The sales comparison approach is a popular and common valuation methodology for real estate. Yet, there are many nuances to the sales comparison approach for commercial real estate that are misunderstood. The sales comparison approach can be particularly helpful when a property does not generate lease income, or that information is not available. In this article we’ll discuss the sales comparison approach for real estate in depth.

What is the Sales Comparison Approach to Real Estate Valuation?

The sales comparison approach estimates market value for a property using recent sales data from other similar properties. The sales comparison approach requires that there is an active market for similar properties. In addition, local market conditions, as well as national economic conditions, should be stable in order to reasonably support the valuation using comparable property sales. The sales comparison approach considers the selling prices of similar, recently sold properties. Those sales prices are adjusted to reflect the time, conditions, and differences between the comparable properties and the subject property. The result of the adjustments is a subject value estimate.

Sales Comparison Approach: Adjustment Factors

Ideally, the comparable sales should be as close to the present time as possible and be nearly identical to the subject property. These conditions minimize the need for adjustments. In practice, there can be many factors that can cause price differences between two comparable properties. These differences can fall into nine categories.

- Ownership Interest – Differences in ownership interest result in differences in value. A property is valued differently if the owner has a fee simple interest compared to a leased fee interest. Therefore, a valuation must adjust for differences in ownership interest.

- Cash Equivalency – In some cases, a buyer pays a higher sales price for a property in exchange for below market rate financing. So, the sales price must be adjusted downward to account for that premium.

- Conditions of Sale – A value estimate should consider an arm’s length transaction between two unrelated parties. Adjustments are required for comparable sales that were forced sales and those in which the buyer and seller were in some way related or affiliated.

- Market Conditions – Depending on the local economy and market for real estate, prices may trend in either a positive or negative direction over time. Unless the comparable sale took place in the last week, chances are that the market conditions have changed a bit. It can be more difficult to accurately make these market adjustments when there are large movements in price during a short period of time.

- Locational Characteristics – Location is a key element in real estate valuation because an individual property’s value is dependent upon the properties and area that surround it. Differences in location-specific factors like transportation, traffic patterns, school quality, shopping availability, and access to adequate utilities between a comparable property and the subject property require an adjustment to the sales price.

- Physical Characteristics – Physical characteristics make up the most obvious differences between two comparable properties. As a result, adjustments are necessary for physical differences such as age, condition, quality, design, and special equipment or features.

- Economic Characteristics – Aside from physical, locational, and transactional differences in properties, there may be economic differences that affect the expected cash flows. For example, higher operating expenses or management expenses reduce the net operating income of the property. In turn, lower net operating income results in a lower valuation. If the operating and management efficiency of a comparable property is not similar to the subject property, an adjustment is necessary. In addition, differences in tenant mix, lease terms, and lease concessions all directly impact expected net operating income and therefore property value. These differences are directly measured when using the income approach to valuation, but they cannot be ignored in the sales comparison approach either.

- Use – A key component of real estate appraisal is valuing a property at its highest and best use. In the case where either the comparable property or subject property’s existing use is not its highest and best use, there must be an adjustment to the value.

- Non-realty Components of Value – Sometimes the sale price of a property not only reflects the land and improvements but also non-realty components. For example, the sale may include furnishings or other items of personal property, intellectual property, or ongoing business value. These non-realty components of the sales price must be extracted in order to accurately establish a value estimate using the sales comparison approach.

Sales Comparison Approach: Making Adjustments to Comparable Properties

The goal of the adjustment process is to make the comparable property look more like the subject property. So, the price is adjusted to account for valuation differences due to each of the factors from the previous section. Adjustments can be made as a direct dollar amount or a percent of overall value. Factors such as ownership interests, non-realty components of value, and cash equivalency are easier to estimate as a direct dollar amount. Other factors, such as market conditions, location, economics, and physical characteristics may be more accurately represented as percentage adjustments in value. Consider direct dollar adjustments first and then incorporate percentage adjustments.

Determining the actual amount of the price adjustment is a subjective process. Most of the time, there is not a single correct answer. As a result, appraisers often present a value estimate in range rather than as a single number. The estimate of the adjustment can come from a data source publishing value estimates, personal knowledge of and experience in a given market, or using quantitative analysis of past sales.

Estimating Subject Value Using The Sales Comparison Approach

After completing the process of making adjustments to comparable prices, the result is a market estimate that can be applied to the subject property. The subject value can be estimated using a market estimate of dollars per square foot or dollars per unit as well as a market multiplier. Examples of market multipliers include the Potential Gross Income Multiplier (PGIM), Effective Gross Income Multiplier (EGIM), Net Income Multiplier (NIM), or cap rate.

