Equity waterfall models in commercial real estate projects are one of the most difficult concepts to understand in all of real estate finance. Cash flow from a development or investment project can be split in a countless number of ways, which is part of the reason why real estate waterfall models can be so confusing. In this article, we’ll take a deep dive into real estate waterfall distributions, dispel some common misconceptions, and then we’ll tie it all together with a step-by-step real estate waterfall example. Here’s what you’ll learn:

- What is a Waterfall Model in Real Estate?

- The Importance Of The Owner’s Agreement

- Common Real Estate Waterfall Model Components

- How to Create a Waterfall Model

What is a Waterfall Model in Real Estate?

First of all, what exactly is a “waterfall” when it comes to cash flow distributions? An investment waterfall is a method of splitting profits among partners in a transaction that allows for profits to follow an uneven distribution. The waterfall structure can be thought of as a series of pools that fill up with cash flow and then once full, spill over all excess cash flow into additional pools.

This type of arrangement is beneficial because it allows equity investors to reward the operating partner with an extra, disproportionate share of returns. This extra share of returns is called the promote, which is used as a bonus to motivate the operating partner to exceed return expectations. Under a waterfall structure the operating partner will receive a higher share of profits if the project’s return is higher than expected, and a lower share of profits if the project’s return is lower than expected.

The Importance Of The Owner’s Agreement

With investment waterfalls, cash flows are distributed according to the owner’s agreement. In practice, this is also often called the partnership agreement, even if the ownership structure is not a partnership. It is also common to refer to the sponsor as the general partner (GP) and the investor as the limited partner (LP). Because there are so many variables when it comes to investment waterfall structures, it’s critically important to always read the owner’s agreement.

The agreement will spell out in detail how profits will be split among partners. While there are some commonly used terms and components in investment waterfall structures, waterfall structures can and do vary widely. This means there is unfortunately no one size fits all solution, and the only way to understand a specific waterfall structure is to read the agreement.

Common Real Estate Waterfall Model Components

Although waterfall structures vary widely, there are several commonly used waterfall model components. Before we dive into our step-by-step waterfall model example, let’s first take a look at some basic building blocks.

The Return Hurdle

The return hurdle is simply the rate of return that must be achieved before moving on to the next hurdle. This is important to clearly define because the return hurdles (or tiers) are what trigger the disproportionate profit splits. Since the term “rate of return” can be defined many ways, the return hurdle in a waterfall distribution structure can also be defined in many ways. In practice, the Internal Rate of Return (IRR), XIRR, and the Equity Multiple are most commonly used as return hurdles.

Once the return hurdle has been defined, the next logical question is, from what perspective will the return be measured? Since a project will have a sponsor and at least one other investor, the return can be calculated from several perspectives. The return hurdle could be measured from the perspective of the project itself (which could include both the sponsor and the investor equity), the third-party investor equity only, or the sponsor equity only.

The Preferred Return

Another common component in equity waterfall models is the preferred return. What exactly is the preferred return? The preferred return, often just called the “pref”, is defined as a first claim on profits until a target return has been achieved. In other words, preferred investors in a project are first in line and will earn the preferred return before any other investors receive a distribution of profit. Once this “preference” return hurdle has been met, then any excess profits are split as agreed.

A few key questions with the preferred return are:

- Who gets the preferred return? Preferred investors could include all equity investors or only select equity investors.

- Is the preferred return cumulative? This becomes relevant if there isn’t enough cash flow to pay out the preferred return in any given year. In waterfall models, this preferred return can either be cumulative or non-cumulative. If the pref is cumulative, then it will be added to the investment balance for the next period and accumulate until it’s eventually paid out.

- Is the preferred return compounded? A preferred return can also be compounded or non-compounded. When the pref is cumulative, a key question is, is this unpaid cash flow compounded at the preferred rate of return as it accumulates?

