estate development proforma, then you’ve come to the right place.

Our web-based commercial real estate proforma software provides advanced capabilities for real estate development analysis. However, sometimes all you need is a simple and straightforward tool to get started. That’s why we’ve created this user-friendly real estate development proforma template for your convenience.

A real estate development proforma, sometimes called a real estate development pro forma, is a financial model used to evaluate the feasibility and profitability of a real estate development project. It is a vital tool for real estate developers, investors, lenders, and other stakeholders involved in the development process.

Our template is designed to meet your needs and provide a solid foundation for your financial projections. With its comprehensive sections, formulas, and calculations, this template will help you streamline your back of the envelope real estate development analysis process.

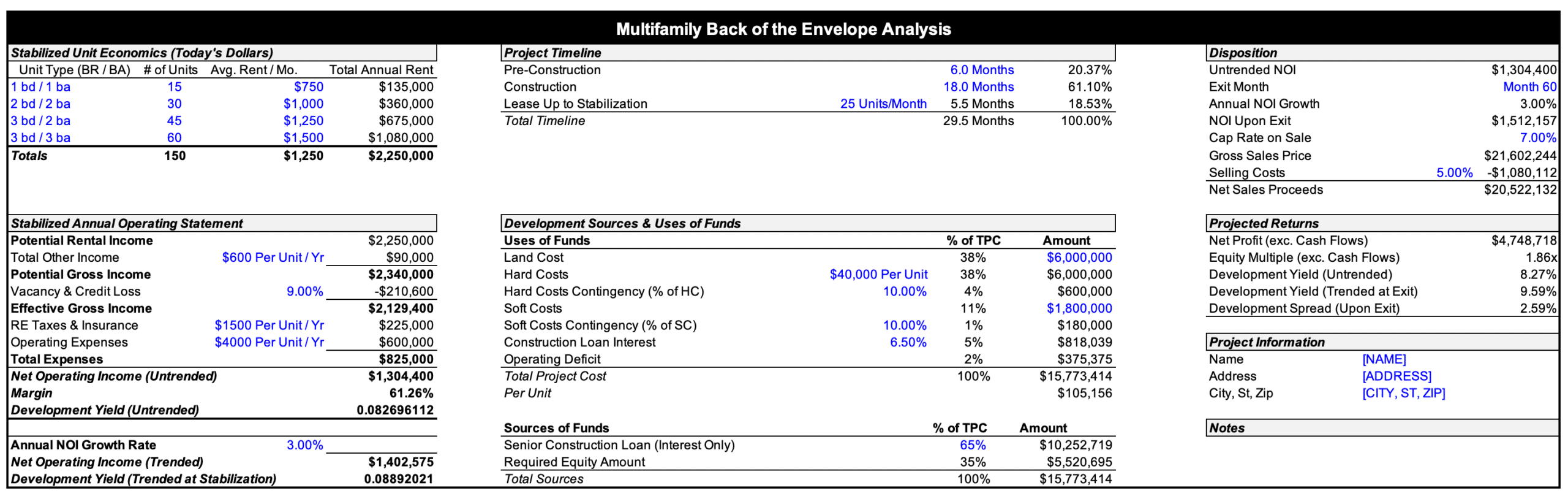

Our real estate development proforma includes six sections: unit economics, annual operating statement, project timeline, sources and uses, disposition assumptions, and return metrics. This guide is intended to serve as a user manual, helping you navigate the various sections of our template and customize it for your real estate development project.

Unit Economics

The unit economics section is where you will input information about the units in your development project. This includes the unit type (bedrooms/bathrooms), the number of units, the average rent per month, and the total annual rent for each unit type. By inputting this information, you can calculate the total potential rental income for your development project.

Annual Operating Statement

The annual operating statement section provides a breakdown of the income and expenses for your development project. This includes potential rental income, total other income, potential gross income, vacancy and credit loss, effective gross income, real estate taxes and insurance, operating expenses, total expenses, and net operating income (untrended).

In addition to these metrics, we also calculate the operating margin (net operating income divided by effective gross income) and the development yield (untrended). You can also input an annual NOI growth rate and calculate the net operating income (trended) and development yield (trended at stabilization).

Project Timeline

The project timeline section provides a clear outline of the major milestones of your development project. You can input the pre-construction and construction timelines as a total number of months, as well as the lease-up to stabilization timeline as a number of units leased per month. Based on these inputs, we will automatically calculate the total timeline for your project.

Sources and Uses

The sources and uses section provides an overview of the financing for your development project. You can input the uses of funds, including land costs, hard costs, soft costs, construction loan interest reserve, and operating deficit.

You can also input the sources of funds, including senior construction loan and required equity amount. Based on these inputs, we will calculate the total sources and uses of funds for your development project.

Disposition Assumptions

The disposition assumptions section provides an overview of your plans for selling or refinancing your development project. You can input the exit month and cap rate on sale, then we will calculate the NOI upon exit, gross sales price, selling costs, and net sales proceeds.

Return Metrics

The return metrics section provides a summary of the potential return on investment for your development project. This includes key financial metrics such as the net profit (excluding cash flows), equity multiple (excluding cash flows), development yield (untrended), development yield (trended at exit), and development spread (upon exit).

Conclusion

Our real estate development proforma template is an easy-to-use tool that can help you analyze the financial feasibility of your real estate development project. By inputting key financial metrics and projections, you can create a back of the envelope financial model that can help you secure financing and make informed investment decisions. If the deal pencils out on a back of the envelope basis then you can move on to a more detailed development proforma with our commercial real estate analysis software.

Whether you’re a seasoned real estate developer or new to the industry, our proforma template can help you navigate the complex financial landscape of real estate development. We hope this user guide has been helpful and we look forward to helping you create a successful development project.