Do you need a schedule of real estate owned template for a bank loan or to organize all of your commercial real estate projects? The PropertyMetrics team has created a free and helpful package for commercial real estate professionals who need a schedule of real estate owned:

A schedule of real estate owned is a comprehensive record of a commercial real estate investor’s properties and their financial performance. It provides a detailed view of the properties, including information on square footage, ownership, rents, expenses, and debt service. A well-organized and accurate schedule of real estate owned is essential for managing a commercial real estate portfolio and making informed investment decisions.

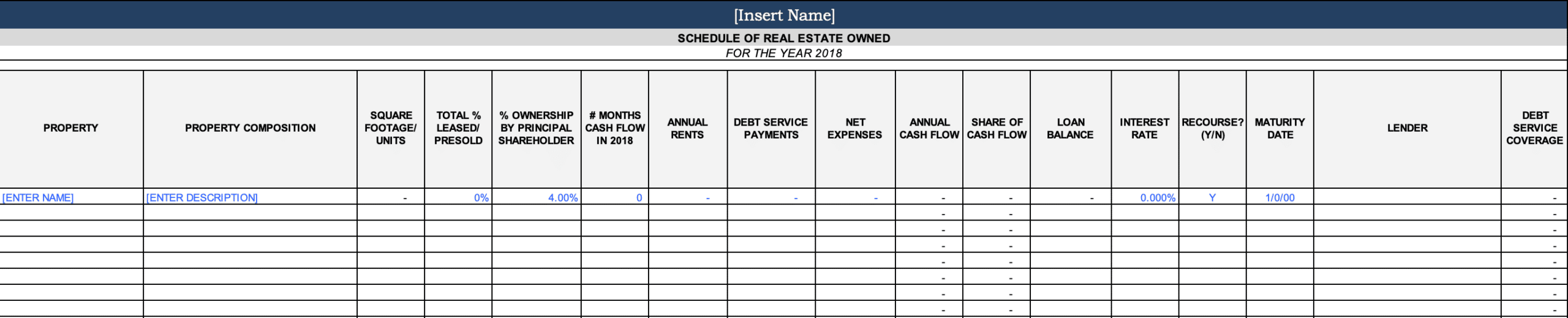

Our schedule of real estate owned form and excel spreadsheet is designed to be comprehensive and user-friendly. It includes a set of sections that provide a detailed view of the financial performance of a commercial real estate portfolio.

Sections Included in the Schedule of Real Estate Owned Template

The schedule of real estate owned template includes the following sections:

Square Footage

The square footage section provides the size of each property in the portfolio in square feet. This section is critical for determining the potential rental income from each property and for understanding the size of the properties in the portfolio.

Total Percentage Leased/Sold

The total percentage leased/sold section provides the proportion of each property that is leased or sold. This section is critical for tracking the occupancy status of each property and for making informed investment decisions.

Ownership Percentage by Principal

The ownership percentage by principal section provides the proportion of ownership of each property by the principal or investor. This section is useful for understanding the ownership structure of each property and for making informed investment decisions.

Annual Rents and Annual Debt Service

The annual rents section provides the total rental income for each property in the portfolio. The annual debt service section provides the total debt service for each property in the portfolio. This section is critical for understanding the financial performance of each property and for making informed investment decisions.

Net Expenses and Annual Cash Flow

The net expenses section provides the total expenses for each property in the portfolio, including operating expenses and debt service. The annual cash flow section provides the net cash flow for each property in the portfolio. This section is critical for understanding the financial performance of each property and for making informed investment decisions.

Percentage Share of Cash Flow and Loan Balance

The percentage share of cash flow section provides the proportion of cash flow from each property in the portfolio. The loan balance section provides the outstanding loan balance for each property in the portfolio. This section is useful for understanding the financial arrangements for each property and for making informed investment decisions.

Interest Rate, Recourse, Loan Maturity, Lender, and Debt Service Coverage Ratio (DSCR)

The interest rate section provides the interest rate for each loan in the portfolio. The recourse section provides information on the recourse provisions for each loan in the portfolio. The loan maturity section provides the maturity date for each loan in the portfolio. The lender section provides the lender for each loan in the portfolio. The debt service coverage ratio (DSCR) section provides the DSCR for each loan in the portfolio. This section is critical for understanding the financial arrangements for each property and for making informed investment decisions.

Conclusion

A schedule of real estate owned is a critical document for commercial real estate investors. Our schedule of real estate owned form and excel spreadsheet provides a comprehensive and user-friendly solution for managing a commercial real estate portfolio. With its detailed sections, formulas, and calculations, this template makes it easier to understand the financial performance of each property and make informed investment decisions.