- What is the compounding period? If the pref is compounded, then it’s also important to know the compounding frequency. The compounding frequency could be annually, quarterly, monthly, daily, or even continuous.

The Lookback Provision

The lookback provision provides that the sponsor and investor “look back” at the end of the deal. If the investor doesn’t achieve a predetermined rate of return, then the sponsor will be required to give up a portion of its already distributed profits to provide the investor with the predetermined return.

The Catch-Up Provision

The catch-up provision provides that the investor gets 100% of all profit distributions until a predetermined rate of return has been achieved. Then, after the investor achieves the required return, 100% of profits will go to the sponsor until the sponsor is “caught up.”

The catch-up provision is essentially a variation on the lookback provision and seeks to achieve the same goal. The key difference is that with the lookback provision, the investor has to go back to the sponsor at the end of the deal and ask the sponsor to write a check. With the catch-up provision, the investor gets 100% of all profits until the required return is achieved, and only then will the sponsor receive a distribution. Typically, the sponsor prefers the lookback provision since they get to utilize money even if they have to eventually give it back. However, the investor prefers the catch-up provision since they get paid first and won’t have to ask the sponsor to make them whole at the end of the deal.

The Promote

The promote defines the disproportionate share of cash flow the sponsor or general partner will receive for achieving return hurdles. There is more than one way the promote can be calculated, so it’s important to determine 1) the amount of the promote and 2) who is responsible for paying the promote.

How much is the promote?

Usually, the amount of the promote is clearly defined as a percentage. For example, the promote could be defined as 10% after the investor earns an 8% preferred return. This 10% promote is the extra amount of return the sponsor will earn, in excess of its ownership percentage share.

Other times the promote is not clearly defined. For instance, it’s not uncommon to see a structure described as something like “90/10 to an 8%, then 80/20 to a 12%, then 50/50 thereafter.” Often these aren’t promote amounts, but rather the final equity splits that should occur after the promote is taken into account. In these cases, it must be worked out what the actual promote amount is for the sponsor. This is why it’s always important to read the owner’s agreement when it comes to waterfall distributions.

Who pays for the promote?

Another important consideration is who pays for the promote. In other words, what is this promote percentage applied to? While this could be structured in a number of ways, in practice it is common for the promote to be paid by either the partnership or instead by the investor’s share of cash flow.

Let’s take a look at how the promote would be calculated in each of these scenarios.

Promote calculations

If the partnership pays for the promote, then the sponsor would first get its promote percentage, and then it would get its pro rata share of the remaining partnership cash flow. The sponsor’s share of cash flow would be calculated as follows:

GP Distribution % = Promote % + GP Pro Rata Share x (1 – Promote %)

For example, suppose the GP owns 10% of the partnership and the LP owns 90%. Further, suppose that the GP will earn a 20% promote after a 12% preferred return hurdle is achieved. In this case, the GP Distribution % would be 20% + (10% x 80%), which equals 28%.

If the investor pays for the promote instead of the partnership, the sponsor would first get its pro rata share, then it would get the promote percentage based off the investor’s share of cash flow:

GP Distribution % = GP Pro Rata Share + Promote % x LP Pro Rata Share

Using the same example as above, the GP Distribution % would be calculated as 10% + (20% x 90%), which equals 28%.

Notice that both of these calculations lead to the same result. The distinction here is that the investor would prefer the first scenario in case the sponsor has to be replaced because that means the original sponsor would share in some cost of replacement.

Again, although these are two common ways of calculating the promote, the important thing to remember about waterfall structures is that there is no one size fits all solution. These terms and conditions will all be spelled out in the partnership or owner’s agreement.

With these basic building blocks in our toolkit, let’s next look at how to create a waterfall model in real estate with a detailed, step-by-step example.

