Financing short falls within the commercial real estate market have become a common occurrence. The great recession has made traditional lenders more sensitive to risk, frequently leaving developers and project investors with large financing shortfalls. Sponsors can seek family and friends financing or a larger joint venture (JV) equity injection, but occasionally this gap may be too large to overcome through traditional methods of financing. Mezzanine financing is designed to fill this gap. In this article, we’ll give you a broad overview of mezzanine financing, discuss common mezzanine loan structures, and we’ll also cover the importance of an intercreditor agreement.

What is Mezzanine Financing?

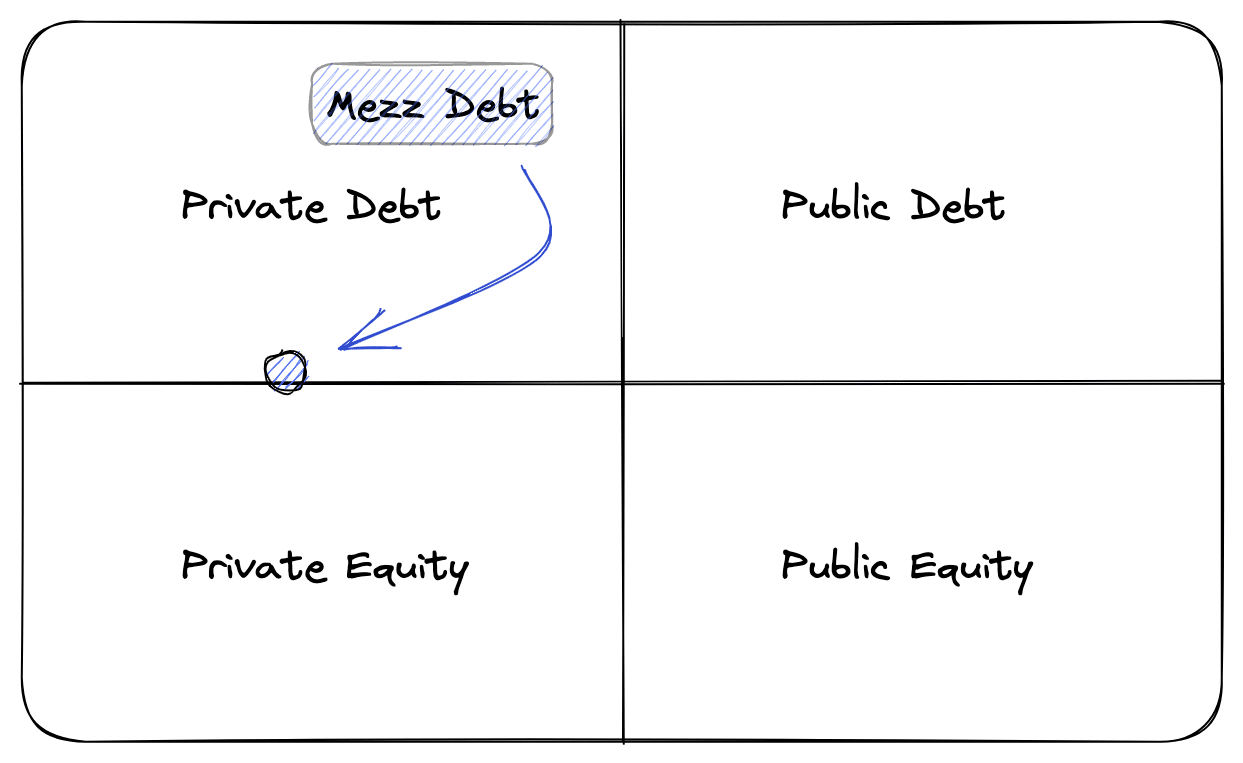

First, what exactly is a mezzanine (mezz) loan? Mezzanine financing is a unique financing instrument which doesn’t cleanly fall into a specific category of the capital markets financing quadrant. It’s a general term that refers to any financing vehicle (debt or equity, but typically issued by private sector participants) that bridges the gap between senior debt and sponsor equity in the capital stack. It can be structured as preferred equity or as debt.

