There’s no doubt about it, construction lending is tough. From changing interest rates, long lead times, and freak weather events, there are a myriad of risks that can derail a project. However, from a lender’s perspective, there’s one risk that is top of mind when making a construction loan – the borrower’s ability to make their loan payments during the construction term.

To protect themselves, lenders require that an interest reserve fund be established prior to the start of construction and that it be seeded with enough money to make payments for the entirety of the construction period. With several variables to consider, some of which can be unpredictable, calculating how much money to deposit in the interest reserve fund can be a tricky task.

Interest Reserve Definition

The interest reserve is a capital account, established by the lender, for the purpose of funding a loan’s interest payments during the construction term. Logistically speaking, it’s a checking account where a predetermined amount of money is deposited as part of the first construction draw. Each month, the lender will debit the checking account for the interest payment.

In establishing the interest reserve fund, the biggest risk is that it’ll be depleted before the project is finished. As such, it’s critically important that the interest reserve calculation be accurate. But, because it’s created at the beginning of the construction period and the input variables can be unpredictable, it’s harder than it seems. Things like permitting delays, mistakes, bad weather, or community opposition, can throw a wrench into the best of estimates.

How to Calculate the Interest Reserve

The interest reserve calculation itself is fairly simple, but estimating the needed variables requires precision and experience. The required inputs are:

- Loan amount: Usually, construction loans are closed-end lines of credit and the loan “amount” represents the borrowing limit on the line of credit.

- Average Percentage Outstanding: Because the loan is disbursed piecemeal over time, it’s necessary to estimate the average percentage outstanding over the construction term. To do so, it’s not necessary to know the exact draw schedule, but it’s good to have a general idea of how much will be disbursed and when. Generally speaking, an estimate of 50% outstanding is safe. But, it may be necessary to adjust it up or down based on whether disbursements are front loaded or back end loaded.

- Loan Interest Rate: If the rate on the construction loan is fixed, then this input is equivalent to the interest rate. However, in many cases, the interest rate is variable and can change over the term so an estimate of the average rate over the term is required. It’s a best practice to err on the high side when estimating.

- Construction Term: This is defined as the period of time from the Notice of Commencement to the Certificate of Occupancy and it’s the trickiest input to estimate. Even the best laid plans encounter unforeseen delays and construction projects always take longer than expected. As a best practice, it’s wise to add a buffer to the term quoted by the contractor.

- Borrower Equity Contribution: The total cost of construction is covered by a combination of the loan amount and the Borrower’s equity contribution. In most cases, the lender will require that borrower equity be injected first to demonstrate commitment to the project. Once equity funds are exhausted, loan funds will be disbursed so it’s an important factor to consider in the average outstanding balance calculation.

- Construction Uses: This is a high level aggregation of the construction budget and it’s used to estimate the draw schedule. For example, the land purchase amount is usually advanced as part of the first draw so it’s a good indication of whether the draws are front or back end loaded.

The goal of the interest reserve calculation is to estimate the timing and amount of the construction draws and to calculate the resulting interest payment for each month. Because it can be cumbersome to perform this calculation, we’ve created an Interest Reserve Calculator as part of this article and it’ll perform the calculation for you. Enter your email address below to get it sent to your inbox:

Interest Reserve Caclulator

Fill out the quick form below and we’ll email you our free interest reserve calculator. You can use our interest reserve calculator to quickly estimate the interest reserve for a construction loan.

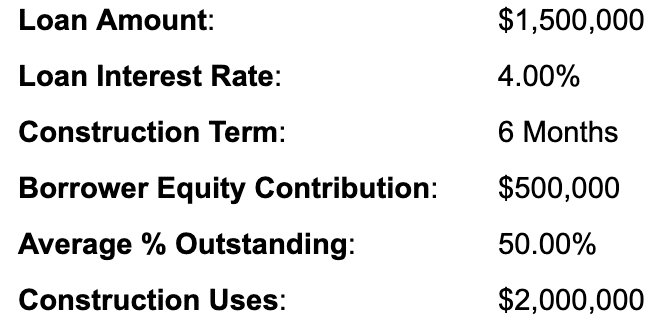

To illustrate the interest reserve calculation, let’s go through an example using the Interest Reserve Calculator. The scenario is below:

Using the scenario above, let’s discuss how it translates into the required input variables for the Interest Reserve Calculator:

Loan Amount: Per the scenario, the loan amount is $1,500,000 and it’s a direct input into the calculator.

