Looking for CRE Investment Software?

Creating financial models for commercial real estate (CRE) investments is hard. Excel based financial models take hours to build, are prone to error, and hard to share with others. If you’re looking for CRE investment software to replace your cumbersome real estate financial models then you’ve come to the right place.

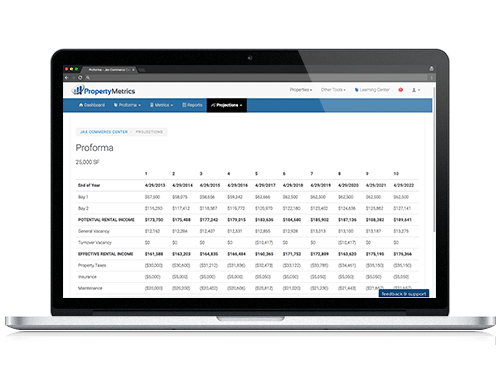

Simple Interface

Enjoy a simple and intuitive user interface that makes CRE investment analysis easy.

100% Online

Analyze CRE investments from any computer with an internet connection. No downloads or installations required.

Affordable

Replace Argus Enterprise with an affordable and easy to use product that won’t break the bank.

Commercial Real Estate (CRE) Investment Software

Our commercial real estate investment analysis software has a simple and intuitive user interface, is 100% web-based, and much more affordable than Argus. If you need to analyze CRE investments for properties with multiple leases, complicated recovery structures, expense groups, market leasing assumptions, fixed vs variable expenses, capital expenditures, development costs, and more… then you’ve come to the right place.

Recovery Structures

Our CRE investment software support complicated recovery structures and expense groups that enable you to create a variety of custom reimbursements for each tenant. By default you can create gross leases, net leases, as well as expense stop and base stop reimbursements. If you need to create a custom recovery structure for a tenant then you can pick and choose individual expenses to add to a custom recovery structure. We also support expense groups for the purpose of reimbursements, which allow even more nuances recovery structures.

Development Costs

If you need to model development costs for ground up construction or value add projects then our CRE investment software will make this easier for you. We include support for hard costs, soft costs, and land costs out of the box. You can also specify start dates and custom timing for each expense, as well as specify different timing curves using straight line or bell curves.

Market Leasing Profiles

If you need to model rollover assumptions for tenants then this is simple using our CRE investment software. By default all tenants are assigned a market leasing profile so you can add tenants and then update the default market leasing profile to automatically apply the rollover assumptions to all tenants. You can also create additional custom market leasing profiles to assign to each tenant or groups of tenants. This makes modeling what if scenarios easy with various renewal probabilities and market assumptions.

Rent Roll Upload

If you have a large rent roll in Excel format you can easily copy/paste the key tenant information into our pre-formatted rent roll excel template. Then you can simply upload the template into our system and automatically import the entire rent roll. This makes working with existing data and exports from other software such as Argus easy.