The Debt Service Coverage Ratio, often abbreviated as “DSCR”, is an important concept in real estate finance and commercial lending. It’s critical when underwriting commercial real estate and business loans as well as tenant financials, and it is a key part in determining the maximum loan amount. In this article, we’ll take a deep dive into the debt service coverage ratio, explain what a DSCR loan is, and walk through several examples along the way. Here’s what you’ll learn:

- What Is The Debt Service Coverage Ratio (DSCR)?

- Debt Service Coverage Ratio (DSCR) Formula

- Debt Service Coverage Ratio (DSCR) Meaning

- What is a Good Debt Service Coverage Ratio?

- How to Calculate DSCR for Real Estate

- Adjustments to NOI When Calculating DSCR

- How to Calculate DSCR for a Business

- Global Debt Service Coverage Ratio (Global DSCR)

What Is The Debt Service Coverage Ratio (DSCR)?

The debt service coverage ratio (DSCR) measures the ability of a borrower to repay its debt. The DSCR is widely used in commercial loan underwriting and is a key formula lenders use to determine the size of a loan.

Debt Service Coverage Ratio (DSCR) Formula

The debt service coverage ratio formula depends on whether a loan is for real estate or a business. While the logic behind the DSCR formula is the same for both, there is a difference in how it is calculated.

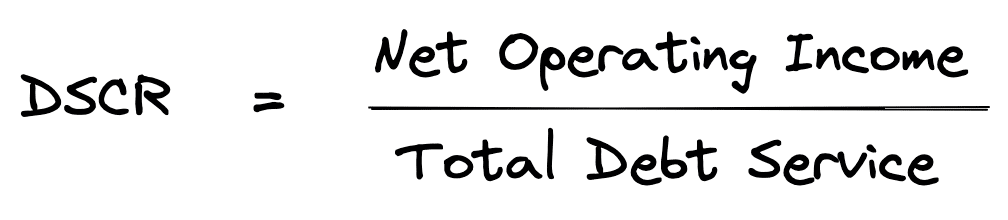

DSCR Formula for Real Estate

For commercial real estate, the debt service coverage ratio (DSCR) definition is net operating income divided by total debt service:

For example, suppose Net Operating Income (NOI) is $120,000 per year and total debt service is $100,000 per year. In this case, the debt service coverage ratio (DSCR) would simply be $120,000 / $100,000, which equals 1.20. It’s also common to see an “x” after the ratio. In this example, it could be shown as “1.20x”, which indicates that NOI covers debt service 1.2 times.

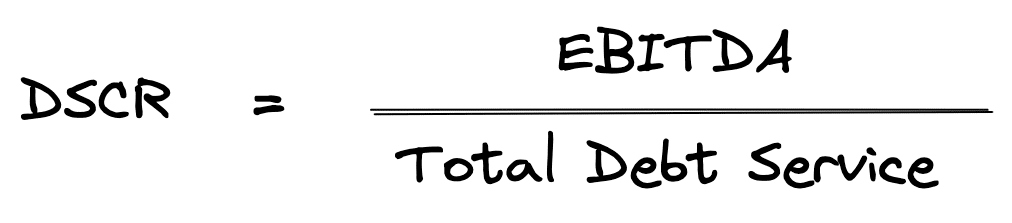

DSCR Formula for a Business

For a business, the debt service coverage ratio definition is EBITDA divided by total debt service:

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. For example, if EBITDA for a company was 240,000 for the last fiscal year, and total debt service was 141,000, then the DSCR would be 1.7x.

Sometimes there will be variation in how the debt service coverage ratio is calculated. For example, capital expenditures are commonly excluded from the DSCR calculation because capex is not considered an ongoing operational expense, but rather a one-time investment. Lenders will have credit policies that define how the debt service ratio is calculated, but there is often still some variation depending on the situation. It’s important to clarify how the DSCR is calculated with all parties involved.

Debt Service Coverage Ratio (DSCR) Meaning

What does the debt service coverage ratio mean? A DSCR greater than or equal to 1.0 means there is sufficient cash flow to cover debt service. A DSCR below 1.0 indicates there is not enough cash flow to cover debt service. However, just because a DSCR of 1.0 is sufficient to cover debt service does not mean it’s all that’s required.

