The yield on cost is a commonly used metric when evaluating real estate development and value-add projects. It is calculated as a property’s stabilized net operating income (NOI) divided by the total project cost. It’s easy to calculate and is useful as a back-of-the-envelope calculation. In this article, we’ll take a closer look at the yield on cost in real estate.

Here’s what you’ll learn:

- What is the Yield on Cost?

- Yield on Cost Formula

- How to Calculate Yield on Cost

- Yield on Cost Calculation: Development Example

- Yield on Cost Calculation: Value Add Example

- Yield on Cost for Specific Value Add Projects

- Yield on Cost and Development Spread

- Yield on Cost vs Cap Rate

- Yield on Cost Limitations

What is the Yield on Cost?

The yield on cost is widely used by commercial real estate professionals to measure the return on a real estate development or value add project.

The yield on cost is also used to calculate the development spread, which is the difference between the yield on cost and the market-based cap rate for similar but already existing buildings in the same market. The development spread tells you how much additional return you are earning in exchange for taking on all the risk of construction and development.

Depending on the context, yield on cost is also commonly referred to as the going-in cap rate, development yield, return on cost, cost cap rate, or build-to rate.

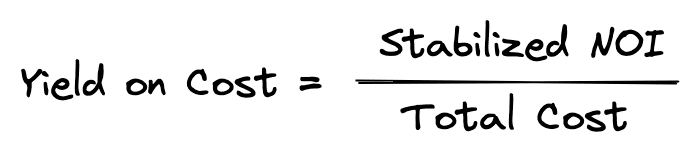

Yield on Cost Formula

The yield on cost formula is the ratio of a property’s projected stabilized Net Operating Income (NOI) divided by the projected total cost:

For example, if a project has a forecasted stabilized net operating income of $100,000 and a total cost of $1,000,000 then the yield on cost would be 100,000/1,000,000 or 10%.

How to Calculate Yield on Cost

Let’s walk through some practical examples to see how the yield on cost is commonly used. First, we’ll discuss how to calculate the yield on cost for a development project. Then we’ll look at how to calculate the yield on cost for a value add project. Finally, we’ll take a look at how to calculate the yield on cost for specific construction or renovation projects.

Yield on Cost Calculation: Development Example

Let’s walk through an example of how to calculate and use the yield on cost for a real estate development project.

Suppose you find a parcel of land for sale and want to evaluate the financial feasibility of developing a small office building. Based on your past projects and local market experience, you are reasonably confident that you can build the entire project for $3,900,000. This total cost includes $800,000 for land costs, $2,600,000 for hard costs, and $500,000 for soft costs.

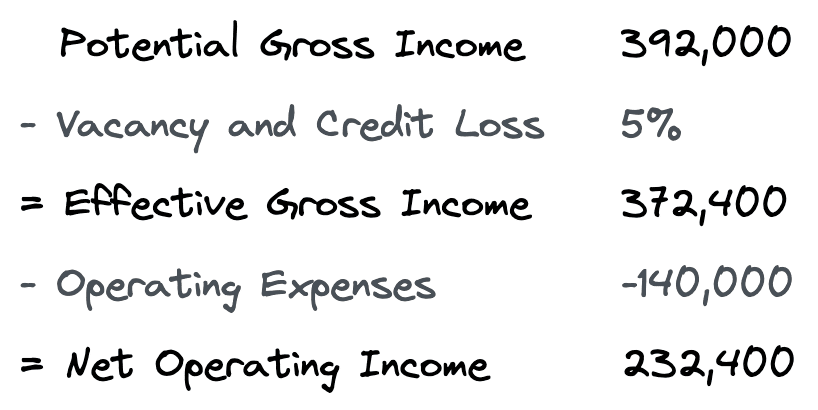

The building itself will have 14,000 rentable square feet, and you expect the stabilized vacancy rate to be 5%. Market rent is $28 per rentable square foot, and you expect to pay $10 per square foot in fixed operating expenses as the landlord, with all other operating expenses reimbursed by the tenant. Based on these assumptions, you come up with the following back-of-the-envelope proforma:

You also know that a few similar, newly constructed office buildings leased to stabilization in your market are trading at a 6.5% cap rate.

Given this limited information, does your potential project make sense? To find out, let’s calculate the yield on cost.

The expected stabilized NOI is $232,400 and the total cost of the project is $3,900,000, which results in an unlevered yield on cost of 232,400/3,900,000 or 5.9%. This is unlevered because it is calculated before considering any debt financing.

