What’s the intuition behind Internal Rate of Return (IRR) and Net Present Value (NPV)? Discounted cash flow analysis is an essential tool in the commercial real estate practitioner’s tool belt, but unfortunately for many people, there is still a lot of mystery surrounding this concept.

First, let’s get some definitions out of the way, and then we’ll walk through an example.

Internal rate of return (IRR) for an investment is the percentage rate earned on each dollar invested for each period it is invested. IRR is also another term people use for interest. Ultimately, IRR gives an investor the means to compare alternative investments based on their yield.

Net present value (NPV) is an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield, assuming everything else remains the same.

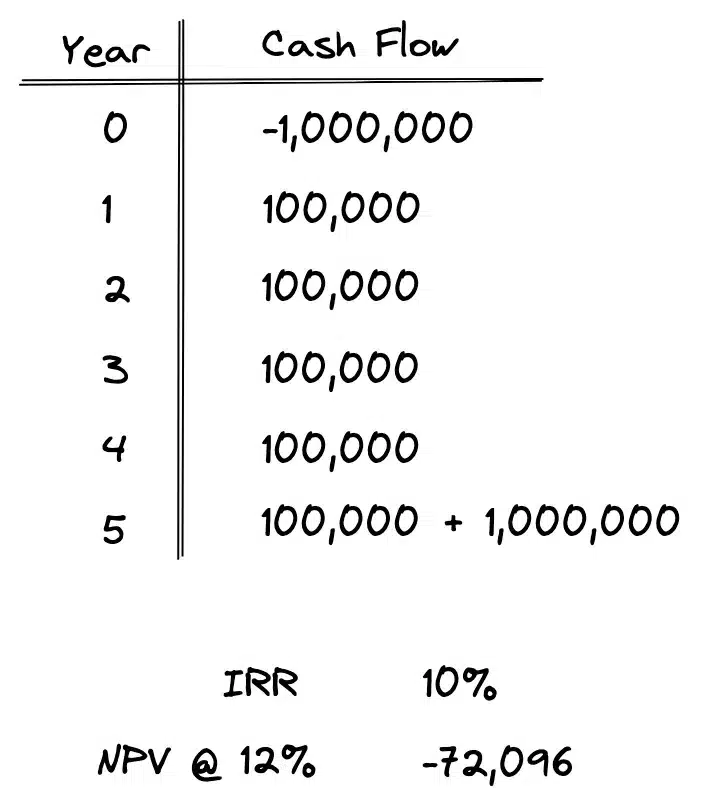

What does all this mean? Consider the following discounted cash flow analysis for a small office building:

The IRR is the rate of return an investor would expect to achieve on this property, given its projected cash flows over the holding period. In this case, it is 10%.

The NPV, on the other hand, depends on the discount rate, which in this case is 12%. What is a discount rate? The discount rate is the investor’s desired rate of return. Normally, the discount rate used is the investor’s opportunity cost of capital or, in the case of an institutional investor, the weighted average cost of capital.

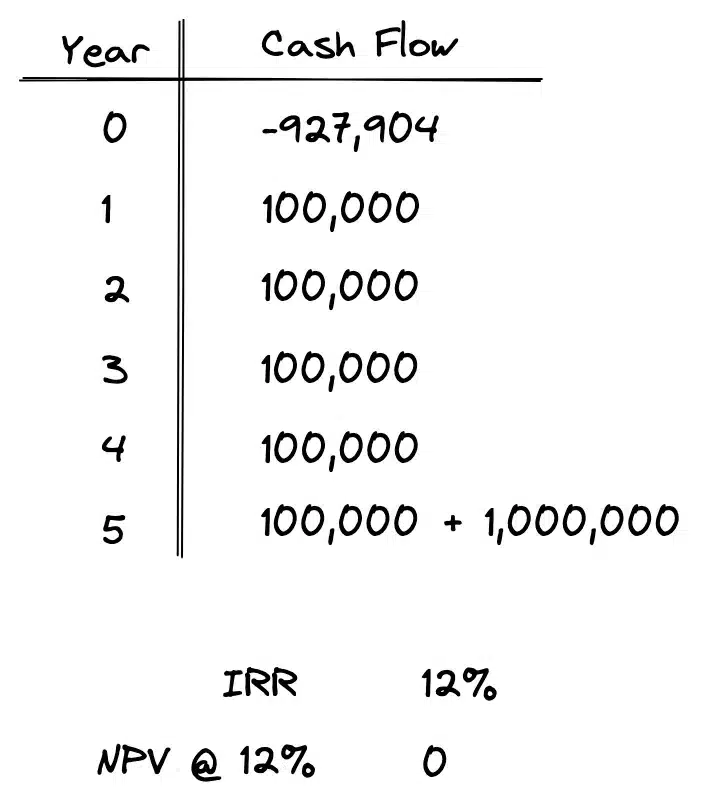

What the NPV tells us is how far off the mark we are from the investor’s desired rate of return. In our example, the NPV is -72,096. This means that to achieve our desired 12% return we’d have to reduce our initial investment in the property (acquisition price, fees, etc.) by 72,096. When we do that, we get a new set of cash flows with an IRR of 12%, which is precisely what we wanted.

Notice that the IRR calculated above told us the return on our first set of cash flows was 10%. So, intuitively, we’d expect to reduce our initial cash outlay to improve our rate of return. The NPV simply quantifies how much we need to adjust our initial investment to achieve our target yield.