Typically, a lender will require a debt service coverage ratio higher than 1.0x to provide a cushion in case something goes wrong. For example, if a 1.20x debt service coverage ratio was required, then this would create enough of a cushion so that NOI could decline by 16.7%, and it would still be able to fully cover all debt service obligations.

What is a Good Debt Service Coverage Ratio?

What is the minimum or appropriate debt service coverage ratio? Unfortunately, there is no one size fits all answer and the required DSCR will vary by bank, loan type, and by property type.

However, typical DSCR requirements usually range from 1.20x-1.50x.

| Property Type | Typical Minimum DSCR Requirement | Notes |

|---|---|---|

| Multifamily (Apartment) | 1.20× to 1.25× | Stable income streams allow for lower DSCR requirements. |

| Office Buildings | 1.25× | Long-term leases contribute to predictable cash flows. |

| Industrial Properties (Warehouses) | 1.25× to 1.35× | Generally stable, but subject to economic cycles. |

| Retail Centers (Shopping Malls, Strip Malls) | 1.30× to 1.40× | Income variability due to consumer spending patterns. |

| Self-Storage Facilities | 1.40× | High turnover and revenue fluctuations increase risk. |

| Assisted Living Facilities | 1.50× | Operational complexities and regulatory factors elevate risk. |

| Hotels (Hospitality) | 1.40× to 1.50× | Income highly sensitive to economic conditions and seasonality. |

Source: Industry reports, lender guidelines, and commercial real estate financing standards.

In general, stronger, stabilized properties will fall on the lower end of this range, while riskier properties with shorter term leases or less creditworthy tenants will fall on the higher end of this range.

