Loss to lease is a commonly used calculation in a commercial real estate analysis. However, loss to lease can also be one of the most confusing calculations to understand, especially when you see it for the first time. In this article, we’ll take a closer look at the loss to lease calculation and walk through several examples to help you understand what it is and how it works.

Loss to Lease Defined

Loss to Lease is defined as the difference between a property or unit’s market lease rate and the actual lease rate. For example, if the market rental rate is $1,000 per month and the actual lease rate is $900 per month, then loss to lease is calculated as the difference between market rent and actual in place rent, which is $100 per month. When market rent is higher than actual in place rent, then there is a loss to lease. When market rent is lower than actual in-place rent, then this is sometimes called a gain to lease.

The “loss” isn’t realized in the sense that the property owner is required to pay the difference. It’s more of an “opportunity loss” that can act as a leading indicator of two possible situations. On the positive side, a loss to lease may indicate that submarket rental rates have grown faster than the individual property, so there may be room to increase rents. Or, on the negative side, it may be an indicator that something is lacking in an individual property (relative to the market) that prevents it from achieving full market rates.

Loss to Lease: Why it’s Important

Loss to Lease is an important concept to consider under two circumstances:

Acquisition Due Diligence: Often, when a seller or broker is marketing an income producing property, they’ll include two income figures in the proforma: (1) In-place rents; and (2) Market rents. If there’s a big difference between the two figures, it may indicate an opportunity to raise rents. Because commercial properties are valued on cash flow, the ability to raise rents is closely correlated to increasing the value of the property, which can bode well for a profitable exit.

Property Performance: For property owners evaluating the performance of a property they already own, a big difference between market rents and actual rents may be an indicator that there’s an opportunity to manage the property more efficiently by negotiating higher rents when leases come up for renewal. Or, it may indicate that there’s something holding the property back from achieving full market rents. In such cases, improvements or renovations may be required to bring the property condition, finishes, and amenities up to market standards to justify market rents.

It’s important to note that rent increases don’t happen all at once. Leases expire at different times throughout the year, and long-term leases may not expire for multiple years. So, the opportunity to close the gap between market and actual rents occurs slowly over time. To illustrate this point, an example is helpful.

Loss to Lease Example

Assume that a multifamily property with the following characteristics is being evaluated for acquisition:

- Units: 50

- Avg. In Place Rent: $800 per unit

- Avg. Market Rent: $1,000 per unit

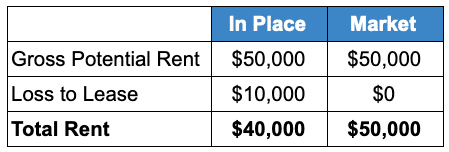

Based on these characteristics, the following income figures can be imputed:

The Gross Potential Rent at the existing price is $50,000, which is 50 units multiplied by the market rate of $1,000 per month. At the time of evaluation, this is the maximum rent possible at the market rate. However, units are currently renting $200 below the market rate, which represents a “loss” on the leases in place. Multiplying the $200 per unit loss by 50 units results in a “Loss to Lease” of $10,000.

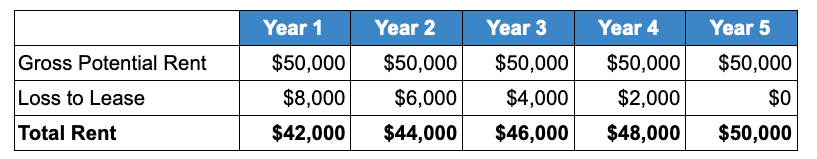

An investor may look at this deal and think that there’s a 20% rental upside, which is an attractive prospect. But, an investor can’t acquire a property and raise all the rents on day 1. They’ll need to do it slowly over time as leases come up for renewal. To illustrate the effect of this, assume that the investor can “turn” 10 units a year to the market rate. Over 5 years, the income may look something like this:

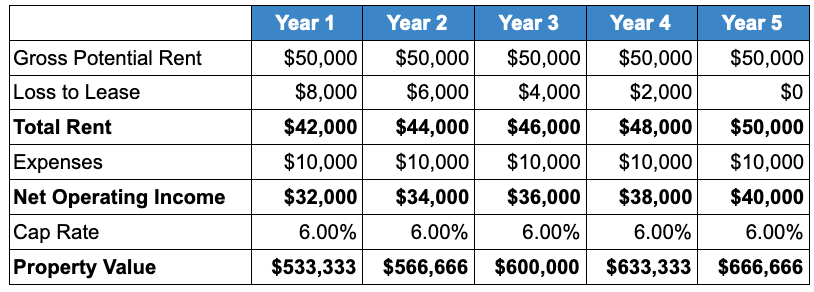

Assuming that market rent stays the same over the 5-year period, “turning” 10 units a year reduces loss to lease by $2,000 annually. Taking the example one step further and building out the remainder of the proforma, assume that expenses for the property and cap rates remain the same over the 5 years:

By assuming that expenses and cap rates remain the same over the 5 year holding period, it can be seen that the value of the property rises solely because reducing loss to lease results in higher NOI, and therefore a higher property value.

Loss to Lease: Raising Rents

In theory, the idea that rents can be raised to be commensurate with the market is simple. In practice, it isn’t always as easy, and it’s not without risk. Every time an owner goes to raise the rent, they run the risk that they’ll raise it beyond the tenant’s ability to afford it or beyond their perceived value of the unit, causing them not to renew the lease.

In such cases, the owner now has to deal with a vacant unit that isn’t producing any income, which nullifies the entire premise that a high Loss to Lease presents an opportunity for an investor. It’s important to consider the balance between raising rents to improve profitability and not driving away tenants with higher prices.

Summary and Conclusions

In this article, we discussed loss to lease in commercial real estate. We defined loss to lease, explained why it is important, and then walked through an example where loss to lease was reduced slowly while expenses and the cap rate remained unchanged. This showed how reducing loss to lease over time can increase the value of a property.

Granted, it’s unrealistic to expect market rents, expenses, and cap rates to remain unchanged over a 5-year span, but this article demonstrates there’s always going to be a difference between market rents and actual rents and the term for this difference is known as loss to lease.

While loss to lease isn’t a complicated calculation, creating an apples to apples comparison to determine true market rents requires detailed analysis to ensure that the properties surveyed are similar to the subject in location, finish, and amenities.

A large loss to lease is an indicator of potential mismanagement and an opportunity to raise rents and therefore raise the value of the property. However, rents usually can’t be raised quickly, simply, and to 100% of the market value. Raising rents too high can cause a tenant to not renew their lease, creating a vacancy that the owner may or may not be able to quickly re-lease at the market rate.