How to Create a Real Estate Waterfall Model Course

Learn how to build real estate equity waterfall models in Excel step-by-step with easy-to-follow videos and done-for-you templates

Reviews foundational waterfall model concepts in depth

Includes complete Microsoft Excel crash course

Step by step instruction on how to make multiple waterfall models in Excel

3-Tier IRR based waterfall model with monthly cash flows and XIRR calculations

Waterfall model with catchup provision

Equity multiple based waterfall model

60-day money back guarantee

Multi-Tier Real Estate Investment Waterfall Calculation Example

Suppose we have a general partner and an outside investor who contribute a combined total of $1,000,000 into a project. The general partner invests 10%, or $100,000, and the outside investor contributes the remaining 90%, or $900,000.

All equity investors (which includes both the general partner and the third-party investor) receive pro rata distributions until the LP achieves a 10% annual preferred return on their invested capital. If distributions in any year fall below the preference level of 10%, then the deficiency will be carried over to the following years and compounded annually at the preferred rate of return. In other words, the pref is both cumulative and compounded.

After the 10% preferred return hurdle has been achieved, all additional cash flow will be distributed 90% to all equity investors in accordance with their ownership percentages, and 10% to the sponsor as a promote, until the LP has achieved a 15% annual return.

After the 15% return hurdle has been achieved, all additional cash flow will be distributed 70% to all equity investors in accordance with their ownership percentages, and 30% to the sponsor as a promote.

So, based on the above assumptions, we have a 3 tier waterfall model with all IRR hurdles measured from the perspective of the limited partner. The first tier or hurdle is a 10% IRR, the second tier is a 15% IRR, and the third tier is anything above a 15% IRR.

All internal rate of return calculations will be computed on annual cash flows using Microsoft Excel’s IRR function.

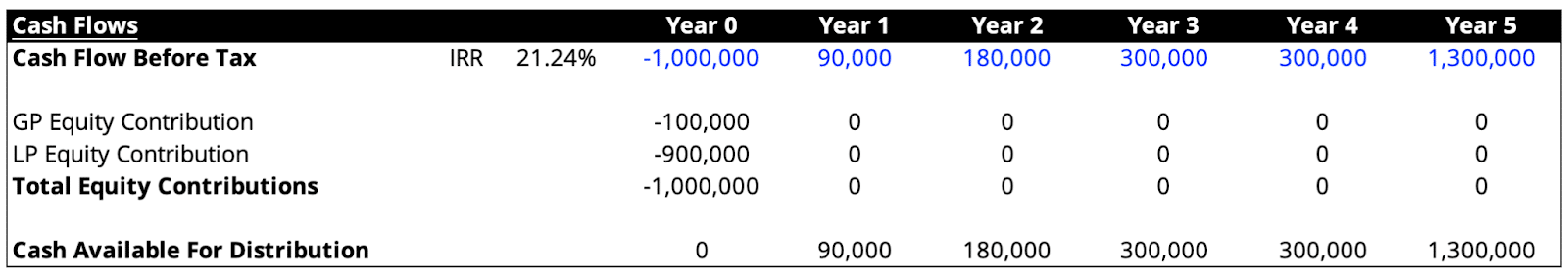

Now, let’s look at how we actually calculate these waterfall distributions. First, let’s take a look at our project level cash flow before tax and equity contributions over the holding period:

The first line is simply our before tax cash flow calculation from a standard real estate proforma. As you can see, the calculated IRR for the entire project is 21.24%. The next few lines show how much equity is contributed to the project by the sponsor and investor and when it is contributed. Since all the equity for this project is required at the beginning, it is all shown at time period 0.

