Do you need a borrowing base certificate for a commercial loan? The PropertyMetrics team has created several helpful resources for commercial real estate professionals. Please feel free to download and use the following borrowing base certificate template:

About Our Borrowing Base Certificate Template

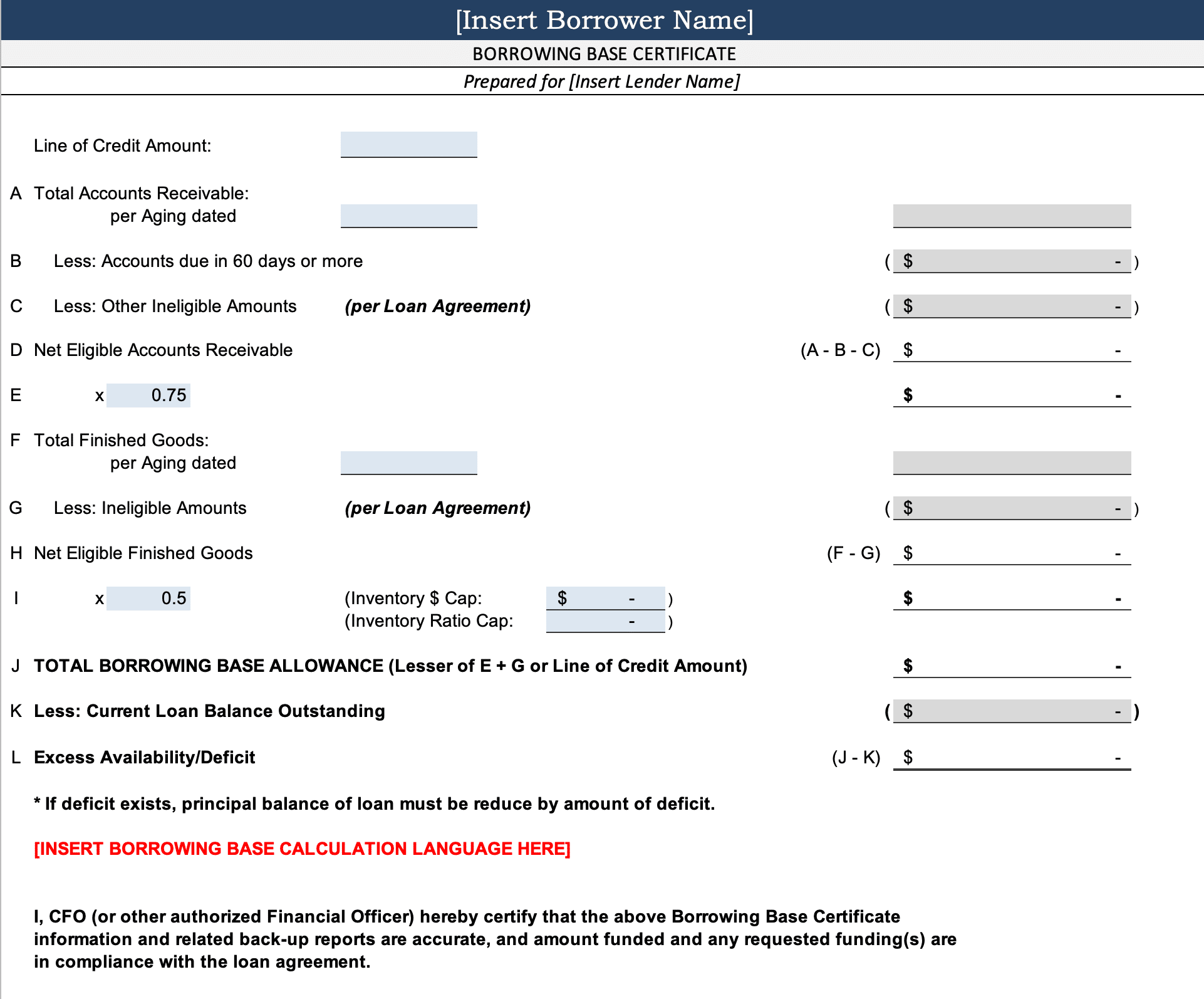

A borrowing base certificate is a crucial document that lenders rely on to determine how much credit they are willing to extend to a borrower. It provides a detailed breakdown of a borrower’s accounts receivable and inventory, which are used as collateral for a line of credit. The borrowing base certificate template that we offer is designed to make this process as simple and efficient as possible for both borrowers and lenders.

The borrowing base certificate template consists of various sections that help to calculate the amount of credit available to the borrower. The first section is the Line of Credit Amount, which is the maximum amount of credit the lender is willing to provide. The next section is Total Accounts Receivable, which lists the total amount of money owed to the borrower by its customers.

The next section, Ineligible Accounts, includes accounts that are not eligible to be used as collateral for the line of credit. These can include accounts that are past due, disputed, or uncollectible. The total amount of ineligible accounts is subtracted from the Total Accounts Receivable to arrive at the Net Eligible Accounts Receivable.

The template also includes a section for Finished Goods, which lists the total value of the borrower’s finished products. Similar to the accounts receivable section, there is a section for Ineligible Inventory, which lists items that cannot be used as collateral. The total value of ineligible inventory is subtracted from the total value of finished goods to arrive at the Net Eligible Finished Goods.

The Total Borrowing Base Allowance Calculation section takes the Net Eligible Accounts Receivable and the Net Eligible Finished Goods and calculates the total borrowing base allowance. This is the total amount of credit that the borrower can access.

Finally, the Excess Line of Credit Availability/Deficit section lists the difference between the line of credit amount and the borrowing base allowance. If the total borrowing base allowance is greater than the line of credit amount, there is an excess line of credit availability. If the borrowing base allowance is less than the line of credit amount, there is a deficit.

Our borrowing base certificate template also includes additional sections that can be customized to fit the needs of the borrower and lender. These can include a section for inventory aging, which lists the age of the borrower’s inventory, or a section for accounts receivable aging, which lists the age of the borrower’s accounts receivable.

To summarize, our borrowing base certificate example includes sections for the following:

- Line of credit amount

- Total Accounts Receivable

- Ineligible Accounts

- Net Eligible Accounts Receivable

- Finished Goods

- Ineligible Inventory

- Net Eligible Finished Goods

- Total Borrowing Base Allowance Calculation

- Excess Line of Credit Availability/Deficit

- and more…

In conclusion, the borrowing base certificate template that we offer is a powerful tool for both borrowers and lenders. It provides a detailed breakdown of a borrower’s accounts receivable and inventory, which is critical information for lenders when determining how much credit to extend. By using our template, borrowers can streamline the process of applying for credit, while lenders can make informed decisions based on accurate and up-to-date information.