Sales Comparison Approach Example

Suppose the subject property we are evaluating is a new 24,000 sqft office property. Market rent for this area is $15/sqft, average operating expenses are $4.10/sqft, and average vacancy is 6%. There have been three similar properties that have sold during the last 18 months.

| Comp 1 | Comp 2 | Comp 3 | |

| Sales Price | $2,675,000 | $4,200,000 | $1,950,000 |

| Time of Sale | 5 months ago | 8 months ago | 18 months ago |

| Age | 5 years | 3 years | 5 years |

| Gross building area (SQFT) | 26,500 | 46,200 | 22,300 |

| PGI | $344,000 | $592,000 | $227,000 |

| Vacancy | 5% | 6% | 0% |

| EGI | $326,800 | $556,500 | $227,000 |

| Operating Expenses | $99,000 | $172,500 | $72,000 |

| NOI | $227,800 | $384,000 | $155,000 |

| Price/sqft | $100.94 | $90.91 | $87.44 |

| PGIM | 7.78 | 7.09 | 8.59 |

| EGIM | 8.19 | 7.55 | 8.59 |

| Cap Rate | 0.085 | 0.091 | 0.079 |

The market values in this area have been steadily increasing by about 1% every quarter for the past two years. So, the comparables must all be adjusted upward since they would sell for a higher price today. While properties constructed in the past five years are nearly new, a brand new property would actually sell for a 4% premium. The prices of the comparables must be adjusted upward by 4% to match the new subject property. Comparable 1 is built with above-average construction materials. The subject, along with comparables 2 and 3, is of average construction quality. Therefore, comparable 1 must be adjusted downward to consider how it would be valued if it were constructed of average quality.

| Comp 1 | Comp 2 | Comp 3 | |

| Price/sqft | 100.94 | 90.91 | $87.44 |

| Market conditions | 2% | 3% | 6% |

| Age | 4% | 4% | 4% |

| Quality | -2% | 0% | 0% |

| Total Adjustments | 4% | 7% | 10% |

| Adjusted Price/sqft | 104.98 | 97.27 | 96.18 |

| Adjusted value | 2,781,970 | 4,493,874 | 2,144,814 |

| Adjusted PGIM | 8.09 | 7.59 | 9.45 |

| Adjusted EGIM | 8.51 | 8.08 | 9.45 |

| Adjusted Cap Rate | 0.082 | 0.085 | 0.072 |

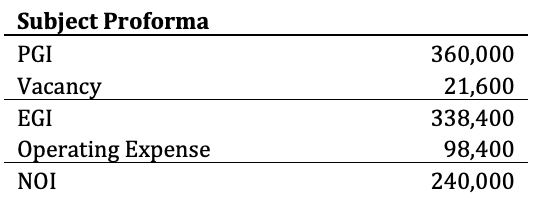

Applying the total adjustments to the original price per square foot for each property results in an adjusted price per square foot and adjusted overall sales price for each comparable. The adjusted PGIM, EGIM, and cap rate result from re-calculating the multiples with the adjusted prices. These adjusted market multiples can then be applied to the subject property in order to estimate its market value using the sales comparison approach. The current market analysis resulted in the following proforma cash flow statement for the subject property next year.

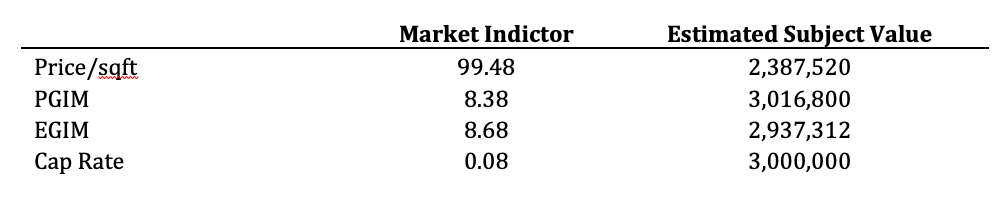

A simple average of three comparables provides an estimate of the market value for each multiple. That multiple can then be applied to the subject property to find the subject value estimate. To do this simply multiply the PGIM by the subject’s expected PGI. Then, multiply the EGIM by the subject’s expected EGI. Finally, divide the subject’s expected NOI by the market cap rate.

In this example, the expected subject value ranges from a low of $2,387,520 to a high of $3,016,800. The interpretation of this range of values is also a subjective part of the valuation process. Since the low estimated value is much lower, it may be appropriate to place less emphasis on that value and conclude that the subject value estimate is $3,000,000.

Conclusion

In this article, we talked about the sales comparison approach to real estate valuation. The sales comparison approach estimates market value for a property using recent sales data from other similar properties. The sales comparison approach process typically involves making adjustments because no two properties are exactly alike. We discussed several causes of adjustments and the walked through a simple example showing how the sales comparison approach works.