In commercial real estate, a common lease structure is the triple net lease, often abbreviated as “NNN Lease”. Despite its popularity, the triple net lease structure is still commonly misunderstood. In this article, we’ll take a deep dive into the triple net lease and cover:

- What is a Triple Net Lease (NNN)?

- Triple Net Lease Meaning

- Triple Net Lease Example

- What Does Landlord Pay in Triple Net Lease

- Triple Net Lease Investment Risks

- Assessing Tenant Credit Risk in a Triple Net Lease

- Triple Net vs Gross Lease

- Triple Net Lease Pros and Cons

What is a Triple Net Lease (NNN)?

What is a triple net lease or NNN lease? A triple net (NNN) lease is defined as a lease structure where the tenant is responsible for paying all operating expenses associated with a property.

NNN means “net, net, net” and describes lease agreements that are net of property taxes, insurance, and maintenance expenses for the landlord. In other words, tenants are required to pay all of these expenses.

In practice there could be variation in which expenses a tenant is responsible for and the only way to know for sure is to read the lease agreement itself. To fully understand the NNN lease, you must first understand the spectrum of commercial real estate leases.

Triple Net Lease Meaning

All commercial real estate leases fall somewhere along a spectrum with absolute net leases on one end and absolute gross leases on the other end. Most leases fall somewhere in the middle and are considered to be a hybrid lease.

When most people discuss a triple net or NNN lease, they are usually thinking about an absolute net lease. However, just because a lease is called or labelled an NNN lease, does not mean it’s actually an absolute net lease. A lease will frequently be called a “triple net lease” for convenience, even when in fact it is not. This makes it hard to define triple net lease precisely because it can take on slightly different meanings by different people in different markets.

For example, when a building is brand new, the tenant may indeed be responsible for funding replacements such as the roof or HVAC systems as they wear out over time. However, in older buildings a lease can often be called triple net, but actually require the landlord to fund these capital expenditures over time, rather than the tenant.

The most important thing to remember when working with commercial real estate leases is to ALWAYS read the lease. The only way to truly understand the terms and conditions of a lease is to actually read the lease. Simple labels like triple net, full service, gross, or modified gross, which are commonly used by brokers and landlords, will often conflict with the actual terms of the lease.

Triple Net Lease Example

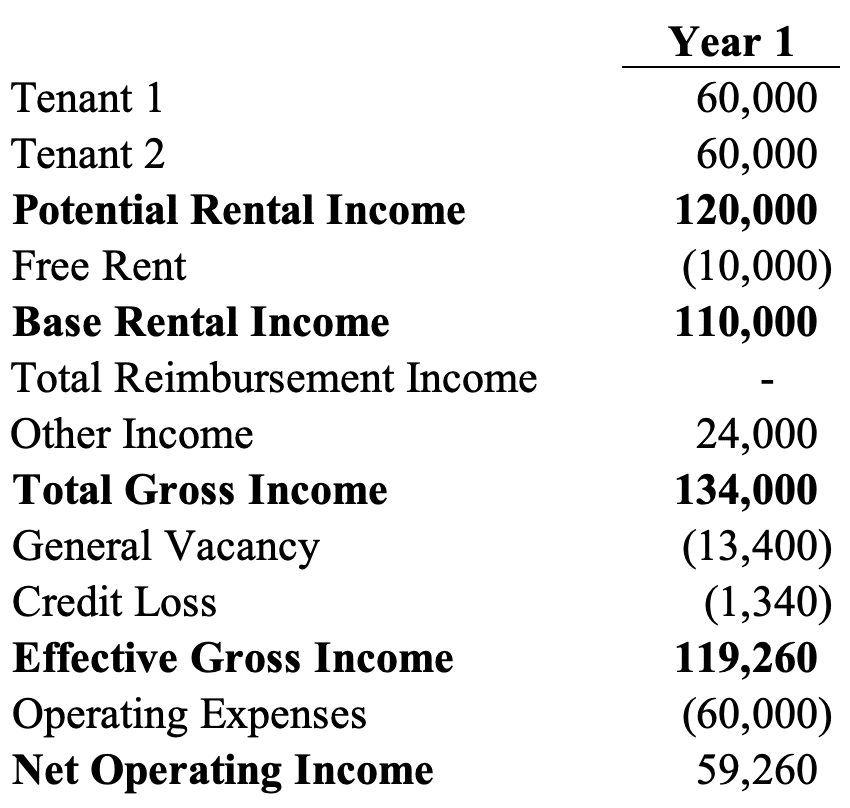

Let’s take an example to see how a proforma is structured with a triple net lease in place. Suppose we have the following proforma cash flows for a sample investment property:

