The full service lease is a commonly used lease structure in the commercial real estate industry. Unfortunately the term “full service lease” can mean different things depending on who you talk to or what part of the world you are in. In this article we’ll take a deep dive into the full service lease and give you a framework for understanding any type of commercial real estate lease.

What is a Full Service Lease?

A full service lease, sometimes called a gross lease, is defined as a lease structure where the landlord is responsible for paying all operating expenses for the property. However, it’s important to note that the term “full service lease” can take on various meanings depending on who you are talking to or what part of the world you are in. To truly understand the full service lease, you must first understand the spectrum of all commercial real estate leases.

The Spectrum of Commercial Real Estate Leases

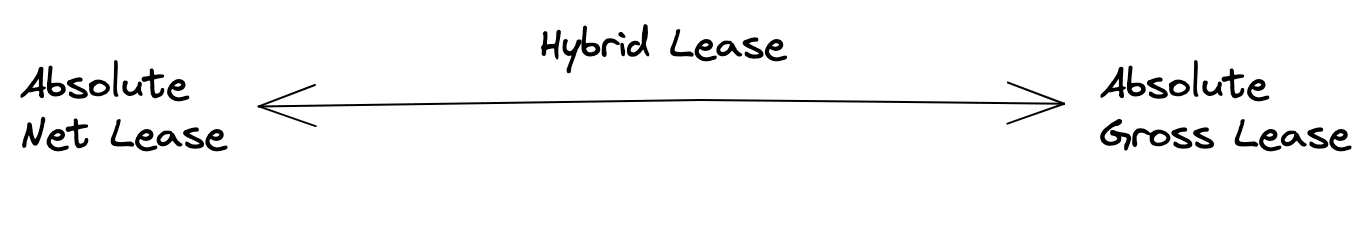

All commercial real estate leases fall on a spectrum with absolute net leases on one end, absolute gross leases on the other end, and hybrid leases (everything else) in between:

The above spectrum of commercial real estate leases shows how the responsibility for paying a property’s expenses shifts between the landlord and the tenant.

As you move closer to the absolute gross end of the spectrum the landlord becomes more and more responsible for paying operating expenses. In an absolute gross lease the landlord will pay all operating expenses.

Conversely, as you move closer to the absolute net end of the spectrum, the tenant becomes more and more responsible for paying operating expenses. And in an absolute net lease, the tenant will be responsible for paying all operating expenses.

This is important because although a gross lease structure could be described as “full service”, it may in fact be something else. In some parts of the world the full service lease means it is a gross lease. In other parts of the world it could include various reimbursement structures or expenses stops.

The Most Important Thing About Leases

The most important thing to know about commercial real estate leases is that the only way to understand a lease structure is to read the lease agreement.

Although there are various terms to describe lease types, such as full service, modified gross, double net, triple net, etc., there unfortunately is no universal agreement on what all of these terms mean. In fact, it is quite common for these terms to take on different meanings depending on who you are talking to or what part of the world you are in.

As we discussed above, even the full service lease can take on different meanings which may or may not include certain reimbursements from the tenant. So, the bottom line is that the only way to understand a commercial real estate lease is to actually read the lease agreement.

Full Service Lease Example

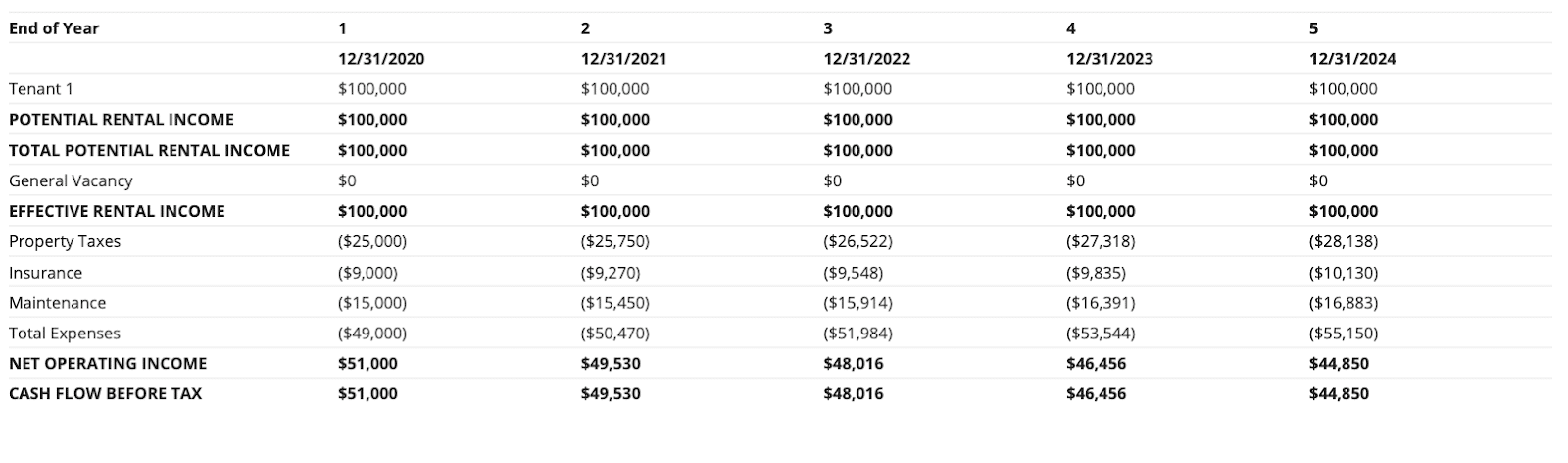

Let’s look at a full service lease example on a proforma. In this example, the landlord is responsible for paying all operating expenses for the property.

