Looking for a sharable cap rate calculator? The cap rate is a commonly used metric in commercial real estate. It can be easily calculated using our cap rate calculator and shared with others on your team.

Gross Potential Income

Gross Potential Income

$0

Effective Gross Income

Effective Gross Income

$0

Calculated Results

Gross Potential Income

$0

Vacancy & Credit Loss

$0

Other Income

$0

Effective Gross Income

$0

Property Taxes

$0

Insurance

$0

Maintenance

$0

Management Fee

$0

Reserve for Replacement

$0

Other Expenses

$0

Total Expenses

$0

Net Operating Income

$0

Property Value

$0

Cap Rate

0.0%

Free Cap Rate Calculator – Quickly Analyze Any Investment Property

Looking for a free cap rate calculator to evaluate commercial real estate investments? The capitalization rate (cap rate) is a key metric used to estimate an investment property’s return. Our cap rate calculator simplifies the process, helping you analyze net operating income (NOI), property value, and potential profitability.

- Instant Calculations – No spreadsheets or complex formulas needed.

- Easy Sharing – Share results with investors, brokers, and partners.

- Investor-Friendly – Works for multifamily, retail, office, industrial, and more.

Our cap rate calculator is a simple tool that is designed to help you calculate the cap rate for commercial real estate properties on a back of the envelope basis. The capitalization rate is a widely used metric in the commercial real estate industry. It is often used by investors to determine the potential profitability of an investment, and by appraisers to estimate the value of a property. With our cap rate calculator, you can quickly and easily calculate the cap rate for any commercial property.

Need a more detailed analysis? Our Proforma App goes beyond quick calculations, allowing you to build customized proformas, model different financing scenarios, and generate professional reports with ease. If you’re serious about analysis and valuation and want to go beyond the cap rate, try our full-featured proforma tool for a deeper financial analysis. Our app makes it easy to model complex rent rolls and scenarios, and gives you professional-grade analysis, including internal rate of return, cash on cash return, equity multiple, debt service coverage, and more.

Cap Rate Calculator – Example Walkthrough

Let’s analyze a 10-story office building using real numbers. Here is the shareable cap rate calculator with everything filled out for this example.

Step 1: Gross Potential Income (GPI)

Gross potential income (GPI) is the maximum rental revenue if 100% occupied.

- Total Square Footage: 50,000 SF

- Average Rent Per SF: $35

- Gross Potential Income Calculation:

- 50,000 × 35 = 1,750,000

- GPI = $1,750,000

Step 2: Adjust for Vacancy & Other Income

Office buildings typically have vacancy rates due to tenant turnover. Additional income may come from parking fees, signage, or conference room rentals.

- Vacancy & Credit Loss (10%): −$175,000

- Other Income (Parking, Conference Room, etc.): +$50,000

- Effective Gross Income (EGI) Calculation:

- EGI = GPI − Vacancy Loss + Other Income

- EGI = 1,750,000 − 175,000 + 50,000 = 1,625,000

- EGI = $1,625,000

Step 3: Subtract Operating Expenses

Operating expenses include property taxes, insurance, maintenance, management fees, and reserves.

| Property Taxes | $120,000 |

| Insurance | $30,000 |

| Maintenance & Repairs | $60,000 |

| Property Management Fee | $65,000 |

| Utilities | $90,000 |

| Janitorial Services | $50,000 |

| Reserves for Replacement | $20,000 |

| Total Expenses | $435,000 |

Step 4: Calculate Net Operating Income (NOI)

- NOI = EGI − Total Operating Expenses

- NOI = 1,625,000 − 435,000 = 1,190,000

- NOI = $1,190,000

Step 5: Determine Property Value and Cap Rate

Let’s assume this office building is valued at $15,000,000.

Cap Rate Formula:

- Cap Rate = NOI ÷ Property Value

- Cap Rate = 1,190,000 ÷ 15,000,000

- Cap Rate = 7.93%

Final Cap Rate: 7.93%

How Our Cap Rate Calculator Works

The calculator is designed to be simple and easy to use. It allows you to calculate the potential gross income, which is the primary potential source of income a property could generate if it were 100% occupied. The inputs required for this calculation include the property value, total rentable square feet, and average rent per square foot. Once you enter this information, the calculator will instantly show you the potential gross income calculation.

Next we have inputs for the vacancy & credit loss, and other income. Once you enter this data, then you will be shown the effective gross income for the property. This is the amount of income expected to be collected after considering tenant turnover and any other income from the property, such as vending, parking, events, etc.

The cap rate calculator also has an expense section that includes inputs for property taxes, insurance, maintenance, management fee, reserves for replacement, and other expenses. By entering this information, you will then get a net operating income (NOI) calculation. This is the amount of income that is generated by the property after all expenses have been taken into account. This figure is then divided by the property value that you entered, which provides you with the cap rate. The cap rate is the ratio of net operating income to the property’s value.