Since the yield on cost for this potential development is less than the current market-based cap rate for similar projects, you conclude that this project does not make sense to pursue. Why not? It doesn’t make sense because it only yields 5.9% (the yield on cost), but you could instead earn 6.5% (the market cap rate) by acquiring a similar but already existing building in the same market. In other words, why would you take on all the risk of development just to earn 5.9%, when you could buy an existing building and earn 6.5% without all the headaches and risks of development?

Yield on Cost Calculation: Value Add Example

Suppose you are now evaluating a small multifamily property that will cost $2,500,000 to acquire. After acquisition, your plan is to vacate all tenants and start a large renovation of all units, with a total construction budget of $750,000. Once complete, you expect to re-lease the units at higher rents and also operate the property more efficiently.

You expect these improvements will increase the stabilized net operating income after renovation to $312,500. Based on your experience in the local market and discussions with appraisers, you know that similarly renovated apartment projects are selling for an 8% cap rate.

Does this value-add project make sense?

The yield on cost for this project is the post-renovation stabilized net operating income of $312,500 divided by the total costs of the project of $2,500,000 + $750,000. This results in a yield on cost of 312,500 / 3,250,000, or 9.6%.

The yield on cost of 9.6% is 160 basis points (1.6%) higher than the 8% cap rate for similarly renovated properties. That means you are earning an extra 1.6% in return each year by taking on the risk of acquiring, renovating, and releasing this project. Is this extra 160 basis points enough to justify taking on all of these risks?

The answer to this question is ultimately subjective and will differ depending on who is doing the asking. However, one way to make this more concrete is to translate the 1.6% spread into a profit margin percentage and then a total dollar amount of profit.

To achieve this, we can take the 9.6% return on costs and divide by the 8% market cap rate upon completion, and then subtract 1. This is 9.6/8.0 -1, or 20%. If we take our 20% profit margin and multiply it by the total cost of $3,250,000 then we will get a total expected profit of about $650,000. This is approximately how much you would make, over and above your total cost, if you sold the building upon completion and stabilization.

Note, this is an approximate profit amount because we rounded the initial yield on cost calculation. The actual yield on cost is 312,500/3,250,000, or 9.6154%. If we used this figure, then we would get a result of 9.6154/8.000 – 1, or 20.1923%. And when multiplied by our total cost, we’d get a dollar amount of profit of $656,250. This is the same result as taking the value upon completion and stabilization of 312,500/.08 or 3,906,250, and subtracting the total cost of 3,250,000, which results in the same $656,250. Often this level of precision is not necessary for back-of-the-envelope calculations, but it is something to be aware of nonetheless.

Also notice that this quick profit calculation also only considers the total cost and the expected value upon completion, and not any interim cash flow received along the way. For development and value add projects, any interim cash flows are usually negligible and therefore will not make or break the project. Although this simple profit calculation ignores any interim cash flows, it is still widely used because it gives you a good approximation, and it is quick and easy to calculate.

If these back-of-the-envelope numbers meet your expectations for a financially feasible project, then that means it “pencils out” and you can now move on to a more detailed analysis of expected costs and income.

On the other hand, suppose that after doing a more detailed analysis, your general contractor reviews your estimates and informs you that not only did you miss a few critical issues, but the cost of materials and labor has also gone up. Now the expected total cost of the project is $4,000,000, which results in a yield on cost of 7.8%.

Now, these numbers do not make sense because you’d earn more just buying and operating an existing property at an 8% market-based cap rate than you would by going through the effort and risk of renovating and re-leasing. Perhaps there still are ways to make this project feasible by changing the renovation plans, using different materials, finding different subcontractors, etc. As you explore these possibilities, the yield on cost can be a helpful tool to quickly navigate these changing conditions and alternative scenarios.

Back of The Envelope Development Analysis

Learn back of the envelope development analysis step by step with done-for-you templates and easy-to-follow videos

Big picture overview of back of the envelope development analysis

Review key terms and performance metrics including yield on cost and development spread

Overview of the construction budget, including land, hard, soft, financing, and contingency costs

How construction loans and interest reserve calculations work

Case study walkthrough of a 100 unit multifamily development project

Fully unlocked Excel model for back of the envelope development analysis

60-day money-back guarantee

Yield on Cost for Specific Value Add Projects

A quick way to evaluate the yield on cost for a specific renovation is to take the additional income you expect to generate after the renovation and divide it by the cost of the renovation itself.