The above proforma includes no expense reimbursements from the tenant. In other words, the above proforma assumes all the leases are absolute gross leases, where the landlord pays all the expenses for the property. Now, let’s take a look at how the proforma changes when the tenant reimburses the landlord for all the property’s expenses:

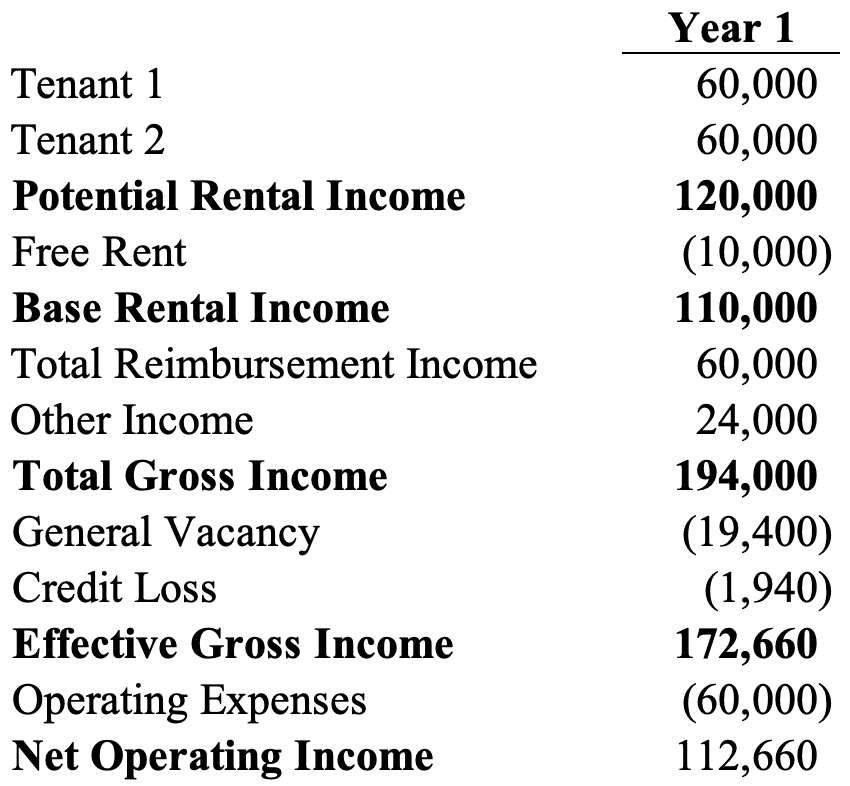

As you can see on the second proforma, the triple net lease in place provides additional reimbursement income that cancels out all of the operating expenses.

To be fair, a triple net lease rate will typically be significantly lower than an equivalent gross lease rate for the same property, which would make the bottom-line cash flows under a gross lease and a net lease much closer together than in the above example.

However, what the NNN lease ultimately achieves is that it shifts the responsibility, and therefore the risk, of paying the operating expenses from the landlord to the tenant.

For example, this means that if property taxes increase one particular year at an unusually high rate, then the owner’s net operating income and bottom-line cash flow will be protected under an NNN lease and the tenant will be the one responsible for paying for this increased expense. The above shows how a proforma would be structured with these reimbursements in place.

What Does Landlord Pay in Triple Net Lease

Even if your lease is a true absolute net lease, a common misconception is that even a true absolute net lease covers ALL expenses associated with a property, which is not always the case. While a true absolute NNN lease with a strong tenant can be thought of as a turnkey commercial property from the landlord or investor’s perspective, even an absolute net lease has some expenses that won’t be covered by the tenant(s).

