Know in 30 seconds whether a rental deal pencils out. Skip the spreadsheet, drop in the numbers, get clear cash flow and sharable ROI metrics instantly.

Investment Data

Total Cost

$0

Financing Data

Total Debt Service

$0

Investment Metrics

Purchase Price

$0

Closing Cost

$0

Renovation Cost

$0

Total Cost

$0

Loan to Cost

$0

Initial Equity

$0

Loan Amount

$0

Going-in Cap Rate

0.0%

Unlevered Yield on Cost

0.0%

Cash on Cash Return

0.0%

Rental Property Calculator: Instantly Assess Cash Flow, ROI, and Cap Rate

Real estate investing is all about the numbers. Our shareable Rental Property Calculator is designed for quick, back-of-the-envelope proforma calculations, helping you get a snapshot of your property’s potential returns. Whether you’re evaluating a new deal or tracking an existing property, this tool gives you a fast and clear financial overview.

Need a more detailed analysis? Our Proforma App goes beyond quick calculations, allowing you to build customized proformas, model different financing scenarios, and generate professional reports with ease. If you’re serious about rental property investing, try our full-featured proforma tool for a deeper financial analysis.

How the Rental Property Calculator Works

Simply input your rental property details, and our calculator will instantly generate key investment metrics. Here’s what you’ll need to provide:

1. Income

- Monthly Rent: Expected rental income per unit or property.

- Other Income: Additional revenue streams (e.g., parking fees, laundry, pet rent).

- Vacancy Rate: The percentage of time the property is expected to be unoccupied.

2. Operating Expenses

- Property Taxes – Annual tax obligations for the property.

- Insurance – Coverage costs for property protection.

- Maintenance & Repairs – Estimated yearly costs for upkeep and unexpected repairs.

- Management Fees – Costs associated with professional property management (if applicable).

- Reserves for Replacement – Budget for large capital expenditures like roof replacement or HVAC systems.

3. Investment & Financing

- Purchase Price – The cost of acquiring the property.

- Closing Costs – Fees related to finalizing the transaction.

- Renovation Costs – Estimated cost of property improvements.

- Loan Terms – Down payment, interest rate, and loan amortization details.

Key Rental Property Investment Metrics Explained

After you enter your assumptions, our rental property calculator will automatically and instantly calculate several key rental property investment metrics.

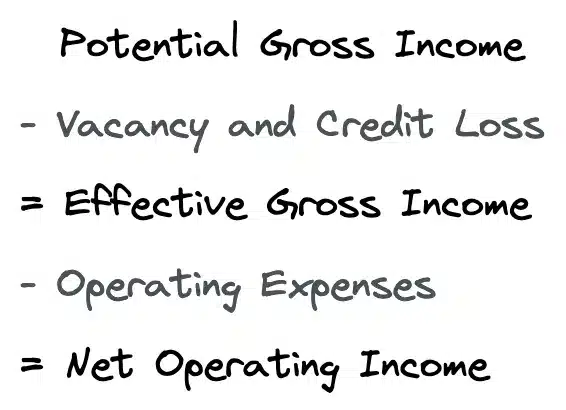

Net Operating Income (NOI)

NOI is the foundation of rental property profitability. It’s calculated as:

Cap Rate (Capitalization Rate)

The cap rate measures the return on a property relative to its purchase price: A higher cap rate often signals greater investment potential but may also indicate increased risk.

Cash-on-Cash Return

This cash on cash return metric evaluates the return on your actual cash investment.

Debt Service Coverage Ratio (DSCR)

Lenders assess DSCR to determine if a property generates enough income to cover its debt: A DSCR above 1.25 is generally favorable to lenders.

Unlevered Yield on Cost

The unlevered yield on cost measures the yield on your total cost of acqusition without consideration of any loan financing. The total cost includes not only the purchase price, but also closing costs and renovation costs.

Example Calculation: Single-Family Rental Property

Let’s assume you’re considering an investment property with the following details:

1. Income Assumptions

- Monthly Rent: $3,400

- Other Income (e.g., pet rent, parking fees): $50 per month ($600 per year)

- Vacancy Rate: 5%

2. Operating Expenses Assumptions

- Property Taxes: $4,000 per year

- Insurance: $1,200 per year

- Maintenance & Repairs: $1,500 per year

- Management Fee: 8% of EGI

- Reserves for Replacement: $1,000 per year

- Other Expenses: $500 per year

3. Investment & Financing Assumptions

- Purchase Price: $300,000

- Closing Costs: $6,000

- Renovation Costs: $10,000

- Loan-to-Cost Ratio (LTC): 75%

- Loan Interest Rate: 6.5%

- Loan Term (Amortization Period): 30 years

Our calculator will provide:

- Net Operating Income (NOI): 27,984

- Cash Flow Before Tax: 10,008

- Cap Rate: 9.33%

- Cash-on-Cash Return: 12.67%

This sharable analysis helps determine whether the property aligns with your investment goals. If you’re looking for a more advanced, professional-grade analysis, our Proforma App is the perfect tool for modeling different scenarios and refining your investment strategy.

Frequently Asked Questions (FAQ)

Here are some frequently asked questions about investment property calculations.

1. How do I estimate cash flow on a rental property?

Subtract projected vacancy and operating expenses from gross rental income to get net operating income (NOI), then subtract annual mortgage payments. The result is pre-tax cash flow.

2. What is a good cash on cash return?

Many investors target between 8-12% in stable markets; riskier markets may justify 15%+. Your own hurdle depends on risk tolerance and financing terms.

3. What is a good cap rate for rental properties?

Cap rates vary by location and risk level:

- 4-6% – Urban markets with high demand

- 6-10% – Suburban and mid-tier markets

- 10%+ – Higher-risk markets with greater vacancy potential

4. How do I calculate my monthly mortgage payment?

Use a commercial mortgage calculator, or enter the standard mortgage components into a financial calculator:

- PMT = Monthly payment

- PV = Loan principal

- R = Monthly interest rate

- N = Number of payments

- FV = Loan Balance at end of term

5. How much should I budget for maintenance?

This really depends on the property, but a general rule of thumb is 1-2% of the property value per year.

6. What’s the difference between cash flow and NOI?

- NOI excludes mortgage payments, focusing on property performance.

- Cash Flow accounts for loan payments, showing actual profit after all expenses.

Why Use Our Rental Property Calculator?

✔ Fast & Simple: No spreadsheets, no complicated formulas—just quick, actionable results.

✔ Investor-Focused: Designed specifically for rental property investors.

✔ Customizable: Adjust inputs to see how different scenarios impact your returns.

✔ Sharable Results: Get a shareable link to easily discuss deals with partners or lenders.

Whether you’re a seasoned investor or just getting started, our rental property calculator helps you quickly analyze rental property profitability so you can make smart investment decisions with confidence.

Get Started – Analyze Your Rental Property Now

The best real estate investors rely on accurate financial projections to make informed decisions. Use our Rental Property Calculator to get a quick estimate, and when you need a comprehensive investment model, our Proforma App is here to help you refine your strategy.

Try it now – fast, free, and easy to use!