How to Calculate DSCR for a Real Estate Loan

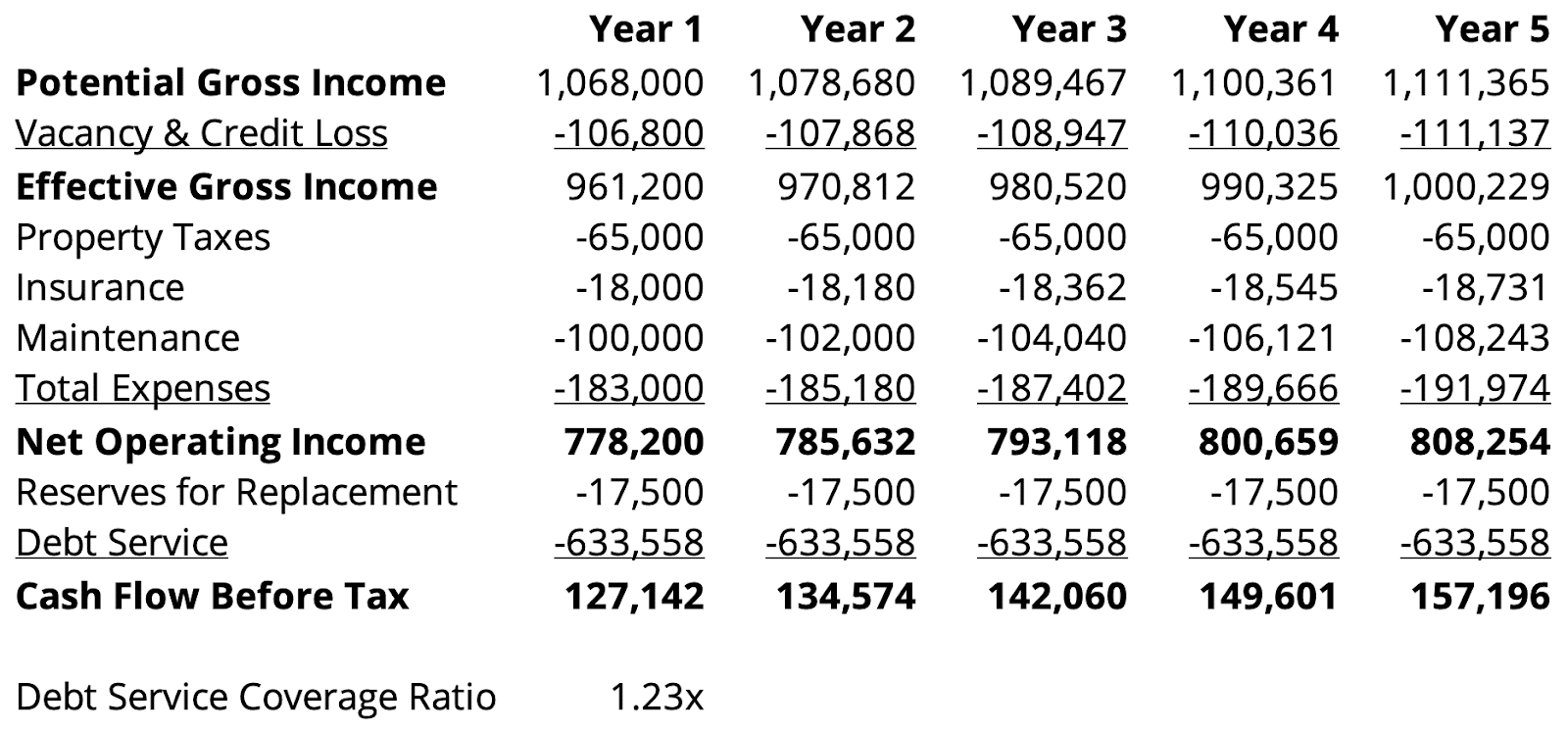

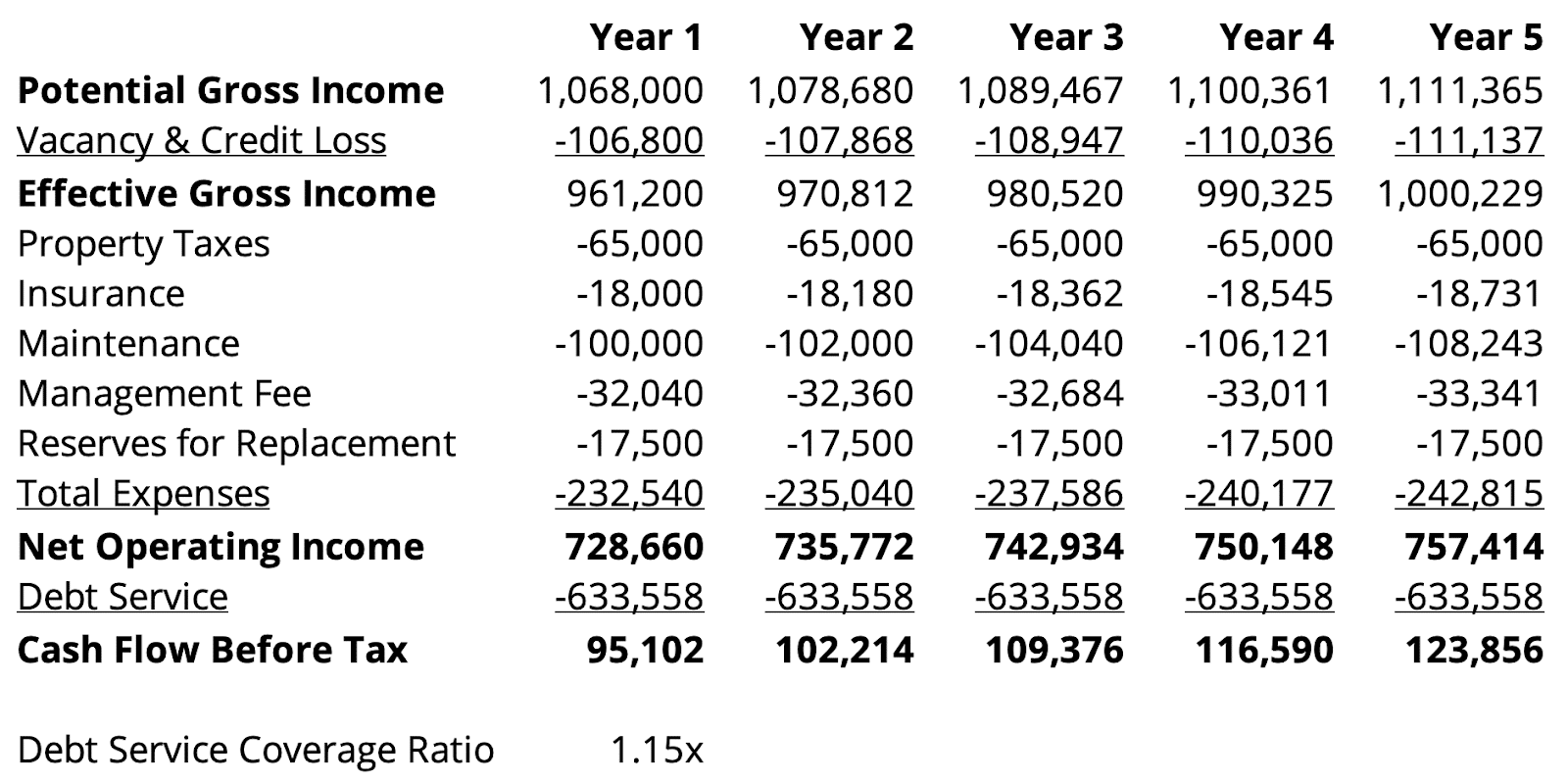

The DSCR is critical when sizing a commercial real estate loan. Let’s take a look at how the debt service coverage ratio is calculated for a commercial property. Suppose we have the following Proforma:

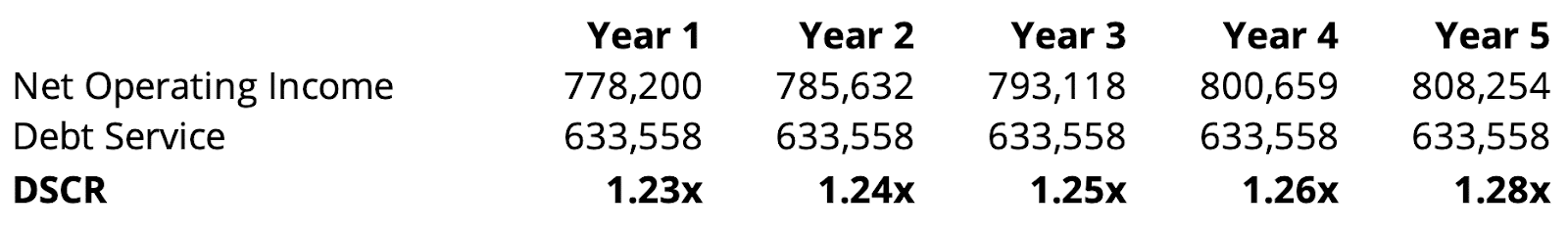

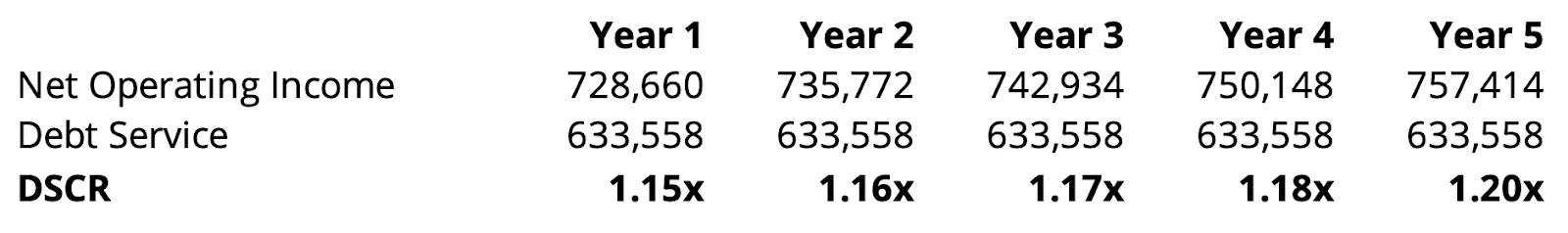

As you can see, our first year’s NOI is $778,200 and total debt service is $633,558. This results in a year 1 debt service coverage ratio of 1.23x ($778,200/$633,558). And this is what the debt service coverage ratio calculation looks like for all years in the holding period:

As shown above, the DSCR is 1.23x in year 1 and then steadily improves over the holding period to 1.28x in year 5. This is a simple calculation, and it quickly provides insight into how loan payments compare to cash flow for a property. However, sometimes this calculation can get more complex, especially when a lender makes adjustments to NOI, which is a common practice.

Adjustments to NOI When Calculating DSCR

The above example was fairly straightforward. But what happens if there are significant lender adjustments to Net Operating Income? For example, what if the lender decides to include reserves for replacement in the NOI calculation as well as a provision for a management fee? Since the lender is concerned with the ability of cash flow to cover debt service, these are two common adjustments banks will make to NOI.

