The term sheet is an important document in commercial real estate lending. It is used to outline the terms of a potential loan prior to fully underwriting the deal and issuing a commitment letter. In this article, we will take a closer look at how terms sheets work for commercial real estate loans.

To provide an introduction to the Term Sheet and its importance in the lending transaction, I’m going to cover the following topics:

- What is a Term Sheet?

- Why are Term Sheets Important?

- What information does a typical Term Sheet contain?

- Analysis of a sample Term Sheet?

What is a Term Sheet?

Once a commercial lender has identified a borrower, held introductory conversations, and conducted enough preliminary analysis to determine that they’d like to proceed into a full underwrite, they will issue a Term Sheet to the potential borrower. Simply defined, a Term Sheet is a document that outlines the general structure under which the bank would be willing to extend credit.

It is critical to note that a Term Sheet is not a commitment to lend. It is an expression of interest in a potential transaction, provided that the Borrower is able to meet the terms and conditions outlined in the document.

Term Sheets are non-binding (for both the borrower and the lender) and may be revised several times before acknowledged and signed by both parties.

Why are Term Sheets Important?

Term Sheets are a critical component in the loan transaction for several reasons:

- It is a formal expression of the lender’s interest in the transaction

- As a starting point for negotiations, it outlines the structure under which the lender would approve the loan

- It sets forth the potential performance covenants that would be enforced over the life of the loan

- It outlines additional documentation that the borrower is required to provide so that a full analysis can be performed

- It signals to other participants in the transaction (Real Estate Brokers, vendors, contractors, etc) that the borrower is in the process of securing financing

Analysis of a Sample Term Sheet

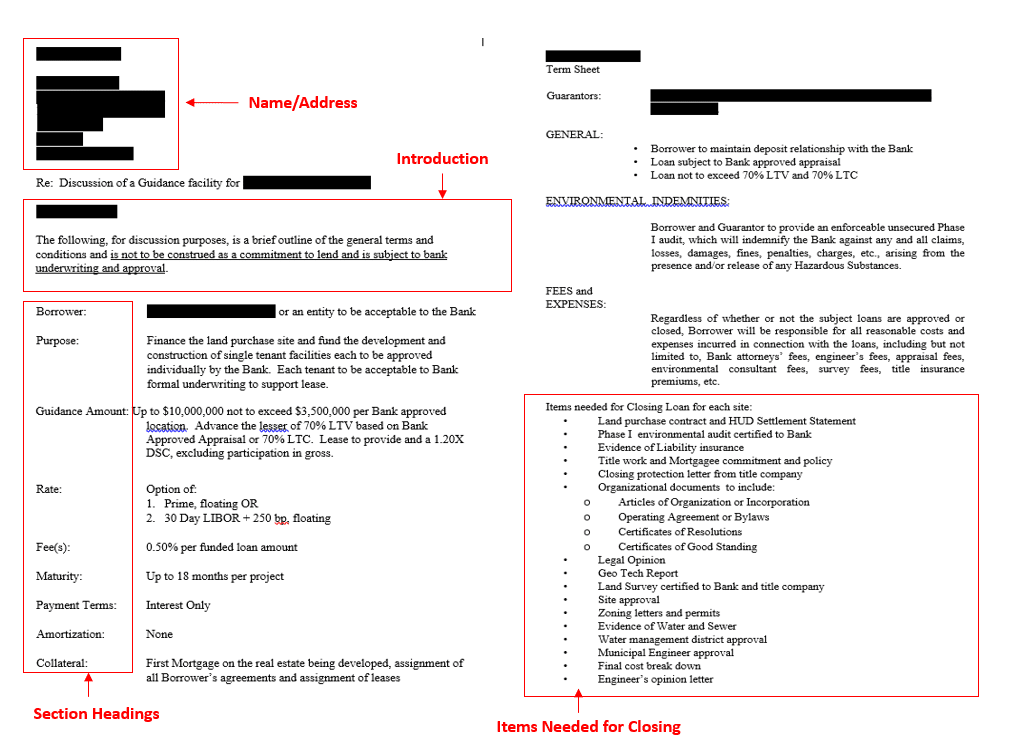

While the deal terms will differ, the general structure of a Term Sheet is fairly standard from bank to bank. Below is an actual Term Sheet (with identifiable information redacted) that we’ll walk through:

Term Sheet Name/Address

Every Term Sheet will start addressed to either the individual who represents the Borrowing entity or an individual representing that borrowing entity that has a relationship with the bank.

Term Sheet Introduction

Every Term Sheet is going to start with an introduction. While the actual language will differ from bank to bank, the introduction typically says something like “Thank you for the opportunity to work with you. XYZ bank is pleased to offer the following terms under which credit will be extended…” It is just a brief introductory paragraph meant to transition into the specifics of the deal

Term Sheet Section Headings

Borrower: Identification of the borrowing entity; typically an LLC in a real estate transaction.

Purpose: Description of the stated purpose for the loan. This is important because the Borrower has an obligation to use the funds for the same purpose that the bank is lending the money for. For example, if the Term Sheet states that the funds are to be used for the construction of a multi-family property, but the Borrower uses them to buy a boat, this is a problem.

