Retail tenants and commercial real estate professionals should be aware of a common provision in leases known as percentage rent. This article will explain how percentage rent and breakpoints work, with clear examples along the way.

Simply put, percentage rent is extra rent paid based on a percentage of gross sales. Percentage rent situations can be found in certain commercial spaces, such as shopping malls and other multi-tenant retail spaces. The idea behind percentage rent is the shopping center is a natural draw for customers, who will tend to walk among the various shops. The owner also creates an advantage for all the retailers by selecting what businesses are placed in the same space, e.g., having a coffee shop, dry cleaners, restaurant, and a general store all being neighbors. This advantage and ability to attract customers can enable the owner to negotiate a percentage of sales.

How Percentage Rent Works

Commercial leases with a percentage rent provision will have a minimum rent paid, which is just a basic rent provision, typically based on a dollar amount per square foot of space. For example, a retailer may pay $10 per square foot with 4,500 sqft, and thus would pay $45,000 in rent or $3,750 per month.

The percentage rent would kick in after a certain amount of gross sales are met. The point at which percentage rent is paid is called a “breakpoint” and can either be a natural or artificial breakpoint. If the breakpoint is never met, the tenant is only obligated to pay the minimum rent.

An artificial breakpoint is simply a dollar amount of sales both parties agree on. For example, a landlord might negotiate that 5% of gross sales over $800,000 should be paid in percentage rent. If the gross sales are $1,000,000, then the renter pays 5% of $200,000, or $10,000 in extra rent.

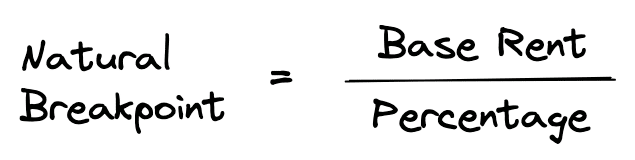

To calculate the natural breakpoint, which is commonly used as well, you simply divide the base rent by the established percentage.

In the above example, that would mean dividing $45,000 by 5%, which equals $900,000 in gross sales as the natural breakpoint. The logic behind the natural breakpoint is that a retailer should only pay the percentage rent on sales over and above what is required to pay the minimum rent. In other words, taking 5% of $900,000 in sales would equal the minimum rent payment of $45,000, so it makes sense that the percentage rent requirement would only kick in after this minimum rent breakpoint is achieved.

As you can imagine, the minimum rent amount and percentage rent can be negotiated. In some cases, a retailer may wish to have a higher minimum rent with a higher breakpoint, which allows them to profit at lower sales levels before percentage rent comes into effect. This could be the case for businesses that recently opened and are just launching their marketing.

When evaluating percentage rent situations, retailers should be aware of what types of revenue are included and excluded, as in most cases returned items and employee sales are not counted towards the total. Owners will also require tenants to allow audits of gross sales, require regular sales reports, not allow tenants to close shop during certain stretches, and ask that retailers not to open additional locations within the same market area.

Percentage rent is a fairly straightforward concept, but can sometimes get tricky when it comes to breakpoints, inclusions, and exclusions. As with all commercial real estate leases, the devil is in the details and as such leases should always be read thoroughly.

What You Should Know About Commercial Real Estate Leases

Fill out the quick form below and we’ll email you our free eBook on What You Should Know About Commercial Real Estate Leases.