Loan Interest Rate: Again, per the scenario, the interest rate is fixed at 4.00% for the construction term and it is a direct input into the calculator.

Construction Term: Per the scenario, the construction term is 6 months, but the calculator input requires the anticipated start and end dates. It’ll calculate the resulting term.

Borrower Equity Contribution: The Borrower Equity Contribution is $500,000, which is a direct input into the calculator. It can also be imputed by subtracting the total project cost from the loan amount.

Average % Outstanding: This is the most critical input in the calculation and it’s an estimate based on experience and a general idea of the draw schedule. 50% is a good place to start and it’s what we’ll use in the example, but it may need to be adjusted based on knowledge of the draw schedule. If the loan draws are front loaded, it may be higher than 50% or if they’re back-end loaded, it may be lower than 50%.

Construction Uses: The total construction uses is $2,000,000, which should equal the loan amount plus Borrower Equity. It should also be divided into a few high level line items to allow for a broad estimation of the draw schedule.

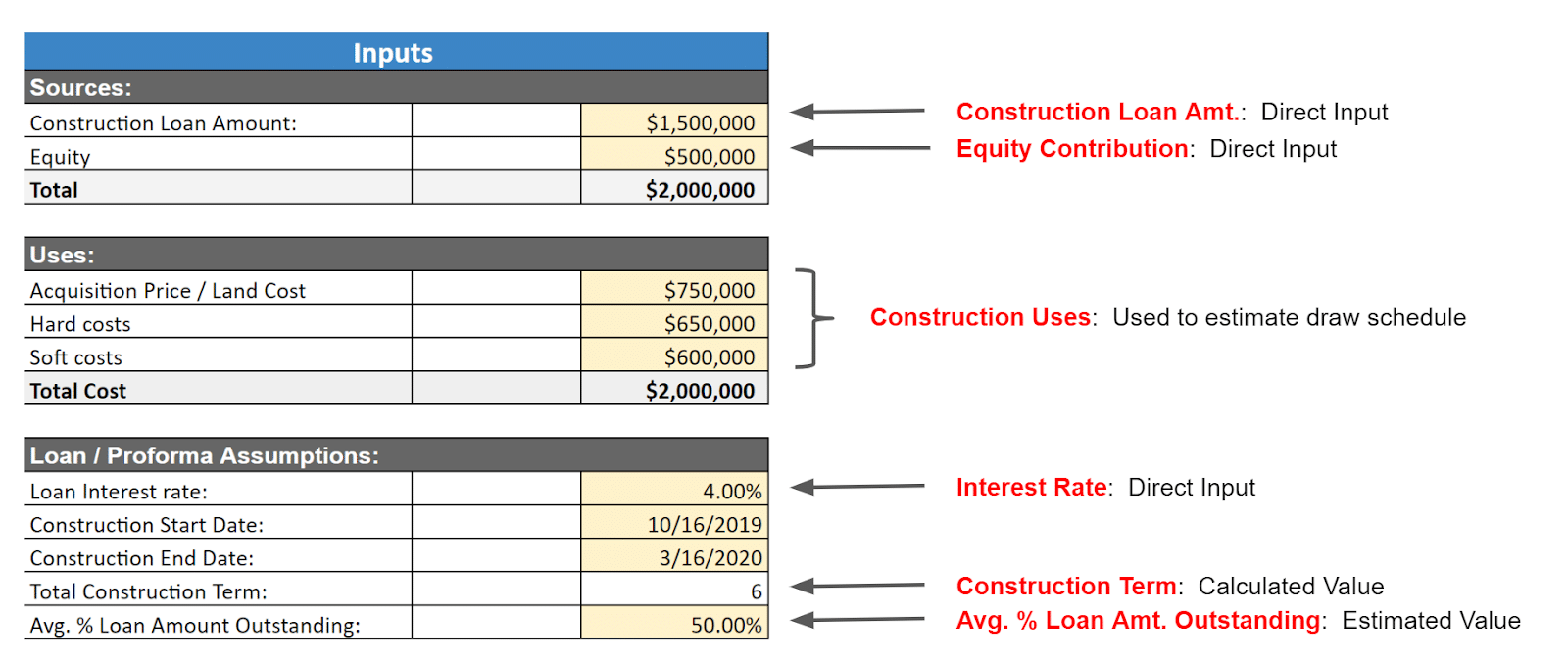

Once the variables are identified and plugged into the calculator, it should look like the screenshot below:

With the inputs complete, the tool will perform the following calculation to estimate the interest reserve.

Step 1: Multiply the loan amount by the Avg. % Outstanding to calculate the average loan balance for the entirety of the construction term: $1,500,000 * 50% = $750,000.

Step 2: Multiply the average outstanding balance by the interest rate to get annual interest paid: $750,000 * 4% = $30,000

Step 3: Divide the annual interest by 12 to get the average monthly interest payment: $30,000/12 = $2,500.

Step 4: Multiply the monthly interest by the number of months in the construction term: $2,500 * 6 = $15,000.

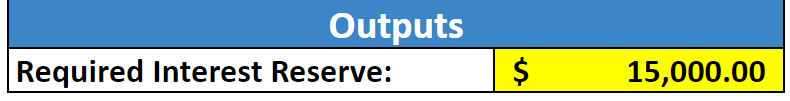

In the Interest Reserve Calculator Excel spreadsheet, the result is shown under the “Outputs” heading and looks like this:

It’s important to note that the tool is used for an estimate only. As a best practice, it’s a good idea to err on the high side or round up to ensure that there is enough money in the interest reserve to make payments for the entire construction term and account for potential delays. So, an analyst may add some contingency into the Interest Reserve estimate and end up at $17,500 or $18,000.

What Happens When Interest Reserve Runs Out?

