Depending on the complexity of a real estate project, financing can come from many sources. Collectively, the sources are often referred to as the “capital stack” where “stack” is an appropriate metaphor because each source comes with its own collateral, return expectations, and repayment priority. In this article, we’ll define the capital stack and discuss what it means. Then we’ll walk through each capital stack component using an example real estate transaction.

What is a Capital Stack?

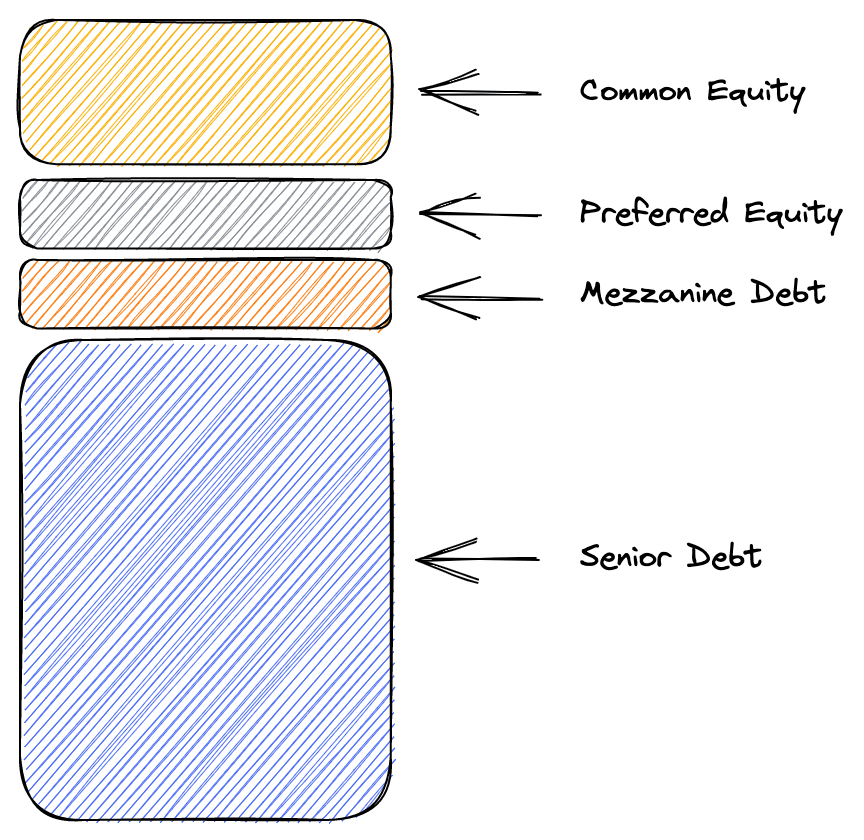

While there are many shades and variations of each, the Capital Stack typically consists of 4 funding sources: (1) Senior Debt; (2) Mezzanine Debt; (3) Preferred Equity; and (4) Common Equity. The sources are “stacked” on top of each other to fund a project. Here’s an easy way to visualize it:

Capital Stack Example

In the following example, we will define each funding source in the capital stack and explain how it contributes to funding a real estate transaction. Here’s how we’ll do it:

- Establish the funding scenario

- Define Senior Debt

- Define Mezzanine Debt

- Define Preferred Equity

- Define Common Equity

- Revisit the Funding Scenario

Let’s start by setting up the funding scenario.

Capital Stack Funding Scenario

PG Development is looking to finalize funding to develop a 50 unit multifamily project. Here are the key details:

- They have a signed contract to purchase a parcel of improved land for $1,000,000

- Construction costs are estimated at $6,000,000

- Discussions with the bank indicate a willingness to lend 80% of total project costs ($5,600,000)

- PG Development has $750,000 in cash available to contribute as equity

- A Term Sheet is in place for a $300,000 Mezzanine Loan

- PG Development has obtained a $350,000 Preferred Equity investment from a local investor

Let’s discuss each of the funding sources in more detail with a focus on the following elements of each funding source: (1) Risk level; (2) Repayment Prioritization; and (3) Return Expectations

Capital Stack: Senior Debt

| Risk Level: | Low |

| Repayment Prioritization: | 1st |

| Return Expectations: | 4% – 8% |

From the funding scenario, we know that the bank is willing to lend 80% of total project costs or $5,600,000. This bank loan is considered to be the “Senior Debt” portion of the capital stack and will typically make up the majority of project funding.

The word “Senior” refers to that fact that the bank is first in line to be repaid should the deal go bad. In fact, if there is any existing debt on the property, the bank will typically require the debt to be subordinated. As part of their analysis, the bank has estimated the improved value of the property. The bank has determined that should they need to take possession and sell the property, they would be able to do so for a price that would repay the loan balance.

The term “Debt” refers to the fact that the bank is expecting their loan funds to be repaid through periodic payments, with interest, over a specified period of time. As part of their analysis, the bank has estimated the income to be generated by the completed apartments and determined that it is sufficient to make the required monthly payments on the loan.