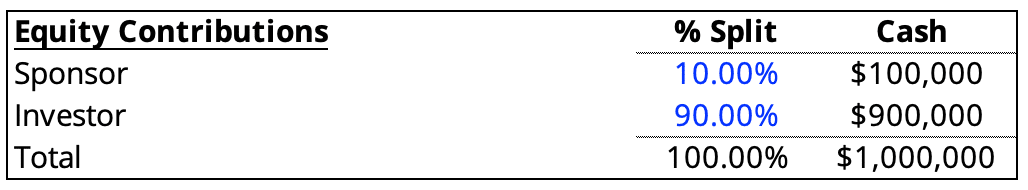

Here is a summary, including percentage allocations of the total equity contributions to the project:

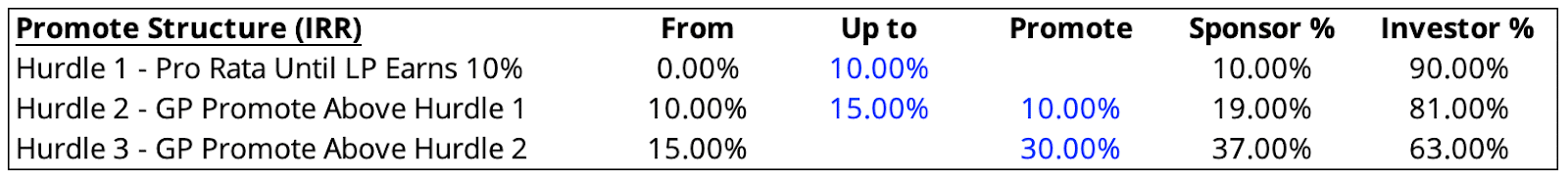

As you can see, the sponsor provides 10% of the equity, or $100,000, and the third-party investor contributes 90% of the equity, or $900,000. Next, let’s take a look at a summary of our promote structure discussed above:

There are 3 tiers (or hurdles) in this promote structure. Profits are split pari passu up until the LP earns a 10% IRR. After the 10% IRR is achieved by the LP, then profits will be split disproportionately. Profits above a 10% IRR up to a 15% IRR will be split 81% to the third-party investor and 19% to the sponsor. Finally, profits above a 15% IRR will be split 63% to the investor and 37% to the sponsor.

Let’s take a closer look at how these percentage splits are calculated.

The first hurdle is straightforward. The sponsor and investor simply receive their pro rata share of cash flow until the investor earns a 10% IRR.

The second hurdle is a little more complicated. In the second hurdle, the sponsor will first receive a 10% promote from the partnership. Then the sponsor will receive its pro rata share of what’s left over after the promote is paid by the partnership, which is 10% of the remaining 90%. That means the GPs total share is equal to 19%, which is 10% (the promote) + 9% (10% of the 90% remaining after the promote is paid). The limited partner simply receives the balance, which is 100% – 19%, or 81%.

The third hurdle is calculated the same way as the second hurdle. The sponsor will first receive a 30% promote from the partnership. Then the sponsor will receive its pro rata share of what’s left over after the promote is paid by the partnership. In this case, it is 30% + (10% * 70%), or 37%. The limited partner again receives the balance of 100% – 37%, or 63%.

So far, all of our assumptions are pretty straightforward and easy to understand. We have a 90%/10% equity split between the third-party investor and the sponsor, and then we have a 3 tier promote structure. Now we need a way to actually calculate the profit splits at each tier.

Real Estate Waterfall Model Tier 1

To calculate the profit splits at tier 1 we have to first determine the cash flows required for the LP to achieve a 10% IRR. Then, we’ll allocate these cash flows to the sponsor and the investor based on the agreed upon profit splits at this tier. Finally, we’ll calculate how much remaining cash is available from the project that can flow into the next waterfall tier.

