To minimize or defer the tax bill when selling investment real estate, investors commonly use what’s known as a 1031 or Like Kind Exchange. In this article, you’ll learn what a 1031 exchange is, how a 1031 exchange works, what the 1031 exchange rules are, the 1031 exchange timeline, and then we’ll cover some frequently asked questions.

What is a 1031 Exchange?

“1031 Exchange” is a colloquial reference to Section 1031 of the United States Internal Revenue Code (26 U.S.C §1031), which defines the conditions for tax deferral on the sale of real estate. Specifically, the tax code states that:

“No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind which is to be held either for productive use in a trade or business or for investment.”

In other words, taxes can be deferred on the profitable sale of a commercial property as long as the proceeds are “exchanged” into a new property of “like kind” that is held for investment purposes. Deferral can provide a powerful tax benefit that acts as an incentive for continued real estate investment, but to take advantage of it, the correct type of exchange must be chosen, and the transaction must be executed flawlessly.

How Does a 1031 Exchange Work?

There are 4 types of commonly used 1031 Exchanges. However, only one of them is dominant, while the others are saved for specific circumstances unique to a commercial real estate investor’s needs. They all benefit from the same tax deferral incentive, but the rules vary slightly for each, so it’s always best to consult a qualified attorney or CPA before choosing and/or entering into one of them. The types are:

- Delayed Exchange: The “Delayed Exchange” is the most common type and occurs when an investor sells their property (the “relinquished” property) and uses the proceeds to acquire a new property (the “replacement” property). Under the Delayed Exchange rules, the replacement property must be identified within 45 days of sale and closed within 180 days to take full advantage of the tax deferral incentive.

- Simultaneous Exchange: It’s just what it sounds like. In a Simultaneous Exchange, the sale of the relinquished property and the purchase of the replacement property are closed at the same time. Executing a Simultaneous Exchange requires a high degree of precision because delays could result in the nullification of the exchange and the application of full taxes to the sale.

- Reverse Exchange: Again, a Reverse Exchange is just what it sounds like. In a Reverse Exchange, the replacement property is acquired first, and the relinquished property is sold second. While the terms of the transaction are relatively simple, the execution isn’t. A Reverse Exchange requires that the replacement property be purchased in cash and that the relinquished property be identified within 45 days and sold within 180 days.

- Construction Exchange: In a Construction Exchange, an investor sells the relinquished property, identifies a replacement property, and places it into the hands of a third-party known as a Qualified Intermediary (QI). While in the QI’s hands, the owner can use the sales proceeds for renovations on the replacement property. Upon completion, the investor takes possession of the replacement property under two conditions: (1) It must be “substantially the same” as it was before the renovations; and (2) construction must be completed within 180 days of the relinquished property’s sale date.

Regardless of the type used, completing a 1031 Exchange can be complicated because there are a series of specific requirements that must be met to be eligible for full tax deferral.

1031 Exchange Rules

The details of a 1031 Exchange transaction are governed by a series of complicated rules that can be both intimidating and confusing. While they’re all important, there are six that should be given thoughtful deliberation before committing to a deal:

- The Replacement Property Must Be Like Kind: To meet the threshold of “like kind” the replacement property must be “of the same nature or character” as the relinquished property. In addition, the replacement property must be within the United States and “held for productive use in a trade or business or for investment.” NOTE: Section 1031 doesn’t make a distinction between property types. For example, proceeds from the sale of an apartment building don’t necessarily need to be invested in another multifamily property to meet the “like kind” test. They could be invested in any type of commercial real estate such as retail rental property, office building, or industrial warehouse as long as they are “held for investment.”

- Property Must Be Held For Sale: Section 1031 language carves out an exclusion for property that is “held primarily for sale.” Although “held primarily for sale” isn’t explicitly defined, it’s generally accepted that a replacement property should be held for 12–24 months to prove that the purpose was for investment.

- 1031 Exchange Timeline: The transaction must be completed within a relatively tight window of time that starts on the day the relinquished property is sold. From the sale date, a replacement property must be identified within 45 days and closed within 180 days to be fully eligible for tax deferral.

- Value: IRS rules state that the market value and equity of the replacement property must be the same as, or greater than, the value of the relinquished property. For example, a property with a market value of $1MM and a mortgage of $250M must be exchanged into a new property worth at least $1MM with a $250M mortgage.

- No “Boot”: Boot refers to any non-like kind property received in a 1031 exchange. It could come in the form of cash, installment notes, debt relief, or personal property and is valued at “fair market value.” Receipt of “Boot” doesn’t disqualify the exchange, it just creates a taxable event. Any non-like kind property received in a 1031 exchange is taxed as if it is a realizable gain. Occasionally, Boot can be received unintentionally. To avoid it, there are three best practices: (1) purchase a like-kind replacement property of equal or greater value; (2) reinvest all the net equity from the sale of the relinquished property into the replacement property; and (3) on the replacement property, obtain debt equal to or greater than what was paid off or assumed on the relinquished property.