For example, if you are thinking about investing $100,000 into a renovation and expect to increase NOI by a total of 20,000 after the renovation is completed, then the yield on cost for this specific renovation is 20,000/100,000, or 20%.

If the yield on cost for a specific renovation is greater than the yield on cost before the renovation, then the renovation will create value.

For example, suppose you own a $1,000,000 building that generates NOI of $100,000, resulting in a yield on cost of 10%. In this scenario, a $100,000 renovation with a 20% return on cost will increase the overall yield on cost of the building to 120,000/1,100,000, or 10.9%.

If the market cap rate remains constant at 8%, then the building would be worth 100,000/0.08, or 1,250,000 before the renovation and 120,000/0.08 or 1,500,000 after the renovation. In other words, you will create $250,000 in value with this $100,000 renovation.

On the other hand, if the return on cost for a specific renovation does not exceed the original pre-renovation yield on cost, then the renovation will cause the overall yield on cost to decrease.

For instance, suppose the $100,000 renovation was only expected to generate an additional 7,000 per year in NOI. Now the return on cost for this specific renovation is 7,000/100,000 or 7% and the yield on cost for the building goes to 107,000/1,100,000 or 9.7% versus the original 10%.

This results in a post-renovation value at an 8% cap rate of 1,337,500. The value before the renovation was 100,000/0.08 or 1,250,000 and the total increase in value is 87,500. In other words, this renovation will cost $100,000, but upon completion the building will only be worth 87,500 more, which means this renovation would destroy $12,500 in value.

Yield on Cost and Development Spread

The yield on cost is one component real estate developers use to calculate the development spread. The development spread measures the difference between the yield on cost and the market-based cap rate for existing and already stabilized properties for sale in the same market.

For example, if the yield on cost for a potential development project was estimated at 9.00% and the average market cap rate for similar, already built and stabilized projects was 7.00%, then the development spread would be 9.00 – 7.00, or 2.00%

This development spread tells you how much additional return you would earn for developing a new building versus purchasing an existing building in the same market. It can also be used to estimate the profit margin for a project by dividing the yield on cost by the market cap rate and subtracting 1. In our example above, this would be 9 / 7 – 1, or 28.5%.

Yield on Cost vs Cap Rate

What’s the difference between the yield on cost and the cap rate? The cap rate is the ratio of net operating income to the property’s market value. The yield on cost is similar, except it uses the total cost in the denominator of the equation rather than the market value of a property. Since the yield on cost and the cap rate measure two different things, these two ratios are often used together and compared to each other. Let’s take a look at an example.

Suppose you can acquire a property that appraised for $5,000,000, and it has a net operating income of $400,000. This results in a cap rate of 400,000/5,000,000 or 8%.

However, suppose your strategy is to acquire the building and then invest an additional $500,000 in capital improvements. Once completed, you think you can increase net operating income to $550,000. That means your total cost is $5,500,000 and your yield on cost is 550,000/5,500,000 or 10%.

Now, assuming the market cap rate is still 8% after you complete your value-add strategy, the value of the building will be $550,000/.08 or 6,875,000, which means you created 1,375,000 in value with your improvements.

What’s a good yield on cost relative to the market cap rate? Ultimately, this is subjective and depends, but developers typically aim for a development spread of 150 – 250 basis points.

Yield on Cost Limitations

The yield on cost is based on net operating income for a single year and does not consider all the other years in the holding period. This can lead to conclusions based on incomplete data.

For example, suppose you are buying an office building, and it looks great based on a simple yield on cost basis. However, all tenants have signed long-term leases with fixed annual rent increases of 3% per year. If inflation is 10% per year for the next 5 years, then this simple yield on cost analysis could lead to poor outcomes. Alternatively, if there will be many leases expiring during the holding period, then these expirations could impact the cash flows in a way a simple yield on cost can’t measure.

Creating a multiyear proforma allows you to gain insight into what happens over the entire holding period. This also enables you to consider a range of expected outcomes to determine the best, worst, and most likely scenarios. Creating a multiyear proforma can be a difficult and time-consuming task, but our Proforma software can make this process much faster and easier.

Conclusion

In this article, we discussed the yield on cost in real estate. First, we defined the yield on cost and looked at the yield on cost formula. Then we looked at three specific examples of how to calculate the yield on cost for a real estate development, a value-add project, and specific renovations. Finally, we reviewed the difference between the yield on cost and the development spread and how the yield on cost compares to the cap rate. Finally, we discussed the limitations of the yield on cost.