As a participant in the real estate market, have you ever come across an attractive deal, but you didn’t have the liquidity needed to secure it? Perhaps you were waiting on another sale to close in order to fund the needed equity for the new deal?

The above scenario happens so often that there’s a specific loan product designed to address it. It’s called a Bridge Loan and the purpose of this article is to take an in-depth look at what they are and how they work. By the end, you’ll have all the tools you need to make the most of the above situation next time it occurs. As it relates to Bridge Loans, I’m going to cover the following::

- Definition

- When to use one

- Typical structure

- Pros and Cons

What is a Bridge Loan?

Simply put, a Bridge Loan is a short term financing vehicle used to get the Borrower from point A to point B.

In the context of the real estate market, a bridge loan is frequently used to finance the purchase or renovation of a property and remains in place until permanent financing can be arranged.

When is a Bridge Loan Appropriate?

By definition Bridge Loans have 2 characteristics that set them apart from more traditional loans:

(1) They are short term vehicles with terms ranging from weeks to 3 years; and

(2) They are more expensive than a permanent loan; often carrying a high origination fees and a higher interest rate than normal.

Because of this, they should only be used in situations where either sales proceeds or permanent financing are a sure thing. Common examples include:

Bridge Loans for Residential Real Estate

A homeowner finds a new home, but the sale on their old one hasn’t closed yet. In this case, a bridge loan may be appropriate to finance the down payment for the new house. Once the old house sells, the loan would be repaid.

Bridge Loans for Commercial Real Estate

An investor sources a deal for an income producing property that has some vacancy and needs a bit of work. To get into the deal quickly, they could obtain a bridge loan to finance the purchase, renovation, and lease-up of the property. Once leased, permanent financing could be obtained with the proceeds used to pay off the bridge loan.

Another example could be when a seller offers a discount on the purchase price of a property if the buyer can close within 30 days. To move quickly, the buyer would obtain a bridge loan to close on the purchase. Once closed, a permanent loan could be obtained with the proceeds used to pay off the bridge loan.

Bridge Loans for Non-Real Estate

Bridge loans can have a non-real estate application as well. For example, a small business owner receives a large order from a national company. They don’t have the funds to produce the product. They can obtain a bridge loan to finance the production, shipping, and carry costs of the order. Proceeds from invoice payment are used to retire the bridge loan. The difference between the invoice amount and the bridge loan amount is the profit on the order.

How are Bridge Loans Typically Structured?

The structure of a bridge loan may vary from deal to deal, depending on the needs of the Borrower; but there are some general guidelines that apply:

Amount: There is no limit to the dollar amount on a bridge loan, but the amount is generally limited to 80% of the value of an owner-occupied property or 70% of an investment property. The lender will order an appraisal to determine the value.

Term: By design, bridge loans are short term in nature, generally up to 12 months. In certain cases, the lender may extend the term for up to 3 years. The actual term may vary depending on the needs of the Borrower.

Rate: Because of the inherent risk, bridge loans are more expensive than traditional sources of permanent financing. Rates are typically variable and based on either the LIBOR or Wall Street Journal prime indices. Expect to pay between 2% and 4% over the index for a bridge loan.

Repayment: In most cases, the repayment terms of a bridge loan are interest only monthly, with the entirety of the principal due at maturity. More often than not, repayment of principal comes from either permanent financing or the proceeds of a sale.

Fees: A Borrower can expect to pay an origination fee of between 1% and 2% of the requested loan amount. For example, a $500,000 bridge loan would have a fee in the neighborhood of $5,000 and $10,000.

What are the Pros and Cons of a Bridge Loan?

As with anything in life, there are advantages and disadvantages to understand when considering a Bridge Loan:

Pros:

- Access to Deals: Obtaining a bridge loan can provide access to deals that a buyer may not have the liquidity to participate in.

- Speed: Bridge loans can be closed relatively quickly

- Documentation: Typically, bridge loans require less documentation than permanent ones. They are designed to be closed quickly to allow investors to take advantage of opportunities.

- Non-Recourse: In many cases, bridge loans are non-recourse meaning that they don’t require the personal guaranty of the borrower.

- No Prepayment Penalty: Because they are short term in nature, bridge loans don’t carry a prepayment penalty. If they are paid off early, this is viewed as a positive in most cases.

Cons:

- Expensive: Between the origination fees and high interest rate, bridge loans are expensive to compensate the lender for the risk they are taking.

- Risky: If either a deal or permanent financing fails to materialize, the Borrower can be left with an expensive, high interest rate loan with a balloon payment and no way to repay it.

Bridge Loan Example

To bring the Bridge Loan concept to life, let’s go through a basic example. Here’s the setup:

An investor feels confident that they’ve come across a deal that can return 20% annually. It is an income producing property and the purchase price is $2MM. To obtain financing they need to contribute $400,000 in equity to the deal (20%).

At the moment, the investor doesn’t have the required $400,000, but they have another property under contract for sale, from which they expect to clear $500,000 in proceeds. They feel confident that the deal is going to close. A bridge loan is a common solution here. Here’s how the financing might work:

Bridge Loan Amount: $400,000

Interest Rate: LIBOR + 4.00% (7.10% annually)

Term: 6 Months

Origination Fee: 2% ($8,000)

Repayment Terms: Interest only monthly, principal due at maturity

Collateral: Second lien on the property to be sold

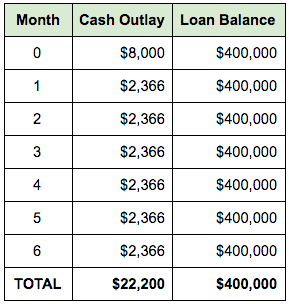

In our example, the Borrower is going to pay an origination fee of $8,000 and monthly payments of $2,366. Full principal of $400,000 is due at maturity. It looks like this:

In our example, the bridge loan is going to cost the Borrower $22,200 ($8,000 origination fee plus 6 monthly payments of $2,366). At the end of the 6-month term, the investor has sold their property, the lien is released, and the $500,000 in proceeds are used to pay the $400,000 principal balance on the bridge loan.

As shown above, bridge loans are an expensive, but useful way, to get into a deal when the needed liquidity isn’t available. With the anticipated 20% return on the property to be purchased, the cost will be recovered through annual cash flows.

Conclusion

In this article, we discussed bridge loans and how they work. We covered how bridge loans are used in both residential and commercial real estate, as well as in non-real estate situations. We went over how bridge loans are typically structured, including a comparison against more traditional loans. Finally, we talked about the pros and cons of bridge loans and then walked through a commercial real estate bridge loan example.