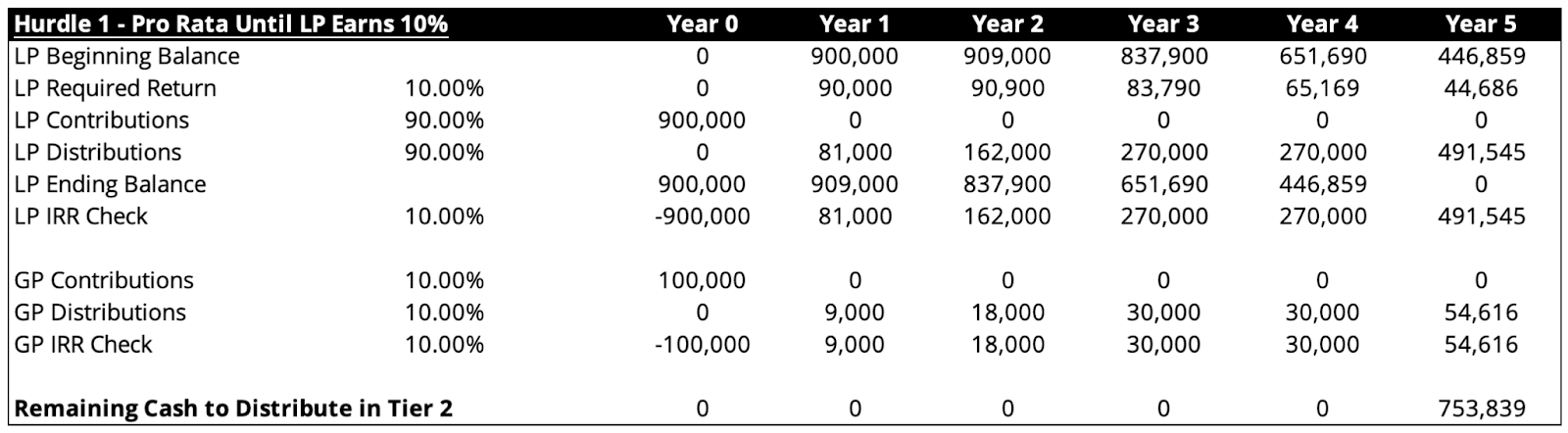

This is where waterfall distribution models get complicated, so let’s take it step by step.

The table above has a lot of information, so as we work through it below, remember that all we are doing is calculating what a 10% IRR to the LP looks like. Then, once we figure out what cash flows are needed for a 10% IRR to the LP, we calculate the amount of cash flow that gets distributed to the LP and the GP. Finally, after subtracting the distributions in Tier 1 to the LP and GP from our before tax cash flows for the project, we figure out how much cash flow is remaining for Tier 2. With this big picture in mind, let’s walk through each line item in the table above.

Year 0 is the beginning of the project and as you can see our LP beginning balance is $0. Next is the LP Required Return line item. This is simply the amount that is owed to the LP based on the beginning balance and the 10% IRR requirement for this hurdle. In this case, the calculation is just 10% times the beginning balance, which for Year 0 is $0 since there is no beginning balance.

The LP Contribution line item is next, and this is the amount of equity contributed by the LP in this period. This is taken directly from the Cash Flows table shown above at the beginning of this example. In this case, the Year 0 LP Contribution is $900,000.

Next is the LP distributions line item. This is what actually gets distributed to the LP in this tier. This may or may not equal the prior LP Required Return line item. This LP Distribution calculation takes the lesser of 1) the Beginning Balance, plus LP Contributions, plus the LP Required Return line item, or 2) the project’s cash flow before tax. The reason this is the lesser of these two items is because we are limited by the cash flow available from the project and can’t pay out more than this amount. Conversely, if there is more than enough cash flow from the project to pay out what’s owed to us, then we want to avoid paying out any more than what’s owed.

The Ending Balance line item takes the sum of the LP Beginning Balance, LP Required Return, LP Contributions, and then subtracts LP Distributions. This is simply taking what we start with (beginning balance), then adding in the required return for this period and any new equity contributions, then accounting for what’s been paid out (the distribution).

We also include an LP IRR check that takes the total cash flows to the LP in this tier to calculate an internal rate of return. This allows us to check that the LP is, in fact, earning the 10% required return in this hurdle. This line item takes the sum of contributions and the distributions. However, the contributions are treated as a negative value here since it is a cash outflow and is required to be shown this way for the IRR calculation.