Reserves are essentially savings for future capital expenditures. These capital expenditures are major repairs or replacements required to maintain the property over the long-term and will impact the ability of a borrower to service debt. Similarly, in the event of foreclosure, a professional management team will need to be paid out of the project’s NOI to continue operating the property. While an owner managed property might provide some savings to the owner, the lender will likely not consider these savings in the DSCR calculation.

Other expenses a lender will typically deduct from the NOI calculation include tenant improvement and leasing commissions, which are required to attract tenants and achieve full or market-based occupancy.

Consider the following proforma, which is the original proforma we started with above, except with an adjusted NOI to account for all relevant expenses that could impact the property’s ability to service debt:

As illustrated by the proforma above, we included reserves for replacement in the NOI calculation, as well as a management fee. This reduced our year 1 NOI from $778,200 down to $728,660. What did this do to our year 1 DSCR? Now the debt service coverage ratio is $728,660 / $633,558, or 1.15x. This is much lower than what we calculated above and could reduce the maximum supportable loan amount or potentially kill the loan altogether. Here’s what the new DSCR looks like for all years in the holding period:

Now when the debt service coverage ratio is calculated it shows a much different picture. As you can see, it’s important to take all the property’s required expenses into account when calculating the DSCR, and this is also how banks will likely underwrite a commercial real estate loan.

Introducing CRE Loan Underwriting

The only online course that shows you how lenders underwrite and structure commercial real estate loans

Reviews key loan personnel at each stage of the loan approval process

Learn fundamental credit concepts used by all lenders

Understand the framework lenders use to underwrite any type of loan

5 detailed case studies using actual real world loans

Package of more than a dozen tools and templates you can download and use

60-day money back guarantee

How to Calculate DSCR for a Business Loan

The debt service coverage ratio is also helpful when analyzing business financial statements. This could be helpful when analyzing tenant financials, when securing a business loan, or when seeking financing for owner occupied commercial real estate.

How does the DSCR work for a business? The general concept of taking cash flow and dividing by debt service is the same. However, instead of looking at NOI for a commercial property, we need to substitute in some other measure of cash flow from the business available to pay debt obligations. But which definition of cash flow should be used? Given the importance of debt service coverage, there is surprisingly no universal definition used among banks, and sometimes there is even disagreement within the same bank. This is why it’s important to clarify how cash flow will be calculated.