For example, it’s rare for an NNN lease to cover the accounting costs charged by the landlord’s CPA or legal costs charged by the landlord’s attorneys when drafting or reviewing documents. While these costs are usually small relative to the purchase price of a property, they are nonetheless not typically covered in a standard “NNN lease”.

Triple Net Lease Investment Risks

A common misconception with triple net lease investments is that they are almost risk-free. While triple net investments do offer several advantages, there are still several risks that should be taken into consideration. The primary advantages of triple net lease investments are that you get a predictable revenue stream due to the long-term leases and pass-throughs in place, and you also get a relatively hassle-free investment due to the low management requirements.

While these are compelling advantages, triple net leases also do come with several inherent risks. First, because most triple net lease investments are for single-tenant properties, tenant credit risk is important to understand.

For example, not many today doubt the strength of a triple net Walgreens investment since the lease is guaranteed by the parent company, which is publicly traded and financially strong.

On the other hand, it is very possible for financially strong and publicly traded tenants to fall out of favor over the term of the lease and ultimately go bankrupt. Since single tenant triple net properties are either 0% vacant or 100% vacant, this should be taken into consideration.

Another risk to consider is the risk of re-leasing. A lot of triple net investment properties are sold towards the end of a longer term lease, shifting the risk of re-leasing the property to the new owner. If the new owner does not have this skillset or a strong team to secure a new lease, then this could present considerable tenant rollover risk.

Assessing Tenant Credit Risk in a Triple Net Lease

One important component to consider when analyzing a triple net lease investment property is understanding the credit risk of the actual tenant(s). After all, a lease is only as strong as the tenant behind it, so analyzing the financial statements of the tenant on the other side of the NNN lease is critical in understanding downside risk.

Many single tenant triple net lease deals involve publicly traded companies such as Starbucks, Walgreens, or Arby’s. In this case, it’s easy to pull up credit ratings on the company’s bond issues and to also read stock analyst reports.

For private companies, credit analysis requires some more effort, but analyzing financial statements and trends to better understand credit risk is a worthwhile endeavor. For these situations, here’s a primer on better understanding tenant credit analysis.

What You Should Know About Commercial Real Estate Leases

Fill out the quick form below and we’ll email you our free eBook on What You Should Know About Commercial Real Estate Leases.

Triple Net vs Gross Lease

The difference between a triple net lease and a gross lease is that in a triple net lease, the tenant pays all operating expenses. On the other hand, in a gross lease, the landlord pays all operating expenses. While this is generally true, the only way to actually understand who pays for what and when is to thoroughly read and understand the lease agreement itself.

It should be noted that the market rental rates will typically be higher for gross leases versus NNN leases to account for the higher expenses the landlord will incur. Although the out of pocket expense for a tenant will likely be similar with a gross lease and a net lease, a triple net lease shifts the risk of expense increases to the tenant and protects the landlord’s bottom line.

Triple Net Lease Pros and Cons

Let’s review the pros and cons of a triple net lease.

Pros:

- Simple to understand. The triple net lease is simple to understand because there are no complicated reimbursement structures that could include expense stops, caps, floors, area measures, expense groups, etc. The NNN lease structure is fairly straightforward and easy for all parties to understand.

- Easy to manage. Since the tenant is responsible for all operating expenses under a triple net lease, that means the property is relatively easy for the landlord to manage. That’s because the tenant will pay all operating expenses, which makes the investment turnkey for the landlord.

Cons:

- Tenant credit risk matters. Since the tenant pays all operating expenses under a triple net lease and the landlord is mostly hands-off, that means the financial strength and stability of the tenant matters. If the tenant can’t pay the bills, then this could create a distressed situation for the landlord, especially if a lender is involved.

- Ambiguity with NNN lease meaning. Depending on who you talk to or what market you are in, the term triple net lease may be used to describe a lease, when in reality the lease itself says something different. This is why it is important to understand the lease agreement itself and only rely on general terms such as the triple net lease as a starting point.

Conclusion

The NNN lease, often just called the “triple net lease” is a popular lease structure in commercial real estate. In this article, we defined the triple net lease in the context of the overall spectrum of all commercial real estate leases. We also discussed some common misconceptions about the NNN lease, reviewed some of the major risks associated with triple net lease investment properties, and finally, we walked through how a triple net lease proforma is structured.