Because Senior Debt is first in line for repayment and because it is secured by the property and all improvements thereto, it poses the least risk of the funding sources in the capital stack. Therefore, it also requires the lowest level of return, which is typically in the 4%-8% range.

Capital Stack: Mezzanine Debt

| Risk Level: | Medium – High |

| Repayment Prioritization: | 2nd |

| Return Expectations: | 12% – 20% |

Mezzanine Debt is one of the mechanisms a developer may use to plug the funding gap between senior debt and common equity. As a funding source, it is also debt, but there are two significant differences between it and senior debt. First, mezzanine debt is second in line to be repaid, meaning that the senior debt holder (the bank in our example) must be repaid in full before any funds are available to the mezzanine debt holder. Second, mezzanine debt is usually not secured by tangible assets (like the property) and is instead secured by an interest in the borrowing entity.

Mezzanine debt is a higher risk form of debt than senior debt, so the holder demands a higher return on their capital, typically in the 12% – 20% range.

Capital Stack: Preferred Equity

| Risk Level: | Medium – High |

| Repayment Prioritization: | 3rd |

| Return Expectations: | 8% – 10% + “Kicker” |

Preferred equity is a debt/equity hybrid that resides in the third position of the capital stack. It is more senior than common equity, but less senior than all forms of debt (Senior and Mezzanine).

Preferred equity serves a similar function to mezzanine debt in that it is meant to fill the gap between senior debt and common equity. However, it differs in one key way. While mezzanine debt is typically secured by the equity in the borrowing entity or management company, preferred equity is secured by the ability to force the sale of a property if needed.

In return for the risk associated with making a preferred equity investment, the investor is compensated in two ways. First, with a steady return in the form of annual payments (like debt), and second, with an opportunity to participate in the upside of the project should it meet certain performance goals (like equity). The performance goals are clearly outlined in the investment contract and typically establish a threshold, above which an equity “kicker” allows the preferred equity holder to participate in additional profits.

Returns for a preferred equity investment are typically in the 7% – 15% range and may go higher with equity participation.

Capital Stack: Common Equity

| Risk Level: | High |

| Repayment Prioritization: | 4th |

| Return Expectations: | 10% + |

Common Equity is the riskiest component of the capital stack, but it’s also potentially the most profitable.

As part of their agreement to finance a project, a lender will require that the Borrower (or General Partner) invest their own money to ensure they have a vested interest in the success of the project. These funds represent the common equity portion of the capital stack and are last in line to be repaid should the deal go bad. A common equity investment is typically unsecured.

In return for being last in line, the common equity investor is compensated with virtually unlimited upside. Because the return potential is great, and the funds are their own, the common equity investor has a significant vested interest in the success of the project.

Revisiting the Funding Scenario

With each component of the capital stack defined, let’s revisit the funding scenario:

| Senior Debt: | $5,600,000 |

| Mezzanine Debt: | $300,000 |

| Preferred Equity: | $350,000 |

| Common Equity: | $750,000 |

Now, imagine the project has been completed, but a freak natural disaster caused PG Development to file for bankruptcy. As part of their filing, PG Development lists the $7,000,000 owed for the 50 unit multifamily project.

The bank has foreclosed on the property and has an interested buyer willing to pay $6MM. Since this is obviously less than the $7MM owed, this is where the details matter in a big way. Assuming the sale goes through, here’s who gets paid:

- As the Senior Debt holder, the bank is repaid in full for the $5,600,000 loan balance. $400,000 remains.

- The Mezzanine Debt holder is also repaid in full for the $300,000 loan balance. $100,000 remains.

- The Preferred Equity holder, who invested $350,000, is repaid with the remaining $100,000. They will realize a loss of $250,000 on their investment.

- With no funds left to pay out, the Common Equity holder loses their entire $750,000 investment.

NOTE: For simplicity, this example does not account for repayment of accrued interest. Although it varies by location and collateral value relative to the loan amount, a secured creditor is normally entitled to collect accrued interest through the bankruptcy petition date. If interest had been accounted for in the example, it would likely affect who gets paid.

Obviously, this is an overly simplistic example, but it’s designed to demonstrate a couple of key points regarding the capital stack:

- Repayment prioritization matters. It may be the difference between getting something or getting nothing.

- Depending on the position in the capital stack, the risk/return profile of the investment varies. Senior Debt is in the safest position, but also earns the lowest return. Common Equity is the riskiest position, but also has the highest upside.

Conclusion

In this article, we discussed the capital stack in commercial real estate. First, we defined the capital stack and used an example scenario to show what a capital stack might look like. Then we walked through each of the capital stack components: senior debt, mezzanine debt, preferred equity, and common equity. Finally, we revisited our example deal and showed what happens to each of the capital providers in the event of a bankruptcy.