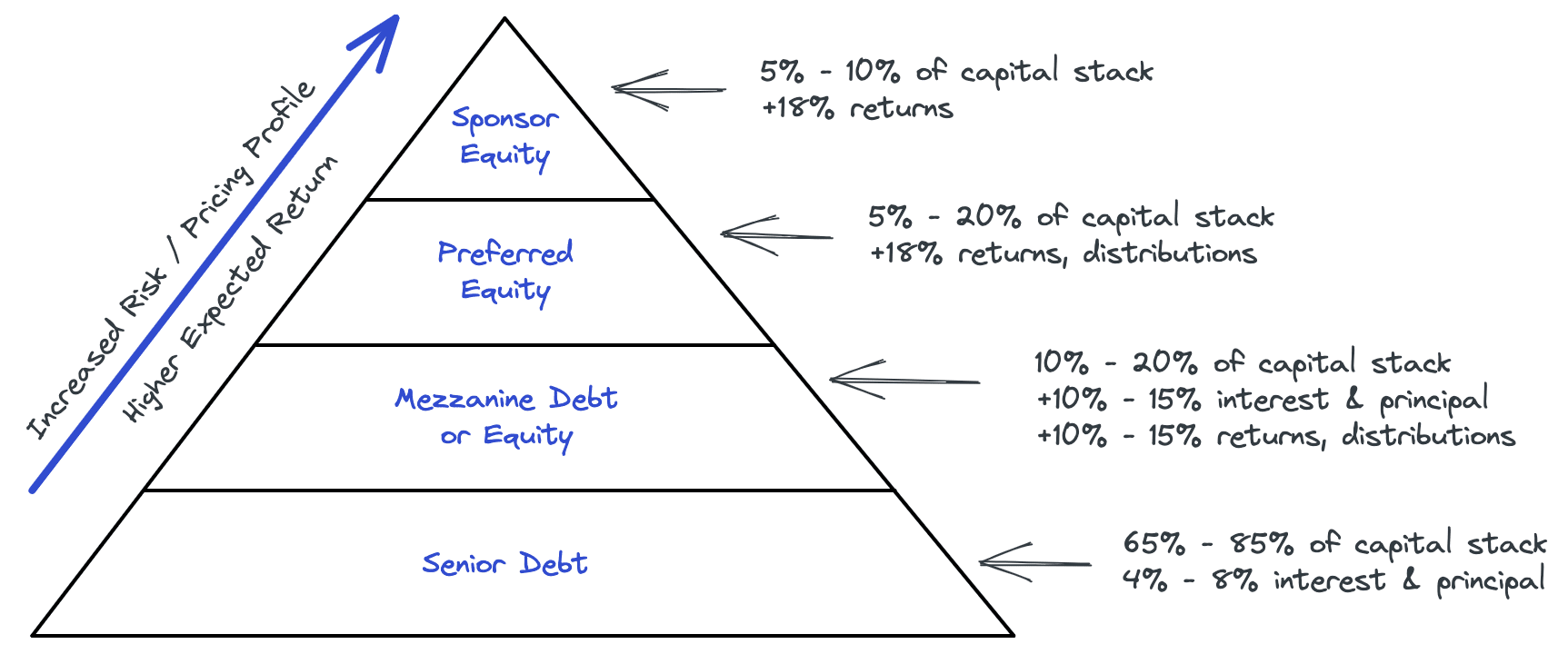

In general, traditional mezzanine financiers are not entitled to receive returns on their investments until senior debt holders are fully compensated. Because of its subordinate position, the mezzanine loan assumes a higher risk profile than senior debt but retains a less risky position than preferred equity. With this understanding, Mezzanine debt investors seek returns between senior debt lenders and preferred equity investors, but this will largely depend on how the deal is structured.

Basic Mezzanine Financing Structure

Mezzanine deals that are structured as debt instruments usually have one of the following forms of collateral:

- Second deed of trust – This is the most desirable form of collateral to the mezzanine lender because it provides the most tangible form of security. It allows the mezzanine lender to foreclose on the property if the borrower defaults on payments. This type of security is rare since the first mortgage lender typically does not allow this type of arrangement.

