The recession officially ended back in 2009 and the economy has been growing ever since, yet it still feels like a recession to most people. Why is this and how long will it take to get back to normal? More importantly, what does this mean for commercial real estate?

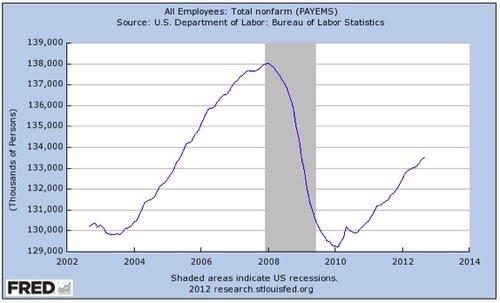

First, let’s take a look at the dent made by the 2008 recession. Employment peaked in December 2007 and bottomed out in February 2010, eight months after the recession was officially over.

Progress is being made and we’ve added back about half of all jobs lost. If employment growth continues at its current pace, then it will take another 40 months to regain all of the jobs lost since the start of the recession. That would take us out to about 2016, assuming that we don’t have another recession before then, which would result in additional job losses.

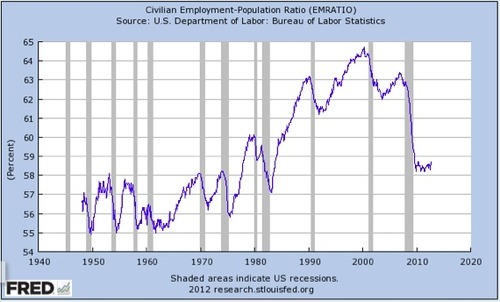

However, this doesn’t take into account population growth. The above analysis shows that it will take at least 4 more years to get back the number of jobs we had in 2007, but since our population continues to increase every year, the hole we have to climb out of keeps getting bigger. As shown below, the employment-to-population ratio appears to have bottomed out, but it hasn’t started growing quite yet. This will likely extend out the 4+ years required for a full jobs recovery by several more years.

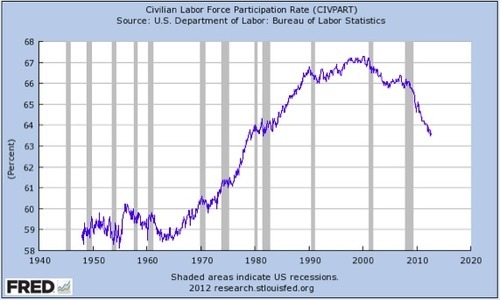

This is also reflected in the labor participation rate, which has been in a free-fall since the official end of the recession.

And of course while we are slowly adding jobs, the above charts don’t show the kinds of jobs being created, the median wages being accepted, or how many people are underemployed, which we’ll dive into in a future post.

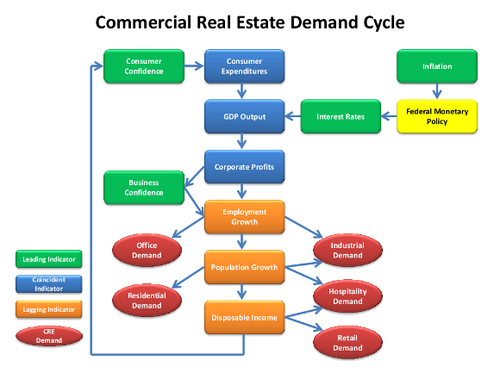

But what does all this mean for commercial real estate? The CCIM Institute has a nice demand cycle flow chart that illustrates how employment drives demand for commercial real estate. As shown below, demand for commercial real estate is directly or indirectly driven by employment growth.

Employment growth drives population growth and disposable income. Office and industrial demand is driven by employment growth. Industrial, residential, and hospitality demand is driven by population growth. And hospitality and retail demand is driven by disposable income.

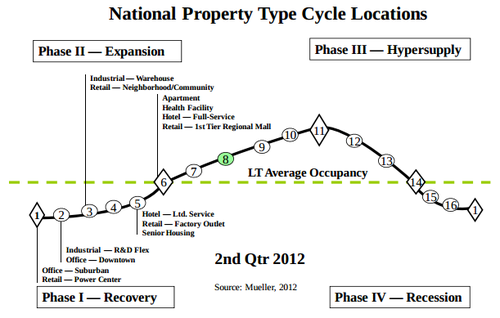

Since it will take at least 4 more years to get back to the level of employment we had in 2007, it stands to reason that it will take at least as long for commercial real estate demand and construction to recover as well, based on the above demand cycle. Dr. Glenn Mueller’s latest Cycle Monitor Report tracks where each asset class is in the market cycle and confirms that all property types are indeed still in the recovery phase or just entering the expansion phase.

In future posts we’ll continue to track employment growth and the cycle locations of various property types. Of course, this analysis is at an aggregate level for the entire U.S. and growth in local markets is uneven. Our market analysis tools allow you to see exactly where individual states, MSAs, and counties are at in the employment cycle and exactly how fast they are growing. We also publish rankings of local areas each month so you can track all U.S. markets in real-time. Later in this series we’ll dig into specific local markets to see how they are doing relative to the U.S. If you want to keep up be sure to subscribe to our mailing list on the top right hand side of this page.