In Year 1 we use the ending balance from the prior year (Year 0) as our Year 1 Beginning Balance. Then we simply repeat the process discussed above by calculating our LP Required Return based on the beginning balance for this period. Then we calculate any new LP Contributions, LP Distributions for this period, and finally, our Ending Balance and IRR check for this period. We continue this process for all years in the holding period, and once completed we can then move on to calculating cash flows for the Sponsor in this tier.

The sponsor cash flow begins with the GP Contributions line item. This value is taken from the cash flow table with contributions discussed above. Next, we calculate the GP distributions using a shortcut method. This is accomplished by taking the LPs distributions for the same period in this tier, dividing by the LPs percentage share of cash flow in this tier, and then multiplying by the GPs share of cash flow in this period. This shortcut method allows us to quickly calculate the distributions for the GP without going through the entire process like we did for the LP. Although this can be calculated in several ways, it is not uncommon to see this shortcut method in practice.

Next we have the GP IRR check, which is calculated in the same way the LP IRR check is calculated.

Finally, the last line in tier 1 is the Remaining Cash Flow to Distribute in Tier 2. This line simply starts with the property level cash flow for each period and then accounts for the distributions taken in tier 1 by the LP and GP.

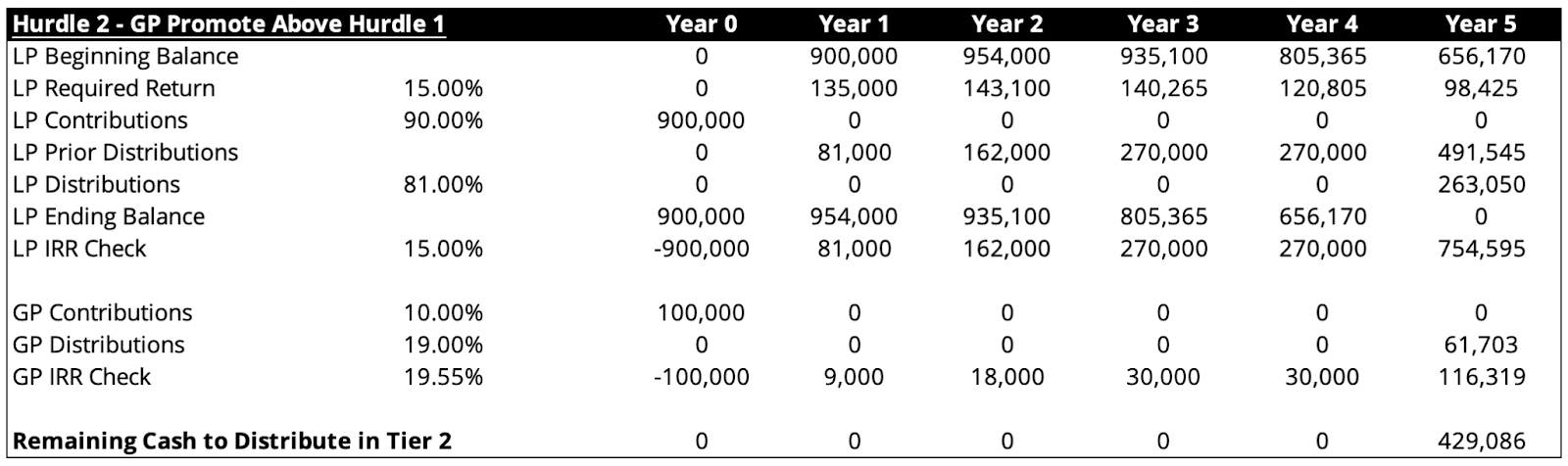

Real Estate Waterfall Model Tier 2

Now let’s take a look at the second IRR hurdle and repeat the same process we followed for Tier 1:

This table is exactly like the table used above for the first hurdle. The key difference is that this time we are calculating the cash flows required for the LP to earn a 15% IRR, and then we are splitting them up between the investor and the sponsor at different rates. When calculating the cash flow splits, we are also taking into account any prior distributions made in Tier 1. Let’s take a look at how this works.

