The Location Quotient is an important tool that allows you to evaluate the strength and size of a particular industry in a region. A Location Quotient is a way of quantifying how concentrated an industry or even a particular demographic group is within an area compared to the country as a whole. Utilizing the location quotient is powerful way to identify growth opportunities and comparative regional advantages. Evaluating the growth of particular industries targeted as tenants for commercial real estate is a key component to predicting the supply and demand characteristics of a region. Quantifying the relative importance of an industry to a regional economy can also help to predict the impact of an industry’s growth or decline on the regional economic health.

Regional governments and planners also use location quotient calculations to determine which industries are considered to be a source of net import and export activity in the region. Import activities are those in which the proportion of employment is less than the national average and thus not high enough to sustain the region’s economic demand. Export activities are sources of regional competitive advantage because the employment productivity exceeds the needs of the local market. The excess supply of industrial productivity can then be exported to other regions. Urban planners and developers can identify those industries and create incentives for those markets to continue growing in the region. Nurturing these regional competitive advantages can result in attracting more new companies and jobs into the area, further strengthening the local economy.

Where to Find Location Quotient Data

The data needed to calculate a Location Quotient is easily accessible online through a variety of federal and state government offices. In particular, the U.S. Bureau of Labor Statistics reports annual average employment by major industry. The Covered Employment data series also breaks this information down by the state, county, and major metropolitan MSA sub-categories. Although data may be available down to census tracts and smaller areas, the general availability of and access to such data can be limited. Practically, the subject market area for a Location Quotient analysis is the smallest area for which data is available. The region you analyze as the local economy should, however, represent a reasonable market area for a particular piece of real estate since potential tenants will be drawn from the market in that region. As a result, the local region may be a larger metropolitan area, county, or entire state.

How to Calculate the Location Quotient

The first step in calculating a Location Quotient is to find the proportion of the entire economy that a particular industry employs. So, divide the average employment for that industry in the United States by the average total employment in the United States for that year. This represents the national industry concentration.

The second step in calculating a Location Quotient is to calculate a similar ratio at the local level. So, divide the average employment for that industry in the regional market by the overall average total employment for the regional market. This represents the regional industry concentration.

Location Quotient = Regional Industry Concentration / National Industry Concentration

Finally, divide the regional industry concentration by the national industry concentration. The result is the Location Quotient for the specific industry. What does the location quotient mean? A Location Quotient equal to one indicates that regional employment matches the proportion of national employment in that industry. A Location Quotient less than one indicates that the regional employment in a particular industry is lower than the national average. A Location Quotient greater than one indicates that the regional market has a higher concentration of employment in a particular industry compared to the national average.