Amount: The stated amount of the loan being considered. It is important to note that this isn’t always going to be the same amount that the Borrower is asking for. Maybe the Borrower is asking for $1 Million, but the lender’s preliminary analysis suggests that the project can only support a loan of $950,000, per credit policy. As such, the lender would indicate a loan amount of $950,000 in the Term Sheet and negotiate from there.

Rate: The proposed Interest Rate for the loan facility. Again, this isn’t necessarily the rate the customer wants, it is the rate at which the bank is willing to lend. The Term Sheet will also clearly state whether the rate is fixed or floating and any potential adjustments over the life of the loan. For example, it may say: “Floating Rate based on the WSJ LIBOR Index + 300bps” or “6.50% fixed for the term of the loan.”

Fees: A statement of the fees on the proposed loan. In most cases, there is an origination fee and occasionally there is a fee for draws or other transactions. For example, the Term Sheet may say something like: Origination fee of 50bps ($50,000) plus a fee of $500 per construction draw.

Maturity: The proposed term of the loan. For example: “24 Months.” The Term Sheet may also specify extension options. The proposed term is derived from the borrower’s needs (for instance, the estimated duration of construction) and/or the lender’s risk appetite for the loan type.

Payment Terms: Description of the proposed payment structure. For example” “Interest Only monthly; Principal due at maturity.”

Amortization Period: The proposed amortization period. For loans that aren’t fully amortizing, this section would work in conjunction with the Payment Terms to establish the exact terms of repayment. For example, it may say something like, 5-year repayment term, based on a 30-year amortization, meaning that the loan term is 5 years, but payments are calculated based on a 30-year amortization schedule.

Collateral: Description of the proposed collateral securing the loan. For example, it may say something like: “First Lien Mortgage on 60 unit multifamily, garden style apartment complex, assignment of rents and leases, and all other improvements made to the collateral property.”

Guarantor(s): When lending to an LLC or a small business, the bank is typically going to want the personal guarantees of the individuals involved in the transaction. This section identifies the individuals by name. For example, it may say: “John Smith and Bill Franklin, joint and several” If there is more than one guarantor, the bank will typically want a “joint and several” guarantee, meaning that if the loan goes bad, each named individual is responsible for the entirety of the loan balance AND the collection of individuals is responsible for the loan balance.

General Performance Covenants: This is where it gets interesting because this section lists all requirements that the Borrowing entity will have to abide by during the term of the loan. This is also the part that will vary from Term Sheet to Term Sheet, depending on the proposed transaction. Some examples of things that you may see in this section include:

- DSCR: Borrower required to maintain Debt Service Coverage of 1.25X during the course of the loan, as demonstrated by Borrower financials and checked quarterly by the bank.

- Relationship: Borrower required to maintain their primary operating accounts with the lender.

- Debt: Borrower may not take on any additional debt on the collateral property without the express written consent of the lender.

- Subordination: Subordination of all existing debts and amounts owed on the collateral property.

- Inspections: Bank to require inspections prior to the distribution of draw proceeds.

- Liquidity: Borrower required to maintain $XX in liquidity during the course of the loan as demonstrated by financial statements and checked periodically by the lender.

Items Needed for Closing: Should the Borrower wish to sign the Term Sheet and proceed with the transaction, the last section describes the documents and information needed to proceed to a full analysis of the deal. This section may include things like:

- 2 Years of tax returns

- CPA prepared financial statements

- Personal financial statement for all guarantors

- Project plans and elevations

- Environmental report

- Appraisal

- Draw Schedule

- Sources and Uses budget

- Articles of Incorporation

- Operating Agreement

- Certificate of good standing

- Surveys

- Engineering reports

- Permits

This list is illustrative and not exhaustive. The actual items needed for closing will be specific to each deal.

Once the borrower has received and reviewed the Term Sheet, one of three things will happen:

- The borrower accepts the terms, signs it, returns it to the lender, and the deal proceeds into underwriting;

- The borrower elects to negotiate certain deal points (rate, term, etc.) with the lender. If they come to an agreement, the lender will revise the term sheet and return it to the borrower for signature. Once signed the deal will proceed into underwriting;

- The borrower rejects the proposed terms, doesn’t sign the Term Sheet, and walks away from the deal. A Term Sheet isn’t binding so this is possible without any fees or penalties.

Once the Term Sheet has been signed, the deal proceeds to underwriting where a complete analysis is performed on every aspect of the transaction. If everything checks out and the deal is within the lender’s risk tolerance, the bank will issue a commitment to lend, which is very similar to the Term Sheet, but differs in 2 key ways: (1) It is a commitment on behalf of the lender; and (2) It is legally binding for parties.

Conclusion

In this article, we took a deep dive into term sheets for commercial real estate loans. We discussed what terms sheets are, why term sheets are important, and then we looked at a real-world example of a term sheet for a commercial real estate loan. We also discussed several of the key components and sections that are usually included in a commercial real estate loan term sheet.