In Year 0 we start off with an LP beginning balance of $0 and LP contributions of $900,000 in equity. Since our beginning balance is $0, the required return and distributions are also both $0.

In Year 1 we start off with the $900,000 ending balance from Year 0, and our Year 1 required return for the LP is 15%, which equals $135,000. LP contributions are $0 in Year 1. Next, we have a new line item in this tier for LP Prior Distributions. This new line item tracks the distributions allocated to the LP in the prior tier for the first hurdle. In this case, we show the $90,000 distributions calculated in tier 1. This will be needed when calculating the LP distribution in this tier and also our ending balance.

The LP Distribution line item takes the lesser of 1) the Beginning Balance, plus LP Contributions, plus the LP Required Return line item, minus LP Prior Distributions taken, or 2) the project’s cash flow before tax. This is the same calculation as hurdle 1 with one key difference. The difference is that we are subtracting the prior distributions taken when calculating what’s owed to the LP in this tier. The reason we subtract out prior distributions is because we just want to distribute the cash needed to earn between a 10% return up to a 15% return. Since we already earned 10% in the first tier, we don’t want to double count this amount in the second tier.

Next we have our LP Ending Balance. This is calculated in the same way as the prior tier, except we now also take into account the LP Prior Distributions as well.

Finally, we have our LP IRR check, which shows the total cash flows made to the LP, including cash flow from the prior tier. Then we calculate an IRR on these cash flows to ensure the LP is, in fact, earning a 15% IRR to satisfy the second return hurdle.

The GP calculations for hurdle 2 are identical to the GP calculations for hurdle 1. The remaining cash to distribute calculations are also identical to the prior tier, except we use the cash available to distribute after hurdle 1 has been met rather than the cash flow before tax from the project itself.

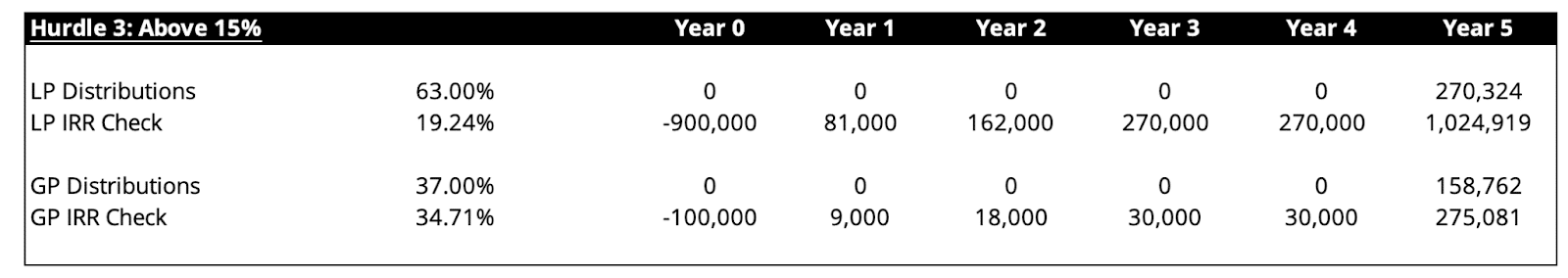

Real Estate Waterfall Model Tier 3

Finally, let’s take a look at the last hurdle, which is an IRR above 15%:

This is the easiest to calculate since we don’t have to figure out the required cash flow for a particular IRR. Instead, we simply take all remaining cash flow and allocate it according to the percentage splits at this tier. In this case, the sponsor gets a 30% promote plus 10% of the remaining 70%, which equals a total GP share of 37%. That leaves the investor with 63% of the cash flow. Just like in Tier 2, all the cash flow in years 1 through 4 is distributed in the prior tiers, which is why all the cash flows in Tier 3 are from the sale in Year 5.