Despite the care put into calculating the interest reserve requirement, there are occasions where the account runs dry before construction completion. On such occasions, one of three things is likely to happen:

- Line Item Reallocation: If available, funds will be reallocated from another line item in the construction budget. This is the best case scenario and a relatively benign situation.

- New Loan or Loan Increase: If there aren’t any funds available from other line items, the next best option is for the lender to either make an additional, smaller, loan to fund interest through construction completion or to increase the limit on the existing loan for the same purpose. This option can be tricky and raises the risk profile of the project. But, often there isn’t much of a choice because the only avenue for repayment is for construction to be completed.

- Borrower Pays Out of Pocket: If the lender refuses option two, the last option is for the borrower to make the interest payments out of their own pocket. If it comes to this, the borrower may not have a choice either because the borrower’s avenue to recovering their investment also requires that the project be completed.

Again, it’s a good idea to err on the high side or add a contingency to the interest reserve estimate to account for potential delays. Doing so will go a long way towards ensuring that the interest reserve doesn’t run out.

Conclusion

Because construction lending can be risky for all parties, one of the safeguards implemented by the lender is the implementation of an interest reserve fund at the outset of the construction period. The interest reserve fund is used to make the interest payments on the loan throughout the construction term.

The amount of the interest reserve fund is calculated at the start of the construction term and an accurate calculation is critical to ensure that there’s enough money to make payments for the entirety of the construction period plus a buffer. To make the calculation, several key variables are required, including an estimation of the construction draw schedule.

In the event that the interest reserve runs out prior to the completion of construction, all parties have a strong incentive to work together to complete the project since it’s the only way they’ll be repaid. Options include a budget reallocation, additional loan, and/or borrower payment.

Lastly, if there’s one takeaway from this article it should be that construction rarely goes according to plan and the interest reserve calculation should include a buffer to account for unforeseen issues that could delay construction progress.