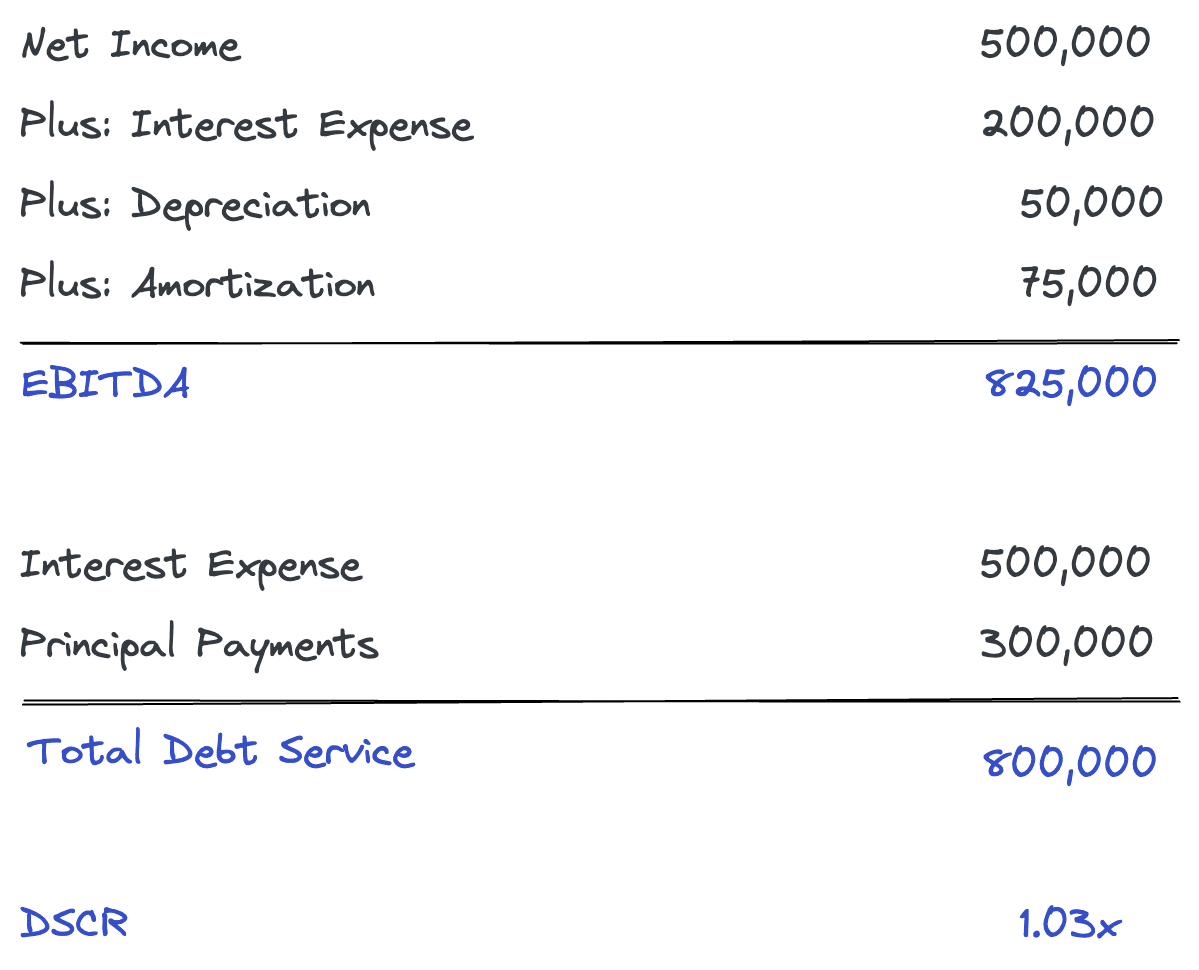

With that said, typically Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) or some form of adjusted EBITDA will be used. Common adjustments include adding back an appropriate capital expenditure amount required to replace fixed assets (which would offset the depreciation add back), and also considering working capital changes (to cover investments in receivables and inventory).

Let’s take an example of how to calculate the debt service coverage ratio for a business.

As shown above, EBITDA (cash flow) is $825,000 and total debt service is $800,000, which results in a debt service coverage ratio of 1.03x. This is found by dividing EBITDA of $825,000 by total debt service of $800,000. This gives us an indication of the company’s ability to pay its debt obligations.

If this analysis were for a tenant, we might want to subtract out existing lease payments and add in the new proposed lease payments. Or, if this were for an owner occupied commercial real estate loan, we would probably subtract out the existing lease payments and add in the proposed debt service on the new owner occupied real estate loan.

Based on the above 1.03x DSCR, it appears that this company can barely cover its debt service obligations with current cash flow. There could be other ways of calculating cash flow or other items to consider, but strictly based on the above analysis, it’s not likely this loan would be approved. However, sometimes looking at just the business alone doesn’t tell the whole story about cash flow and debt service coverage.

Global Debt Service Coverage Ratio (Global DSCR)