- Assignment of partnership interest – This is the most common form of debt security in the mezzanine finance universe. An assignment of partnership interest gives the mezzanine investor the option to take the borrower’s ownership interest in the property in the event of default. Effectively, the mezzanine lender becomes the equity owner and assumes the obligations to the first mortgage lender. This type of arrangement is supported by an intercreditor agreement with a first mortgage lender. This intercreditor agreement is discussed in detail below.

- Cash flow note – This gives the mezzanine lender an assignment of all cash flow from the property in exchange for the mezzanine loan proceeds, as well as a percentage of the proceeds from sale of the property. The cash flow note is not a recorded instrument and typically does not need an intercreditor agreement. This is also sometimes called a soft second.

Deals structured as equity have a different set of characteristics. Equity deals are joint ventures between the equity/owner and the mezzanine lender that are guided by the partnership agreements. Major provisions in the partnership agreements cover decision-making authority and specify decisions that require approval from the mezzanine partner. In the event of default regarding the mezzanine loan, the mezzanine provider may foreclose on the pledged equity interests, not on the underlining property itself, and become the owner of the equity interests in the property-owning entity. Therefore, the owner/sponsor has significantly less control over the project and may lose all control if the property does not perform as expected. These rules are typically enforced by Uniform Commercial Code (UCC) article 9.

With mezzanine financing, owners sacrifice flexibility, control, and upside potential, and will ultimately pay a higher price for the capital. However, in return, owners won’t be required to contribute as much cash, and they also gain a partner who might step in to help if the property starts to falter. What actually determines what a mezzanine provider will and will not do in a default scenario is dictated by the intercreditor agreement, a key link between the senior debt lender and the mezzanine financing provider.

Mezzanine Financing and The Intercreditor Agreement

The intercreditor agreement is negotiated by the first mortgage lender and the mezzanine provider. The purpose of the intercreditor agreement is to outline communication channels and provide guidance between the first mortgage lender and the mezzanine investor. More importantly, the agreement gives certain rights to the mezzanine financing provider in the event of a borrower default.

Many first mortgage lenders, mainly conduit lenders, refuse to negotiate intercreditor agreements, especially if the loan has already closed. In fact, conduit loan documentation routinely prohibits selling or transferring more than 49% equity ownership in the property to a partner. Some non-conduit lenders take the attitude that their interests are already covered in the agreement with the borrower and there is no need to complicate matters by bringing in an additional financial partner with different and potentially conflicting objectives.

Other lenders see value in what mezzanine financing providers can bring to the deal. The additional capital can allow the borrowers to purchase the desired property, pay leasing commissions, tenant improvements and pursue other value-adding strategies. In this case, and especially when the mezzanine financing provider is an experienced real estate investor, the first mortgage lender will often welcome their participation. The depth of experience of a reputable mezzanine financing provider can be advantageous for senior lenders, especially if the borrower defaults.

According to David E. Watkins of Heitman Real Estate Investment Management in Chicago, the mezzanine financing provider typically negotiates for several elements in the intercreditor agreement. The big three are listed below:

- Notification of non-payment or default on the first mortgage. The mezzanine lender wants to know, from someone besides the owner, that the property is being managed professionally.

- The right to cure any default on the first mortgage. The mezzanine position aims to protect itself by taking over the property and not allowing the first mortgage to foreclose and take possession.

- The right to foreclose on the property if the owner fails to pay the mezzanine position. First lenders rarely agree to this clause, as a building that is in foreclosure creates uncertainty among existing tenants (who might elect not to pay rent) and prospective tenants (who might view the property as tainted and unstable).