As you can see above, the tenant pays base rent of $100,000 per year for 5 years. The landlord covers all expenses for the property, including all expense increases over time.

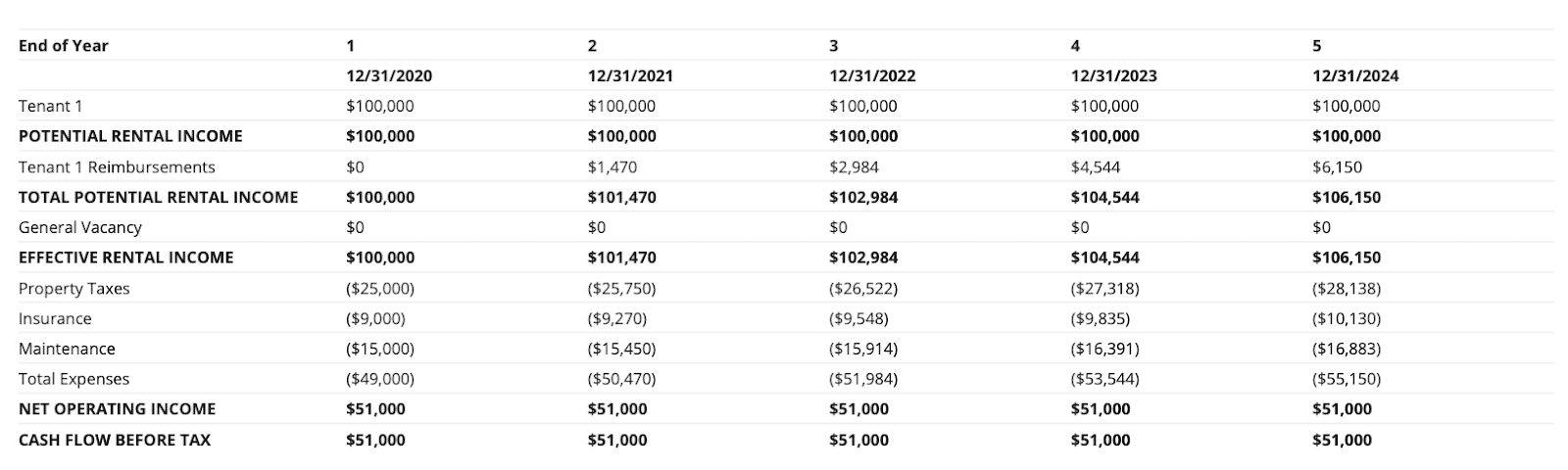

Sometimes a lease is described as full service but the tenant could still be responsible for paying some operating expenses. Here is another example where the landlord pays all expenses for the property but there is also a base year expense stop in place. This means that the landlord pays all expenses in the first year of the lease, but the tenant is responsible for paying for the portion of expenses above the base year expense amount.

As you can see in the above table the tenant pays for the increase in expenses in year 2-5 of the lease. This type of lease agreement could still be described as “full service” by some people, which is why you must always read the lease to understand who pays for what and when.

Full Service Lease vs Gross Lease

The full service lease is usually the same as a gross lease, where the landlord is responsible for all operating expenses of the property. However, as noted in the above examples, the term “full service lease” can also sometimes require tenants to pay some of the operating expenses for the property. In fact, the term full service lease can take on different meanings depending on who you are talking to and what part of the world you are in. It is not uncommon for a lease to be described as full service (gross), but still require the tenant to pay some operating expenses. Although descriptive terms such as full service and gross are a useful starting place, it is not a replacement for reading the lease.

Full Service Lease vs Triple Net (NNN) Lease

The triple net (NNN) lease is a lease structure where the tenant is responsible for paying all operating expenses associated with a property. This is in contrast to a full service lease where the landlord is responsible for paying all operating expenses associated with a property.

To be fair, the lease rate under a triple net lease will typically be much lower than the lease rate under a full service lease. The rate under a triple net lease is typically lower than a full service lease because with a triple net lease the tenant will also be responsible for reimbursing the landlord for its share of property expenses.

While the total amount paid by the tenant will often be comparable with a triple net lease and a full service lease, the key difference is that a triple net lease shifts the risk to the tenant and away from the landlord. The risk it shifts is for increases in operating expenses. Under a triple net lease the tenant will be responsible for paying all operating expenses and therefore all increases year to year. These increases could occur for instance because property taxes or insurance rates rise, or simply because of inflation. On the other hand, under a full service lease, the landlord will bear all of this risk.

Full Service Lease vs Modified Gross Lease

A modified gross lease is anything between an absolute net lease (where the tenants pays all operating expenses) and an absolute gross lease (where the landlord pays all operating expenses). Most leases are negotiated by the landlord and tenant and end up in the middle of this spectrum as a modified gross lease.

As mentioned above, many lease agreements are described as full service but still require the tenant to pay some expenses associated with the property. These expenses could include janitorial, utilities, or a base year expense stop. The only way to know for sure is to read the lease.

Conclusion

In this article we defined the full service lease, discussed some nuances about what it means, and described how it fits into the spectrum of all commercial real estate leases. We emphasized that the most important thing to know about commercial real estate leases is that the only way to understand any lease is to read the actual lease agreement. We also walked through an example proforma to illustrate how a full service lease impacts the bottom line. Finally, we compared the full service lease to other common lease types including the gross lease, triple net lease, and the modified gross lease.