One of the most significant advantages of our cap rate calculator is its simplicity. Unlike many other financial tools, our calculator is easy to use and requires only a few inputs to generate accurate results. This makes it an ideal tool for a quick back of the envelope analysis. By using our calculator, you can quickly and easily determine the potential profitability of any commercial property.

Another advantage of our calculator is that it can be shared. Once you are done with your analysis, just click the share button and you will be able to copy a link that you can send to anyone else on your team.

Our cap rate calculator is a simple tool that can help you make better investment decisions in commercial real estate. With its easy to use interface and simple inputs, it provides you with a quick cap rate calculation that can then be shared with anyone. Whether you are a seasoned investor or a beginner, our calculator can help you determine the potential profitability of any commercial property, allowing you to make informed investment decisions.

Cap Rate Calculator in Excel

To help you quickly calculate the cap rate using various cap rate calculation methods, we’ve also created a handy cap rate calculator in Excel.

Cap Rate Calculator

Fill out the quick form below and we’ll email you our free cap rate calculator. You can use our cap rate calculator to quickly calculate the cap rate as a simple ratio, and also using the gordon model and the band of investment method.

How to Use The Excel Cap Rate Calculator

Here is how you can use this cap rate calculator, step by step.

- Download the cap rate calculator using the form above.

- Choose the cap rate calculation method you prefer by selecting a spreadsheet tab. Methods of cap rate calculations include the cap rate ratio, band of investment, or the gordon model.

- Enter the assumptions on the selected tab/method.

- View the calculated cap rate.

As you can see, we’ve made it simple to use our cap rate calculator.

Cap Rate Calculator in Excel Example #1

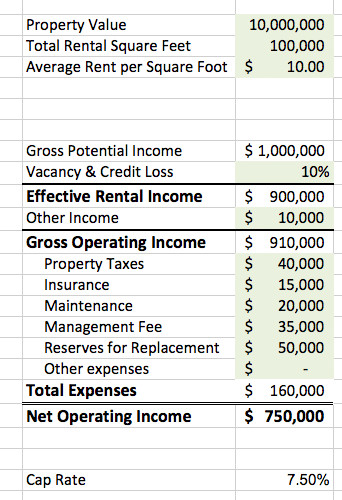

Let’s walk through a simple ratio example using this cap rate calculator. Suppose we have an NOI of $750,000 and a property value of $10,000,000. Here’s how we can calculate the simple cap rate ratio:

As shown above, we can enter a few basic assumptions about the property to build a year 1 proforma. Then we’ll have our net operating income automatically calculated, along with the cap rate, which in this case is 7.5%.

Cap Rate Calculator in Excel Example #2

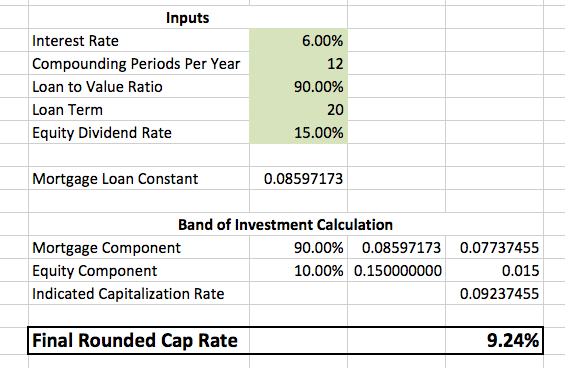

Now suppose we want to find the property value, but we don’t know what the appropriate cap rate should be. In this case, we can use the band of investment method to calculate a market-based cap rate.

The band of investment cap rate calculation method takes market-based commercial loan assumptions as well as investor rate of return requirements. Using this data, we can calculate a cap rate by taking a weighted average of the mortgage constant and the investor’s required rate of return for a project similar to the one we are evaluating. This cap rate calculator produces a cap rate that comes from the weighted average.

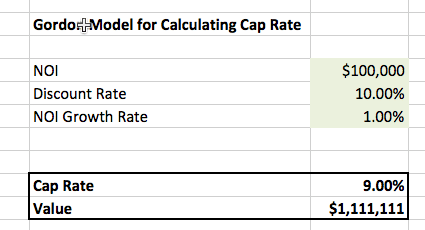

Cap Rate Calculator in Excel Example #3

We can also calculate the cap rate using the gordon growth model popular with valuing stocks. Since the cap rate is simply the discount rate minus the growth rate, if we know 2 out of three variables, then we can easily solve for the remaining unknown. For example, suppose we know that the discount rate (required return) is 10% and our NOI is expected to grow at a constant rate of 1%. That means our cap rate is simply 10%-1%, or 9%. If our NOI is $100,000 then that means our property value is $1,111,111.

Cap Rate Calculator

Fill out the quick form below and we’ll email you our free cap rate calculator. You can use our cap rate calculator to quickly calculate the cap rate as a simple ratio, and also using the gordon model and the band of investment method.