Mezzanine Financing Example Structure

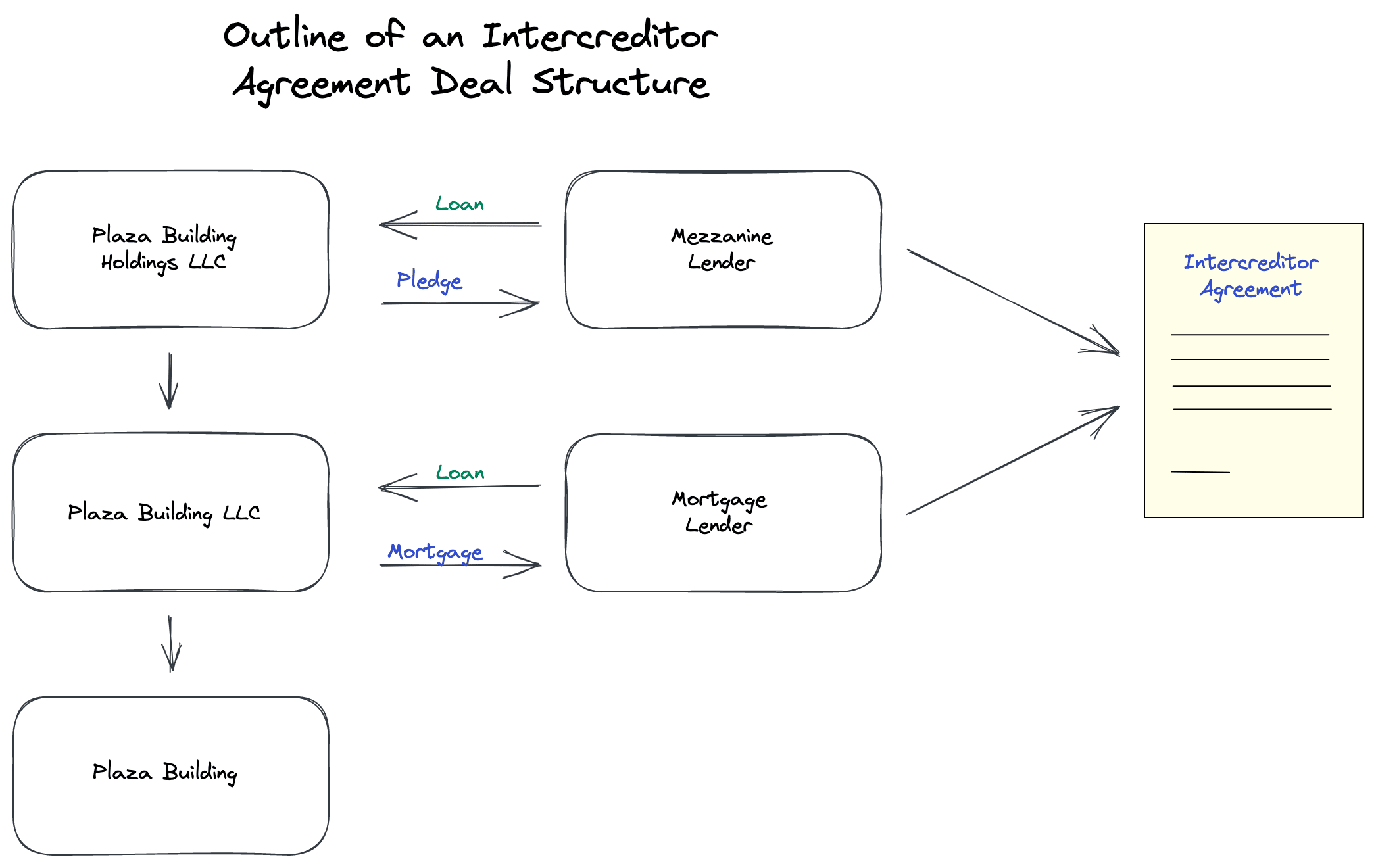

What makes the intercreditor agreement unique is how the instrument secures the mezzanine investor’s interest. It’s common that the agreement secures a 100% interest in the company which owns the underlying property through a bankruptcy remote “special purpose entity” holding company. This entity will be loaded with special covenants and restrictions and would be structured to ensure the borrower is limited in its ability to file for bankruptcy. An independent director may be appointed as well in order for the special purpose entity to maintain neutrality. The diagram below illustrates what this hypothetical structure might look like:

As shown above, Plaza Building Holdings LLC is the special purpose entity which secures a 100% interest against the borrower, Plaza Building LLC. Plaza Building LLC holds the ownership interest in the subject property. The borrower will then make payments to both the mortgage lender and the mezzanine financing provider.

Conclusion

Mezzanine financing can provide borrowers the necessary financing to get a deal done, but it doesn’t come without risk. If a project experiences cash flow shortfalls or otherwise gets stuck in a down market, sponsors/owners will have less control and flexibility in the deal. This article outlined mezzanine financing basics and also covered the importance of the intercreditor agreement.