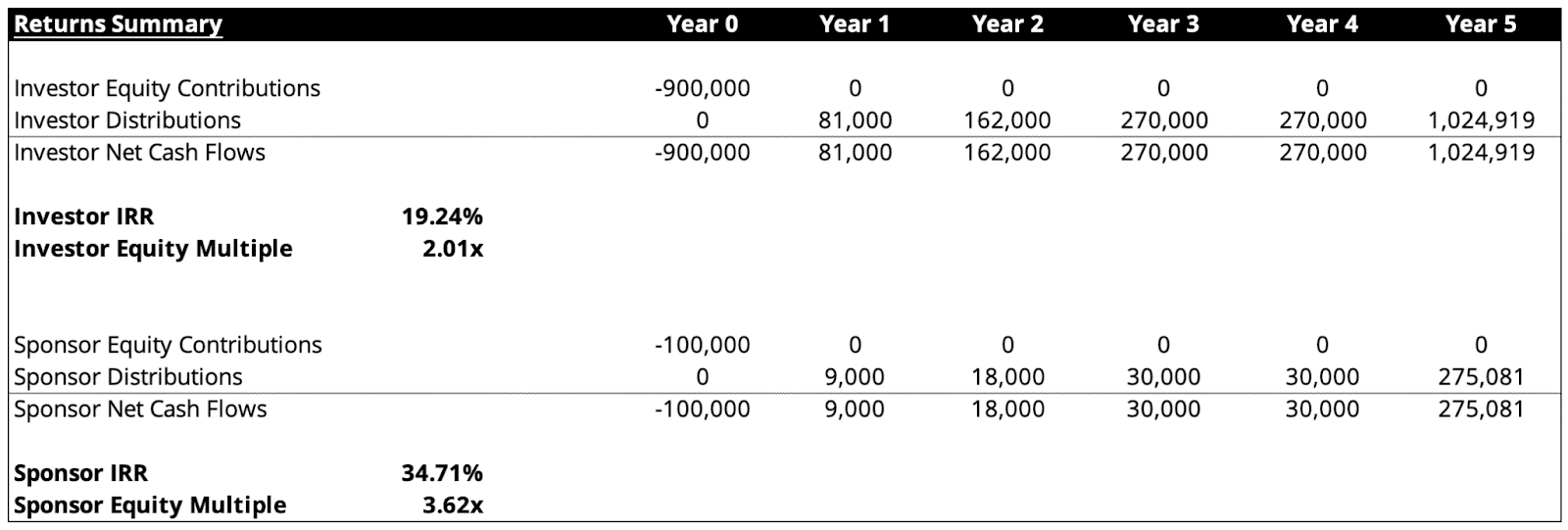

Waterfall Model Returns Summary

The last component in our real estate waterfall model is to look at the total cash flows across all tiers for the investor and the sponsor, and then finally we’ll calculate some overall return metrics.

In this table, we are simply adding up the cash flows from each tier for both the investor and the sponsor. Then we calculate the overall IRR and equity multiple for both the investor and the sponsor. Recall from our project’s cash flow before tax that our project level IRR was 21.24%. However, based on our promote structure, the sponsor earns a disproportionate share of these cash flows, resulting in a 34.71% IRR for the sponsor and an 19.24% IRR for the investor. This disproportionate cash flow split is also reflected in the equity multiple, which is 2.01x for the investor and 3.62x for the sponsor.

Download Real Estate Waterfall Model

Fill out the quick form below and we’ll email you our real estate waterfall Excel model containing helpful calculations from this article.

Conclusion

In this article, we tackled the real estate equity waterfall model, which is perhaps the most complicated topic in real estate financial modeling. The reason real estate waterfall models are so complex is because there are so many variables that can be changed. We discussed some common components in equity waterfall models and emphasized the importance of reading the owner’s agreement to truly understand a waterfall structure. Finally, we walked through a detailed 3 Tier waterfall model example step-by-step.