- Same Taxpayer: The taxpayer/titleholder associated with the relinquished property must be the same as the taxpayer/titleholder associated with the replacement property. In addition, the properties must be similarly titled to be eligible for full tax deferral.

When the rules are followed and the transaction is completed correctly, a 1031 Exchange can provide significant benefits beyond just tax deferral.

Benefits of a 1031 Exchange

While the primary benefit of a 1031 exchange is tax deferral, there are some important, ancillary, benefits to consider:

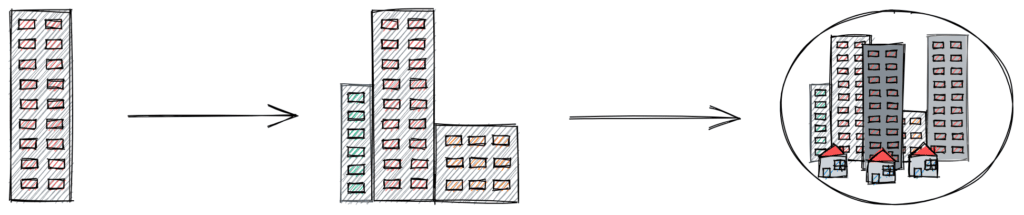

- Increased Purchasing Power: A 1031 Exchange provides an investor with increased purchasing power. Because the money that would have been paid in taxes can be re-deployed, investors can often buy a more expensive property than would have been possible had they paid capital gains taxes.

- Diversification: A 1031 Exchange can be used as a tool to diversify an investor’s real estate portfolio because the rules don’t require a one-for-one swap. §1031(k)-1(c)(4) states that the “maximum number of replacement properties that a taxpayer may identify” is either: (A) Three – without regard to their fair market value; or (B) Any number of properties as long as their aggregate fair market value as of the end of the identification period does not exceed 200% of the aggregate fair market value of all the relinquished properties. For example, proceeds from the sale of a retail property could be reinvested into a retail property and an office property, provided they’re of equal or greater value.

- Upgrades: A 1031 Exchange can be an easy and cost-effective way to upgrade a physically obsolete asset (or one where the cost basis has been depreciated to zero). By exchanging an older property for a newer one, an owner has effectively upgraded their investment for little to no additional cost.

While the benefits are impressive, 1031 exchanges aren’t perfect and there are several important risks to consider.

How to do a 1031 Exchange

1031 Exchanges aren’t risk-free transactions. They’re complicated, require a lot of paperwork, and can be somewhat chaotic due to the time constraints involved. In addition, if the transaction isn’t completed correctly, the exchange can be nullified and taxes can become due.

To avoid the common pitfalls associated with a 1031 exchange, there are a few best practices to keep in mind.

- Always use an expert. From CPAs to Attorneys and Qualified Intermediaries (QIs), it’s a best practice to employ the services of the professionals when completing a 1031 Exchange. Doing so ensures that the transaction runs smoothly and that the paperwork is filed correctly.

- But, do your research. In November 2008, a leading 1031 Exchange Qualified Intermediary filed for an unexpected bankruptcy. Unfortunately for investors, their escrow money was commingled with other funds and got caught up in the bankruptcy, leading to significant losses and confusion. It was a harsh reminder that careful due diligence must be completed on the experts chosen to assist in the transaction.

- Timing is everything. Remember, the replacement property must be identified within 45 days and closed in 180. Finding a property, making an accepted offer, and closing within the required timeframe can be stressful. Start early, work with a knowledgeable broker, and move quickly when a suitable property is identified. By doing so, you can avoid making a “panic offer” or overpaying for the property.

Although 1031 Exchanges are commonly used by all types of real estate investors, the details are still somewhat misunderstood. Let’s try to clear them up by answering some of the most commonly asked questions.

1031 Exchange FAQs

A 1031 Exchange transaction has many moving parts and, for first-timers, can be confusing. Below are the answers to come of the most commonly asked questions about 1031 Exchanges:

Can you live in a 1031 Exchange property?

Maybe. Under the language described in section 1031 of the IRS code, taxes can be deferred as long as the property is “held for productive use in a trade or business or for investment.” So, by definition, a single-family personal residence or vacation home doesn’t meet this requirement.

However, there are certain situations where an investor may acquire a property intending to hold it for an investment, but circumstances change, and they end up using it as their primary residence. In such cases, the key to determining the allowability of tax deferral is the investor’s intent at the time of the replacement property acquisition. Was it intended to be an investment, but changed later? Or, was it always intended to be a personal residence.

If it’s the former and the property was held for 12 – 24 months prior to the conversion to a primary residence, it may pass the ‘safe harbor” test and qualify under §1031(k)-1(g) of the exchange rules.