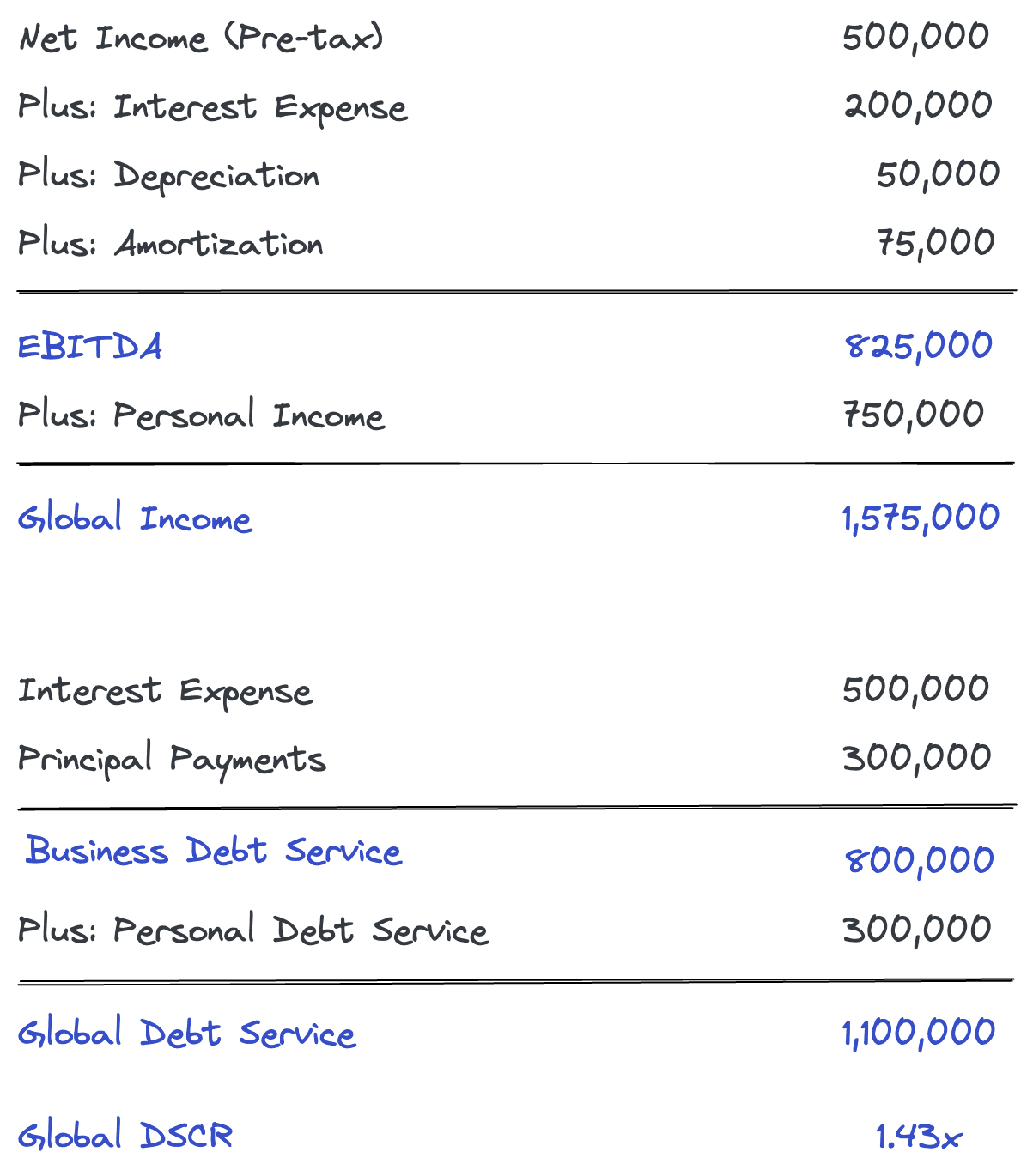

Calculating the debt service coverage ratio like we did above doesn’t always tell the whole story. For example, this could be the case when the owner of a small business takes most of the profit out with an above market salary. In this case, looking at both the business and the owner together will paint a more accurate picture of cash flow and also the debt service coverage ratio. Suppose this was the case with the company above. This is what a global cash flow analysis might look like if the owner was taking most of the business income as salary:

In the above analysis, we included the business owner’s personal income and personal debt service. Assuming the owner was taking an abnormally high salary from the business, this would explain the low debt service coverage ratio when looking at the business alone, as in the previous example. In this new global debt service coverage calculation, we take this salary into account as cash flow, as well as all personal debt service and living expenses. Digging into how personal cash flow is calculated is beyond the scope of this article, but most of this information can be found just from personal tax returns, the personal financial statement, and the credit report, all of which will be required by a lender when underwriting a loan.

As you can see, this new global DSCR paints a much different picture. Now global income is $1,575,000 and global debt service is $1,100,000, which results in a global DSCR of 1.43x. This is found by simply dividing global income by global debt service ($1,575,000/$1,100,000). More often than not, a global cash flow analysis like this tells the full story for many small businesses.

DSCR Cheat Sheet

Fill out the quick form below and we’ll email you our free debt service coverage ratio Excel cheat sheet containing helpful calculations from this article.

"*" indicates required fields

Conclusion

In this article, we discussed the debt service coverage ratio, often abbreviated as just DSCR. The debt service coverage ratio is a critical concept to understand when it comes to underwriting commercial real estate and business loans, analyzing tenant financials, and when seeking financing for owner occupied commercial real estate. We covered the definition of the debt service coverage ratio, what it means, and we also covered several commercial real estate and business examples for calculating the debt service coverage ratio. While the DSCR is a simple calculation, it’s often misunderstood, and it can be adjusted or modified in various ways. This article walked through the debt service coverage ratio step by step to clarify these calculations.