Location Quotient Example

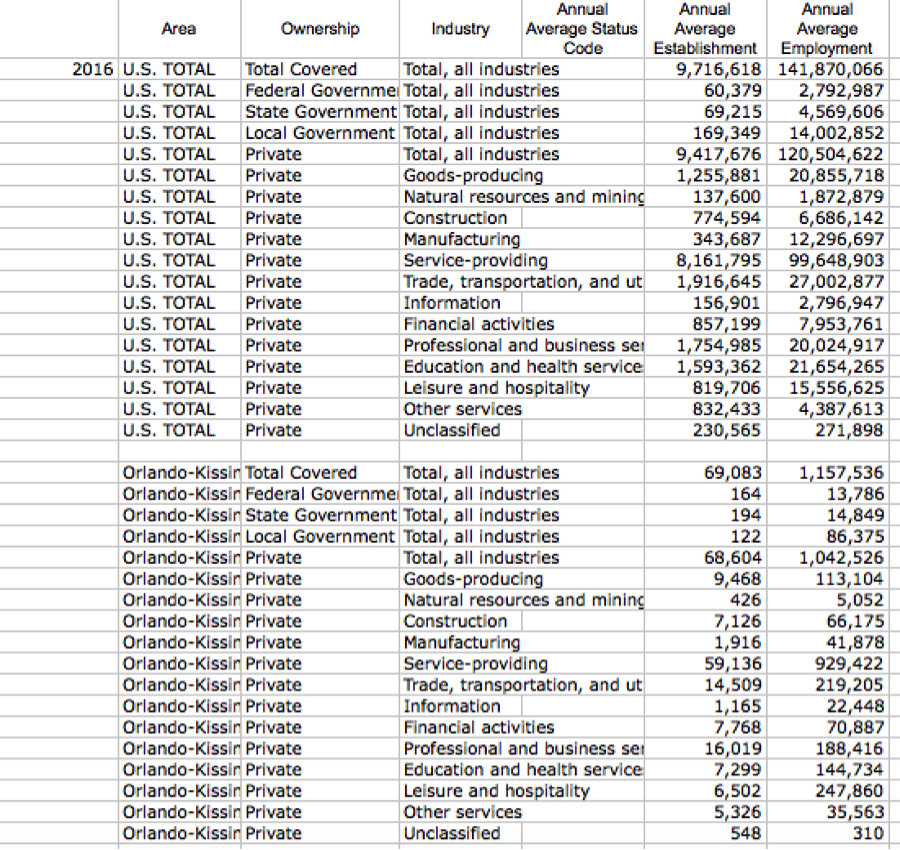

Download the Covered Employment data from the U.S. Bureau of Labor Statistics for the entire United States and the county or metropolitan area of choice. This example uses the Orlando-Kissimmee, Florida MSA. This example uses data on annual average employment by industry. Choose the most recent year for which data is available. This is an example of the raw data collected for the year 2016.

Start with the national data and divide the total average annual employment for each industry by the employment listed as total covered for all industries. These are the national industry concentration values. Repeat the same process for the subject market area. Divide the total annual average employment for each industry by the total covered employment in all industries in the regional market. These are the regional industry concentration values. Finally, divide each regional industry concentration by the corresponding national industry concentration.

These are the Location Quotient results for the Orlando-Kissimmee, Florida market in 2016:

| Industry | Location Quotient |

|---|---|

| Goods-producing | 0.664674599 |

| Natural resources and mining | 0.330605357 |

| Construction | 1.213038593 |

| Manufacturing | 0.41740123 |

| Service-providing | 1.143132811 |

| Trade, transportation, and utilities | 0.99493952 |

| Information | 0.983670576 |

| Financial activities | 1.092321103 |

| Professional and business services | 1.153196509 |

| Education and health services | 0.819187622 |

| Leisure and hospitality | 1.952753058 |

| Other services | 0.993404995 |

| Unclassified | 0.13973717 |

The Orlando, Florida region has a much smaller proportion of its market employed in the manufacturing and natural resources and mining industries. As a result, a downturn or policy changes impacting these industries would have little impact on the employment and economy of the Orlando-Kissimmee area. Unsurprisingly, employment in the Orlando-Kissimmee area is highly concentrated in the leisure and hospitality industries. As a matter of fact, the region employed twice as many people in leisure and hospitality in 2016 than the national industry concentration.

The health of the leisure and hospitality industry is highly dependent upon disposable income. For example, changes to federal tax policies that result in lower disposable income or a national economic recession could negatively impact the Orlando-Kissimmee regional economy far more than the nation as a whole. Construction, services, financial activities, and professional and business services have just a slightly higher Location Quotient compared to the national employment concentration.

Fill out the quick form below and we'll email you the completed location quotient example used in this article.Location Quotient Worksheet

Conclusion

Location Quotients are relatively quick and easy way to gather information about the relative size and importance of local industries. Understanding the regional industrial mix is important to forecasting the drivers of future demand for specific types of real estate. In addition, it is necessary when forecasting regional economic growth patterns.

There are, however, a few points to consider when analyzing the results of the analysis. First, the Location Quotient captures industrial concentration at a single point in time. This snapshot does not account for trends over time. It may be helpful to compute the location quotient for several years in order to understand the dynamic relationship between regional concentration and national employment.

Second, the location quotient assumes that the level of productivity for workers is constant in all locations. The analysis must consider whether the higher regional employment concentration is indicative of a competitive advantage or lower productivity levels compared to the national average.

Third, be careful not to overlook niche markets that may be a source of regional economic strength and opportunity. The data available from the Bureau of Labor Statistics groups employment into large categories such as manufacturing, education and health services, and natural resources and mining. As a result, the location quotient calculation may underestimate the important contribution of a smaller, niche market within that large employment category.

Location Quotients are useful tools for understanding regional economic strengths and opportunities. They are also useful in forecasting regional economic trends based on trends for specific market sectors. Location Quotients, however, should just be one of the models of economic growth considered as part of a market analysis.