How much does it cost to complete a 1031 Exchange?

Most 1031 Exchange transactions are completed using a Qualified Intermediary (QI) and the fees can be a bit opaque. Generally speaking, an Institutional Qualified Intermediary charges ~$1,500 in administrative fees for a 1031 exchange that involves one “relinquished property (the old one)” and one “replacement property (the new one).” For each additional property to be processed, it’s ~$350 more.

However, this fee structure is slightly misleading. The majority of a Qualified Intermediary’s income is derived from the interest earned on an investor’s 1031 Exchange funds while they’re being held. As such, the out-of-pocket administrative fees are only part of the picture. Always ask for a complete accounting of the fee structure.

How Long Does a Property Have to Be Held to Qualify for a 1031 Exchange?

The language in section 1031 doesn’t explicitly define a time period that a property must be held, only that it be “held for investment.” But, what does “held for investment” mean? Depending on your advisor’s opinion, it may mean anywhere from 12–24 months.

The IRS attempted to clarify this in Private Letter Ruling 8429039 (1984), which states that a minimum of 2 years is “sufficient” to prove that a property was held for investment. However, it may not apply evenly to all transactions, depending on an investor’s intent at the time of purchase.

Is it possible to take cash out of the 1031 Exchange transaction?

Yes, but the withdrawn funds will be taxed. To achieve 100% tax deferment, 100% of sales proceeds from the original property must be reinvested into the replacement property. Any portion that isn’t is considered to be “boot” and will be subject to income tax when the exchanger files their tax return

Can an attorney handle the 1031 Exchange paperwork?

Sometimes. Under section 1031(k)-1(k)(2)(i), an attorney may not assist in the transaction if they’ve provided non-exchange related services to the investor within the 2 years before the closing of the sale.

Is it easy to find a replacement property?

It can be, but the challenge comes when trying to comply with the fairly short time window allowed under 1031 rules. Remember, the 1031 exchange timeline requires that a property must be identified within 45 days and closed within 180. Real estate transactions have long lead times, certain markets can be expensive, and investors have different return requirements. To find a well priced property in the desired geographic location that meets the return requirements within 45 days can be a daunting task. It’s always best to work with brokers and agents who specialize in these types of deals so that they can reduce the lead time.

Is it possible to exchange one property for multiple properties?

Yes. But the number isn’t unlimited. §1031(k)-1(c)(4) states that the “maximum number of replacement properties that a taxpayer may identify” is either: (A) Three – without regard to their fair market value; or (B) Any number of properties as long as their aggregate fair market value as of the end of the identification period does not exceed 200% of the aggregate fair market value of all the relinquished properties.

Is it possible to do a 1031 Exchange into a REIT?

Yes and no. By definition, securities in a REIT are not considered “like kind” to a physical property, so it isn’t possible.

However, there is a somewhat complicated and involved process that could make it possible. IRS Ruling 2004-86 allows for the exchange of sales proceeds into something called a Delaware Statutory Trust (DST). A DST functions similarly to a REIT in the sense that investors buy into a company (the trust), which entitles them to a fractional share of the income and profits produced by the underlying property.

If the DST is controlled by a REIT, IRC Section 721 allows for the “nonrecognition of gain or loss on contribution to a partnership.” So, an investor could convert their DST stake into Operating Partnership units through an Umbrella Partnership Real Estate Investment Trust (UPREIT). Because the contribution is to a partnership, it falls under section 721 and qualifies for continued tax deferral while enjoying the benefits of the UPREIT. Again, this is a complicated process and a qualified lawyer should always be consulted if considering it.

What is a Delaware Statutory Trust?

A Delaware Statutory Trust is defined under Delaware Statutory Trust Act, Del. Code Ann. title 12, §§ 3801 – 3824 12, but the non-legal definition is “an entity that is set up for the purpose of conducting business. They are formed using a private trust agreement under which real property is held, managed, invested, administered, and/or operated for the purpose of profit.”

In other words, a DST is a company set up for the purposes of acquiring a specific property. Acquiring shares in the trust entitles the investor to a fractional ownership stake in the underlying property and thus qualifies for a 1031 Exchange.

What needs to be done to start a 1031 Exchange?

Remarkably little. To initiate the process, the first step is to choose an exchange facilitator or Qualified Intermediary. They are the experts in the process and will provide guidance every step of the way.

It’s important to do a fair amount of due diligence on potential facilitators as their prices, levels of insurance, experience, and reputation vary widely.

Summary & Conclusions

1031 Exchanges can be a great way to defer capital gains taxes on the sale of an asset, but careful consideration must be paid to the rules, requirements, and time considerations required to execute a successful transaction.

Experts, especially Qualified Intermediaries, should be used to assist in the transaction to help limit downside risk and ensure a smooth outcome.